The Billion-Rupee Germination: How a Seed Company Is Quietly Growing a Financial Moat

A deep dive into how seasonal demand, pricing power, and rural reach make this agri stock worth watching.

COMPANY OVERVIEW

Kaveri Seeds, established in 1986, stands as a leading Indian powerhouse in the seed industry. The company excels in the research, production, processing, & marketing of high-quality hybrid seeds for a diverse range of field & vegetable crops. Propelled by an unwavering commitment to R&D & innovation, Kaveri Seeds has cultivated an expansive network of over 15,000 distributors & dealers nationwide. This robust foundation underpins its position as one of India's fastest-growing seed companies, consistently delivering superior genetic solutions to farmers across the country.

Crop Market Sizes FY25

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789

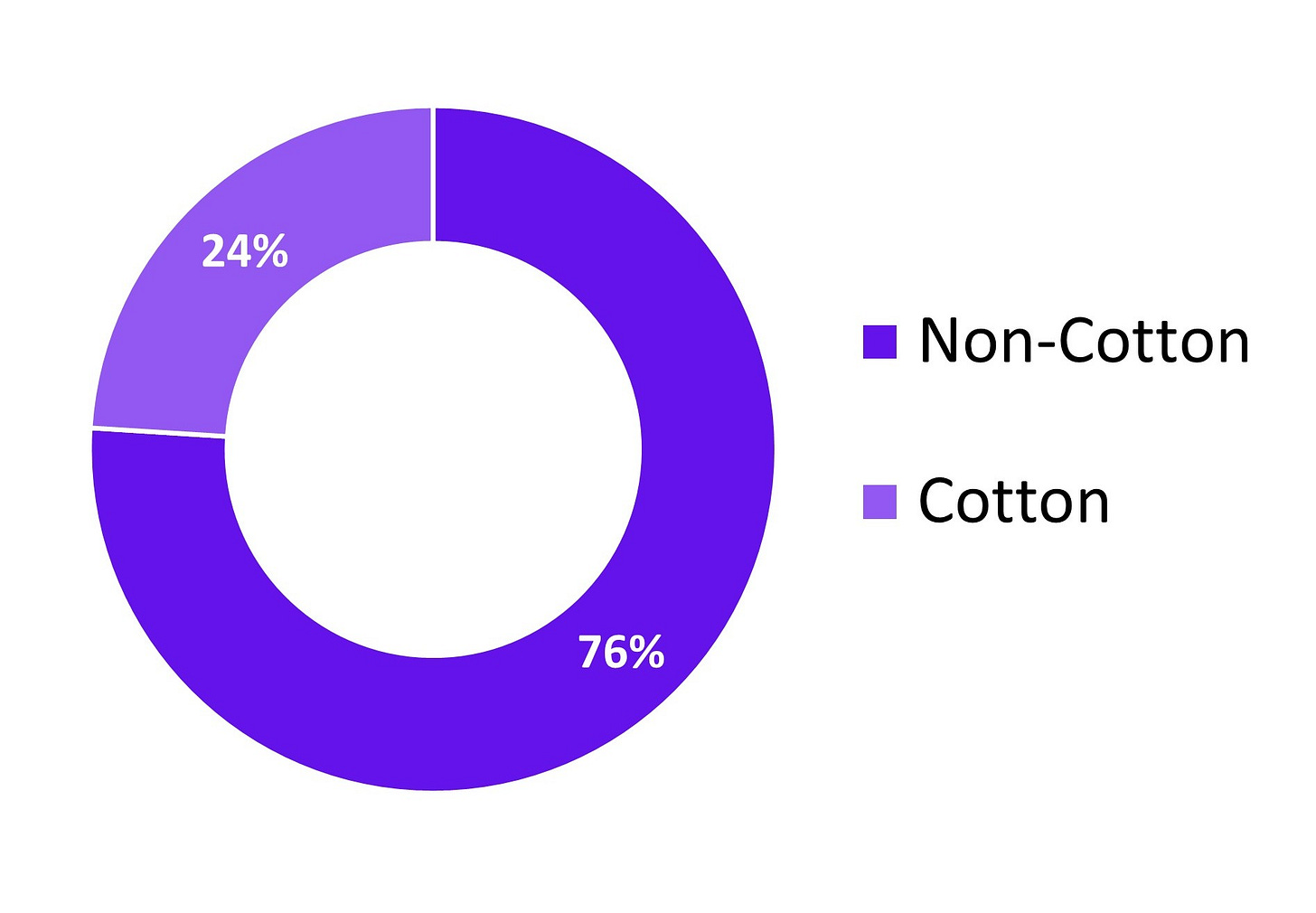

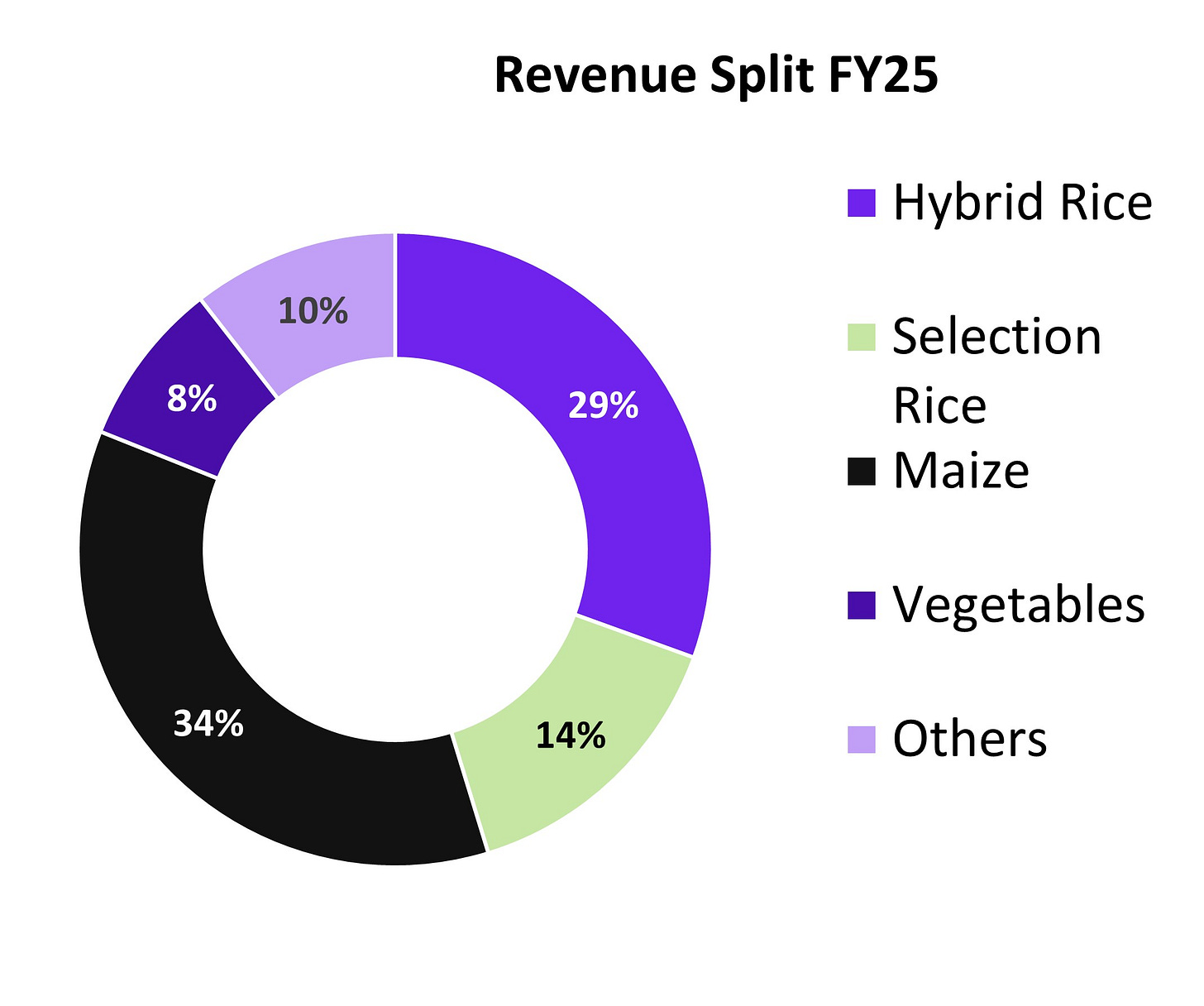

BUSINESS SEGMENTS

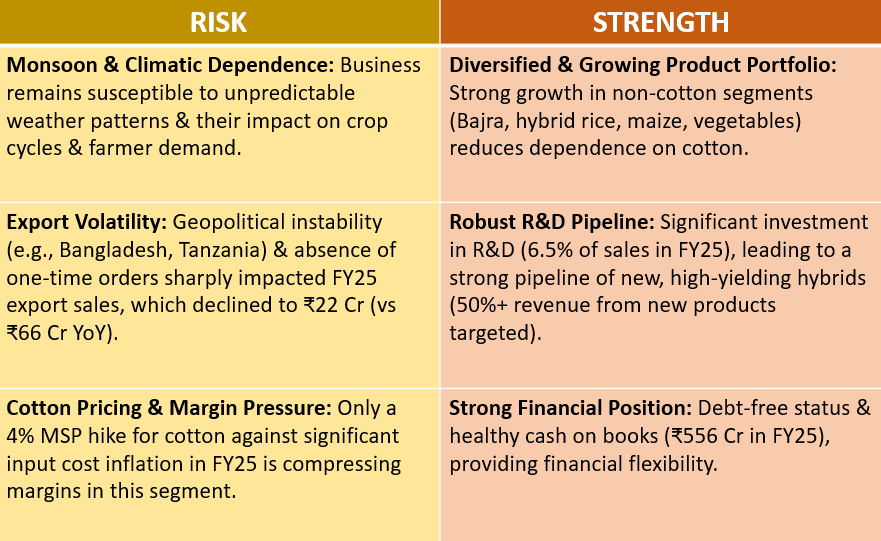

Cotton Segment: Cotton hybrid volume fell 27% YoY in FY25. Management anticipates 12%–15% volume growth in FY26, but margins are pressured by a low 4% MSP hike versus high input costs.

Non-Cotton Portfolio: FY25 saw strong growth: Bajra volumes up 13% (revenue up 22%), hybrid rice volumes up 26% (revenue up 39%), & maize volumes up 7% (revenue up 22%).

Vegetable Segment Growth: Volumes increased by 3% in FY25, though exports were impacted by geopolitical issues. Focus remains on high-realization products.

MANUFACTURING UNIT

Kaveri Seeds boasts a modern & scalable infrastructure:

Processing Plants: Owns 8 plants across 10 locations in India, with ~145 tonnes per hour processing capacity. All processing, packing, & storage facilities are owned & in-house.

Warehousing: Has 26 strategically located warehouses with ~500,000 sq.ft storage, including climate-controlled godowns.

Seed Production Acreage: Accesses ~60,000 acres through a ~90,000-strong grower network.

R&D Infrastructure: Operates over 600 acres of research farms, labs, & a biotech center in CWIP of ₹90 Cr as of March 2025, not yet commissioned.

Capex: Annual Capex is projected at ₹20–30 Cr for maintenance & new additions.

