Pioneer in water and environment management

This midcap is quietly building a global business in industrial water, waste, and sustainability solutions.

COMPANY OVERVIEW

Ion Exchange (India) Ltd. (IEIL) is a public limited company incorporated in India in 1964. The company is dedicated to conserving the planet's resources through comprehensive water and environment management solutions. They provide state-of-the-art sustainable technologies and solutions for managing liquid, solid, and gaseous waste generated by industries, institutions, homes, and communities.

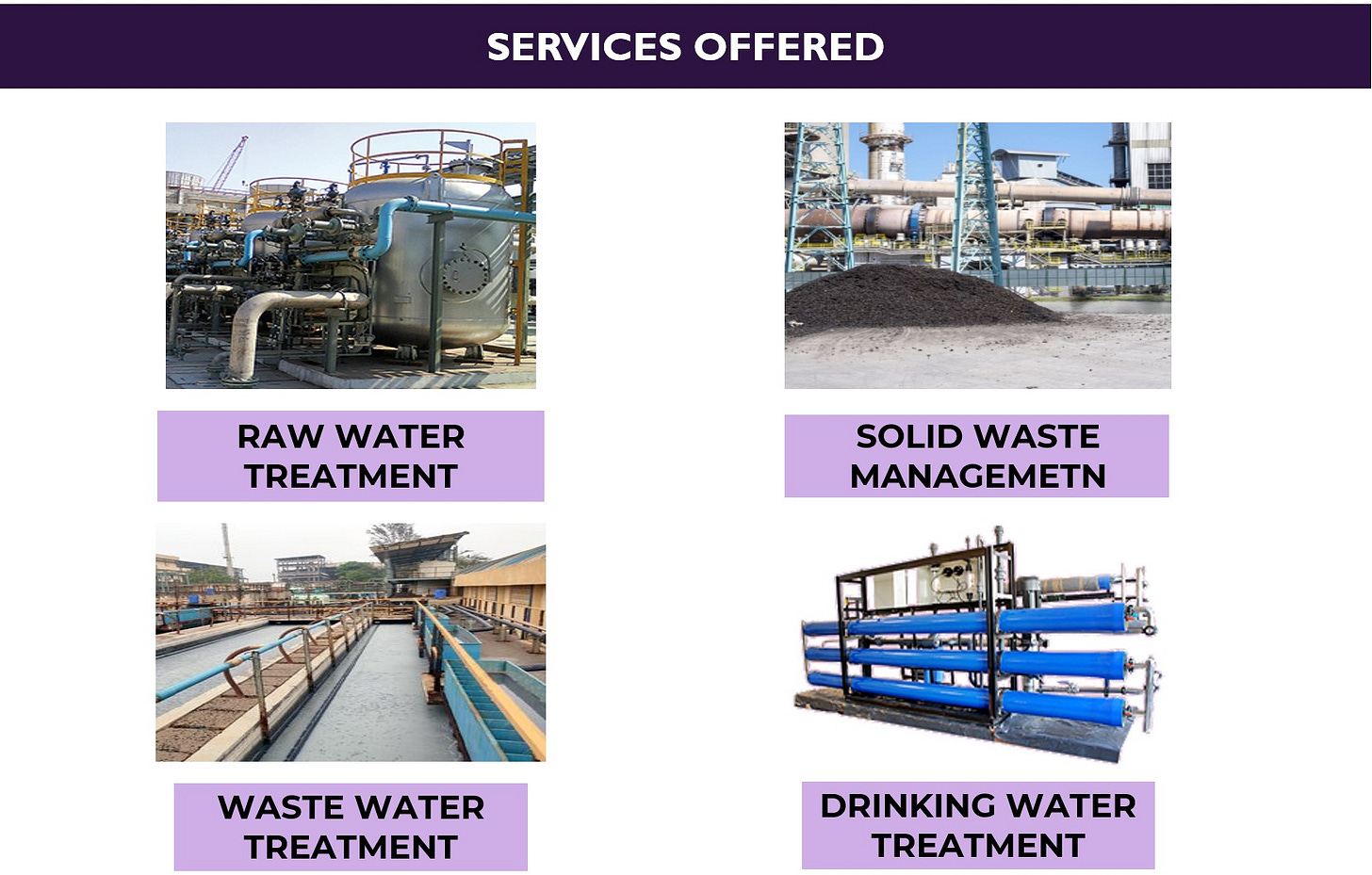

SERVICES

Ion Exchange offers a wide range of products across three main segments:

Chemical Resins & Chemicals: Includes ion exchange resins, adsorbents, speciality process chemicals, and customized chemical treatment programs for various utility applications.

