The Architect Behind India’s Skyline

A legacy construction company specializing in premium institutional, healthcare, and commercial projects—now riding a historic order book backed by strong execution and brand trust.

Ahluwalia Contracts (India) Limited stands as a seasoned leader in India's construction sector, renowned for its expertise in engineering, designing, & building a diverse portfolio of large-scale infrastructure projects. ACIL continues to shape the nation's landscape through its commitment to quality & ethical practices.

COMPANY OVERVIEW

Ahluwalia Contracts (India) Limited (ACIL) is a Public Ltd. with its registered office in New Delhi. ACIL primarily focuses on civil construction activities, encompassing large building infrastructure projects and Engineering, Procurement, & Construction (EPC) services. The company also engages in developing & operating commercial complexes under license agreements & is involved in real estate trading.

SPECIALIZATION

ACIL specializes in the construction of:

Residential & Commercial complexes

Information Technology (IT) Parks

Institutional Buildings

Hospitals & Medical Colleges (like AIIMS)

Corporate Offices

Metro Stations & Depots

Industrial & Townships

BOT (Build-Operate-Transfer) projects

Urban Infrastructure

Sports Complexes

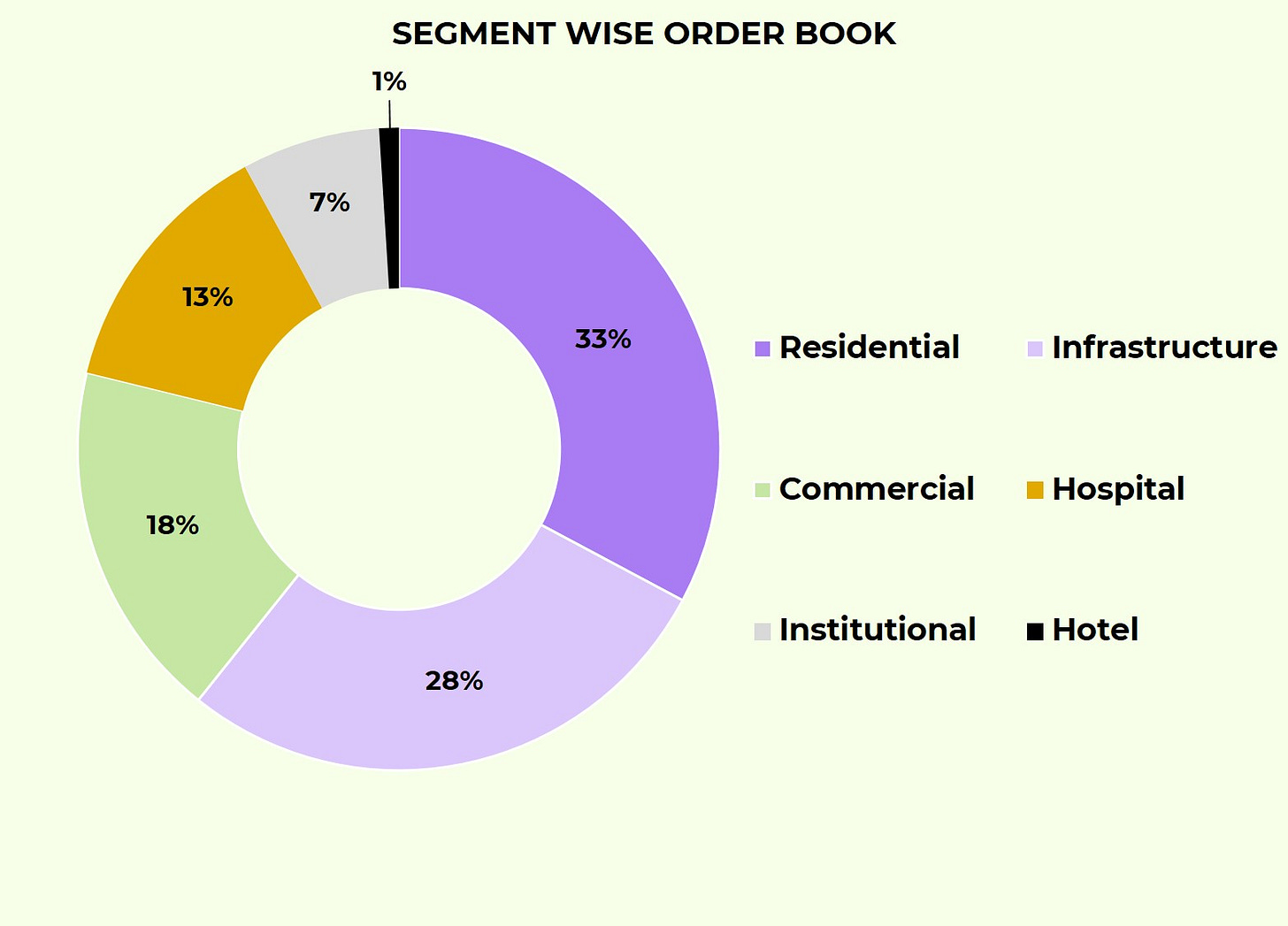

SEGMENT WISE ORDER BOOK

BUSINESS MODEL

Ahluwalia Contracts (India) Limited's business is structured around distinct operating segments. The primary focus remains on construction contract activities. This core segment encompasses a wide range of projects, including residential & commercial complexes, IT Parks, institutional buildings, hospitals, corporate offices, metro stations, industrial & township developments, BOT projects, urban infrastructure, and sports complexes.

In addition to construction, the company generates lease rental income from investment properties. This includes revenue from assets like the commercial complex in Kota, which the company developed under a license arrangement. A smaller, but relevant, segment involves real estate trading through its inventory property business.

