Margin Surge in a Plastic Precision Play

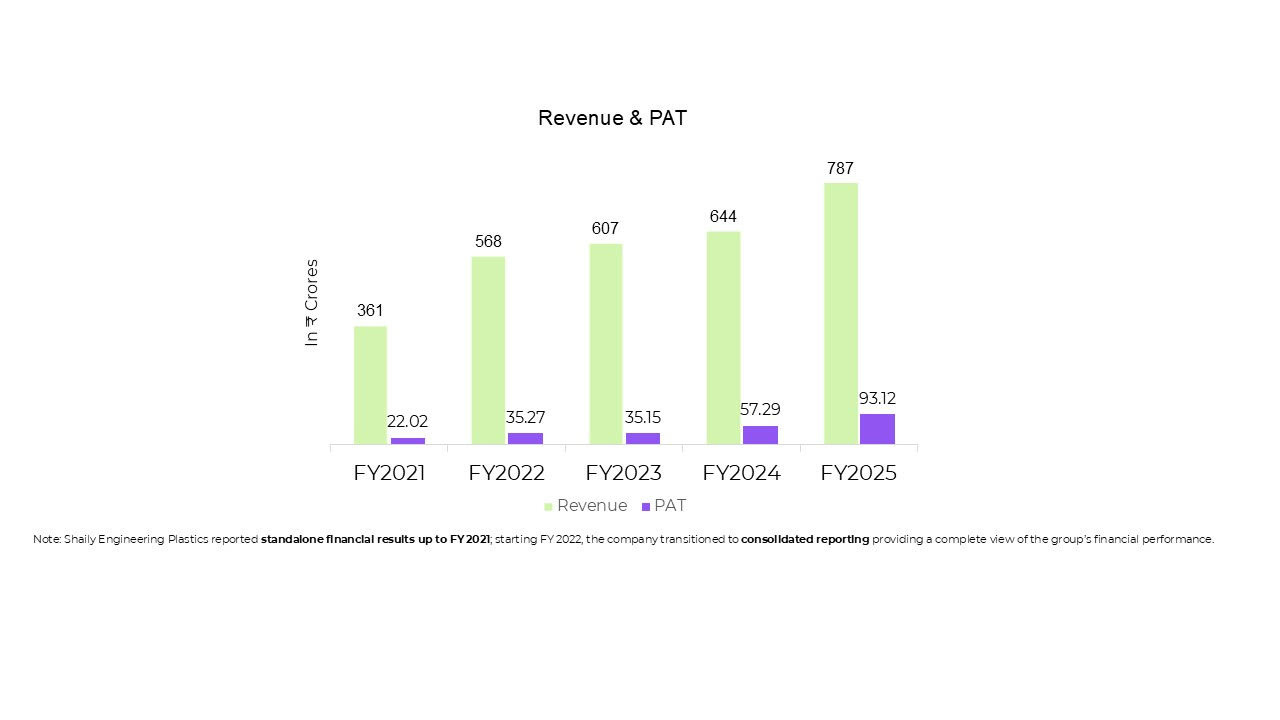

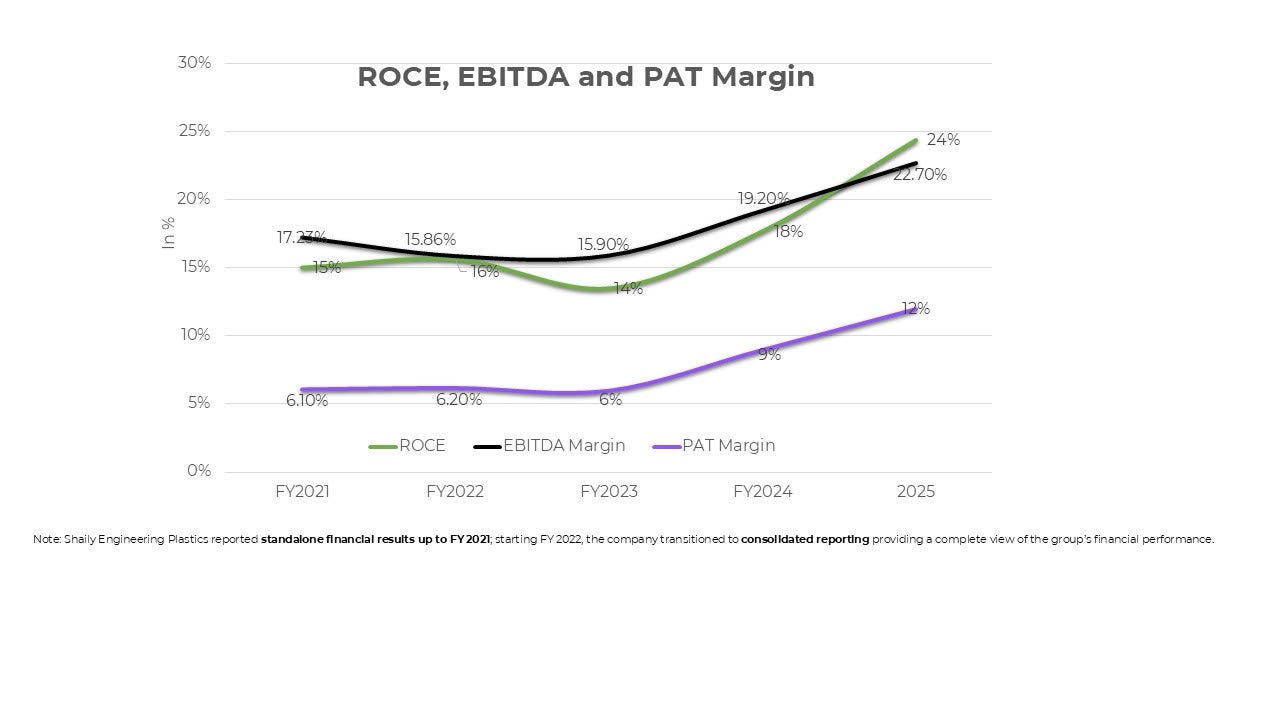

Revenue grew 22% and net profit jumped 63% in FY25, powered by 25% operating margin—this precision plastics supplier is cashing in on export, pharma, and consumer OEM demand

Designed in India, Delivering to the World: Shaily’s Multi-Sector Growth Play

Founded in 1987 by Mike Sanghvi, Shaily began as a startup with just two injection-molding machines.Headquartered in Vadodara, Gujarat. It has evolved into India’s largest exporter of plastic components and is publicly listed.

From its roots as a niche plastic components supplier, Shaily has transformed into a global precision-manufacturing partner. Leveraging deep expertise in high-precision, high-compliance plastic solutions, it serves demanding industries such as healthcare, pharma, FMCG, consumer goods and lighting,appliances and automotive. Over the years, Shaily has earned the trust of global leaders like IKEA, Procter & Gamble, and Dr. Reddy’s relationships built on an unwavering commitment to scale, precision, and reliability.

With more than 80% of revenues derived from exports, Shaily has established a strong presence in regulated international markets. The healthcare segment in particular, is experiencing rapid growth driven by its US FDA and ISO-certified manufacturing facilities and rising global demand for GLP‑1 drug-delivery platforms.

Shaily operates a multi-client model across regions including Brazil and Canada and maintains active engagement at international exhibitions like Pharmapack Paris. Positioned as a strategic enabler in global precision manufacturing, Shaily is truly "designed in India, trusted worldwide."

What the Company Does?

Shaily designs and produces custom-engineered plastic parts used in:

Healthcare: Drug delivery devices like insulin pens, GLP-1 injector pens, inhalers, and more.

Consumer goods: Products such as razor handles, toothbrushes, and home care packaging.

Automotive and furniture: High-strength plastic parts used in vehicles and IKEA furniture.

