Analyzing India’s Electronic Manufacturing Services (EMS Sector

Transforming from Low-Cost Assembly to High-Value Innovation in Electronics Manufacturing and key players in this sector!

India’s EMS sector is at a real turning point. What used to be known mainly for low-cost, high-volume assembly is now growing into something much more capable. The industry, already worth over $23 billion, is starting to move up the value chain—designing its hardware, building complex systems, and playing a bigger role in high-tech innovation. It’s not just about scaling anymore; it’s about stepping into a more central role in the global electronics space.

Introduction

Over the past few years, India’s Electronic Manufacturing Services (EMS) sector has been quietly but steadily gaining momentum. What was once largely viewed as a cost-effective destination for basic assembly work is now emerging as a critical link in the global electronics supply chain.

Backed by strong policy support, rising domestic demand, and strategic global realignments like the China+1 strategy, India is positioning itself as a serious contender in high-value electronics manufacturing. As the world looks to diversify supply chains and tap into new growth markets, India’s EMS sector is not just catching up, it’s gearing up to lead.

The Global Shift in Manufacturing

The 1980s: When Manufacturing Began Leaving the U.S.

In the early 1980s, the U.S. stood as a global powerhouse of manufacturing. But cracks were beginning to show. Rising labor costs, strict regulations, and increasing global competition pushed companies to seek cheaper, more efficient alternatives overseas.

This era marked the rise of globalization, with U.S. corporations beginning to offshore labour-intensive manufacturing operations, especially to Asia. It wasn’t just about cost — it was about staying competitive in a rapidly changing global economy. For the EMS sector, which demands high-volume production and tight cost control, offshoring became a strategic necessity.

Japan: The First Mover in Asia’s Manufacturing Boom

During the same time, Japan emerged as a manufacturing powerhouse, especially in consumer electronics and automotive. Lean manufacturing, precision engineering, and innovation became synonymous with Japanese production.

But Japan's dominance didn’t last forever. In 1985, the Plaza Accord led to a sharp appreciation of the yen, making Japanese exports more expensive and less competitive. Faced with rising domestic costs, Japanese manufacturers began moving their production to lower-cost countries. One destination quickly stood out: China.

This move wasn't just about cost — China offered scale, infrastructure, and an eager workforce. Japan’s shift marked the beginning of China’s rise as the "world’s factory", and set the stage for what would become the EMS sector’s most important manufacturing hub.

The Rise of China: The World’s Factory Floor

By the early 2000s, China had transformed into the backbone of global supply chains. Massive infrastructure investments, special economic zones, and a government focused on industrial growth turned China into the ideal destination for EMS players.

From circuit boards to mobile phones, companies flocked to China to capitalize on its scale and efficiency. The EMS sector, in particular, benefited from access to a dense ecosystem of component suppliers, assembly facilities, and skilled labor — all at a fraction of the cost of Western markets.

Cracks in the Foundation: Rising Tensions and the Call to Reshore

More recently, rising labour costs in China, trade tensions with the U.S., and supply chain shocks from COVID-19 have exposed the risks of over-dependence on a single country. This prompted a wave of interest in reshoring manufacturing back to the U.S., fuelled in part by the “Make America Great Again” push.

But bringing manufacturing back home is easier said than done. The U.S. faces challenges like:

High wages and regulatory hurdles

A limited skilled manufacturing workforce

Lack of local supplier depth for components

For EMS firms, especially those dealing with thin margins and complex production networks, reshoring in its pure form isn’t always viable.

Global theme - China + 1

What is the China Plus One Strategy?

The China Plus One Strategy, also known as Plus One or C+1, is a supply chain strategy that encourages companies to minimize their supply chain dependency on China by diversifying the countries they source parts from. The goal here is to reduce the risk of over relying on a single country for sourcing and manufacturing–if you’ve ever heard the famous saying, “don’t put all your eggs in one basket”, it’s a very similar approach.

This new strategy would allow businesses to continue to invest in China, while spreading their operations across multiple countries, which are considered the “Plus One”. By establishing additional sourcing and manufacturing locations outside of China, companies found a way to mitigate business risks, access new consumer markets, and explore other innovation and technology, all while keeping their operations cost-effective

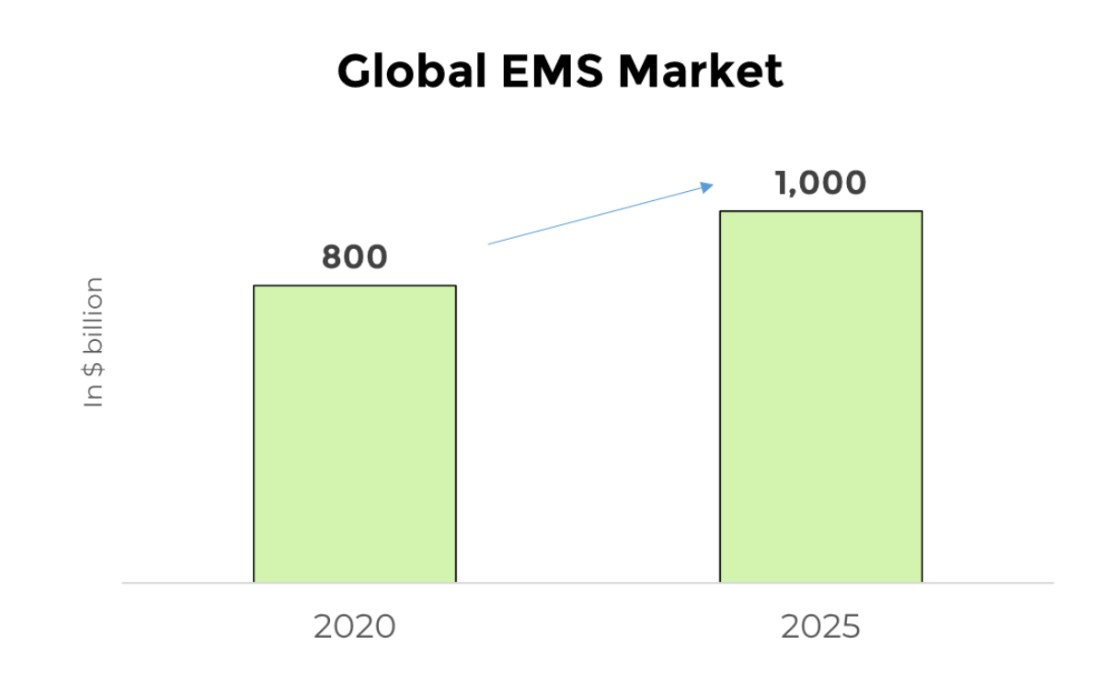

The global electronics manufacturing industry is undergoing a quiet realignment. Valued at around $800 billion in 2020 and projected to reach nearly $1 trillion by 2025, this sector is being shaped by a mix of technological progress and geopolitical shifts.