CLIENTS

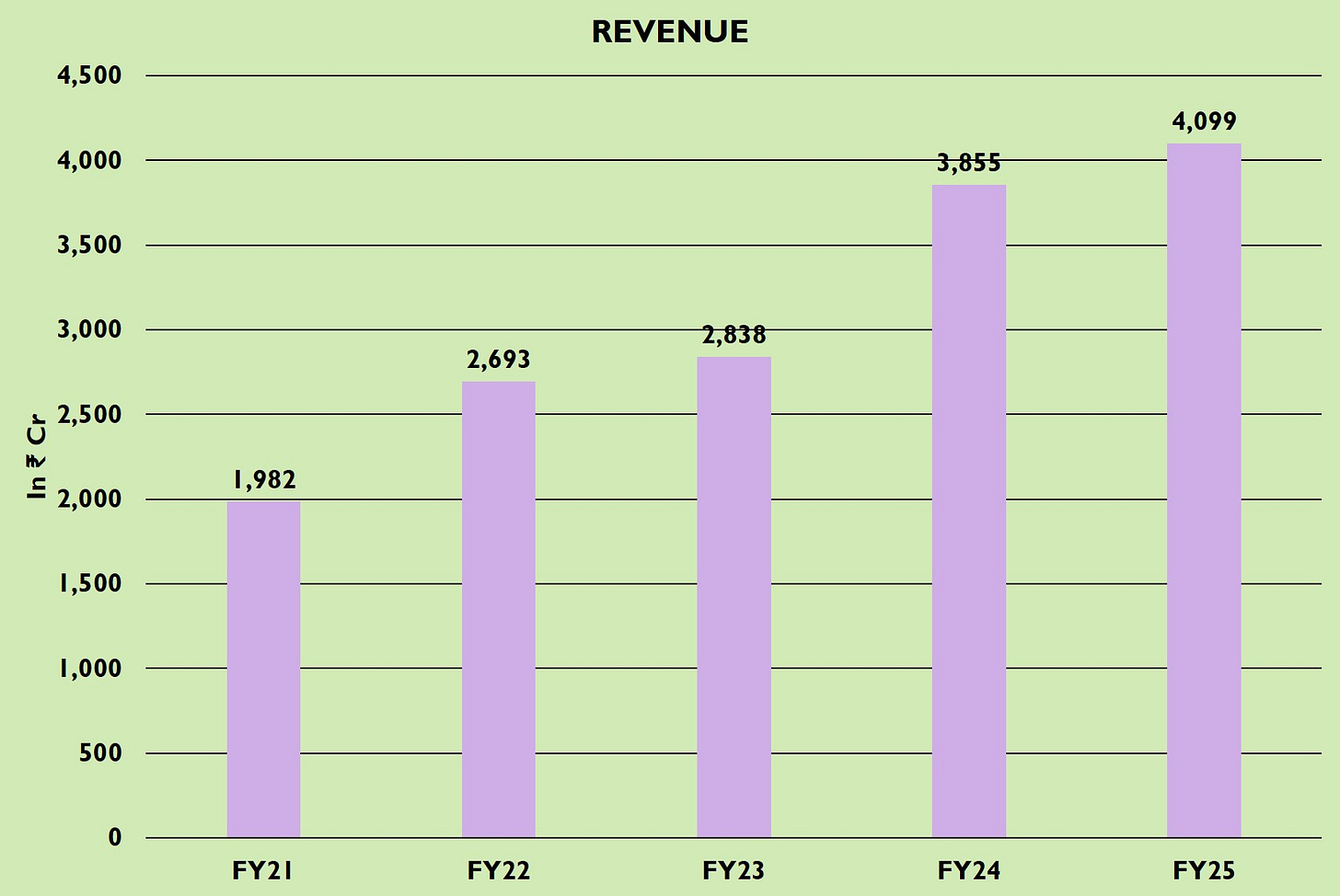

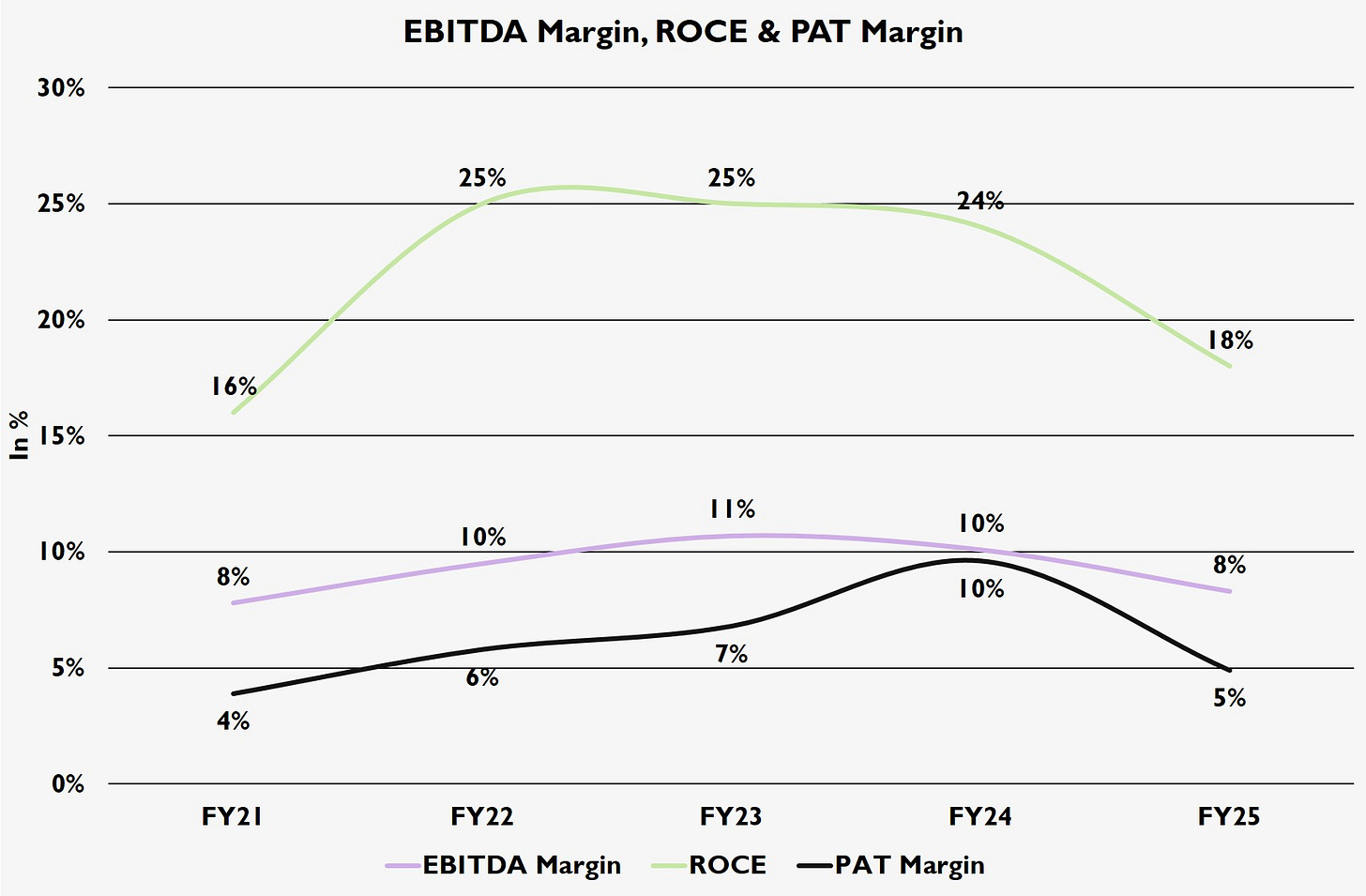

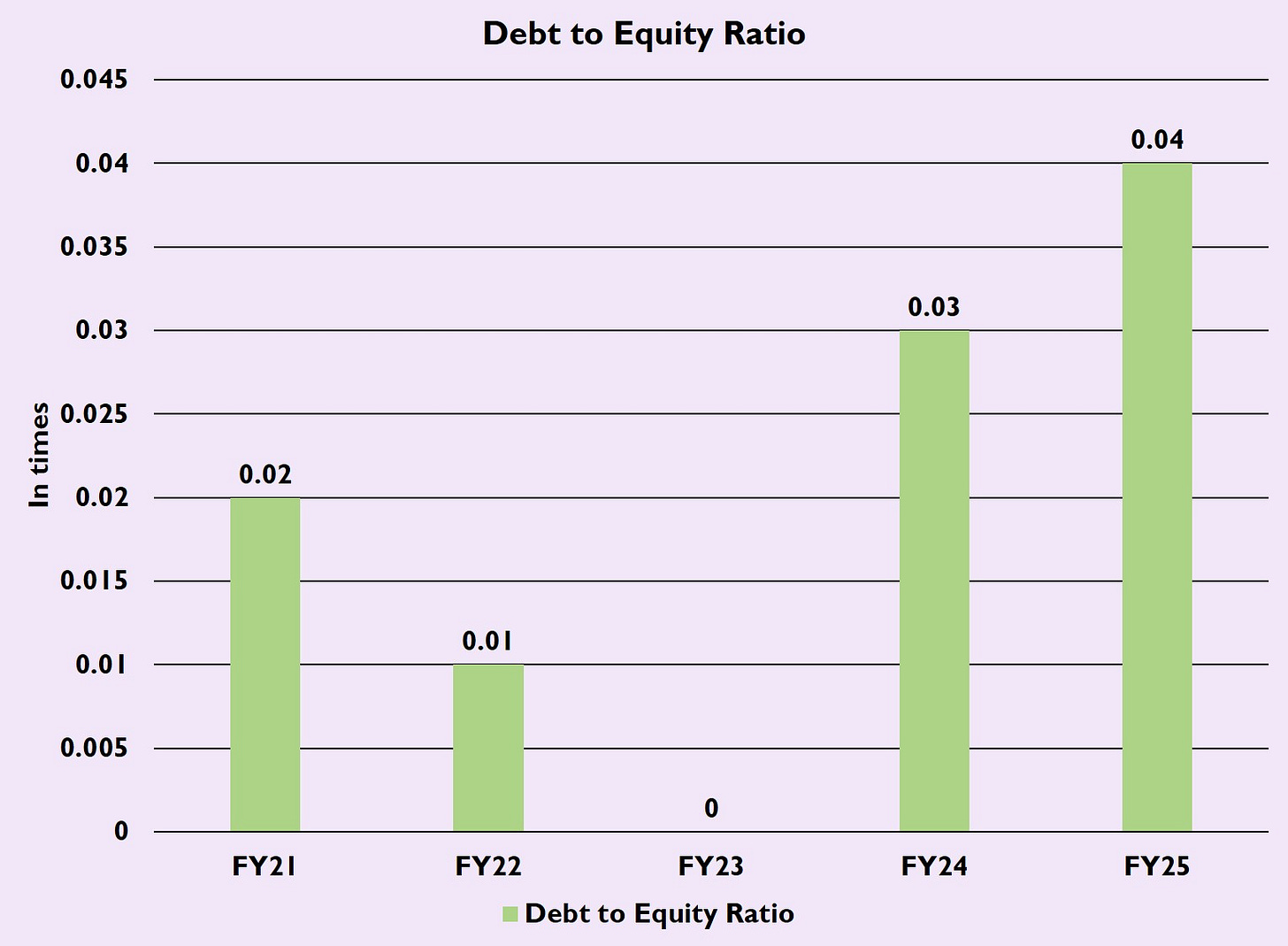

FINANCIALS

FUTURE OUTLOOK

Ahluwalia Contracts (India) Limited projects a revenue growth of approximately 15% for FY26. The company aims to maintain a double-digit EBITDA margin in FY26. Planned FY26 capex is around ₹200 crores, mainly for specialized high-rise construction machinery.

Order inflow for FY26 is targeted at ₹7,000-8,000 crores. As of June 2, 2025, the