The Debt-Free Developer

In a sector drowning in leverage and delays, one developer is quietly scaling up through zero-debt discipline, strategic redevelopment, and lean execution.

Company Overview

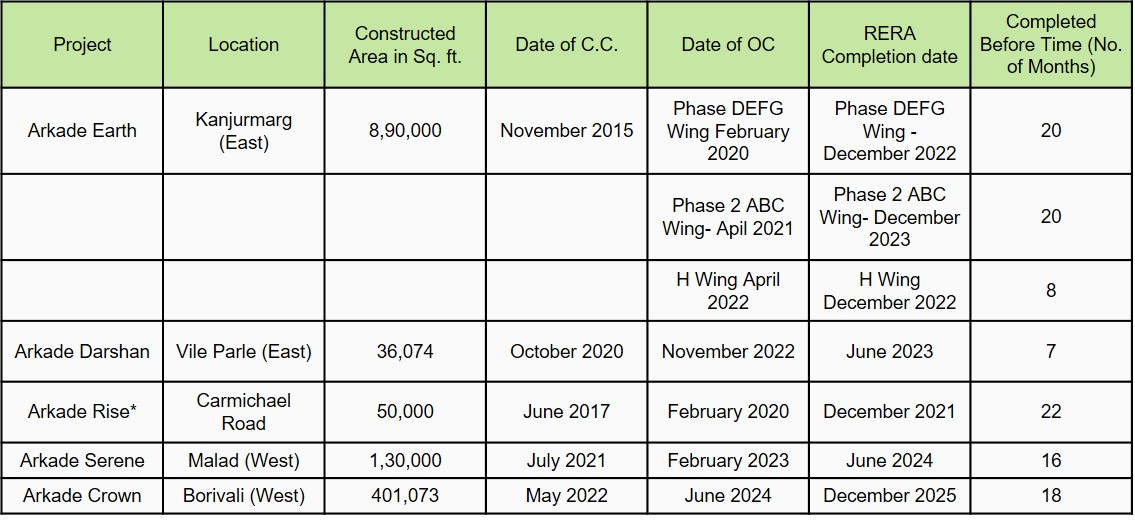

Arkade Developers Ltd. is a Mumbai based real estate development company with a sharp focus on premium and lifestyle residential housing in the Mumbai Metropolitan Region (MMR). Established in 1986, Arkade has built a reputation for timely delivery, high construction quality, and execution discipline, with a successful track record of 28 completed projects totaling over 4.5 million sq. ft., serving more than 4,000 customers. The company specializes in both greenfield developments and redevelopment of old buildings in high-density micro-markets like Borivali, Goregaon, Kanjurmarg, and Santacruz.

Arkade operates on a cluster development model, with in-house capabilities spanning legal, design, procurement, and marketing. The company has completed all past projects without delays or litigation, delivering with full Occupation Certificates (OC). Its business is predominantly concentrated in MMR, which the management views as its “home ground,” backed by deep local expertise and the untapped potential of over 25,000 eligible redevelopment buildings. The company raised ₹410 crore via IPO in September 2024, with proceeds earmarked for new projects and redevelopment.

Products & Launch Pipeline – Arkade Developers Ltd.

Arkade Developers Ltd. focuses exclusively on residential real estate development, with a strong specialization in premium, lifestyle oriented housing and urban redevelopment projects in the Mumbai Metropolitan Region (MMR). Its product portfolio includes 2, 3, 4, and 5 BHK apartments, penthouses, and gated residential complexes equipped with modern amenities such as landscaped gardens, gymnasiums, recreational spaces, and community infrastructure. The company is known for its cluster development model, targeting high-demand, high value micro markets in Mumbai through both new construction and redevelopment of old housing societies.