Top “Plus One” Alternatives to China

When picking your “Plus One,” it all comes down to what fits your business best. But two countries are clearly stealing the spotlight: India and Vietnam. Both have been attracting major investments lately, thanks to their booming economies, skilled labor, geographic locations, and business friendly policies.

India: The Rising Star of China Plus One

India’s making waves as a top China Plus One pick and for good reason. With a massive labor force, competitive costs, and a market size that rivals China, it’s catching global attention. Even the World Bank CEO urged India to” cash in on the ‘China plus one opportunity”. Add to that its strategic location and pro-manufacturing government policies, and India’s clearly ready to shine on the global supply chain stage.

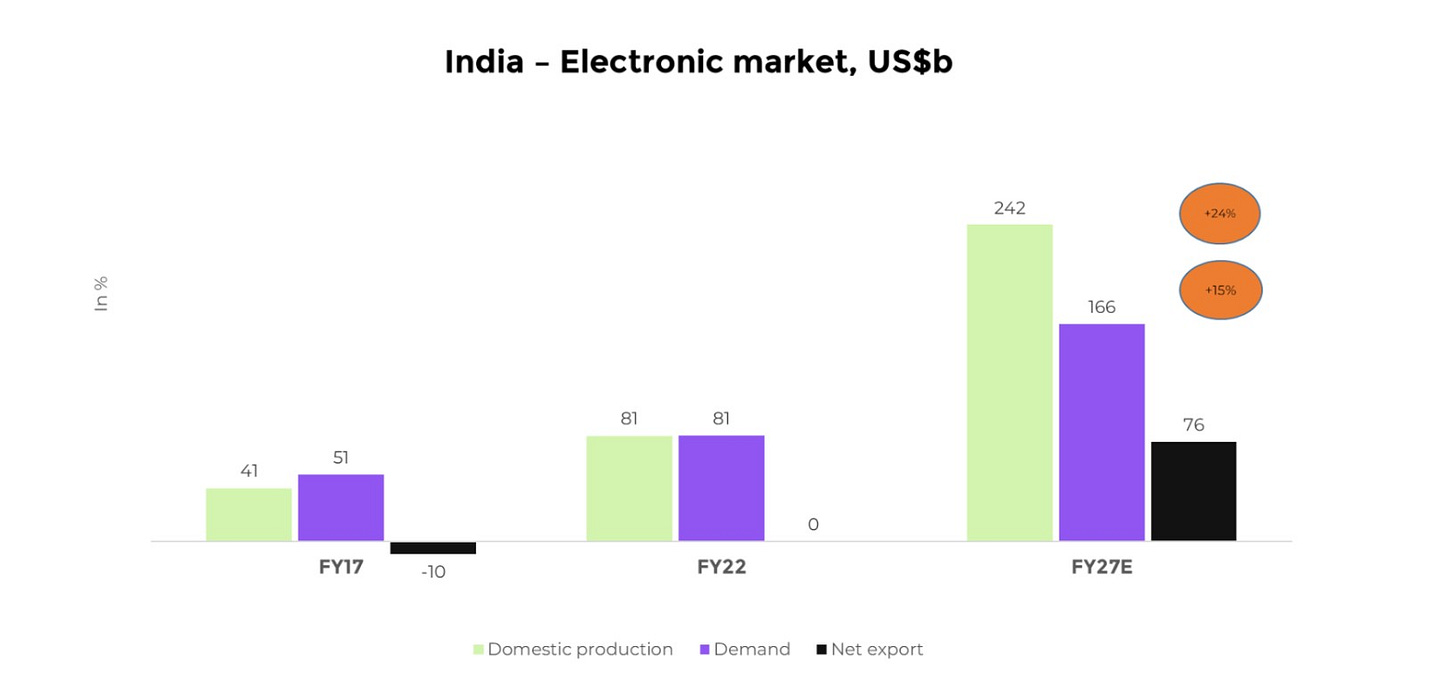

Let's look at this chart

As the chart shows, the electronic market is projected to grow at 24% CAGR and demand for electronic products is expected to grow at 15% CAGR by 2027.

This shows

India is expected to become an electronics manufacturing powerhouse over the next decade driven by increasing local demand and improving competitiveness for exports

Electronics production in India: higher growth expected in production driven by both domestic demand and exports

As global supply chains undergo realignment, India is positioning itself as a competitive manufacturing base. Companies like Samsung and Apple have already ramped up their operations in the country, motivated by geopolitical shifts and the growing need to diversify beyond China.

India’s presence across the electronic value chain

Mobile

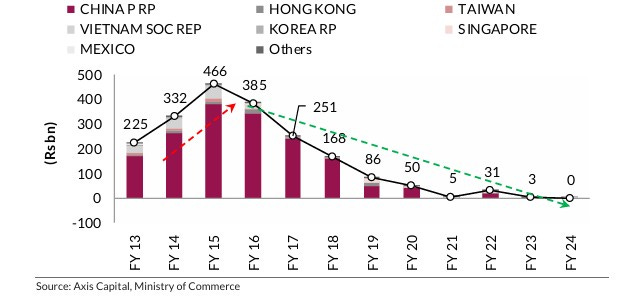

Between FY20 and FY24, mobile phones led the growth in India’s electronics production, with a strong ~19% annual growth rate. This was mainly because of government support through import duties, the Phased Manufacturing Programme (PMP), and PLI schemes, which helped build a local mobile manufacturing base and cut down imports of ready-made phones.

