Thyrocare Recall

Thyrocare Q1 FY26 Concall: Strong Execution, Margin Leverage, and a Clear B2B-First Strategy

Thyrocare Technologies has delivered a solid Q1 FY26 performance, reflecting the strength of its B2B-led model, focus on operational excellence, and disciplined reinvestment philosophy. With secular growth across regions, a rapidly expanding franchisee network, and Six Sigma-driven quality initiatives, the company continues to cement its position as a differentiated diagnostics player in an otherwise crowded landscape.

Q1F/Y’26 Updates

The company has fully integrated the Polo and Vimta networks and has launched ECG-at-home services across its network through the acquisition of Think Health.

They have 40 lab networks currently like Thyrocare India, Tanzania, Polo, Vimta and their other partner labs.

For Q1FY’26, they have more than 9,500 active quarterly franchises (vs 8,145 in Q1 FY25 and 9,413 in Q4 FY25). They processed 46.9 million tests which grew by 15% year-on-year & served 4.6 million patients in the year which increased by 12% year-on-year.

In the past quarters, they have added multiple advanced technologies including histopathology, a new equipment platform in HPLC and their first foray into Coagulation.

Launched BioFire, one of the most advanced PCR platforms.

During Q1 FY’26, Reports were released within 3.35 hours on average after sample were sent.

On average in Q1 FY’26, the company released reports within 3.35 hours of receiving samples at the lab.

Aarogyam remains the company’s flagship brand, while two new brands—Jaanch and Her Check—were launched recently.

During Q1 '26, they expanded their geographical footprint by opening new partner labs in Roorkee, Kashmir and started processing at a new regional lab in Bhagalpur.

In Tanzania, since going live in March 2024 and processing their first test in April, they have partnered with over 192 healthcare facilities in Dar es Salaam till date.

New Brands Launched

Jaanch -

Jaanch, recently launched by the company, is positioned as a comprehensive diagnostic brand targeting lifestyle-related health challenges. It offers a broad spectrum of solutions ranging from routine fever checks and hair fall diagnostics to advanced cancer screening and chronic disease investigations, including diabetes and cardiac health. Jaanch has grown 17% year-on-year and is soon becoming a strong pillar for lifestyle offer.

Her Check -

Thyrocare’s “Her Check” is a women-centric diagnostic brand targeting hormonal health, thyroid, PCOS, and nutritional deficiencies. It addresses a key gap in preventive care for women, especially in urban and semi-urban India. The brand benefits from Thyrocare’s extensive at-home testing and phlebotomy network. Integrated into B2B2C channels, it complements the broader Aarogyam and Jaanch offerings. Though early-stage, Her Check is poised to become a high-growth, high-margin contributor.

Franchise Network Expansion -

Thyrocare’s franchisee-led model continues to scale effectively. The company reported over 9,500 active quarterly franchisees in Q1 FY26, up from 8,145 in Q1 FY25 and 9,413 in Q4 FY25. Management added ~2,400 franchisees in the past year while seeing a churn of ~1,000, resulting in a net addition of 1,400.

Looking ahead, management is targeting 1,200–1,500 net additions in FY26, maintaining a run rate of ~100 additions/month. Notably, over 95% of new franchisees are existing diagnostic operators, enabling faster ramp-up and higher throughput.

Menu Expansion -

Thyrocare has expanded its test portfolio with several advanced diagnostics, including:

Histopathology

A new HPLC platform

First-time entry into Coagulation testing

Launch of BioFire, an advanced multiplex PCR platform capable of detecting multiple pathogens from a single sample

Despite having a smaller test menu (~1,000 tests) compared to some B2C peers (2,000–3,000), the company claims full technology parity, activating tests based on demand and viability.

Business Performance -

Consolidated

The company is pursuing an expansion strategy through smaller labs in partnership with franchises and storefronts, which is expected to improve processing capacity and drive franchise growth in the coming quarters.