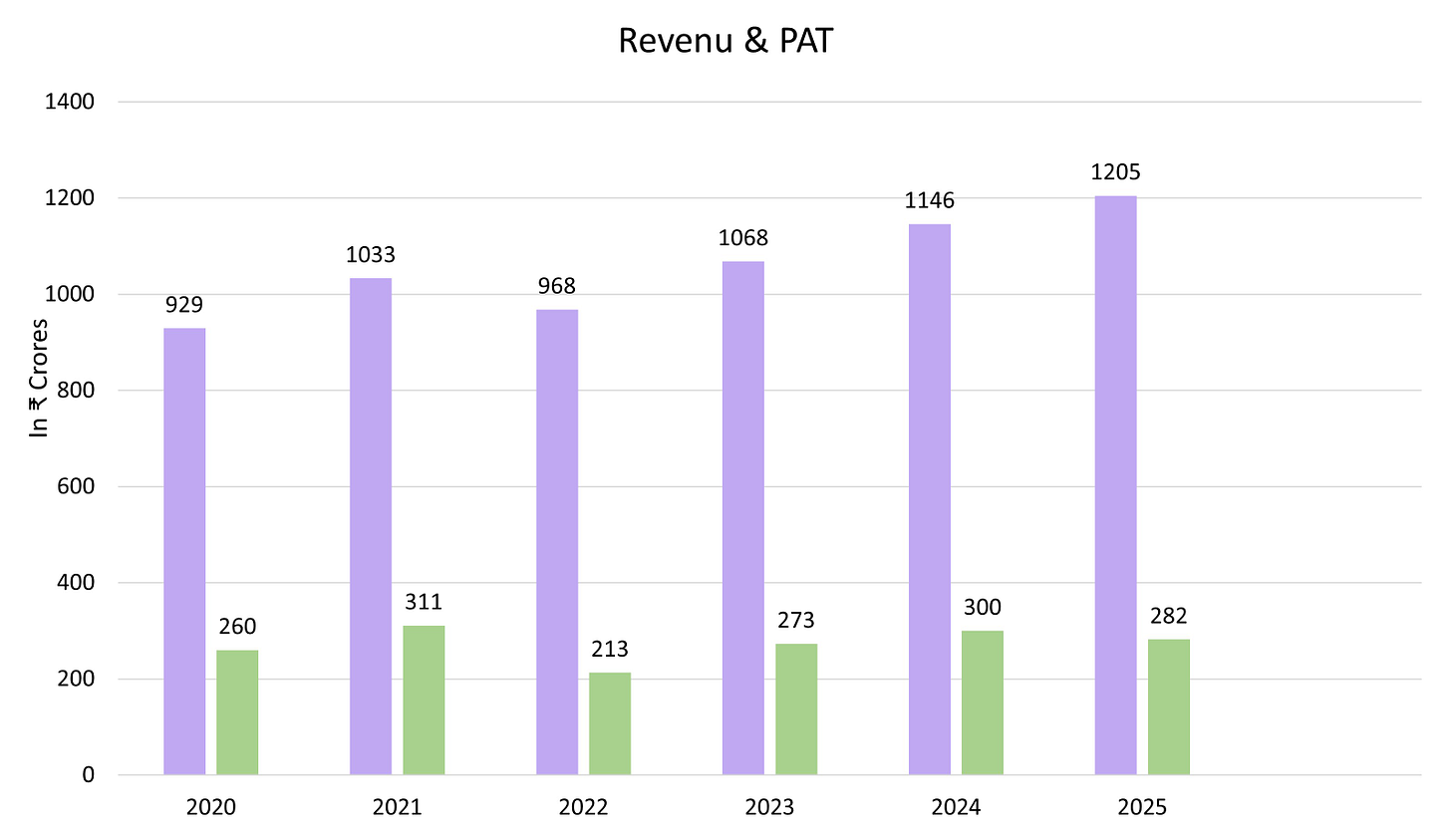

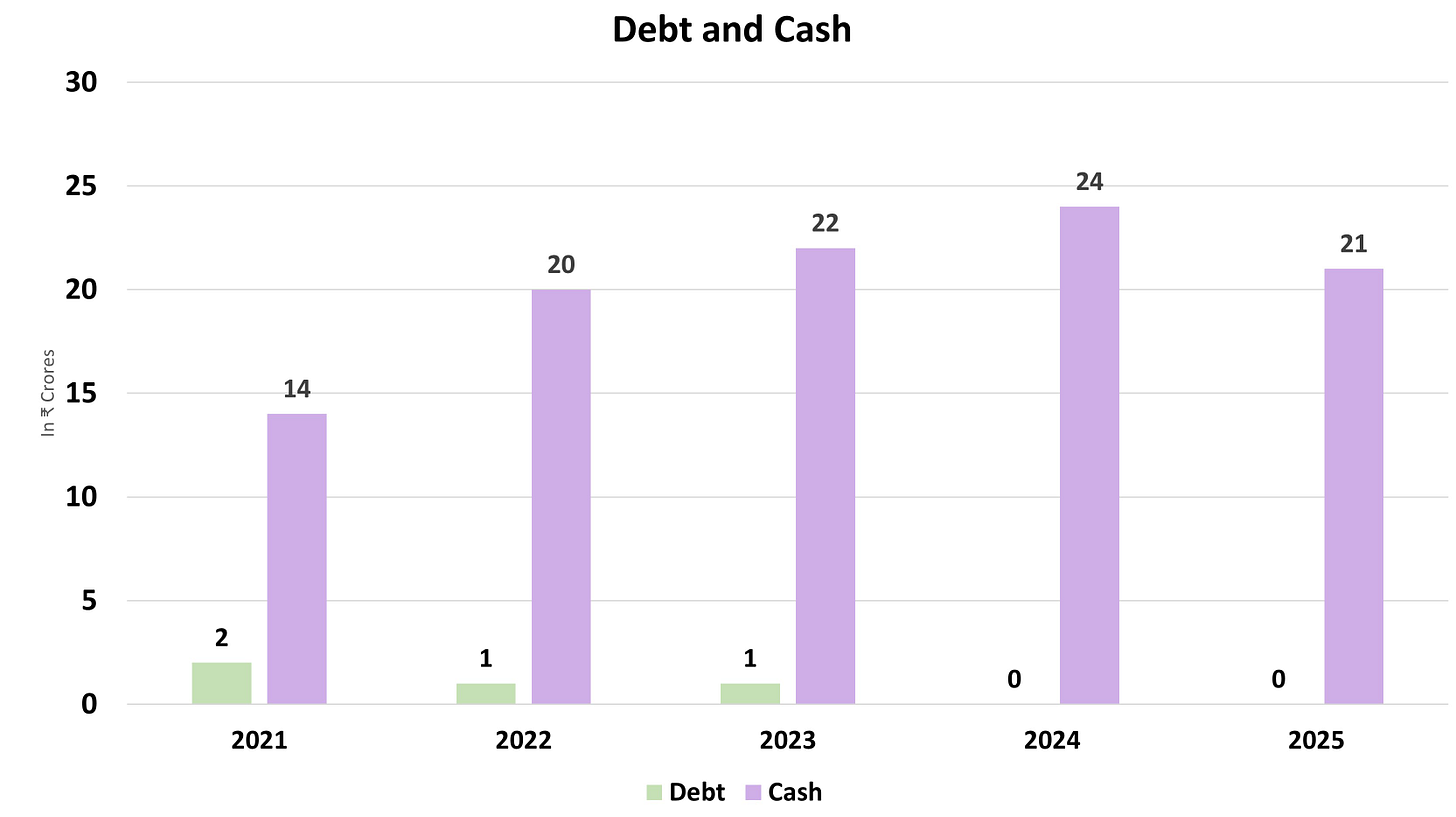

FINANCIAL

FUTURE OUTLOOK

Revenue Growth: 10%–12% CAGR for next 3–5 years. Cotton to grow 15%+ from low base, non-cotton 10%–12%.