Imports of finished smartphones - with the imposition of and increase in duty, we see imports reaching almost nil in FY24

The rise of Indian electronics manufacturers was boosted by large order volumes from Chinese brands and joint ventures with global ODMs, mainly set up to share PLI scheme benefits. Here's a quick summary of how these partnerships helped local growth.

Brands prefer manufacturing via ODM

Most smartphone brands today prefer to work with Original Design Manufacturers (ODMs) for making low- and mid-range models. In fact, all of the top 10 OEMs now collaborate with ODMs as part of their supply chain. Chinese ODMs lead in this space thanks to their strong R&D, cost efficiency, and large-scale manufacturing capabilities.

Key smartphone OEMs’ ODM / IDH partners

Note : (1) All are Chinese ODM/IDH suppliers. (2) ODM develops, designs and manufactures for brands / OEMs. Independent Design House (IDH) only develops and designs products for OEMs and does not provide manufacturing services. (3) Apple is excluded as design is done in-house and majorly assembly is outsourced to EMS players.

Manufacturing origin of critical mobile components in major countries

RAC

The heating, ventilation and air-conditioning (HVAC) industry in India is one such sunrise sector that has the potential to contribute to the country’s manufacturing story. Economic prosperity creates better and larger growth opportunities for the HVAC sector, which in turn fuels economic growth.

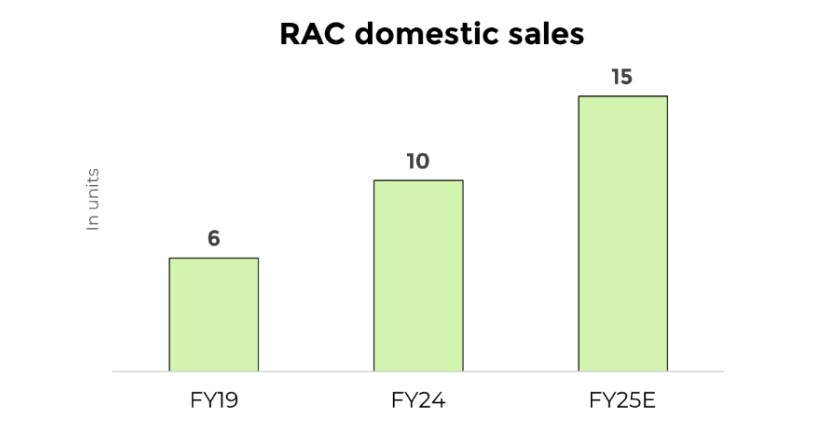

The Indian RAC market is driven by increase in disposable income, urbanization, electrification, and easy consumer financing. Tightening of energy efficiency norms has led to the introduction of inverter technology, resulting in a reduction in operating costs. This has resulted in more consumers opting for RACs.