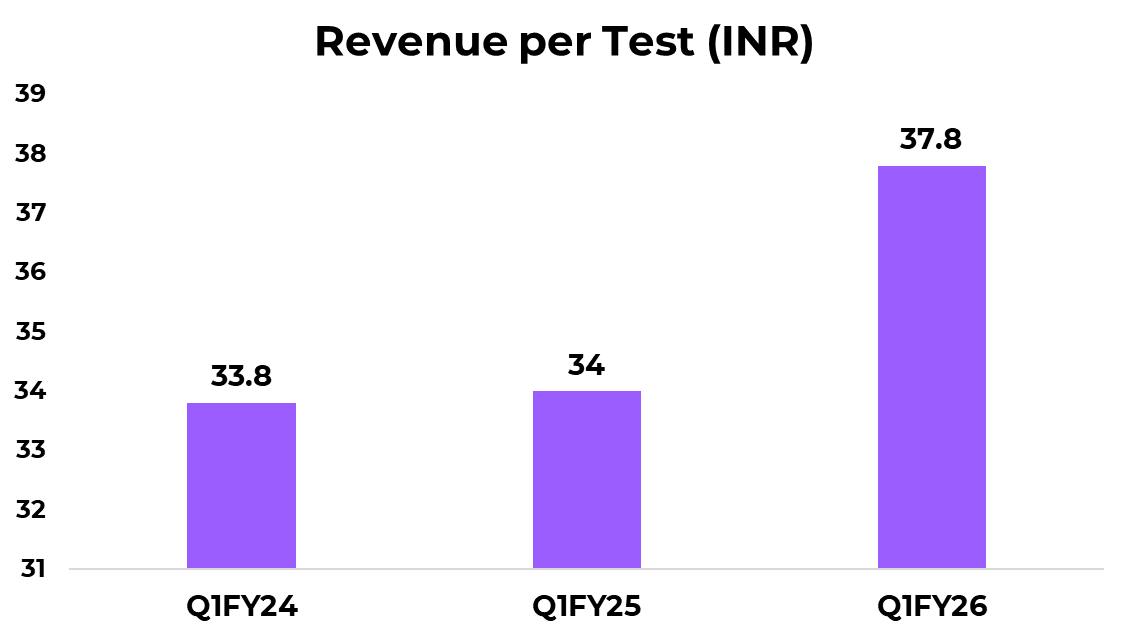

Increase in Revenue per test

Price increase during the quarter was marginal at ~1.5–2%. The rise in revenue per test was largely driven by mix improvement and the introduction of newer, higher-priced products, as well as up-selling initiatives across partner labs.

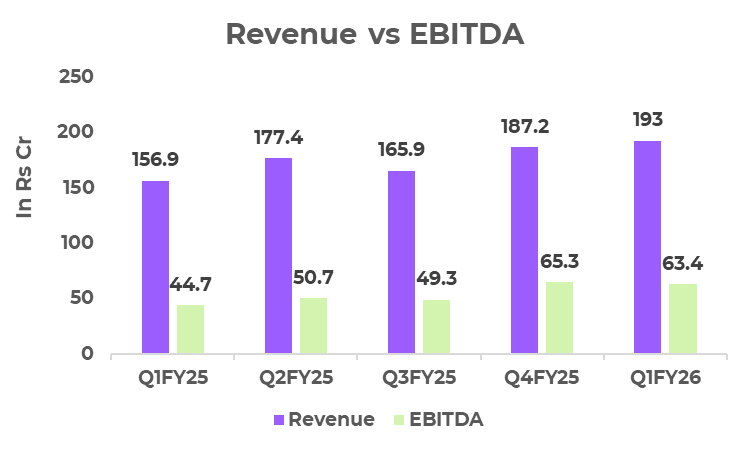

Management has guided for revenue and volume growth in the mid-teens.

Business Segments Performance

Franchise Revenue-

Revenue from franchisee operations grew 20% YoY, aided by improved slab-based pricing and increased volume throughput per center.

Partnership Business-

Partnership revenue grew 36% YoY, with API Pharmacy Diagnostics contributing +52% YoY and non-API partnerships growing 29% YoY. These include insurance, corporate wellness, and healthtech aggregators. The company is deepening offerings in the insurance segment, particularly around pre-policy and annual health check-ups.

Radiology-

Radiology services, including Pulse Hitech, grew at a modest 6% YoY, and remain a small but important part of Thyrocare’s multi-modal diagnostics approach.