Engineering: Provides comprehensive and integrated services and solutions in water, wastewater treatment, and solid waste management. This includes advanced membranes for desalination, recycle, Zero Liquid Discharge (ZLD), purification, and concentration of process streams.

Consumer Products: Caters to individual homes, realty, and institutions with pure and safe drinking water solutions and sustainable waste management.

BUSINESS SEGMENTS

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789

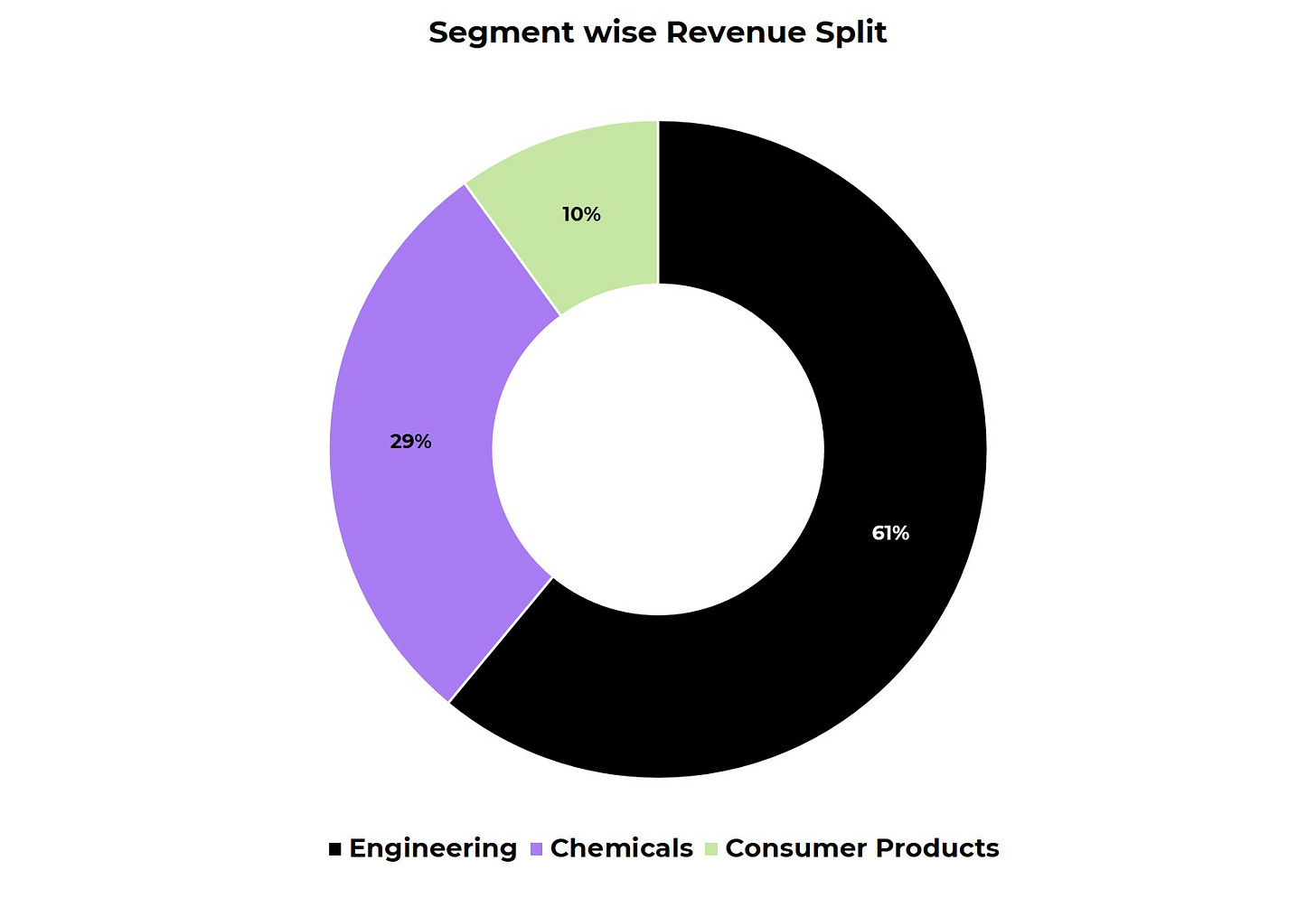

Ion Exchange's operations are organized into three primary business segments:

Engineering Division:

This segment focuses on water treatment plants, spares, and related services.The Engineering division's total order book for Q4 FY'25 stood at ₹2,762 crore. The UP Jal Nigam order execution remained "muted" , and a "positive development" was seen with the Sri Lanka order where authorities committed funds to expedite progress. The company mentioned a slowdown in order intake for the last quarter of the previous fiscal year due to aggressive market pricing and some large orders not being won. Key jobs have spilled over to the next financial year but are still being pursued selectively to maintain attractive margins. The outlook for FY'26 in the engineering segment is expected to see a similar trend, with a better outlook anticipated after Q2 due to SAP implementation causing some timing issues and disruption. The UP project and another legacy project are expected to continue impacting margins and execution throughout FY'26, possibly into early FY'27. The unexecuted UP project order value is ₹378 crore. The company aims to be selective in picking up good quality orders to improve profitability in the engineering segment.

Chemicals Division:

This segment deals with resins, water treatment chemicals, and specialty chemicals. The new greenfield manufacturing facility at Roha for resin production is expected to be operational in Q2 FY 2025-26. Chemical margins were lower this quarter due to the seasonality of certain product lines and increases in input costs, which the company is now passing on to customers. The