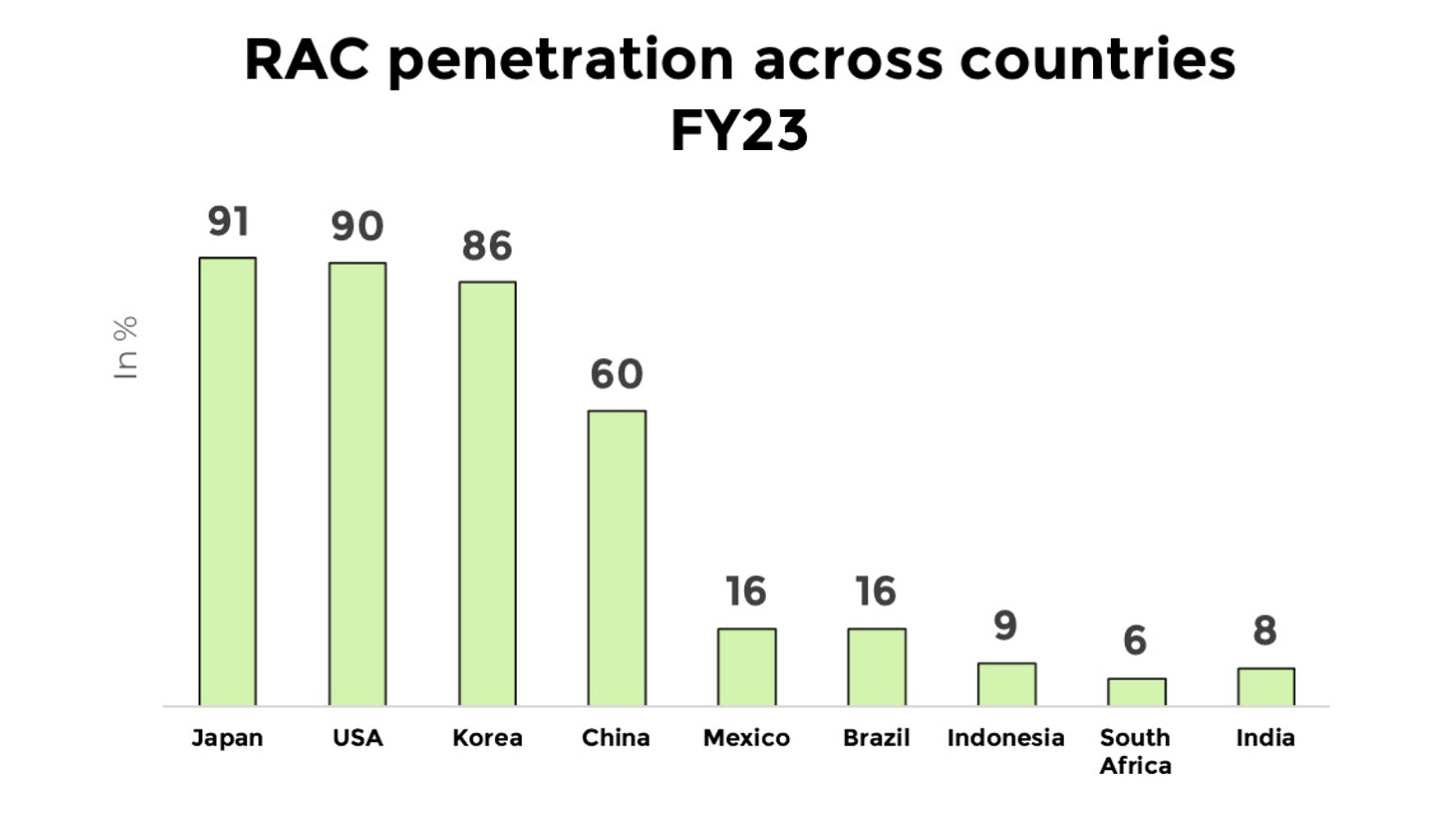

India has been among the lowest, but penetration has significantly increased in the past two years and is now at ~11%.

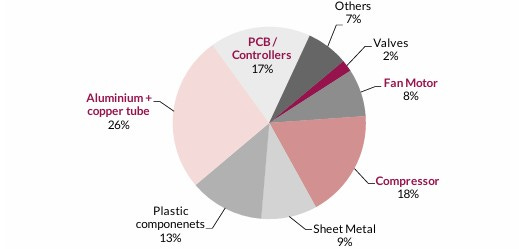

BOM for 1.5 t split-AC costs ~Rs 16k per unit

It is clear from the cost comparison of different components that compressors, PCBs, controllers, heat exchangers, fan motors, aluminium coil and copper tubes are broadly of interest. These components comprise close to 70% of the manufacturing cost of ACs.

Players in RAC manufacturing ecosystem

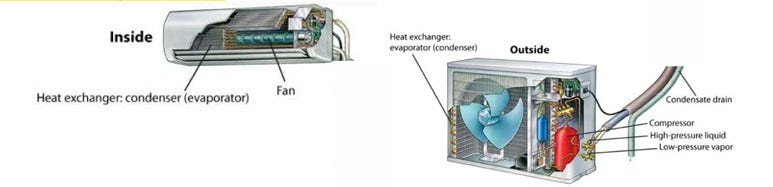

Parts of Split Air Conditioner

The components story

For RAC, the government is focused on localizing three major components which are still mostly imported - copper tubes, aluminum coils and compressors.

Compressors are one of the most important components in any HVAC device. In India, compressor manufacturing does not happen at the scale that is needed. In some ways, India is a new kid on the block.

Additional measures by the Government to promote compressor manufacturing.

To further drive Indian companies and MNCs to establish compressor manufacturing in India, the government has stopped the extension of the BIS licenses - which are mandatory for foreign vendors selling RACs and components in India.

Adding to manufacturers’ concern, the Bureau of Energy Efficiency (BEE) has announced stricter efficiency standards for ACs, effective 1 Jan 2026.

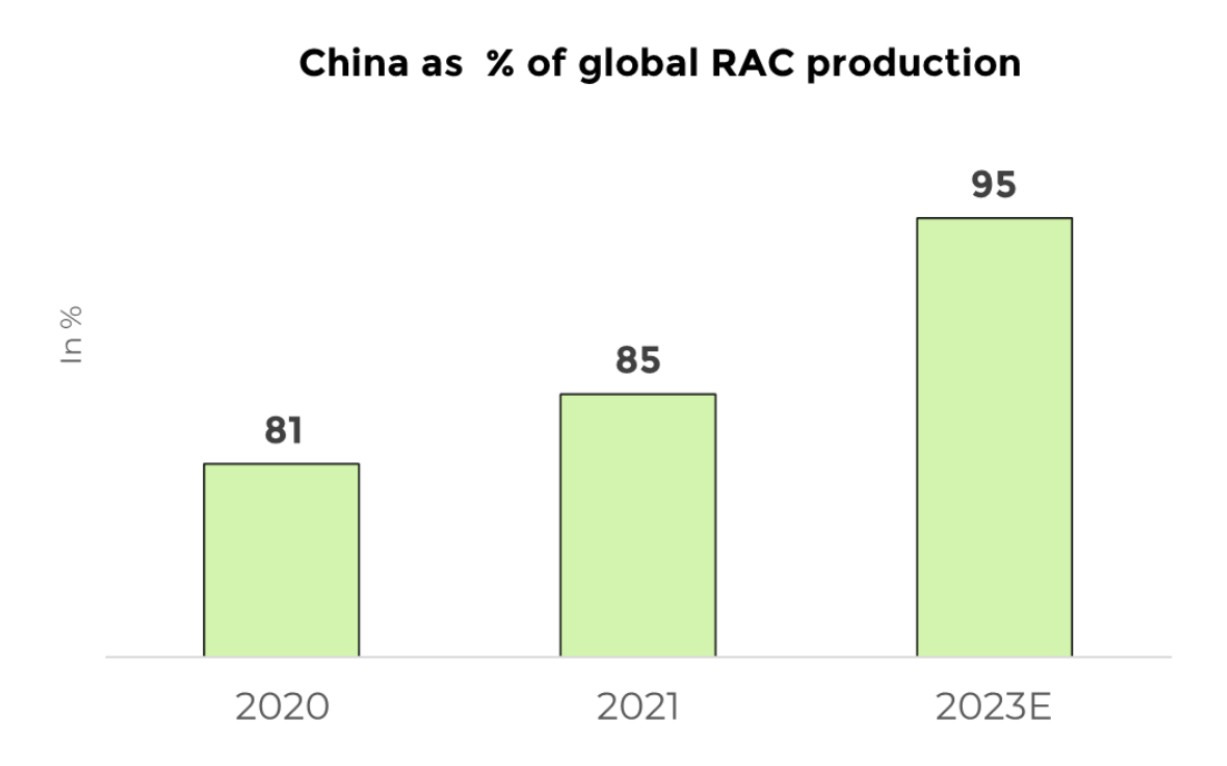

China’s compressor market

From the global supply chain standpoint, China’s position in compressor manufacturing is solid. With more than 276 mn units sold in FY24, China has over 95% of global RAC compressor production. Thailand is second, with a production capacity of ~18 mn compressors. With these data points, it is easy to see that China remains the most dominant and competitive in compressor manufacturing globally.

