Not a Fortis. Not an Apollo. But Growing Just as Fast.

With rising occupancy rates, operational leverage, and expansion in high-income suburbs, this healthcare provider is quietly delivering scalable, sustainable growth

The Pulse of Growth: A Healthcare Saga Unfolds

Ever wondered what it takes for a healthcare provider to not just grow, but to truly innovate and expand its reach? Well, the recent earnings call of Yatharth Hospital & Trauma Care Services Ltd. offers a compelling narrative of ambition meeting execution, showcasing how a blend of clinical excellence and strategic expansion is setting new benchmarks in North India's healthcare landscape. 📈🇮🇳

A Healing Touch: Company Overview 🩺

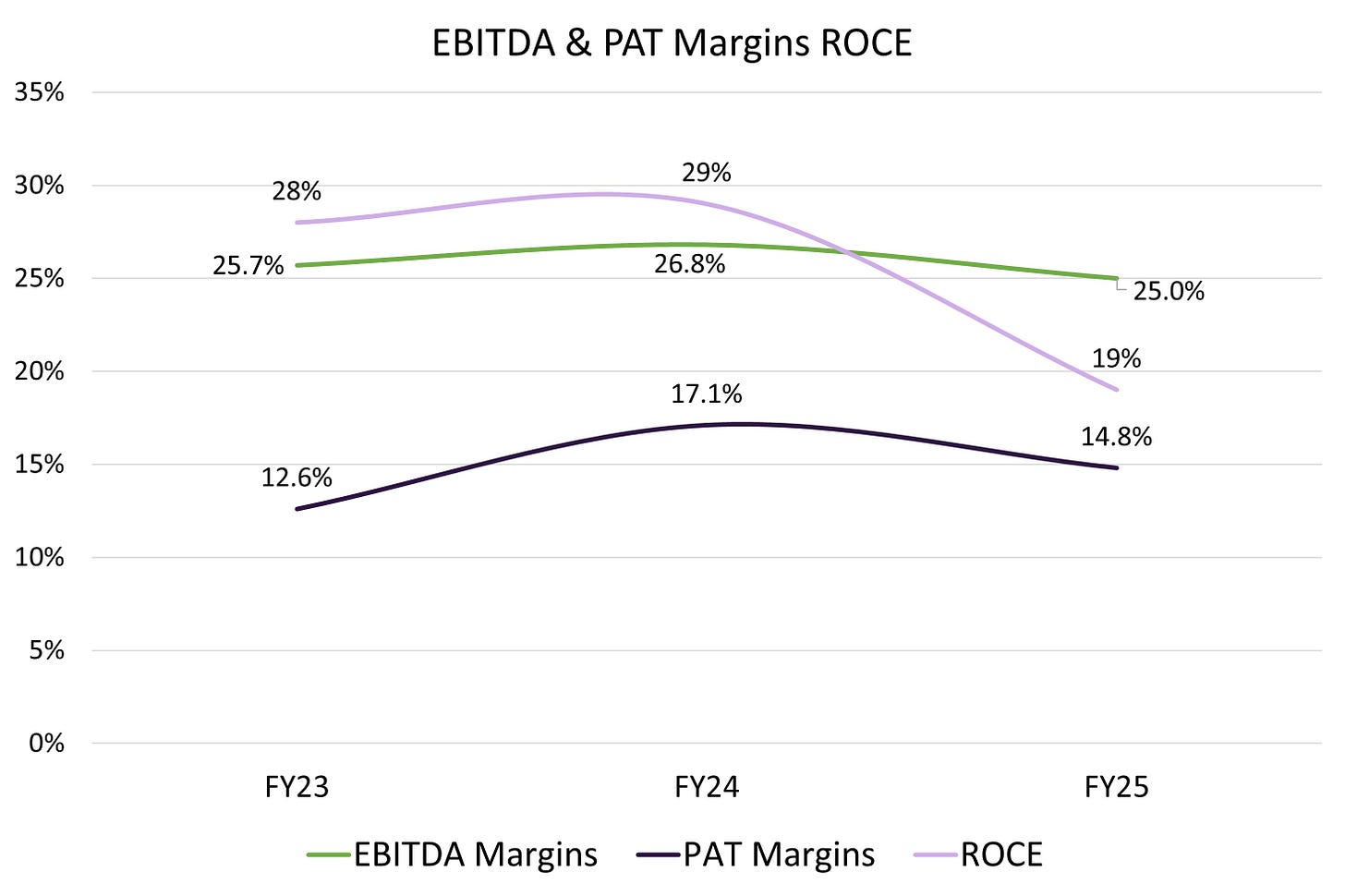

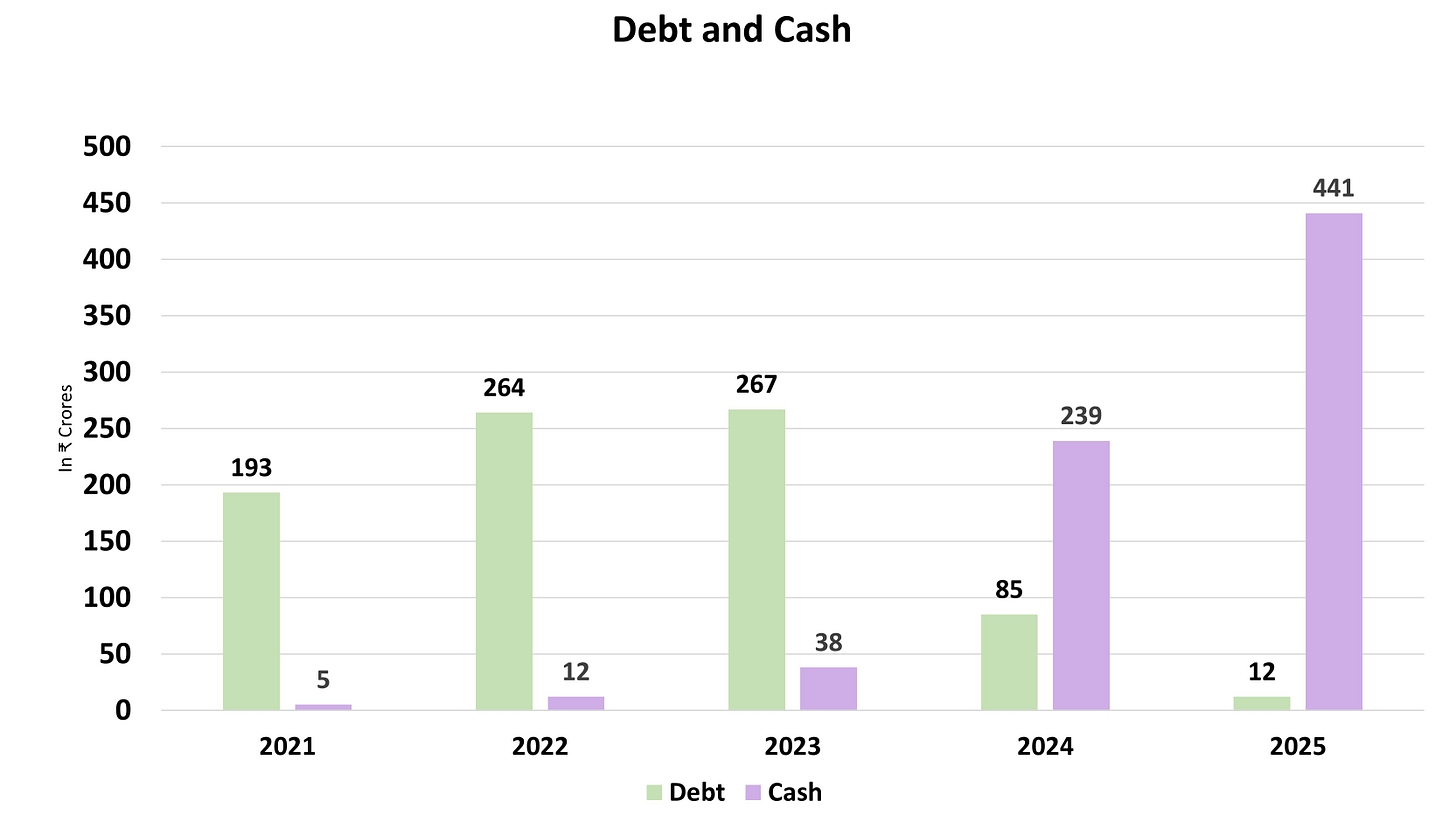

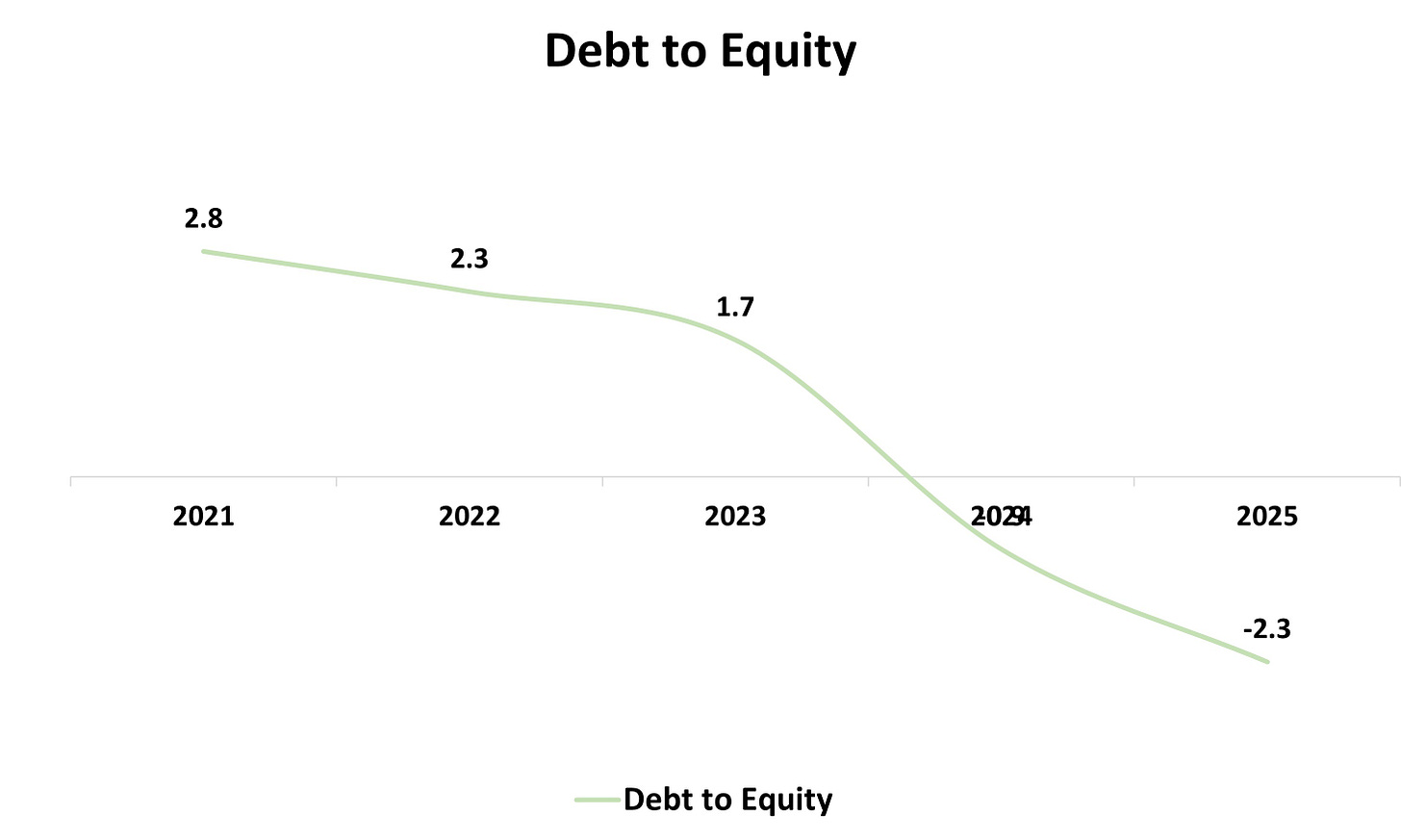

Yatharth Hospital & Trauma Care Services Ltd. is a rapidly growing force in the super-specialty hospital domain. Headquartered in Greater Noida West, the company excels in advanced and tertiary care, primarily serving the Delhi NCR region and North India. Their commitment to patient care and operational excellence is reflected in their strong financial performance. For FY25, revenue surged over 30% year-on-year to INR 8,805 million, with EBITDA climbing over 20% to INR 2,202 million. They also achieved a robust operating cash flow of INR 1,496 million, boasting an impressive cash conversion ratio of around 70%, underscoring their robust financial health and strategic growth.