total CAPEX for the Roha plant is around ₹400 crore, with approximately 80% financed by debt, and the interest cost on this term loan is just below 10%. The Roha plant will largely cater to the export market, and the company is strengthening its international "go to market" strategy. The plant does not require new customer approvals as it produces standard products using standard processes.

Consumer Products Division:

This segment includes water purification equipment for homes, institutions, and communities. The company expects a much better margin profile from Q3 and Q4 onwards, attributing previous losses to substantial investments in infrastructure, manpower, and distribution networks, as well as venturing into new market segments. The company also saw good traction in its core B2C & B2B businesses and is working to improve order acquisition in the institutional segment.

MANUFACTURING UNIT

Ion Exchange has 7 manufacturing plants and 11 offices nationally, and 2 international offices. Key manufacturing facilities include:

Resins (Ankleshwar, Gujarat): A new greenfield manufacturing facility for resin production in Roha, Maharashtra, is expected to become operational in Q2FY26. This expansion is a significant step to cater to increased demand for ion exchange resins, particularly for the export market. The total capital expenditure (CAPEX) for the Roha plant is around ₹400 crore, with approximately 80% financed by debt.

Chemicals (Patancheru, Telangana): The Patancheru, Telangana facility produces water treatment chemicals and specialty chemicals, and is certified for Occupational Health and Safety Management System.

Membrane (Goa): The Goa plant is dedicated to membrane manufacturing. The Membrane Division has experienced significant growth, with double-digit growth in its top-line and proportional growth in EBITDA margins. Its capacity expansion happened earlier than planned, bolstering market share in India and increasing exports. Over 150,000 membrane elements are installed and operating satisfactorily across India.

The company also has R&D Laboratories certified by DSIR in Patancheru and Vashi, and NABL in Bangalore.