Outlook & Guidance

Management has reiterated its guidance of mid-teens growth in both volume and revenue for FY26. Despite the Q1 outperformance, no upward revision has been made, with management citing a strong H2 FY25 base effect and a focus on sustainable growth.

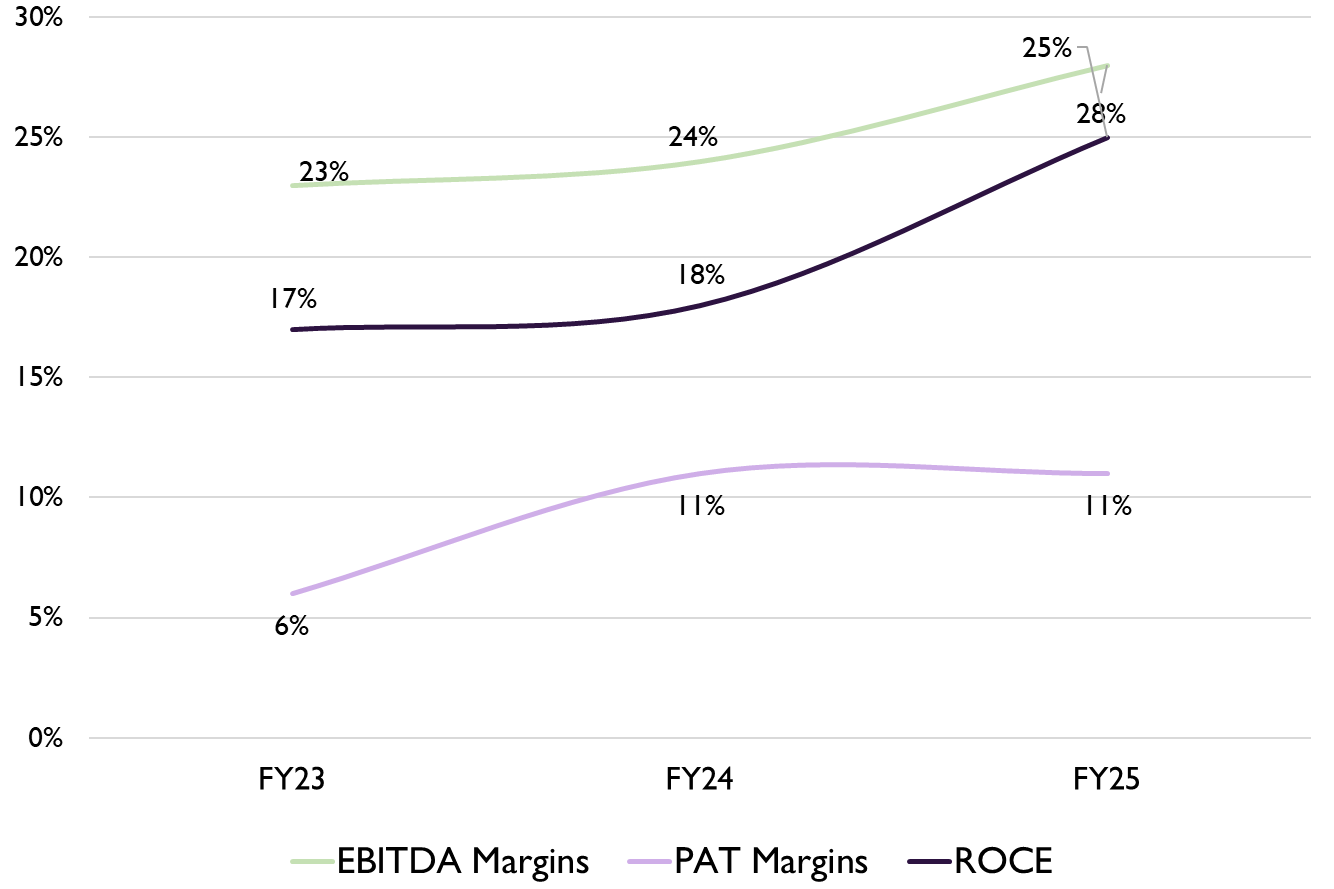

On margins, the company maintains its stance of reinvesting any EBITDA margin above 30% back into the business — prioritizing network expansion, technology, and quality over near-term profitability maximization.

Financials

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."