Turning Input Cost Pain Into Operational Gain

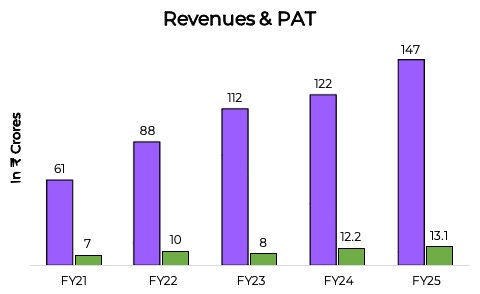

After input headwinds hurt earlier quarters, Q4 saw margins improve sharply, profit jump to ₹4.48 Cr, and a ₹47.5 Cr capital raise for expansion ahead.

Company Overview

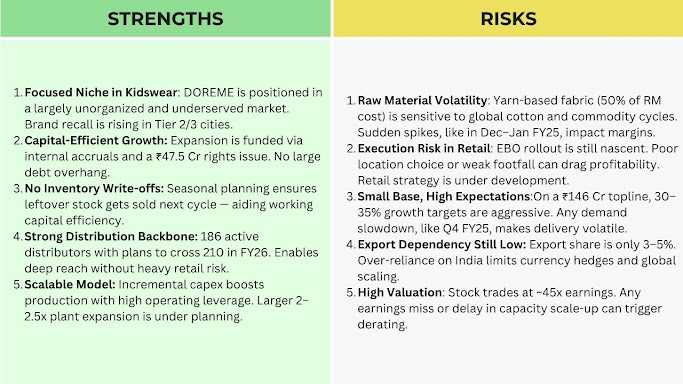

Iris Clothings Ltd is an Indian kidswear company known for its flagship brand DOREME. It designs, manufactures, and sells affordable readymade garments for children aged 0–14, covering casualwear, sportswear, and now innerwear.

The company operates through a mix of B2B distribution, Exclusive Brand Outlets (EBOs), and online sales (mainly via FirstCry). With a growing pan-India presence, Iris has expanded its distributor base to 186 and is steadily entering retail with a focus on Eastern India.

Led by promoter Santosh Ladha, the company aims to build DOREME into India’s leading kidswear brand — combining consistent product quality with strong market execution.

Market Presence & Distribution

Iris Clothings has built a strong distribution-led model centered around the DOREME brand. Its primary revenue comes from a growing B2B distributor network, supported by selective retail and digital channels.

As of FY25, Iris had 186 active distributors, with plans to expand to 210–215 by FY26. This helps the company reach deep into Tier 2/3 cities, where branded kidswear is still underpenetrated.

The company has opened 7 Exclusive Brand Outlets (EBOs) so far, with 5 of them launched in FY25. These are largely concentrated in Eastern India and showed strong sales during festive and summer seasons.

On the e-commerce front, 10% of FY25 revenue came from FirstCry, which remains the company’s sole significant online partner for now. D2C (Direct-to-Consumer) is a future opportunity.

Exports contributed ~3% of revenue in FY25, mainly to Saudi Arabia, UAE (Dubai), and Mozambique. The company expects exports to rise to 5% in FY26, led by inbound interest from retailers abroad.

Overall, Iris is strategically balancing wholesale scale via distributors with selective brand-building via retail and export opportunities.

Product & Innovation Strategy

Iris Clothings focuses exclusively on kidswear under its flagship brand DOREME, with a strategy built on seasonal relevance, affordable pricing, and design variety.

The product portfolio spans casualwear, winter wear, sportswear, and now innerwear, covering kids from newborns to 14 years.

In FY25, the company launched a new winter sportswear line, which received strong market response for its quality and comfort, especially in colder regions.

Iris plans to launch its kids’ innerwear segment in FY26, targeting a largely unorganized category with strong demand but limited branded presence. Revenues from this segment will start accruing from Q3–Q4 FY26.

The company follows a 3-season planning cycle — summer, pre-winter, and winter, allowing it to spread production and inventory efficiently.

Inventory innovation is a key strength: Iris avoids write-offs by designing timeless seasonal pieces that retain value year after year — e.g., unsold summer stock in May sells at full price in the next March-April cycle.

On sourcing, fabric (mostly yarn-based) accounts for nearly 50% of raw material cost. Iris proactively times its purchases to lock in favorable rates, helping stabilize margins.

The company’s innovation edge lies not in R&D labs, but in market-led design, fast response to trends, and tight control on cost and wastage, enabling profitable growth in a price-sensitive category.

Operations & Capacity

Iris currently produces ~30,000 pieces/day against a capacity of 34,000. A planned capex of ₹6–7 Cr in FY26 will raise this to 38,000–39,000 pieces/day.

The setup is lean, with in-house design and stitching, and selective outsourcing. A major capacity expansion (2x–2.5x) is being planned for the next phase.

Raw material is yarn-based fabric (~50% of costs), and the company actively manages procurement to control input costs. The operations are aligned with seasonal cycles to optimize inventory and production.

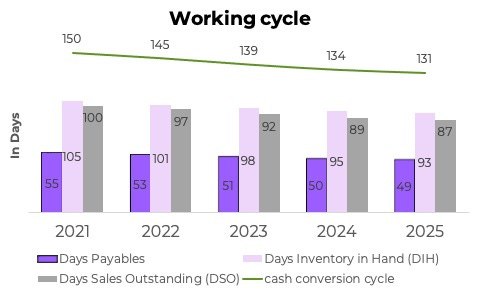

Financial

Future Outlook

Iris aims for 30–35% revenue growth in FY26, led by new capacity (38–39k pcs/day), launch of kids’ innerwear, and retail expansion.

It plans to add 15–20 new distributors and open 3–4 EBOs in the near term, while strengthening exports (targeting 5% of sales) and growing its presence on FirstCry.

Margins are expected to stay near 20% EBITDA, supported by input cost stabilization and better scale. A larger capex plan is under evaluation for FY27+.

Risks & Strengths

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."