PCBA

PCBAs are the backbone of all electronic products. PCBAs are required to operate a wide variety of electronic products such as mobile phones, tablets, laptops, desktops, gaming consoles, televisions, washing machines, microwave ovens, ACs, refrigerators, automobiles, medical equipment, and industrial products.

Process of PCB assembly

There are 4 critical stages in the PCBA manufacturing assembly

PCB design

Manufacture of laminates

Manufacture of PCB

Mounting components on the PCB.

It is noteworthy that each stage is an industry by itself.

India already had PCBA capabilities, but growth was stagnant as we were importing electronics as finished goods. However, over the last 5 years, with increased import duty and more focus on domestic manufacturing, India has made a complete switch towards domestic PCBA activity for mobiles.

Players in PCB ecosystem

Shogini Technoarts, Ascent Circuits, AT&S India, Epitome Components, Cipsa-Tec India, Vintek Circuits etc.

Government Schemes

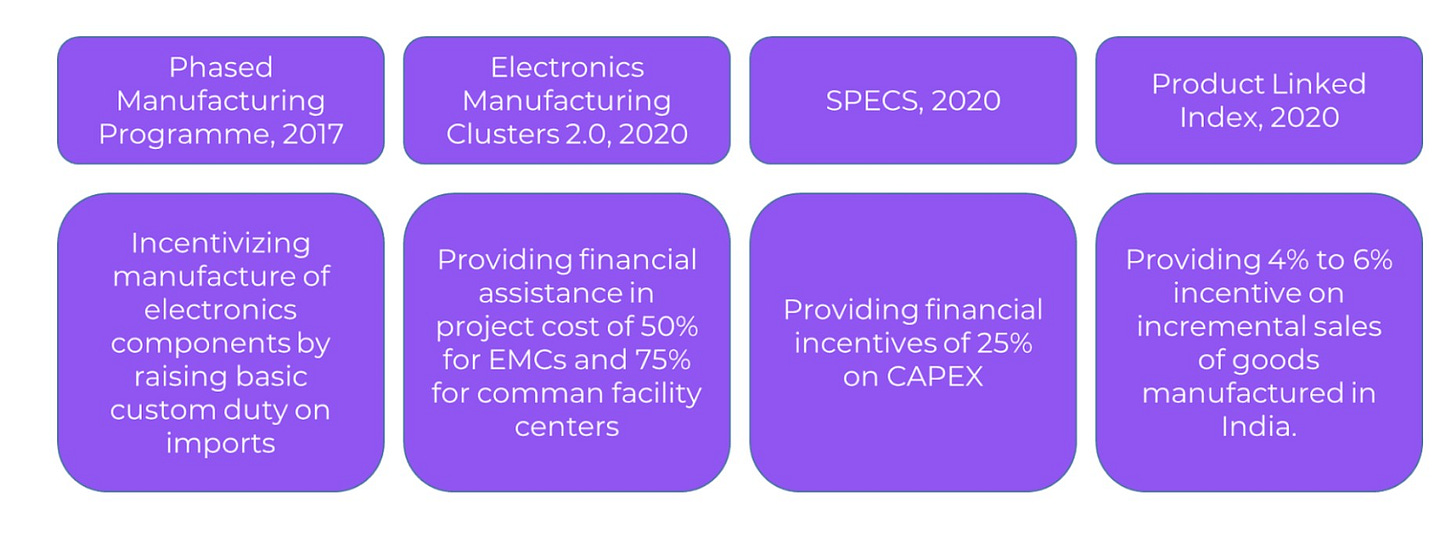

The government has come up with various schemes to cumulatively address India’s manufacturing cost disability.

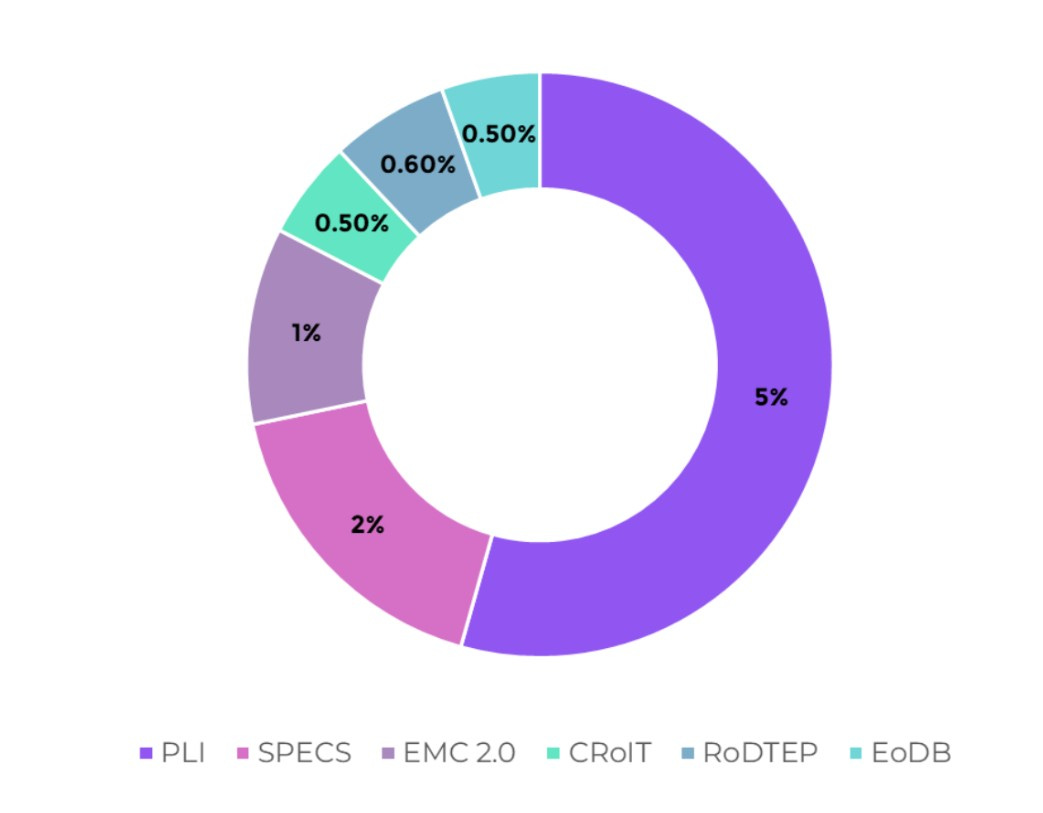

The below chart shows various schemes introduced by the Government

Of this, the PLI scheme has been the most successful in addressing challenges associated with India’s high cost of capital.