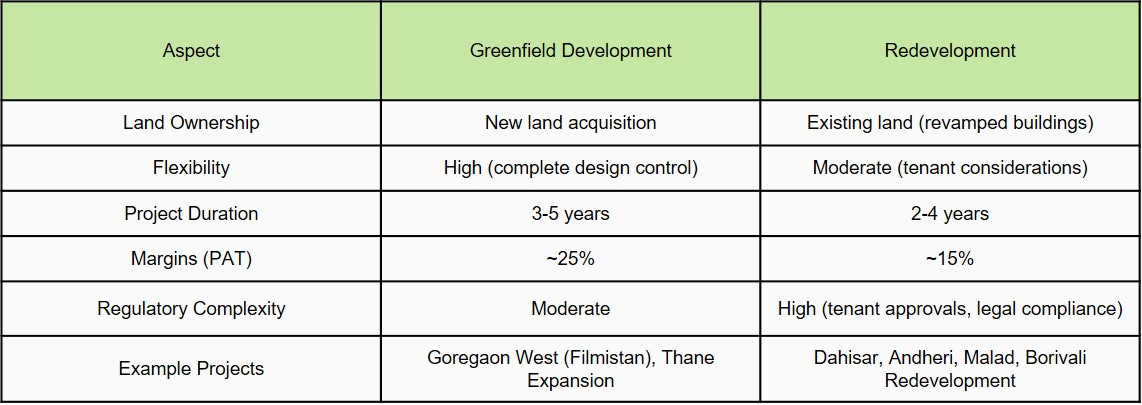

Arkade offers two primary product formats:

New Projects (Greenfield Development): Developed on land parcels owned or acquired by the company, often featuring mid- to high-rise premium towers with lifestyle upgrades.

Redevelopment Projects: Focused on replacing old, dilapidated buildings with modern residential complexes in high-density areas like Goregaon, Borivali, Santacruz, and Malad. These offer faster monetization and higher margins due to lower land acquisition costs.