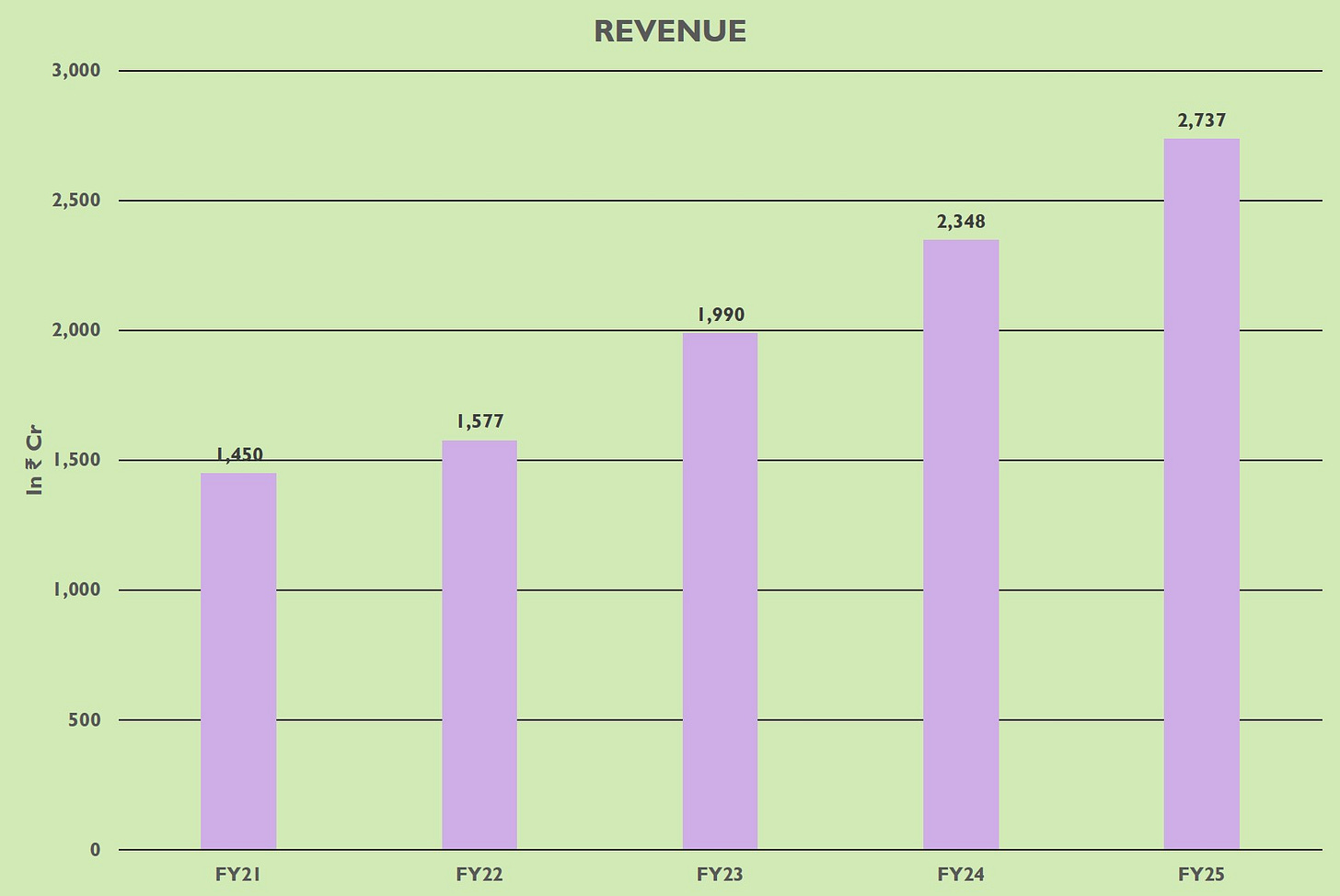

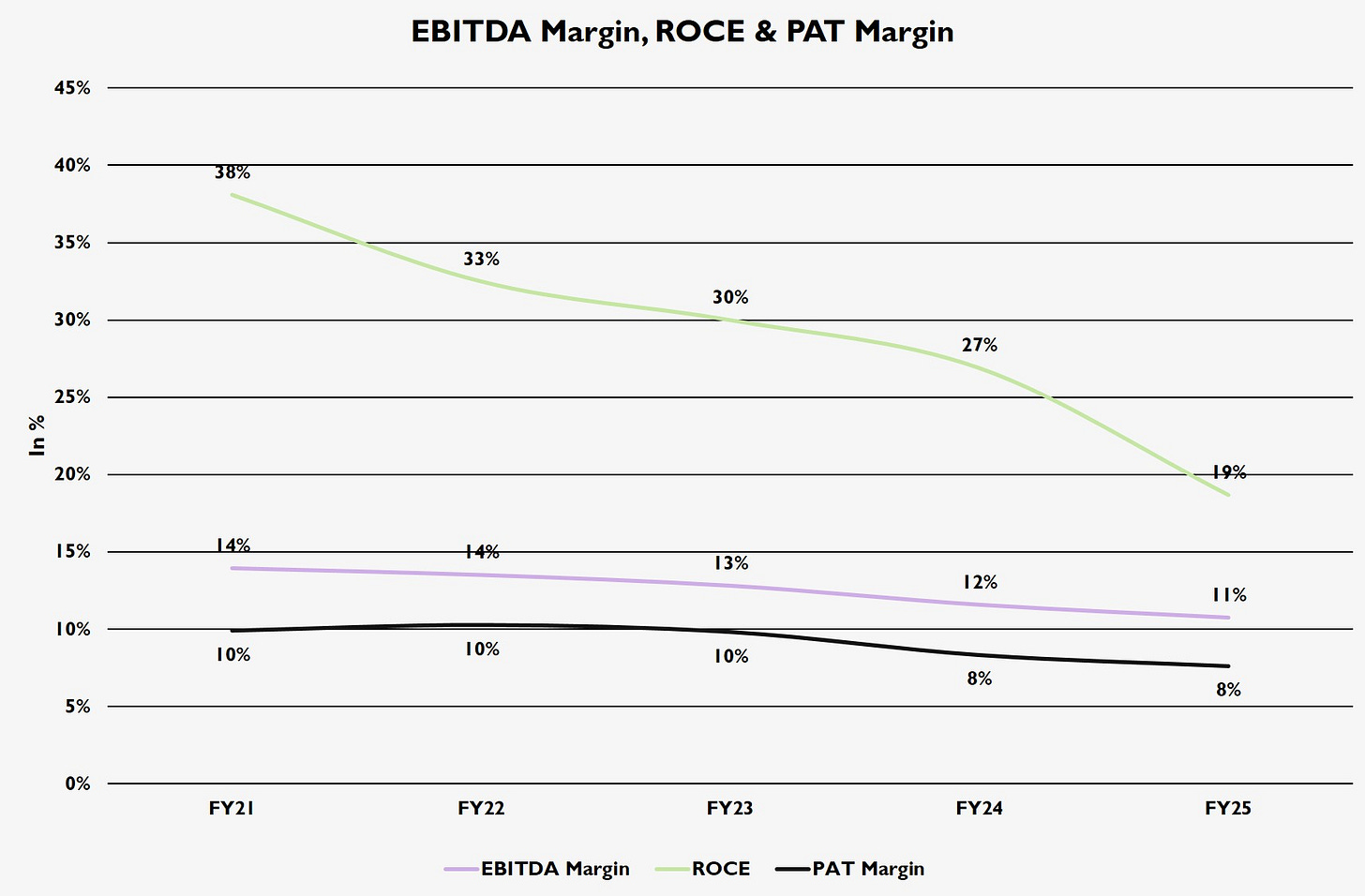

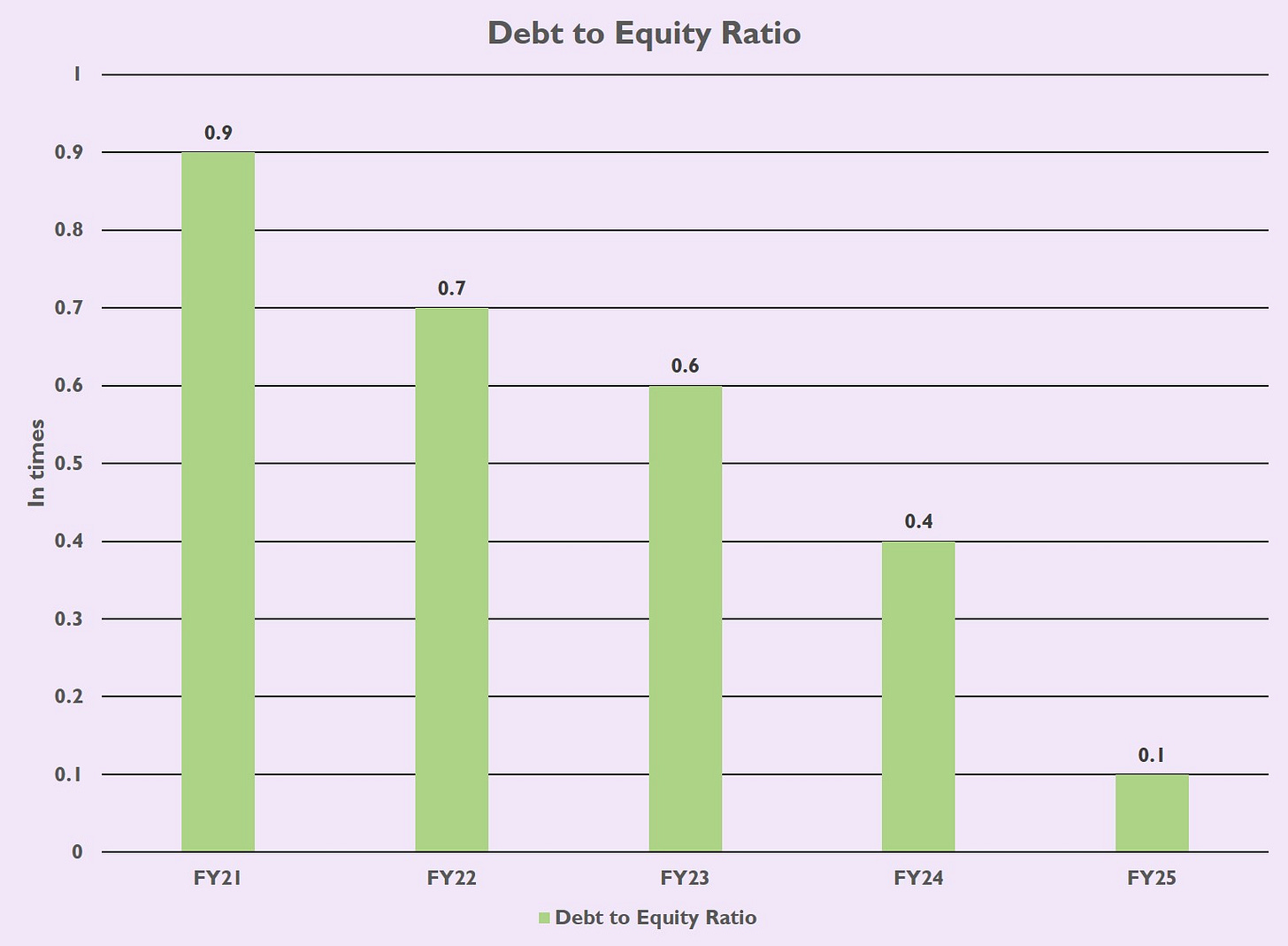

FINANCIALS

FUTURE OUTLOOK

Strategic Order Book & Growth Focus: Key opportunities from the previous quarter have "spilled over to the next financial year" and are actively being pursued. The engineering division's total order book stood at ₹27.62 billion at the end of Q4 FY'25.

Roha Plant & Chemical Expansion: The new Roha plant for resin production is set to become operational in Q2 FY26. This expansion, with a ₹400 Cr CAPEX (80% debt-financed), will boost chemical production, primarily for exports.

International Market Push: Ion Exchange is expanding its chemical business in North America and Europe, anticipating better margins. The Mapril acquisition in Portugal provides a strategic entry into the South European market.

Favorable Indian Market: India's economy is expected to grow by 6.9% in 2024 and 6.6% in 2025, benefiting the water and environment industry. Government initiatives like Jal Jeevan Mission and Clean Ganga Project are driving significant growth in this sector.