SPECS - Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors, PLI- Production Linked Incentives, EMC 2.0 - Modified Electronics Manufacturing Clusters, CRoIT - Concession Rate of Income Tax, RoDTEP - Remission of Duties or Taxes on Export Products, EoDB - Ease of doing business

The launch of the Indian government’s PLI for the EMS sector, inviting applications from 1 May, could not have come at a better time, with disruption caused by the US-China tariff war. While the US has exempted essential electronics from reciprocal tariffs applicable to Chinese imports, they would still attract a 20% tariff against nil from other countries.

Further, uncertainty surrounding the overall trade dynamics is pushing companies to consider building alternative supply chains. Here, India emerges as a strong supply base. This will benefit companies like Dixon, Kaynes and PG Electroplast.

Key Players

Dixon Technologies

Dixon Technologies, established in 1993, has emerged as a leading force in India's Electronics Manufacturing Services (EMS) sector. Headquartered in Noida, Uttar Pradesh, the company specializes in manufacturing a diverse range of products, including consumer electronics, lighting solutions, home appliances, mobile phones, security devices and reverse logistics. With 17 manufacturing units across India, Dixon has solidified its position as a key player in the domestic electronics landscape.

Q3FY25 : Why does this quarter matter?

Unlike most Indian manufacturing plays, Dixon isn't just riding government policy tailwinds—it's creating a sustainable competitive moat through backward integration, scale advantages, and strategic joint ventures.

Q3 FY2025 wasn't just another good quarter; it represented an inflection point in Dixon's journey from contract manufacturer to integrated solutions provider.

Three Critical Developments This Quarter

Mobile Manufacturing Scale Achievement

Volumes approaching 30 million units annually (on track for 40-45 million)

Clear path to 60 million units long-term

Partnerships with premium global brands strengthening

2. High-Value Component Ecosystem Emergence

a. Display module integration progressing

b. Camera module & precision component capabilities expanding

c. Battery pack integration enhancing margins

3. Export Momentum Building

a. Ismartu platform targeting 3 million export units

b. Global certification processes completed

c. International expansion becoming meaningful revenue driver

The ₹24,000 cr Question : Capex Strategy Decoded

Dixon's aggressive CAPEX plans represent both its greatest opportunity and most significant risk. Let's break down where the money is going and what returns we can expect:

Capex Allocation & Expected Returns

Significant government subsidy expected

The display fab project represents Dixon's highest-risk, highest-reward bet.

Kaynes Technology

Founded in 2008, Kaynes Technology India Ltd. has rapidly emerged as one of the fastest-growing and most trusted names in India’s EMS sector. What sets Kaynes apart is its ability to deliver a complete, end-to-end solution — right from conceptual design and process engineering to integrated manufacturing and life-cycle support. Whether it’s assembling high-quality PCBs, building fully integrated electronic products (Box-Build), or offering design-led Original Design Manufacturing (ODM) services, Kaynes is a one-stop destination for electronics innovation.

Serving both domestic and international clients, Kaynes has built a strong global footprint across diverse industries — from Automotive and Industrial applications to Railways, Aerospace, Medical Devices, and even Information Technology.

Financial Performance and Growth Trajectory

In the fiscal year 2023–24, Kaynes reported a revenue of ₹1,804.62 crore, marking a 60.25% increase from ₹1,126.11 crore in the previous year.

Looking ahead, Kaynes has set an ambitious target to achieve a revenue of ₹8330 cr FY28, implying a CAGR of approximately 45% over the next four years.

This goal reflects the company's commitment to expanding its electronics system design and manufacturing offerings and capitalizing on high-growth areas.

Strategic Initiatives and Market Positioning

Kaynes' growth is propelled by several strategic initiatives:

Government Initiatives: The Indian government's "Make in India" and Production Linked Incentive (PLI) schemes have been instrumental in fostering a conducive environment for domestic manufacturing. These initiatives have spurred large-scale investments in the electronics sector, positioning India as a formidable contender in high-end electronics production.

Technological Advancements: The rollout of 5G technology provided a significant boost to the EMS industry by driving demand for advanced electronic telecommunication components and devices. Similarly, rising demand from wearable electronics, mobile and other consumer appliances leading the growth in consumer segment while notable demand for EV components and EV charging infrastructure to drive Electric Vehicle (both 4W and 2W) industry growth.

Value-Added Services: Over the years, Kaynes has built strong relationships with its customers, with many partnerships lasting over seven years. This trust enables Kaynes to offer high-value services such as "Box Build" (assembling complete systems) and Original Design Manufacturing (ODM), where it not only manufactures but also designs products for its customers, thereby increasing its share of business.

Manufacturing Facilities

Kaynes has set up manufacturing facilities equipped with cutting-edge technology located in proximity to customers.

The company is undertaking significant capex expansion which primarily includes OSAT facility and PCB manufacturing facility.

Additionally, an integrated manufacturing facility with an estimated capex of $600mn is being set up at Chamarajanagar.