Launch Pipeline - FY26 and Beyond

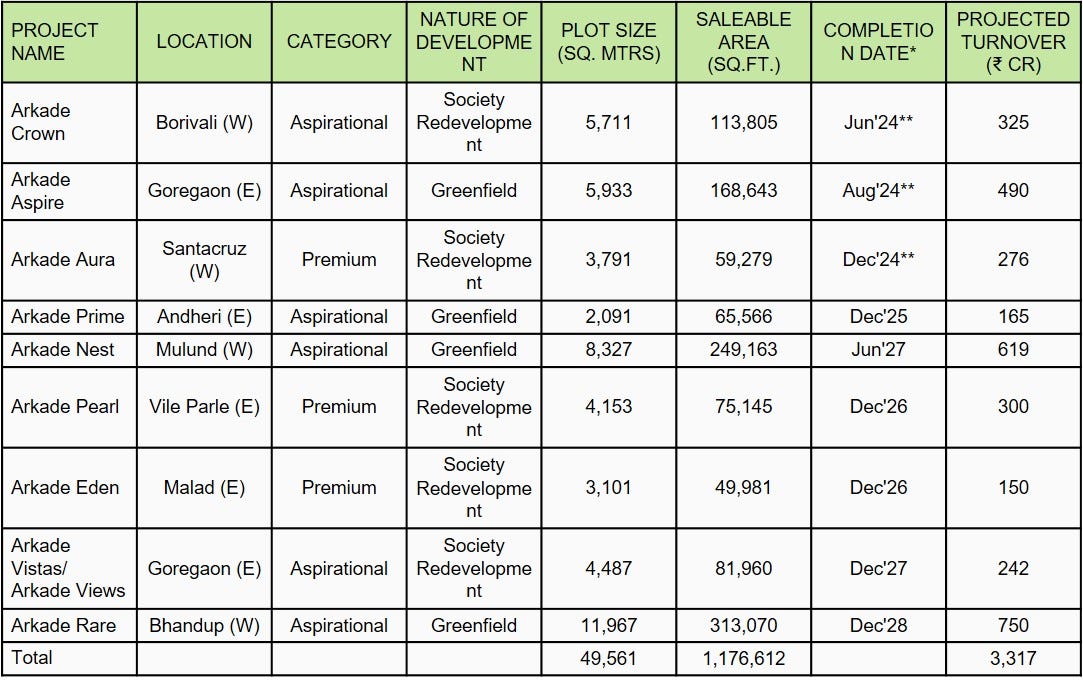

Ongoing Projects

Upcoming Projects

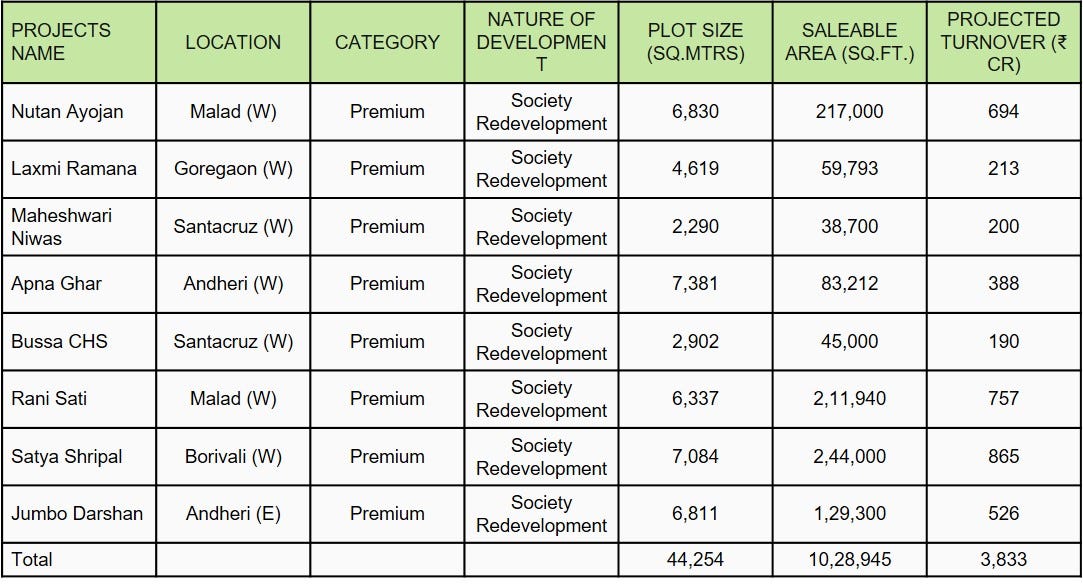

Arkade has an aggressive launch pipeline in place, with an estimated ₹10,000crore GDV executable over the next five years. Some key upcoming launches include:

1. Filmistan Project (Goregaon West):

A landmark uber-luxury project on a 4-acre land parcel leased from Filmistan Pvt. Ltd. This will feature 3, 4, and 5 BHK apartments and penthouses, marking Arkade’s foray into the ultra-premium housing segment. Launch expected by end FY26.

2. Santacruz Redevelopment Project:

Premium redevelopment in a prime suburban market. Targeted for launch in FY26.

3. Goregaon West Redevelopment:

Large-format redevelopment project; expected to be launched in FY26, complementing the company’s presence in western suburbs.

4. Malad West Redevelopment Project:

Scheduled for Q4 FY26 launch. This project taps into a highly active redevelopment zone with growing demand for modern housing.

5. Arkade’s Entry into Thane (New Project):

Recently announced 6.28 acre land parcel in Thane with an estimated ₹2,000 crore GDV. This marks the company’s first strategic move outside traditional western suburbs, tapping into one of MMR’s fastest growing residential corridors.