FY25 Performance Snapshot

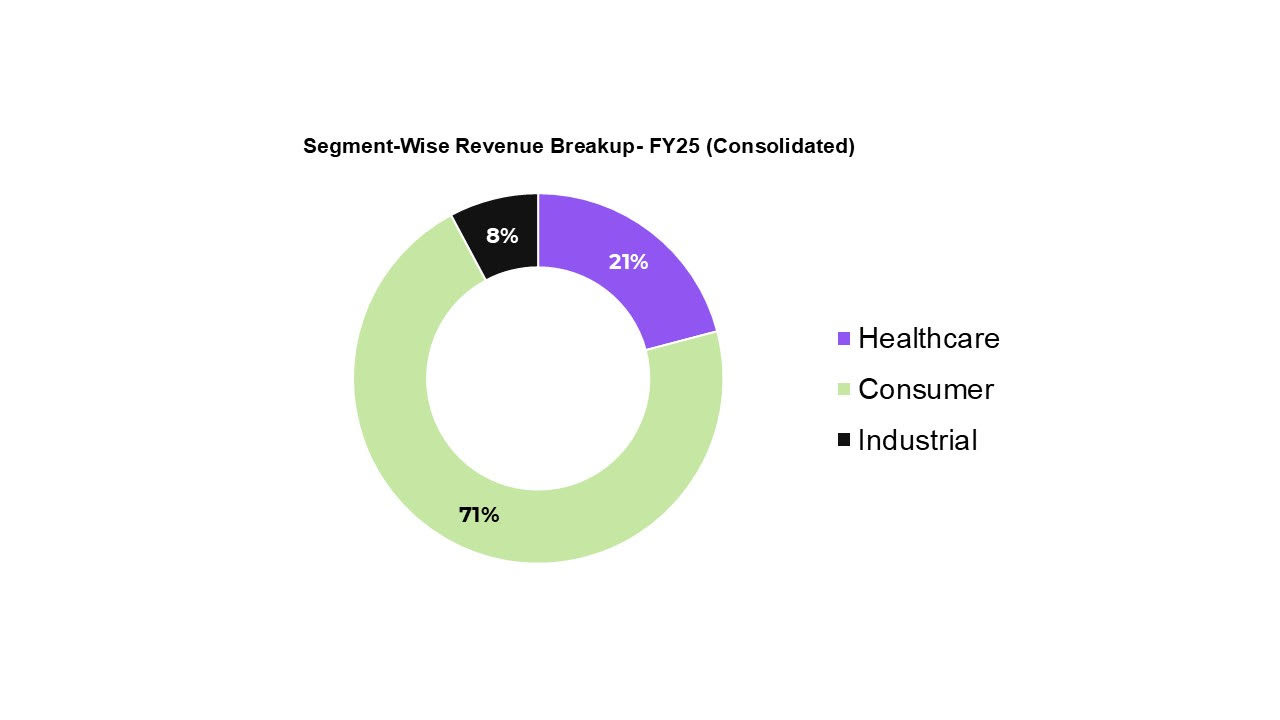

In FY25, Shaily’s Consumer segment took center stage, contributing a dominant 71% of total revenue driven by strong volumes and long-standing relationships with global FMCG giants. The Healthcare segment, contributing 21%, remains a high-priority growth engine, especially with rising traction in drug delivery devices and GLP-1 platforms. Meanwhile, the Industrial segment, at 8%, held steady with consistent demand from niche global clients.

This segmental mix not only reflects Shaily’s diversified revenue base, but also its strategic tilt: scale from Consumer, growth from Healthcare, and stability from Industrial. It’s a balanced, export-led model designed for both near-term strength and long-term upside.

Consumer Segment – FY25 Results, Client Wins & Outlook

FY25 marked a transformative year for Shaily Engineering’s Consumer segment not just in terms of revenue, but in reaffirming its position as a trusted, design-led manufacturing partner for global consumer brands.

From toothbrushes and kitchenware to carbon steel lifestyle products, Shaily’s precision-engineered components have quietly become the backbone of everyday essentials across households worldwide. Backed by deep integration across the value chain from in-house design and tooling to high-volume molding and assembly.The company delivered 17% YoY revenue growth, reaching ₹560.8 crore in FY25. This performance was powered by:

5 new product launches (2 plastic, 3 carbon steel) for a marquee home furnishing client.

Multiple mandates from a top-tier FMCG company, including two products under development.

New relationships with two global retail chains, with shipments already underway in Q1 FY26

And a 17% YoY growth in carbon steel offerings, reflecting success in material diversification.

Yet, Shaily’s evolution isn’t stopping there.

As the global manufacturing landscape pivots toward high-tech and precision-led solutions, Shaily is strategically positioning itself for the next wave of growth in consumer electronics. The company sees a significant opportunity to plug into this fast-growing ecosystem. It has already entered active discussions across the electronics value chain, and if these talks translate into firm mandates, it is prepared to commit substantial capex over the next 12–24 months signaling entry into a high-potential, tech-enabled vertical.

This isn't just diversification; it's a strategic leap. Shaily aims to leverage its core strengths in precision engineering, scale, and regulatory compliance to build a meaningful presence in a segment with strong global demand tailwinds.

