The Invisible Ingredient Behind Your Favorite Brands

India’s largest fragrance and flavour company is transitioning from legacy to leadership — with premiumisation, margin expansion, and backward integration at its core.

For over a century, this company has been the hidden artistry behind your favorite scents and tastes. They drive innovation and deliver top-notch quality in fragrances, flavors, and aroma ingredients, making everyday experiences more captivating and joyful.

COMPANY OVERVIEW

S H Kelkar and Company Limited (SHK) is the largest Indian-origin fragrance & flavour company in India with over 100 years of experience. The company’s products are sold under SHK, Cobra & Keva brands and are applied across various industries such as personal care, fabric care, home care, fine fragrances, bakery products, dairy, pharmaceuticals, & other food & beverages.

PRODUCTS

SHK's products include fragrances, aroma ingredients, & flavors.

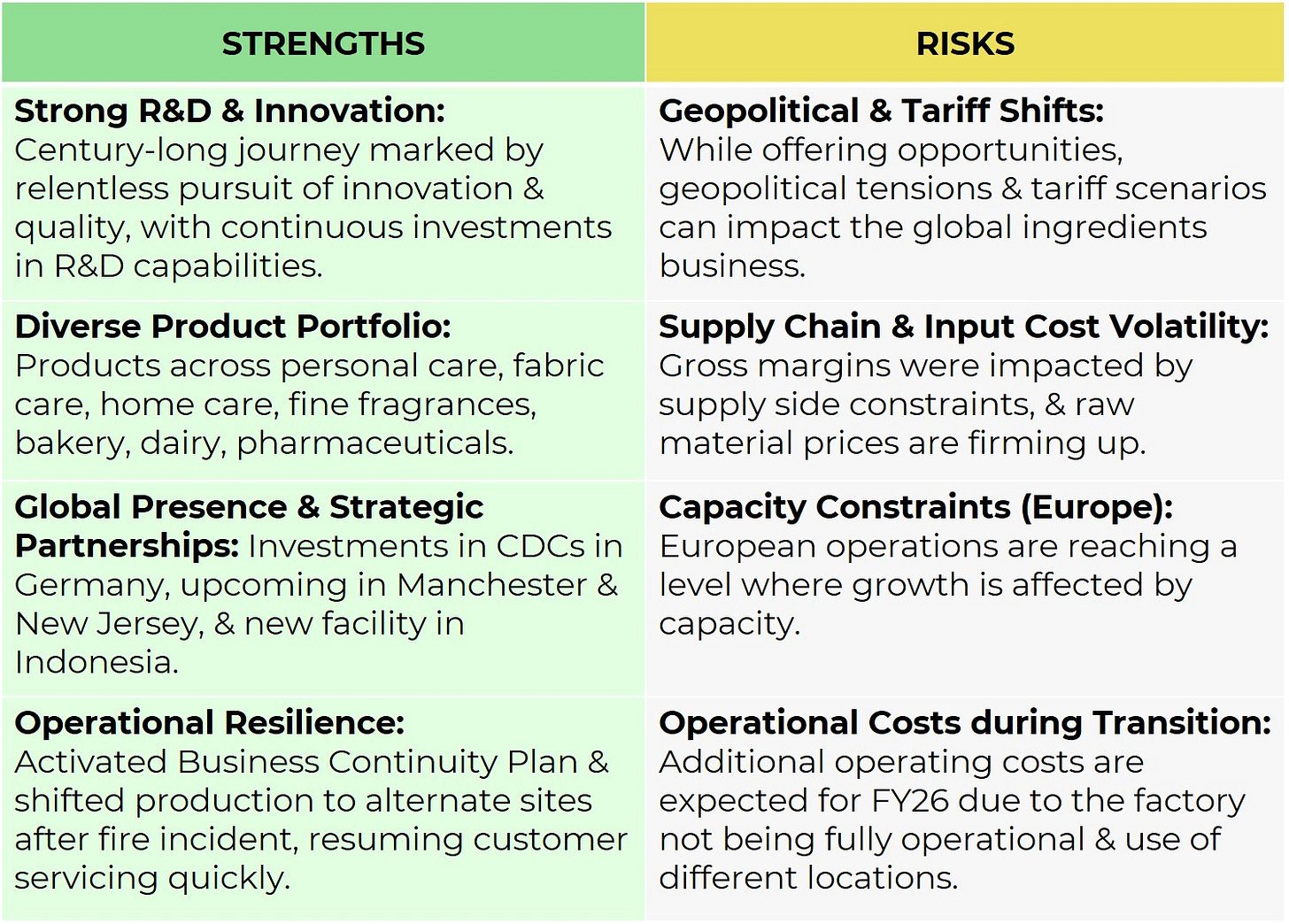

FRAGRANCE SEGMENT: The division grew by 19% in FY25, driven by sustained demand, especially in the domestic market, and increased engagement from small & mid-clients. European operations also showed strong growth. The re-establishment of the Vashivali Fragrance facility & the new Greenfield facility at Vanavate are expected to be commissioned within the current financial year (FY26). Price increases have been implemented to mitigate elevated input costs, with benefits expected in coming quarters. Global MNC accounts have significantly strengthened their engagement, resulting in a healthy order book for FY 2024-25.

FLAVOUR SEGMENT: This division recorded a robust 43% growth in FY25 on a subdued base from the previous year. The flavor segment experienced a revival in the international market due to increased customer engagement. The company expects a robust 15% plus growth in the flavor segment moving forward.