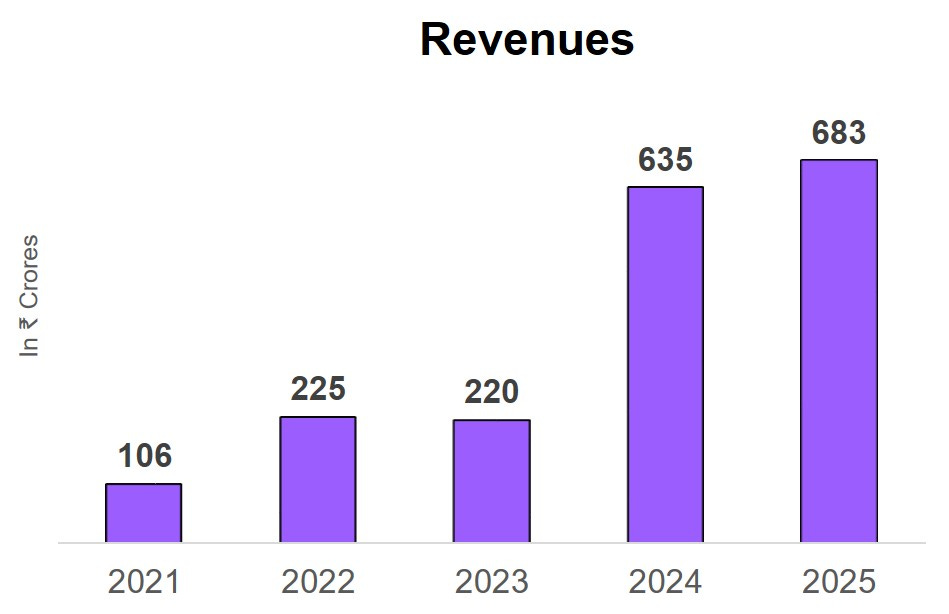

Future Guidance

Arkade Developers is targeting sustained double digit growth, driven by a robust project pipeline, strong demand for premium housing, and the vast untapped opportunity in Mumbai’s redevelopment market. While the company has not issued explicit numeric guidance, management reiterated its long term aspiration to deliver a 20% CAGR in both revenue and profit, consistent with its historical performance.

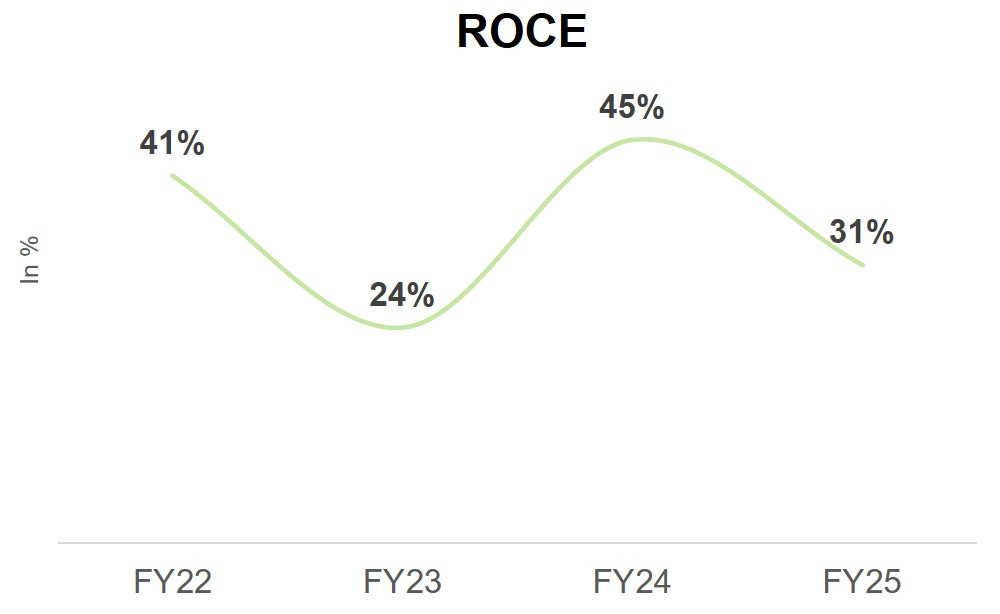

This growth will be anchored by high margin projects, timely execution, and monetization of existing inventory.For FY26, the company plans to launch several high value projects, including the Filmistan luxury project in Goregaon West and redevelopment projects in Santacruz, Malad, and Goregaon, with a combined top-line potential of ₹3,500–4,000 crore. Additionally, Arkade’s recent strategic entry into Thane through a 6.28-acre project with a GDV of ₹2,000 crore expands its footprint into a new, fast growing micro market. Management expects significant pre-sales and collection momentum from these launches over the next 12–18 months. On the margin front, Arkade aims to sustain EBITDA margins in the 30–34% range and PAT margins above 20%, among the best in the industry.

The company remains committed to low leverage growth, with cash flows, internal accruals, and IPO proceeds expected to fully support current and upcoming project execution. With a total pipeline GDV of ₹6,700 crore, and a long-term ambition to cross ₹10,000 crore in cumulative revenue and ₹2,000 crore PAT over the next 5 years, Arkade is well positioned to capitalize on Mumbai’s premium housing demand and redevelopment boom while maintaining its execution focused, financially disciplined approach.

Financials

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."