Healthcare: Shaily’s Fastest-Growing Frontier

Shaily Engineering’s healthcare segment is undergoing a transformation from a capable supplier of drug delivery devices to a global partner in chronic care innovation. In FY25, healthcare revenue surged 53% YoY to ₹165 crore, now contributing 21% of total revenue. But more importantly, it’s now the company’s fastest-growing and most strategically important vertical one expected to account for nearly 30% of revenues over the next few years.

At the core of this momentum is the global explosion in demand for GLP-1-based therapies used to treat diabetes, obesity, and metabolic disorders. Shaily delivered 17.5 million drug delivery pens in FY25 and has already guided for 30 million in FY26 with internal estimates hinting at 35 million units. This translates to a 70–100% YoY volume growth, riding on new non-insulin therapies, many of which are based on Shaily’s proprietary, IP-led platforms such as Neo, Toby, and Tristan.

To stay ahead, Shaily is doubling down on capacity and innovation.Two new GLP-1 platforms are being commissioned, adding 40–50 million units of additional throughput to its current 30 million pushing total annual capacity to 70–80 million pens, a staggering 133%–167% expansion. And over 70% of FY26 volumes are already commercialized, meaning most customer programs have moved from validation to full-scale production significantly de-risking the scale-up.

But this isn’t just about more pens it’s about better pens. After nearly two years of R&D, Shaily is launching a next-generation, IP-led fixed-dose injection platform that directly addresses the practical flaws in current drug delivery devices. Traditional auto-injectors require multiple monthly units and are prone to priming issues, dose-dialing errors, and imprecise usage. Shaily’s new platform flips the experience: no priming, no dialing, just a pull-to-arm, push-to-inject mechanism. It features a built-in dose counter for accurate tracking, is compact and customizable, and has a lower environmental footprint aligning perfectly with global compliance and sustainability trends.

Meanwhile, Shaily continues to participate in the insulin pen market but with a focused, margin-conscious strategy. With intense price competition from Chinese players in unregulated markets, the company is carefully limiting its insulin exposure to established players in India and regulated global geographies. It is consciously avoiding low-margin or fragmented opportunities, and instead, is reallocating capacity to mid-scale drug delivery programs that offer stronger profitability and long-term relevance.

With innovation at its core, de-risked scale-up in motion, and strategic selectivity in place, Shaily’s healthcare vertical is redefining the company’s identity. No longer just a precision plastics manufacturer, but also a trusted CDMO partner in the drug delivery space with IP-led solutions,engineering not just devices, but therapeutic outcomes, patient compliance, and sustainable growth for the chronic care world of tomorrow.

Capex Strategy: Doubling Down on High-Growth Pharma

Shaily Engineering is making a bold, targeted bet on the future of healthcare manufacturing.

Shaily has earmarked ₹180–185 crore in capex for FY26, with ₹150 crore directed toward expanding its healthcare capacity primarily for GLP-1 platforms. As per management, healthcare asset turnover is expected to remain strong at 1.5x to 2x, highlighting confidence in efficient capital deployment despite the segment’s capex-intensive nature.

Final Outlook

Shaily aims to prove its ability to scale manufacturing through the upcoming semaglutide pen launch and expansion. While not yet at the scale of global leaders like Ypsomed, it expects to close that gap soon. On the development side, Shaily sees itself ahead of many competitors, especially in pen injectors, thanks to its agility and strong pipeline. For Tirzepatide, Shaily expects to supply devices to three customers by FY26, with deliveries ending by October 2025

Industrial Segment: Quietly Consistent, Strategically Expanding

While it may not command the spotlight like healthcare, Shaily Engineering’s Industrial segment continues to deliver quiet, consistent growth, driven by solid volumes, new client wins, and expanding export traction.

This segment supplies high-performance plastic components used in automotive, appliance, and electrical systems domains where precision, durability, and advanced polymer engineering are non-negotiable. Shaily’s capability to handle complex geometries and high-spec materials positions it as a preferred partner to both Indian and global OEMs(Original Equipment Manufacturers companies that produce finished products like cars, appliances, or electronics)..

FY25 was marked by expansion and execution. The company secured new orders from marquee automotive clients for precision parts, and in Q4, it bagged fresh export contracts for precision knobs further reinforcing its credibility in industrial sub-assemblies.

Financially, segment revenue grew 12% YoY to ₹61.4 crore, up from ₹55 crore in FY24. Management expects this steady trajectory to continue, anchored by growth in exports, ongoing material innovation, and deeper client penetration.