Yatharth Hospitals prides itself on offering cutting-edge tertiary and quaternary care services. Imagine a hospital that's not afraid to push boundaries:

Pioneering Treatments: Their Noida Extension Hospital, for instance, became the first in the region to introduce revolutionary CAR T-cell therapy for cancer patients .

Technological Advancement: They've also embraced robotics across their Noida Extension, Greater Noida, and Greater Faridabad facilities, significantly boosting their oncology revenue, which now contributes 10% to the group's overall top line.

Evolving Patient Mix: Their patient mix is strategically evolving. While institutional (government) business currently stands at about 37%, the focus is shifting towards increasing private insurance and cash-paying patients.

Global Reach through Medical Value Travel: This includes a significant push into medical value travel. They're actively engaging in strategic partnerships and setting up information centers in countries like Nigeria, Uzbekistan, Tajikistan, Mauritius, Tanzania, and Kenya to attract international patients, recognizing that international business often yields higher margins.

Expanding Horizons: Hospital Units & Growth Strategy

Forget "manufacturing units"—Yatharth's prowess lies in its expanding network of healing centers! The company strategically grows through a mix of greenfield projects, acquisitions, and brownfield expansions. They prefer to own 100% equity in their facilities, including land and buildings, which they believe contributes to better margin visibility.

Currently, they operate multiple facilities, including those in Noida (Sector 110, Greater Noida, Noida Extension) and Jhansi-Orchha. A major milestone was the operationalization of their Greater Faridabad facility in May 2024, adding 200 beds and quickly contributing significantly to revenue. Looking ahead, two new hospitals—a 300-bed facility in New Delhi and a 400-bed hospital in Faridabad—are slated to become operational very soon, promising to further solidify their presence in the Delhi NCR region. Additionally, brownfield expansions are set to add another 200 beds in Greater Noida and 250 beds in Noida Extension hospitals.

Financial

Charting the Course Ahead: Future Outlook 🚀

Yatharth Hospitals is not resting on its laurels; their future outlook is brimming with calculated ambition:

Strategic Expansion & Capacity Building: The company is committed to aggressive expansion, targeting the addition of at least one new facility through acquisition this financial year. Their capital expenditure plan of around INR 300-310 crores for FY25 and similar expected for FY26/FY27 underscores this commitment, focusing on equipping new hospitals and enhancing existing ones.

Improving Payer Mix & ARPOB: A key focus is to increase the proportion of high-value cash and TPA (Third-Party Administrator) business, especially from medical value travel. This strategic shift is expected to significantly improve their Average Revenue Per Occupied Bed (ARPOB) across the group, with newer facilities starting at ARPOB levels comparable to their top-performing Noida Extension and Greater Noida hospitals (around INR 35,000).

Sustained Growth Momentum: Management is confident in sustaining their impressive revenue growth of over 30% year-on-year, a trend observed consistently for the past few years. While new facilities might initially impact EBITDA margins due to operational ramp-up costs, the company expects overall margins to stabilize around current Q4 levels (24.6%), bolstered by the ramp-up of existing facilities and new hospitals achieving break-even within 12-15 months.

RISK FACTORS

Initial Operational Losses in New Facilities: New hospitals, especially greenfield projects, typically take 12 to 18 months to reach operational breakeven, leading to initial EBITDA losses.

Promoter Share Pledge: A recent pledge of 8% of promoter shares was for personal investments, with promoters confident of unpledging them within a year

Income Tax Matters: The company has been dealing with an ongoing income tax assessment, though a significant positive development includes the resolution concerning their subsidiary AKS Medical.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."

What’s your view on the low cfo/ebitda conversion ? They have that government business segment, which is creating delayed payables.