order inflow for FY26 stands at ₹396.50 crores. The company is the lowest bidder (L1) for two projects totaling ₹1,796 crores , including a Bhubaneshwar university (₹1,000 crores) and a Mumbai MIDC project (₹700-odd crores). The overall order pipeline is estimated at ₹15,000 crores.

Key project contributions for FY26 include:

CSMT Railway Station: Targeting ₹400-500 crores in revenue, with completion expected in 2-2.5 years.

Gems & Jewellery Park: Expected to start in Q3 FY26, contributing approximately ₹150 crores to FY26 revenue.

Medical College at Chapra: The order value increased to ₹160-odd crores, with remaining work to finish in the next six months.

DLF projects: Housing project in Sector 623, Gurgaon, with a run rate of ₹25-30 crores/month; commercial project on Delhi-Gurgaon highway with a similar expected run rate starting next month.

Signature Global project: Generating ₹15-20 crores/month turnover, expected to be maintained in FY26.

Tata Memorial project: Ramping up to ₹15-20 crores/month.

Orderbook

The total order book as of March 31, 2025, is ₹15,775.08 crores, to be executed over the next two to two and a half years. Total order inflow for FY25 was ₹8,436.69 crores. The company's focus for the next 1-2 years will be on the private sector due to better margins, anticipating a 60-40 private-to-government split. Working capital days are expected to remain around 88 days , and the interest-bearing portion of mobilization advances has decreased from 58% to 40%.