Beyond just top-line support, the Industrial segment plays a strategic role offering volume stability and a counter-cyclical buffer to Shaily’s overall portfolio.It diversifies end-market exposure and underscores the company’s identity as a trusted, cross-sector engineering partner capable of scaling across industries.

Key Profitability Metrics

Note: Shaily Engineering Plastics reported standalone financial results up to FY 2021; starting FY 2022, the company transitioned to consolidated reporting providing a complete view of the group’s financial performance.

Future Outlook: Focused Innovation with Optionality on the Horizon

Applicator Project – Expanding the Healthcare Footprint

Shaily is investing ₹35 crore in a next-generation applicator project, a move that strengthens its position in precision healthcare delivery. These devices, often used for dermatology, gynaecology, nasal, and rectal drug applications, demand exacting standards in hygiene, dosing accuracy, and patient usability.

Backed by its core strength in high-precision plastic injection moulding and regulatory compliance, Shaily is well-positioned to carve out a niche in this single-use medical device segment. This project fits neatly into its broader strategy of expanding within the regulated, high-value drug delivery ecosystem.

GLP-1 Opportunity in India-Long-Term, Not Immediate

While Shaily is scaling rapidly in GLP-1 injector platforms for global markets, the Indian opportunity remains a longer-term wildcard.

Currently, GLP-1 therapies like semaglutide are not approved or marketed in India including by the original innovators. With no regulatory green light and zero domestic demand, India contributes nothing to Shaily’s GLP-1 revenues today.

That said, management remains alert. In other markets like Canada, the entry of generics has expanded the addressable device market by 4-5x. If a similar pattern unfolds in India post-approval and genericization, Shaily could emerge as a go-to domestic partner for Indian generics in need of quality drug delivery devices.

For now, however, GLP-1 remains an export-driven story, with India as an optional upside, not a near-term growth lever.

Vertical Integration: Staying Focused, Scaling Smart

Shaily has carefully evaluated whether to expand into adjacent CDMO areas like fill-finish operations, API manufacturing, or pharma packaging but has decided not to dilute its strategic focus.

Why? These segments are fast becoming commoditized, with overcapacity and thinning returns. Instead of chasing volume in crowded markets, Shaily is doubling down on what it does best: IP-led, high-margin device platforms that offer engineering complexity and global stickiness.

That said, the company may selectively add downstream capabilities like final assembly for clients in the clinical development phase reinforcing its role as a full-cycle device partner without taking on heavy capital risk.

This clear, margin-conscious strategy keeps Shaily’s capital disciplined, its innovation pipeline focused, and its positioning aligned with premium global pharma demands.

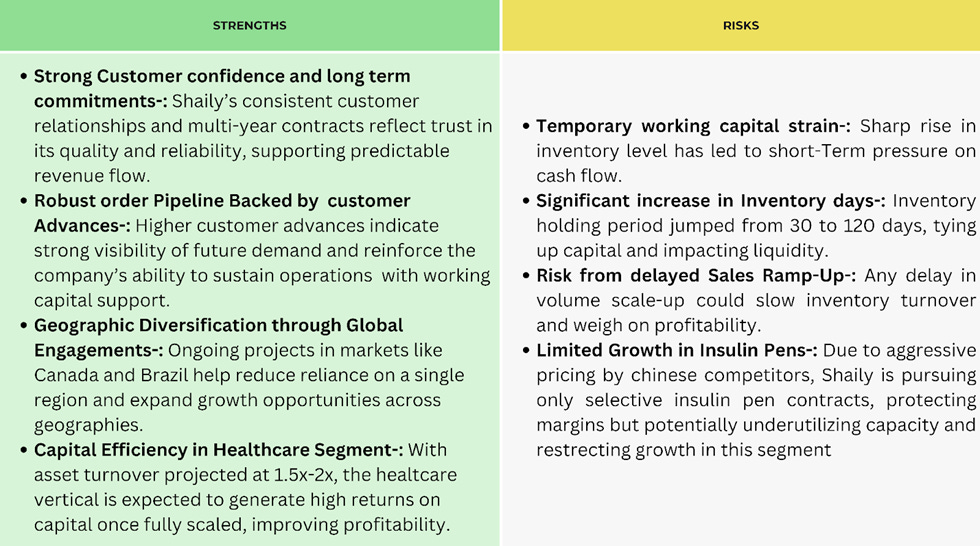

Key Strengths and Risks

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."