GLOBAL INGREDIENTS BUSINESS: This segment continued to make steady progress in FY25, driven by tariff & China plus One shift, as well as rising demand in European markets. There are good niche opportunities to build upon the existing business.

MANUFACTURING UNIT

Vashivali Facility: Re-establishment of the Vashivali Fragrance facility is progressing well and is expected to be commissioned within the current financial year. The facility was fully insured, and an interim payment of ₹ 95 Cr has been received for fire-related claims. The company has decided to put an additional factory in parallel with the rebuilding of the Vashivali factory, an investment that would not have been needed for another two to three years under normal circumstances.SHK plans around ₹ 200 Cr in CAPEX for the next two years, with some spillover into the next financial year. This CAPEX primarily involves the rebuilding of the Vashivali factory, which experienced a major fire incident on April 23, 2024.

Vanavate Greenfield Facility: This facility is advancing as planned & is slated for commissioning later this calendar year.

Operational Synergies: Due to the proximity of Vashivali & Vanavate sites, SHK is building operational synergies & systems as part of its broader BCP framework to enable better inventory management & reduce inventory days of sales.

Global Centers: SHK has invested in a CDC in Germany (operational for over a year), & has upcoming investments in Manchester (UK) & New Jersey (USA) which are just starting. These centers are expected to generate around ₹ 100 Cr of new business per year at their peak.

Indonesia Greenfield Facility: Operations commenced at the new greenfield facility in Jakarta from March 20, 2024, significantly bolstering presence in Southeast Asia.