Further, some of these facilities are located within dedicated parks and clusters identified by the government, which offers incentives like that of special economic zones:

Mysuru, Karnataka - Unit - I: Approved under Electronics Hardware Technology Park Scheme of Software Technology Park of India, Bengaluru

Chennai, Tamil Nadu: Approved under 100% Export Oriented Unit Scheme

PG Electroplast Ltd

PG Electroplast stands out for its expertise in Original Design Manufacturing (ODM), Original Equipment Manufacturing (OEM), and Plastic Injection Moulding—three core areas that are crucial to the global manufacturing ecosystem.

In the ODM model, the company designs and manufactures products based on its own innovations and technical specifications, which are then rebranded and sold by other companies. This allows clients to bring high-quality, ready-to-market products to consumers without investing in design and development themselves.

With its OEM capabilities, the company works closely with clients who supply their own designs and specifications. The company then manufactures these products or components with precision and efficiency, enabling brands to scale production while maintaining strict quality standards.

Their Plastic Injection Moulding operations are equally impressive. This process allows for the mass production of plastic parts with exceptional accuracy and consistency—an essential requirement in industries like automotive, consumer electronics, healthcare, and packaging.

Strong Momentum Backed by Demand

The company’s product business has nearly doubled in size year-on-year, driven by rising domestic demand for consumer durables. PGEL expects product revenue to touch ₹3,300 crore in FY25, up from ₹1,668 crore in FY24. This includes OEM manufacturing for ACs, washing machines, and air coolers — segments expected to see sustained growth with increasing electrification and urbanization.

Financials That Back the Story

PGEL has seen sharp growth over recent quarters:

Q3 FY25 profit more than doubled to ₹39.5 crore

Revenue jumped 82% year-on-year to ₹967 crore

For FY25, PGEL has guided for ₹4,550 crore in total revenue and ₹280 crore in profit, a 100%+ jump from last year

These numbers show PGEL is not just scaling — it’s scaling profitably.

Focused Strategy, Not Spreading Too Thin

In 2023, PGEL exited direct TV manufacturing by forming a 50:50 JV (Goodworth Electronics) with the Jaina Group, allowing it to focus on high-volume consumer durables instead. That decision has freed up resources for scale and specialization — especially in fast-moving categories like air conditioners.

Investing in Capacity, Not Just Talk

PGEL is putting its money where the growth is. It plans to invest ₹370–380 crore in FY25 toward two new manufacturing plants in North India and expansion of its Maharashtra unit. This capacity boost is essential if the company is to meet its ambitious growth targets and reduce supply-side bottlenecks.

Bottom line: PGEL might not be as diversified as Dixon or Kaynes, but its tight focus on consumer durables is translating into scale, profitability, and relevance. For India’s EMS story to work, we don’t just need broad-spectrum players — we also need specialists like PGEL.

Amber Enterprises

COMPANY OVERVIEW

Founded in 1990, Amber has evolved into a leading backward-integrated player in India’s RAC industry, leveraging its strong R&D and manufacturing expertise. With 27 strategically located plants, it delivers quick turnaround times across HVAC, mobility and electronic segments. Initially reliant on RAC, which contributed 72% of revenue in 2018, Amber has aggressively diversified into high-growth areas like railway subsystems and electronics, reducing RAC’s share to 40% in FY24. Through strategic capex and acquisitions, Amber continues to expand its footprint, strengthening its position across the value chain.

BUSINESS VERTICALS

Consumer Durables

mber leads the room air conditioner (RAC) segment with a wide range of products, including indoor units (IDUs), window units (WDUs), and outdoor units (ODUs) for split air conditioners ranging from 0.75 to 2.0 tons. These products come in different energy ratings and use various types of refrigerants. Beyond air conditioners, Amber also manufactures key components such as heat exchangers, electric motors, electronic controllers, condensers, and copper tubes. The company is also expanding into the commercial air conditioning space by introducing ductable and cassette ACs. Additionally, Amber now covers around 70% of the indoor and outdoor unit value chain for inverter air conditioners.

Electronics

Through its subsidiaries ILJIN, Ever, and Ascent, Amber has established itself as a leader in printed circuit board assemblies (PCBAs) for consumer durables, room air conditioners (RAC), and telecom products. In FY23, the company expanded into smart wearables, hearables, and telecom hardware like optical network terminals (ONT) and remote radio heads (RRH). This move taps into the growing demand for smart electronics and strengthens Amber’s position in the market.

Railways and defense sub-systems

Since acquiring Sidwal in 2019, Amber has boosted its presence in mobility air conditioning, becoming the leading supplier of roof-mounted ACs for railways, metros, buses, and defense. It serves major clients like Indian Railways, Siemens, and DMRC, and has won important contracts for metro AC projects. Amber also continues to innovate in HVAC systems and railway-related components.

Syrma SGS Technology

COMPANY OVERVIEW

Incorporated in 2004, Syrma SGS Technology Limited is a Chennai-based engineering and design company engaged in electronics manufacturing services (EMS). The company provides integrated services and solutions to original equipment manufacturers (OEMs) from the initial product concept stage to volume production through concept co-creation and product realization.

Syrma is a technology-focused engineering and design company engaged in turnkey electronics manufacturing services (“EMS”), specializing in precision manufacturing for diverse end-use industries. They are leaders in high-mix volume product management and are present in most industrial verticals

PRODUCT PORTFOLIO

Printed circuit board assemblies (PCBA)

Radiofrequency identification (RFID) products

Electromagnetic and electromechanical parts

Motherboards

Memory products - DRAM modules, solid state and USB drives

KEY DRIVERS

Expanding value-added offerings to strengthen margins

Syrma is strategically enhancing its focus on value added products to drive long-term margin expansion. The revenue contribution from box-build increased - from 18% in FY23 to 25% in FY24 - signalling a shift toward higher-value manufacturing. Also, Syrma is the largest manufacturer of RFID products in India, a segment that typically commands 250-300 bps higher margins compared to PCBA.

Diverse client portfolio providing stability

A well-diversified customer base acts as a natural hedge against market fluctuations. Syrma has boarded 200 new customers between FY20 and FY23, bringing the total count to 270+ in FY24, with 15-18 key clients maintaining relationships for over a decade. The company has also reduced its Top 5 customer concentration from 35% in FY23 to 25% in FY24, mitigating risks from client-specific disruptions. Going forward, Syrma is set to expand its client base across high-margin industries such as industrial, consumer, automotive (primarily EVs) and railways over the next 2 to 3 years.

