10 Red Flags in Company Narratives That Investors Often Miss

Spotting warning signs in how companies sell their story—not just their numbers

Investor decks are the storytelling weapon of every founder and CFO. They’re designed to convince — not to confess. They’ll show hockey stick growth, market domination, visionary founders, and glowing customer quotes.

But beneath the glossy design and visionary language often lie red flags — subtle cues that signal deeper structural issues, flawed assumptions, or even outright deception.

Here are 10 overlooked red flags that seasoned investors and analysts learn to sniff out — with real-life examples that prove just how costly it can be to ignore them.

🚩 1. TAM So Big, It’s Practically the Universe

“We’re disrupting a $3 trillion industry!”

When a startup highlights a massive Total Addressable Market (TAM) without clear segmentation or bottom-up math, it’s often a red flag.

💥 Case in Point: WeWork

WeWork’s investor decks pitched a $3 trillion TAM — counting every square inch of office real estate on Earth. But the reality? They were leasing properties and subleasing them to freelancers and startups in premium urban locations. Their actual Serviceable Obtainable Market (SOM) was a fraction of that.

💡 Investor Insight:

Always check if the TAM is top-down (“we’ll get 1% of a billion people”) or bottom-up (“we’ve sold 5,000 units at $20 — here’s how we’ll scale to 50,000”).

🚩 2. Design Overload, Data Underload

All fluff, no stuff.

A beautiful investor presentation can hide the fact that the company has no idea what it’s doing.

💥 Case in Point: Theranos

Elizabeth Holmes wowed investors with sleek decks, futuristic images of compact blood analysers, and catchphrases like "One drop changes everything." But the deck never included standard lab data validation, false positive rates, or FDA approvals.

💡 Investor Insight:

Design is meant to aid understanding, not replace it. If a deck spends more time on fonts and stock photos than margins or business model, proceed with caution.

🚩 3. No Competition Mentioned (Or Poorly Understood)

“We’re the only ones doing this.”

If a founder says their company has “no competitors,” they’re either bluffing or don’t understand their own market dynamics.

💥 Case in Point: Stayzilla

Stayzilla pitched itself as India’s first and only “alternative stay” marketplace — connecting travelers with homestays, guesthouses, and offbeat stays. The founders often implied they had no direct competition because no one else was doing exactly what they did.

In reality, OYO was eating their lunch, scaling faster with standardized budget stays, and Airbnb was growing in India with better UX and global trust. Stayzilla underestimated how both traditional hotels and horizontal platforms like MakeMyTrip could pivot into their space — and eventually shut down in 2017.

💡 Investor Insight:

Always look deeper than “no one does what we do.” Ask: Why not? And: How defensible is this really? Even if competitors don’t look identical today, distribution, customer base, and execution speed often matter more than vision.

🚩 4. The Hockey Stick With No Supporting Strategy

“We'll make 10x revenue next year.”

Every founder loves the legendary hockey stick growth curve — that sharp upward spike that promises explosive scale. But if the curve isn’t backed by execution clarity, it’s just a slide-shaped fantasy.

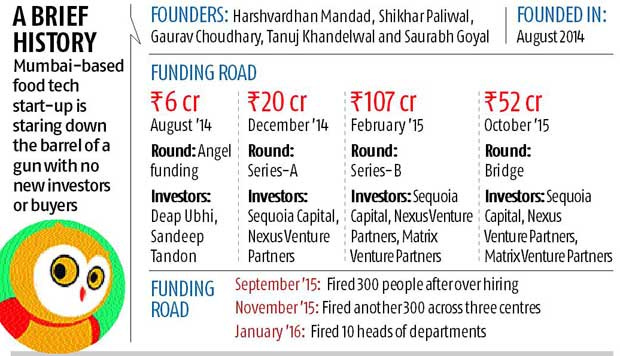

💥 Case in Point: TinyOwl (India)

TinyOwl, one of India’s early food delivery startups, raised millions on the promise of exponential growth. Their projections were bold — but the business model was fragile. They expanded rapidly to over 11 cities without a solid logistics backbone or local strategy. Burn rates soared. Chaos followed. Eventually, the company collapsed and was absorbed by Roadrunnr.

💡 Investor Insight:

A sharp revenue curve should be built on sharp reasoning — unit economics, market depth, distribution plans, and retention levers. If the pitch shows scale without infrastructure, you’re looking at ambition unmoored from reality.

🚩 5. Founder Worship Without Balance

“He built India’s biggest EdTech unicorn!”

Founders who become the face of a movement can command media love, board trust, and investor patience. But when checks and balances disappear, admiration can turn into enablement.