Industry growth Details

Urban populations are projected to contribute 75% of GDP by 2030, with 68 cities having over 1 million people, driving demand for 25 million additional mid-end & affordable housing units. The government's increased capital expenditure (11.1% increase to ₹11.1 lakh crore for FY25) is expected to continue driving infrastructure investments, particularly in roads, power, & railways

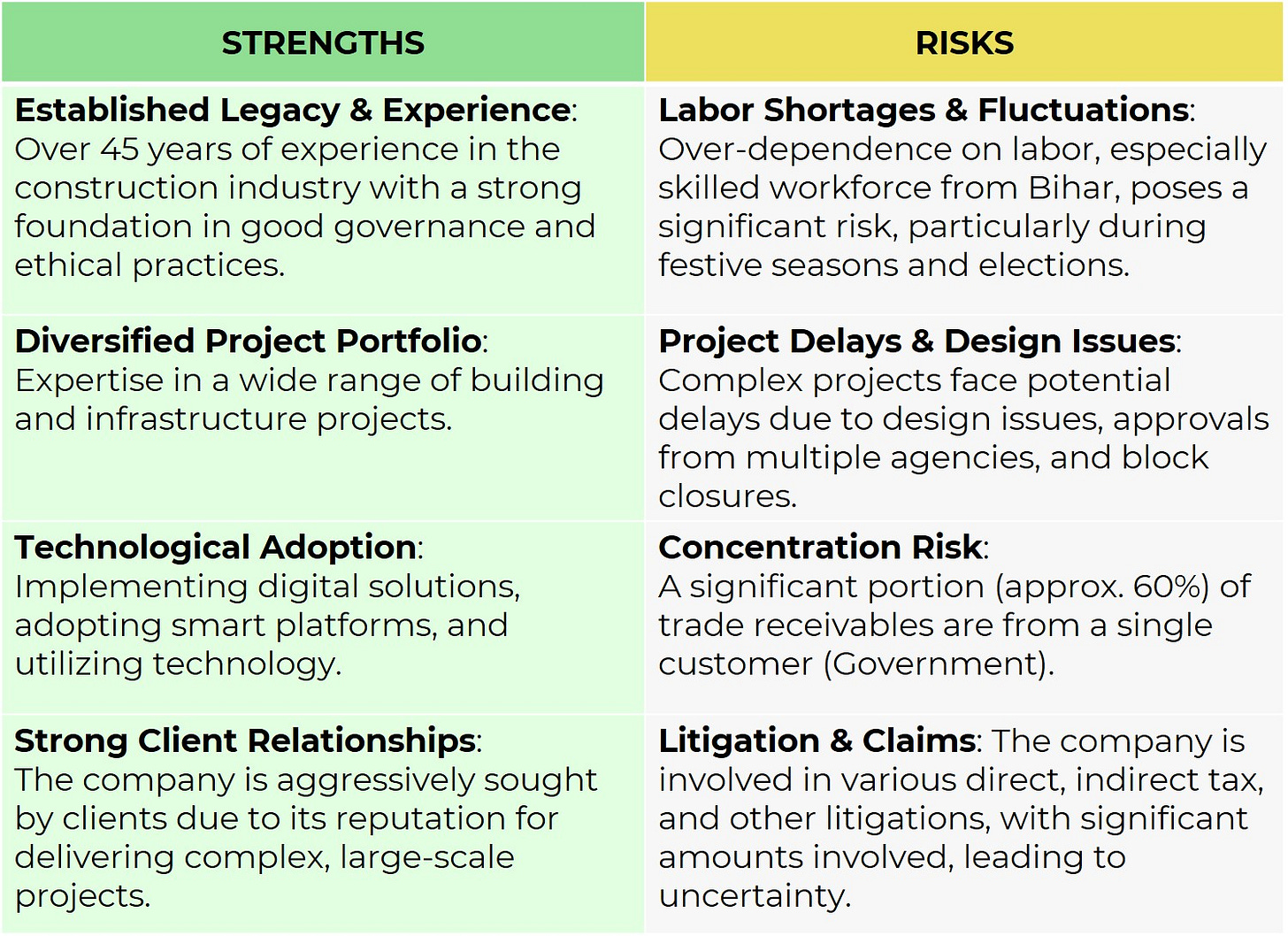

Risk & Strengths

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."