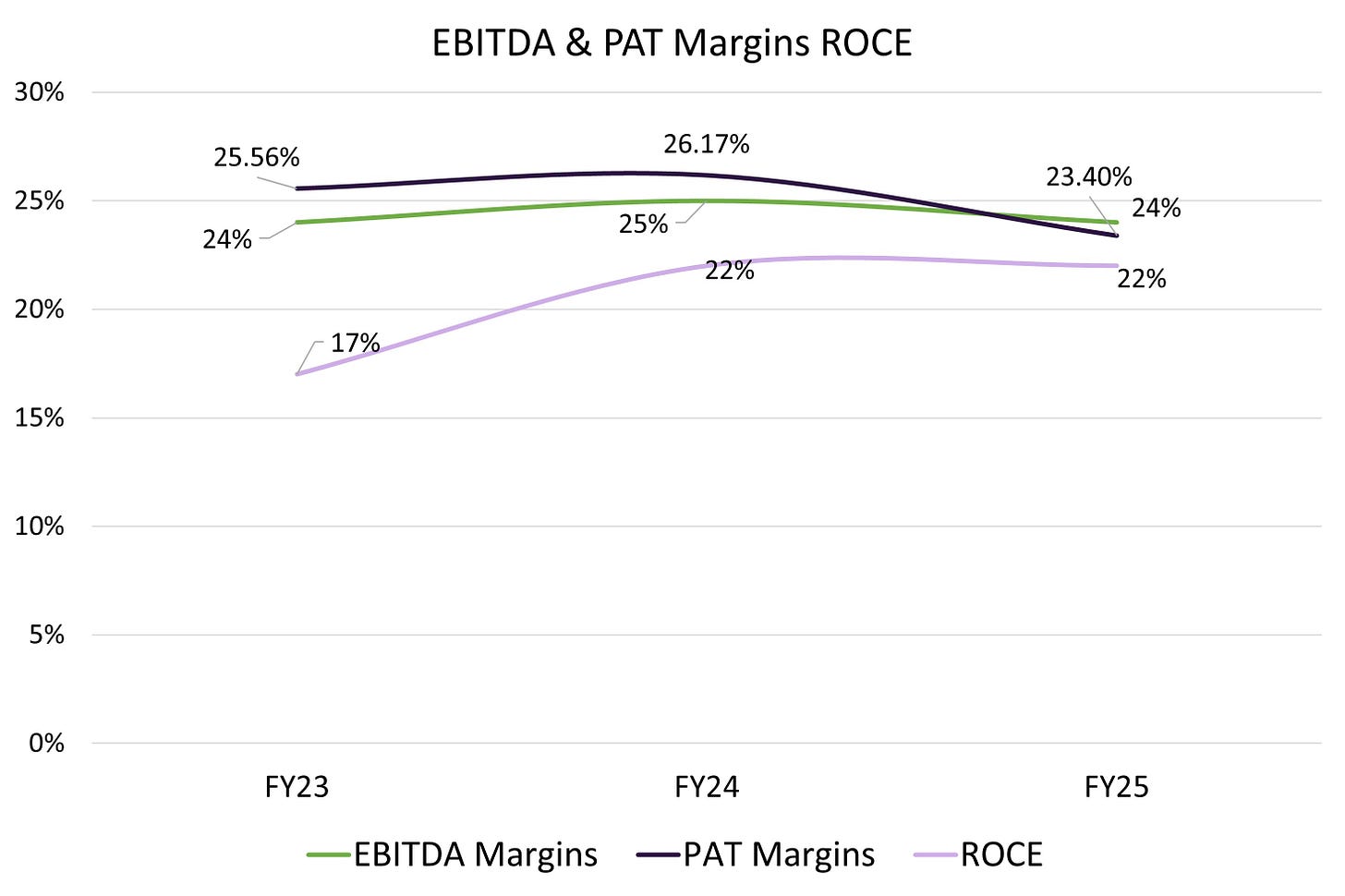

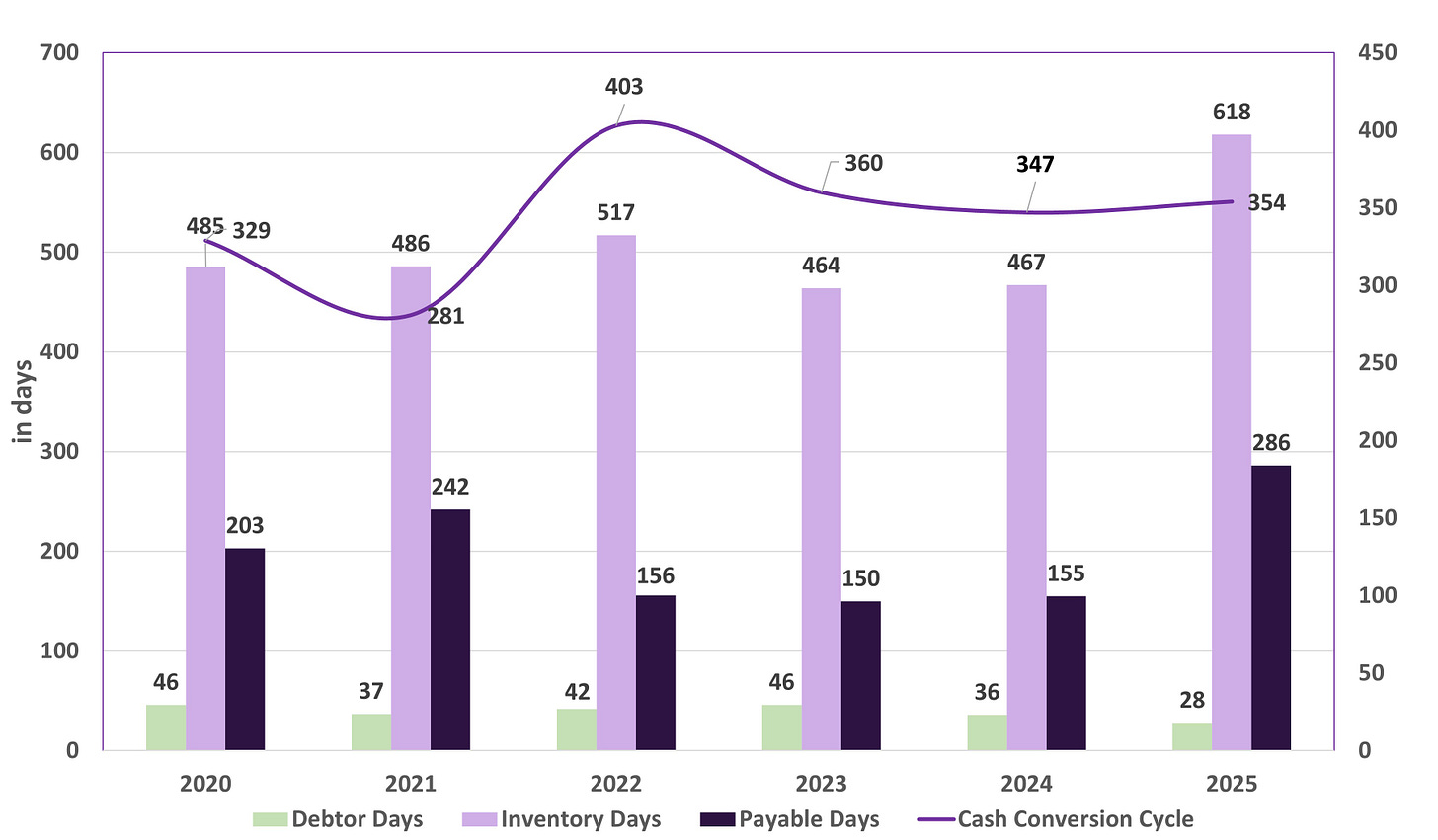

Margin Outlook: Gross margins to sustain at 46%–47%, expected to improve as inventory normalizes & higher-margin products scale.

New Product Contribution: Over 50% of revenue anticipated from new products in the next 3–5 years.

Export Expansion: Medium-term export guidance of ₹150–160 Cr p.a., with recovery expected in Bangladesh & growth in Africa & SE Asia.

Strategic Inventory & Capex: Elevated inventory is strategic, to normalize by FY26. Annual capex of ₹20–30 Cr for maintenance & expansion, including biotech center commissioning.

Product Mix: Aggressive focus on new, differentiated products for higher realizations.

Industry Growth: Indian seed industry growth driven by yield needs & climate-resilient varieties provides a conducive environment.

STRENGTH AND RISK

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."