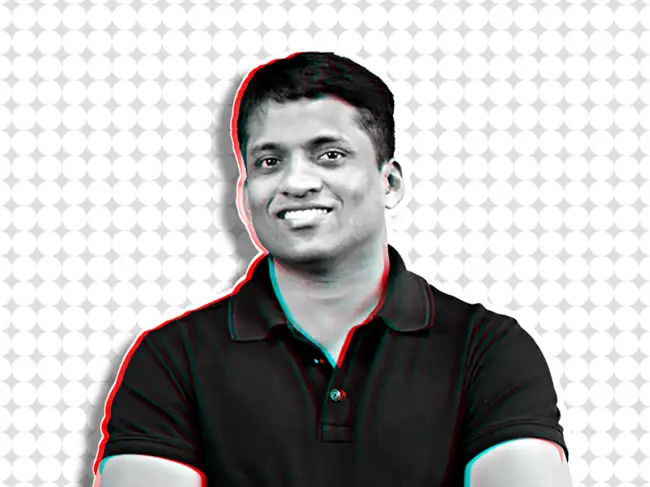

💥 Case in Point: Byju Raveendran & BYJU’S (India)

Byju Raveendran was once celebrated as the poster boy of Indian edtech — a teacher-turned-billionaire who scaled BYJU’S into a global powerhouse. But beneath the unicorn glow were red flags: aggressive sales tactics, opaque accounting, overvalued acquisitions, and delayed financials. Despite multiple warnings, governance took a backseat. As scrutiny mounted, the board fell apart, the CFO and auditor resigned, and investors filed lawsuits.

💡 Investor Insight:

A magnetic founder can raise capital — but sustained value comes from operational transparency and team depth. Always ask: Is this company bigger than the founder’s personal brand?

🚩 6. Customer Quotes Without Quantification

“We love your product!” - Random User

Anecdotes are easy to fabricate. Metrics are harder to fake.

💥 Case in Point: Juicero

Juicero showed happy customer reviews, lifestyle photos, and glowing media clippings. But customers quickly learned they didn’t need the $400 machine — squeezing packets by hand worked just as well.

💡 Investor Insight:

Ask for NPS scores, churn rates, monthly active users (MAU), or customer acquisition cost (CAC). Stories are nice — numbers are evidence.

🚩 7. “Strategic Partnerships” That Are Just Fluff

“We’re partnering with Amazon.” (to sell $29 items on their marketplace)

Founders love dropping big names. But is it a strategic alliance, or just a sales channel?

💥 Case in Point: Multiple ICO scams (2017–2019)

Crypto projects falsely claimed partnerships with IBM or Microsoft. In most cases, they had simply used cloud hosting or attended an event — not actual co-development or contracts.

💡 Investor Insight:

If a partnership is real, there will be specifics: duration, revenue impact, exclusivity. Look for signed press releases or contract terms — not just logos slapped onto a slide.

🚩 8. Buzzwords Instead of Tech Depth

“AI-powered blockchain solution for the metaverse.”

Words like “AI,” “machine learning,” and “Web3” are catnip for investors — but they’re often thrown in without substance.

💥 Case in Point: Nikola Motors

Nikola hyped its hydrogen truck technology. The famous demo video showed the truck “in motion,” but later it was revealed it was rolling downhill. No functioning prototype existed at the time.

💡 Investor Insight:

Ask for demo videos, prototype specs, patents filed, or developer credentials. If the deck says “AI-powered,” ask: What model? Trained on what data?

🚩 9. No Mention of Risk

“We’re perfectly positioned for explosive growth!”

No business is risk-free. Ignoring risks in the deck means the team may be ignoring them operationally too.

💥 Case in Point: FTX

FTX was seen as the gold standard of crypto exchanges. But nowhere in its public documents were there real discussions of custodial risk, governance, or counterparty exposure. The lack of internal controls led to a spectacular collapse.

💡 Investor Insight:

Look for transparency. Are market, operational, regulatory, and liquidity risks even acknowledged? Or is it all blue skies?

🚩 10. No Exit Strategy or M&A Awareness

“We’ll IPO once we hit $100M ARR.”

Some startups throw around big outcomes but dodge the real question: how will investors actually get liquidity? If the only plan is “we’ll IPO,” and there’s no path to acquisition or cash flow, it’s a red flag.

💥 Case in Point: AskMe (India)

AskMe was once pegged as India’s answer to Yelp + Craigslist — backed by Astro Group and flush with capital. It scaled aggressively into classifieds, e-commerce, and hyperlocal delivery. But when the cash dried up, it had no profitable core, no strategic buyer, and no route to exit. In 2016, it shut down suddenly, leaving employees unpaid and vendors stuck.

💡 Investor Insight:

A good pitch includes realistic exit thinking — who might acquire them, which IPO windows they’re targeting, or how they’ll become cash-flow positive. No exit clarity = potential capital dead end.

🧠 Final Thought:

The best investor presentations don’t hide complexity. They explain it.

Red flags don’t always mean fraud — but they often signal wishful thinking, poor planning, or dangerous blind spots. As an investor or analyst, your job is not to be impressed — it’s to be skeptical.

So the next time a deck wows you, ask yourself:

👉 What are they not telling me?

📬 Found this useful? Subscribe for more insights on startup analysis, investor psychology, and market stories that matter. And if you’ve ever spotted red flags in a deck — share them in the comments. Let’s dissect them together.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

🧾 Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."