Consumer & Tech Optimism: The consumer segment anticipates growth and improved margins from Q3 and Q4 FY'26 onwards. The company plans to integrate AI, machine learning, and IoT for more efficient water management systems.

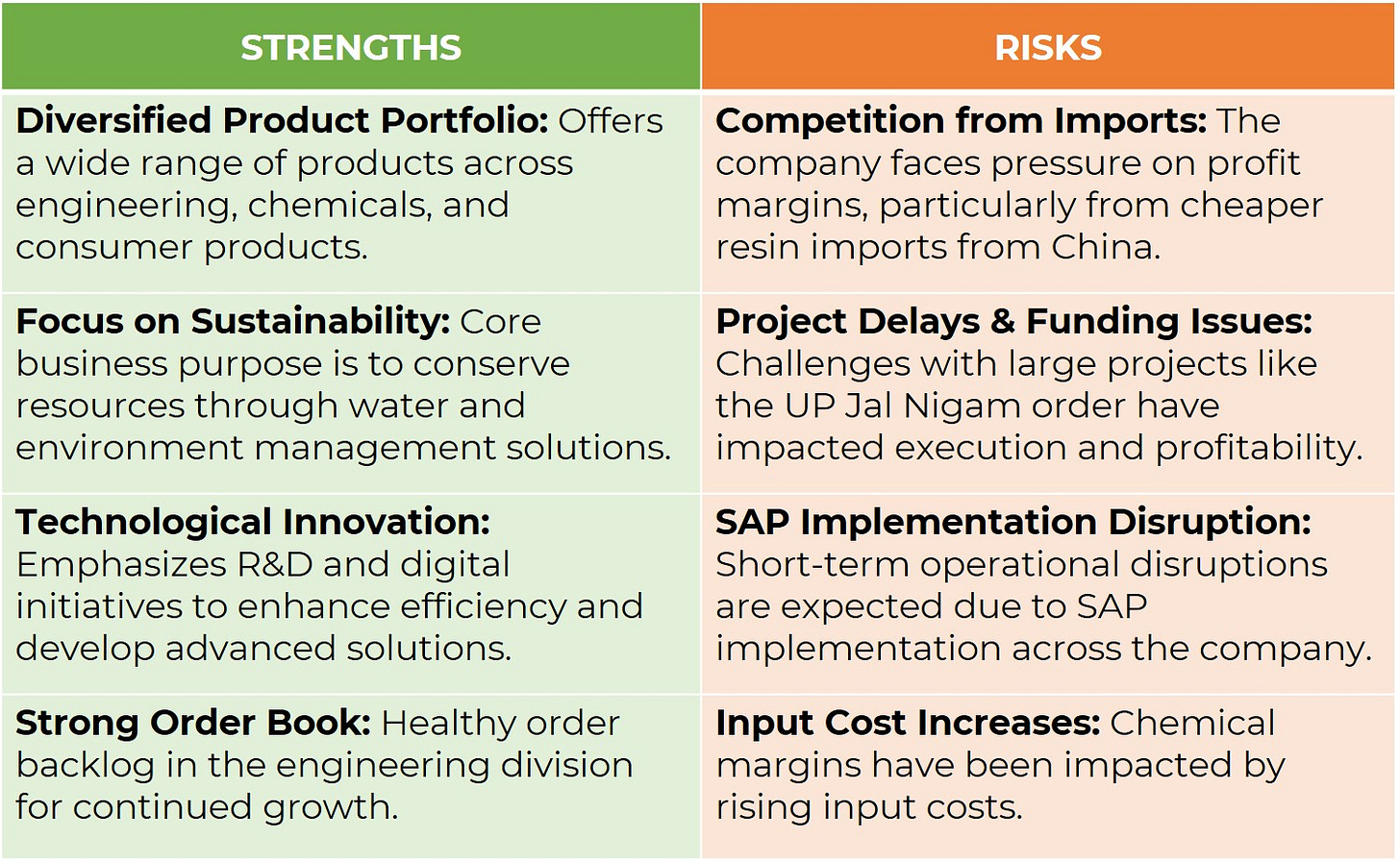

RISK & STRENGTHS

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."