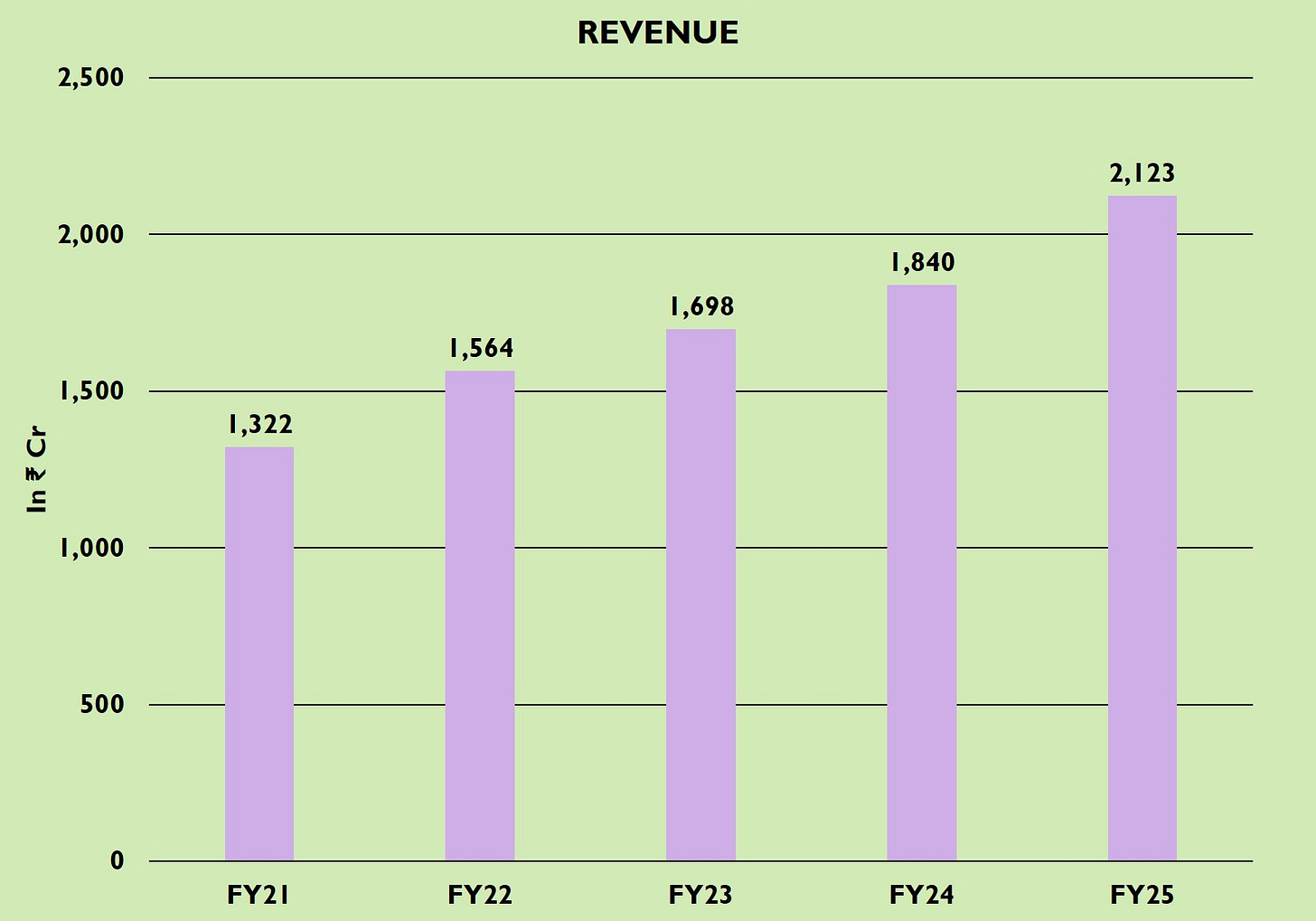

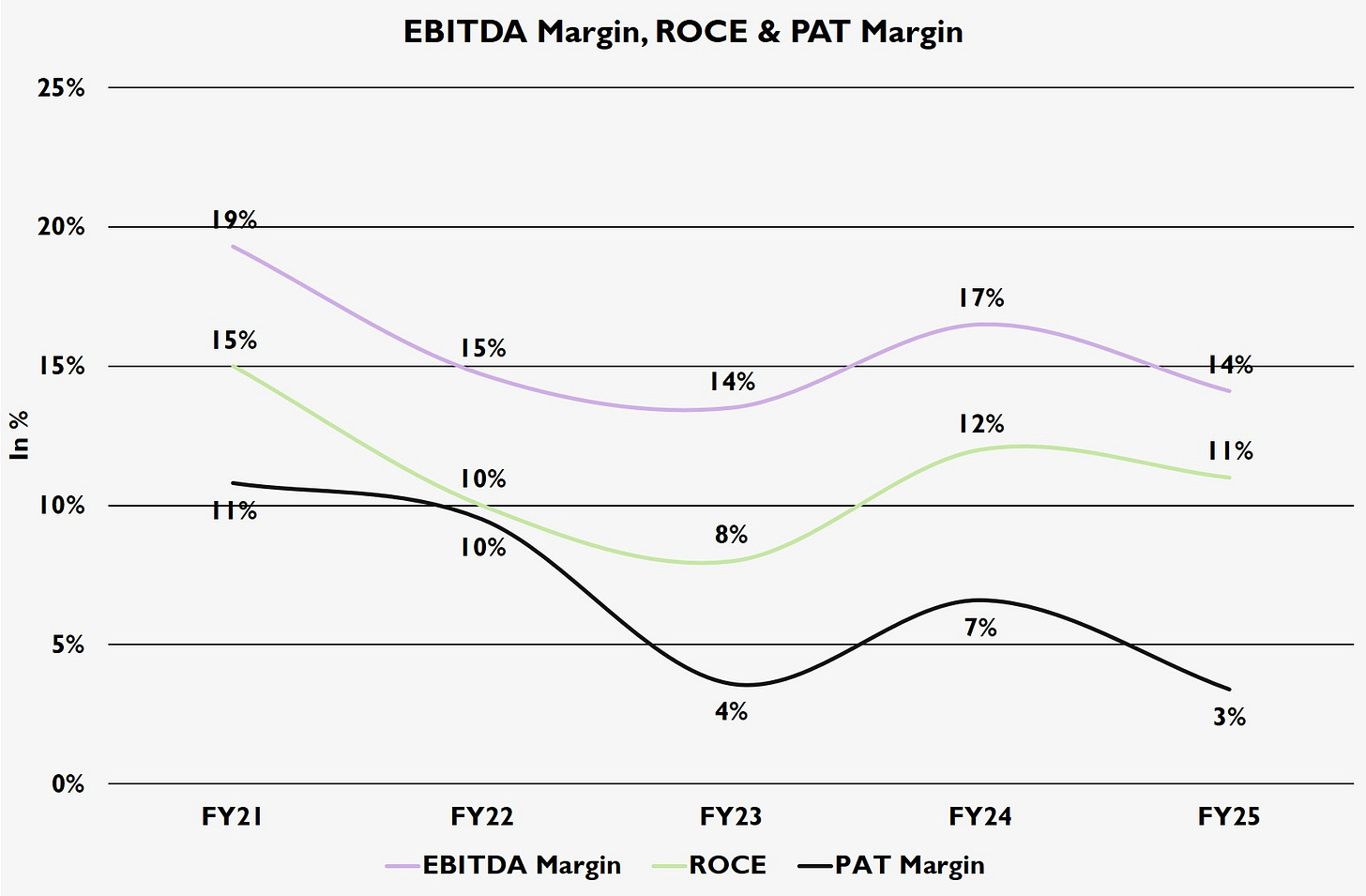

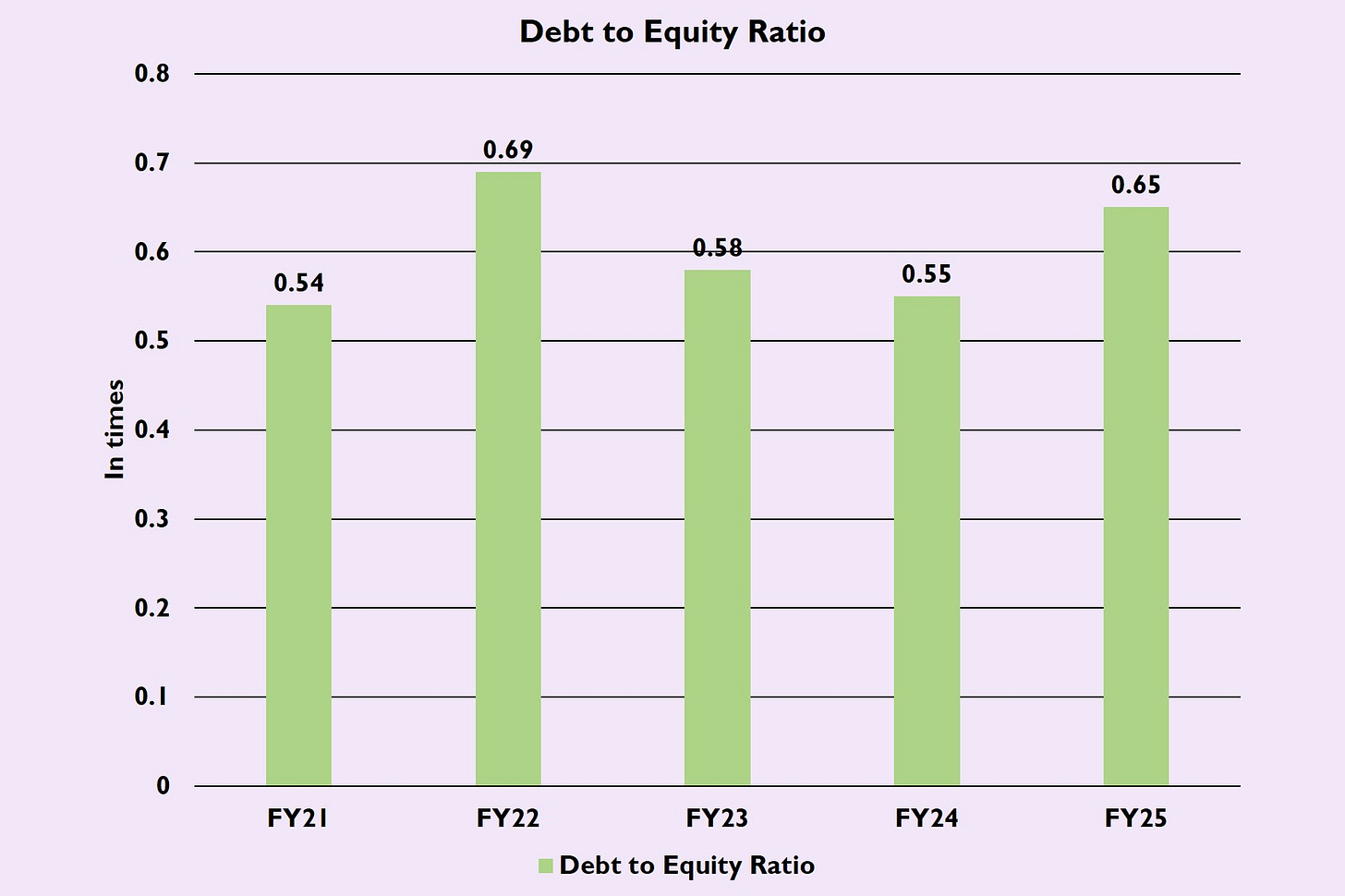

FINANCIALS

FUTURE OUTLOOK

Revenue Growth: SHK expects a 12% plus CAGR growth year-on-year for FY26 & beyond, despite strong growth in the past year. Domestic sales growth is expected to be higher double-digit.

Margin Improvement: The focus for FY26 will be on margin management to improve gross margins from the current ~43%. EBITDA margin is expected to stay around 15% in FY26, with a jump to 18-20% expected in FY27, once the new factory operations stabilize.

Global Expansion: Ramping up CDC in Germany, UK, & New Jersey (USA) to drive future sustainable growth in new geographies.

Global Ingredients Business: Seeing good tailwinds from China plus One strategy and rising demand in European markets.

Orderbook: Healthy order book for FY 2024-25 from a prestigious global MNC account, more than doubling the previous year's value. SHK is confident of achieving the 12% growth target for the current year due to its new win pipeline and existing momentum.

Industry Growth: The global flavours & fragrances (F&F) market grew 3.8% in 2023 to US$ 32.2 billion & is expected to grow at 4.6% CAGR during 2024-32, driven by expanding personal care industry, innovations in F&B, & rising awareness about personal grooming & hygiene. India's F&F market is also dynamic & rapidly growing.

RISK & STRENGTHS

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."