KP Energy - Building a Resilient, Cash-Generating Portfolio.

Disciplined capital deployment aimed at doubling IPP capacity to 100 MW by FY27, while maintaining balance sheet strength and enhancing long-term annuity revenues.

Business Overview

Established in 2010, the Company has emerged as a leading end-to-end provider of wind energy solutions, consistently working to reshape the global energy landscape. Its integrated offerings cover the entire lifecycle of utility-scale renewable energy projects from concept and design to development and execution ensuring smooth and reliable delivery.

The Company is among the few specialized players in the wind and hybrid renewable energy sector. Leveraging deep industry expertise, innovation, and execution capabilities, it delivers state-of-the-art solutions in a rapidly evolving market. With its commitment to clean energy, the Company is well-positioned to drive sustainable growth and support the global transition to a greener future.

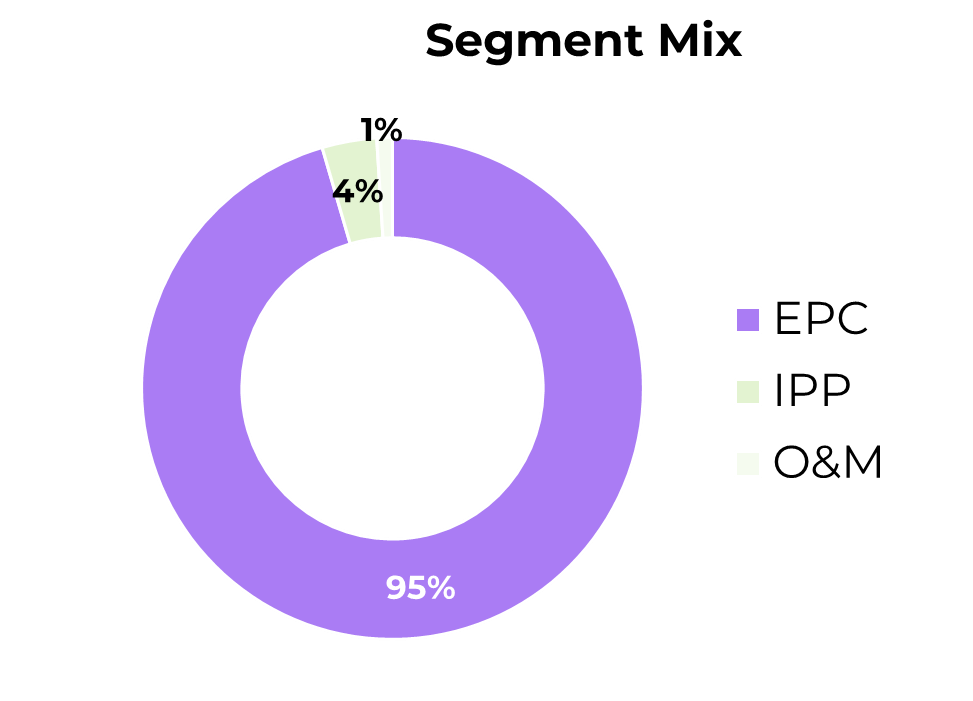

Revenue by Segment

Business Model

Engineering, Procurement, Construction & Commissioning (EPCC)

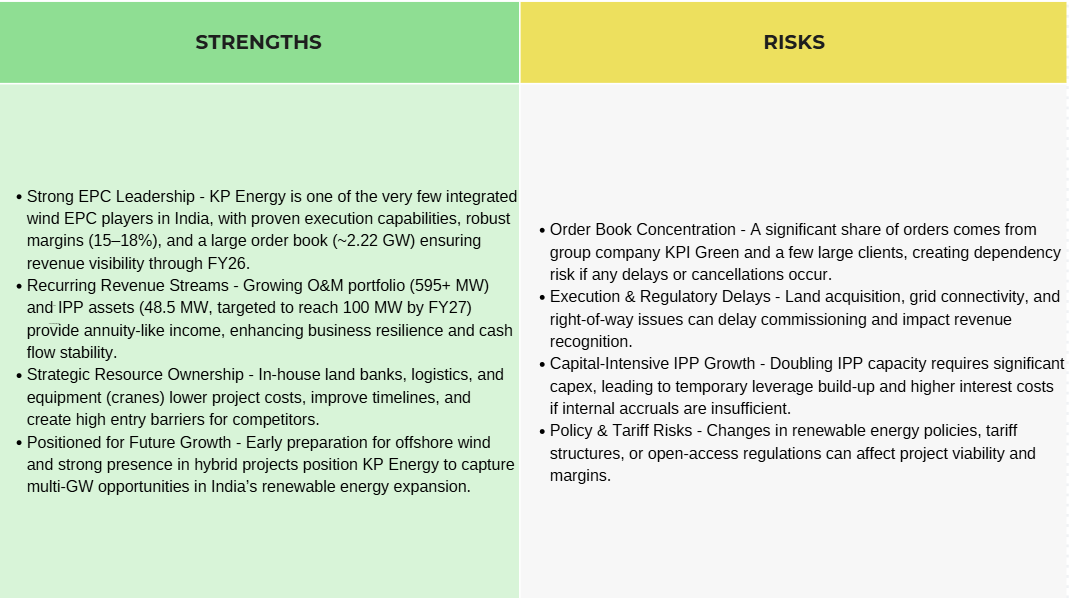

The EPCC segment is KP Energy’s flagship division and core revenue driver, contributing over 95% of consolidated revenues. The company is one of the very few integrated wind EPC players in India, offering turnkey BOP solutions — including site identification and acquisition, engineering & design, procurement & logistics, construction & erection, and grid commissioning.