AVALON TECHNOLOGIES LTD

COMPANY OVERVIEW

Incorporated in 1999, Avalon Technologies Limited is a leading fully integrated Electronic Manufacturing Services ("EMS") company with end-to-end capabilities in delivering box-build solutions, focusing on high-value precision-engineered products.

They provide a full stack product and solution suite, from printed circuit board (“PCB”) design and assembly to the manufacture of complete electronic systems (“Box Build”), to global OEMs across the United States, China, Netherlands, and Japan.

PRODUCT PORTFOLIO

PCB Design and Assembly

Metals / Sheet Metal Fabrication

Cable Assembly and Wire Harnesses

Transformers

Chokes and Inductors

Injection Moulded Plastics

KEY DRIVERS

Diverse customer base with reduced concentration risk

Avalon has grown its customer base by adding around 41 new clients in recent years, reaching a total of 95 as of FY23. It has also reduced its reliance on its top 10 clients, with their revenue share dropping from about 64% to 55% in FY24, leading to a more balanced and diverse customer mix.

End-to-end capabilities with industry-leading box-build share

Avalon provides end-to-end services, from design to final assembly (box-build), which made up about 50% of its revenue in FY24, growing at an 11% CAGR over FY20–24. It leads the industry in this segment with a strong gross margin of ~36% in FY24. With around 88% of its manufacturing already in India, Avalon plans to localize further to cut costs and improve margins.

US manufacturing and new geographies to aid higher export growth

Avalon stands out in its industry with over 20 years of manufacturing experience in the US, allowing it to benefit from favourable Trump-era policies and the US economic recovery. The 6% duty difference between India and the US won’t affect Indian manufacturers due to lower costs, and Avalon remains protected by its SEZ operations, which are duty-free. The company is also expanding its global presence, with plans to secure contracts in Europe and Japan by FY26, reducing regional risk and supporting growth.

Cyient DLM

COMPANY OVERVIEW

Cyient (formerly Infotech Enterprises Limited) is an Indian multinational technology company that is focused on engineering, manufacturing, data analytics, and networks and operations. Infotech Enterprises Ltd. was established in 1991 in Hyderabad.

Cyient is one of the world's top 30 outsourcing companies and operates through eight strategic business units: Aerospace & Defense; Transportation; Industrial, energy and natural resources; Semiconductor, Internet of things and Analytics; Medical and Healthcare; Utilities & Geospatial; Communications and Design-led-manufacturing (Cyient DLM)

KEY GROWTH DRIVERS

Strong niche positioning and loyal customer base

Cyient DLM operates in specialized sub-segments with high entry barriers, ensuring strong customer loyalty. By FY24, the company served about 35 customers, with its top 10 clients accounting for nearly 92% of the order book, reflecting high customer retention and strong potential for recurring business.

Scaling growth through enhanced asset utilization

Cyient DLM has three manufacturing facilities operating at under 50% capacity, giving it room to benefit from growing demand and greater customer penetration. As production efficiency improves, the company expects operational leverage to lead to higher margins.

Expanding export dominance while entering domestic markets

Exports, a major growth driver, grew at a 25% CAGR from FY21 to FY24, making up 47% of total revenue in FY24. With new opportunities in defence and industrials, Cyient DLM plans to explore domestic market potential while maintaining its strong export base.

Ventures into US manufacturing

Altek’s strong presence in the US, especially in the defence sector, boosts its ability to serve clients in the medical, healthcare, and industrial sectors. With ITAR certification, advanced manufacturing, and strong relationships, Altek provides Cyient DLM with a significant competitive edge.

Company Coverage Across Value Chain

Challenges in EMS sector - India vs Vietnam

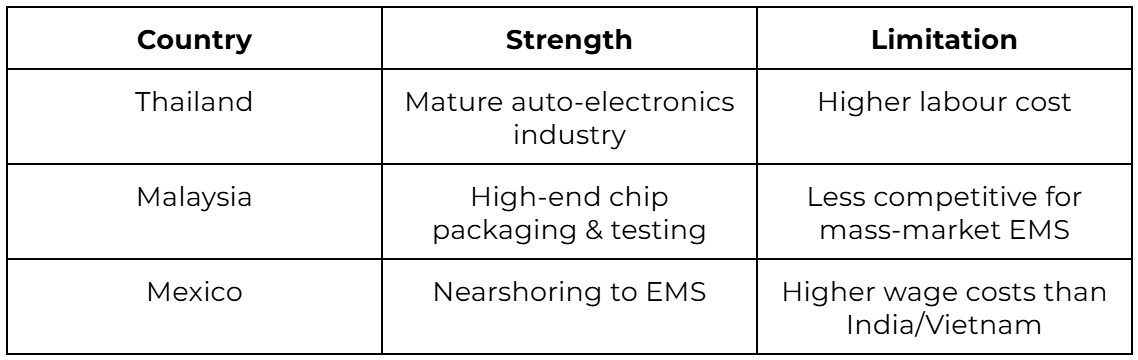

Other EMS Hubs in the Region

Conclusion

In conclusion, the EMS sector in India is at a crucial juncture, with significant potential for growth, but it also faces challenges that need to be addressed. Government initiatives, technological advancements and global market dynamics are driving this sector’s growth, making it a vital player in India’s digital and technological narrative.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."

Great sector update, Shashank! I really enjoyed going through the entire newsletter :-)

Just one small suggestion - consider reviewing the content indexing. There are a few inconsistencies. For instance, the “Financial Performance and Growth Trajectory” section under Kaynes Technology is also appearing in the main content index due to the applied markdown. Ideally, it shouldn’t - especially since similar subsections like “Company Overview” and “Business Verticals” under Amber Enterprises aren’t listed in the index.

This is particularly helpful for readers who rely on the content index to navigate long-form pieces on Substack.