Management highlights that BOP expertise is scarce in India, creating a high entry barrier and positioning KP Energy as a differentiated and preferred partner. The company leverages group synergies — including land banks, logistics capabilities, and large-capacity cranes — to deliver quality projects with cost efficiency and accelerated timelines.

The current order book stands at ~2.22 GW (~₹3,000+ crore), with projects under execution through FY26, including marquee projects like the NTPC/INGEL/Indian Oil 462 MW project. Management remains confident of robust inflows, supported by strong policy push, open-access demand, and hybrid project opportunities. EPC margins remain structurally in the 15–18% range, with execution scale and resource ownership expected to sustain profitability.

Operation & Maintenance (O&M)

The O&M vertical, operated through wholly owned subsidiary KP Energy OMS Limited, extends the company’s value proposition beyond project commissioning, ensuring asset reliability, uninterrupted power generation, and grid stability.

With a growing O&M portfolio of 595+ MW, KP Energy provides comprehensive services, including pooling substation management, transmission network upkeep, civil infrastructure maintenance, power commercial management, and proactive Right of Way (RoW) resolution.

Initially bundled with EPC contracts, O&M services gradually transition into standalone, annuity-based revenue streams, providing financial resilience. The segment is expected to deliver increasing revenue share as free O&M periods expire, offering a stable, recurring income source over the long term.

Independent Power Producer (IPP)

The IPP business reinforces KP Energy’s commitment to long-term value creation by owning and operating renewable energy assets, thereby generating recurring, annuity-like revenues. As of Q1 FY26, the portfolio stands at 48.5 MW (37 MW wind, 11.5 MW solar) — all fully commissioned and operational.

The company targets to double capacity to 100 MW by FY27, with around 20 MW planned for phased commissioning in FY26. Expansion is being funded largely through internal accruals, maintaining prudent leverage and balance sheet strength.

IPP assets deliver robust PLFs (wind: 35–37%, solar: 20–23%) and healthy realizations (₹4.5–5/unit net for wind, ₹5–5.5/unit for solar), strengthening earnings visibility and complementing EPC revenues. This segment underscores KP Energy’s commitment to sustainability and enhances overall business resilience.

Future Growth Area: Offshore Wind

India’s offshore wind segment represents a large untapped opportunity, with the National Institute of Wind Energy (NIWE) identifying 70 GW of potential across Gujarat and Tamil Nadu. Offshore wind provides higher and more consistent PLFs (45–50% vs. 30–35% for onshore), minimal land requirements, and the ability to supply round-the-clock power, supporting grid stability.

Government support is strong, with incentives such as Viability Gap Funding (up to ₹7,453 crore per GW), seabed leasing exclusivity for developers during survey periods, and tenders in Gujarat and Tamil Nadu. Globally, more than 73 GW of offshore wind capacity is installed, and India’s entry into this space is expected to open a significant new market. KP Energy is actively preparing to participate as commercial frameworks and policy clarity evolve, positioning itself as an early mover.

Order Book

KP Energy maintains a healthy order book of ~2.22 GW, providing strong revenue visibility through FY26 and beyond. Approximately 1.3 GW is linked to KPI Green, with the balance from marquee external clients such as Aditya Birla and NTPC-linked projects. The execution schedule is well staggered, with projects completing in phases through Sep’25, Dec’25, and beyond FY26, ensuring steady revenue recognition.

Execution remains on track, with 92 MW commissioned for KPI Green and 23.1 MW for Aditya Birla in Q1 FY26. Importantly, the bid pipeline remains robust at nearly 3 GW, driven by strong demand for hybrid projects and open-access opportunities. Management expects significant new inflows in Q2 FY26 (Sep’25), further replenishing the order book and sustaining growth momentum.

Capex

On the capex front, KP Energy is steadily scaling its Independent Power Producer (IPP) portfolio, with a target to double capacity to 100 MW by FY27 from the current operational base of 48.5 MW (37 MW wind, 11.5 MW solar). Around 20 MW of fresh capacity is expected to be added in FY26, in a phased manner, ensuring measured growth without over-stretching resources. The expansion is capital intensive, funded largely through internal accruals, though management acknowledged a temporary rise in debt levels linked to these investments.

During Q1 FY26, the company recorded a ₹252 crore increase in fixed assets, primarily due to the commissioning of a 30 MW wind plant (28.7 MW energized), demonstrating its ability to execute and monetize IPP capacity additions efficiently. The IPP business not only provides a steady, annuity-like revenue stream but also delivers accelerated depreciation benefits and tax efficiencies, supporting operating cash flows and improving return on capital employed over time.

Management reiterated its intent to pursue a phased IPP build-out strategy, balancing growth ambitions with prudent leverage management, thereby safeguarding balance sheet health while complementing the high-volume EPC business. This approach ensures that the company remains well-capitalized and positioned to capture value-accretive opportunities across both EPC and IPP verticals, driving sustainable, long-term shareholder value creation.

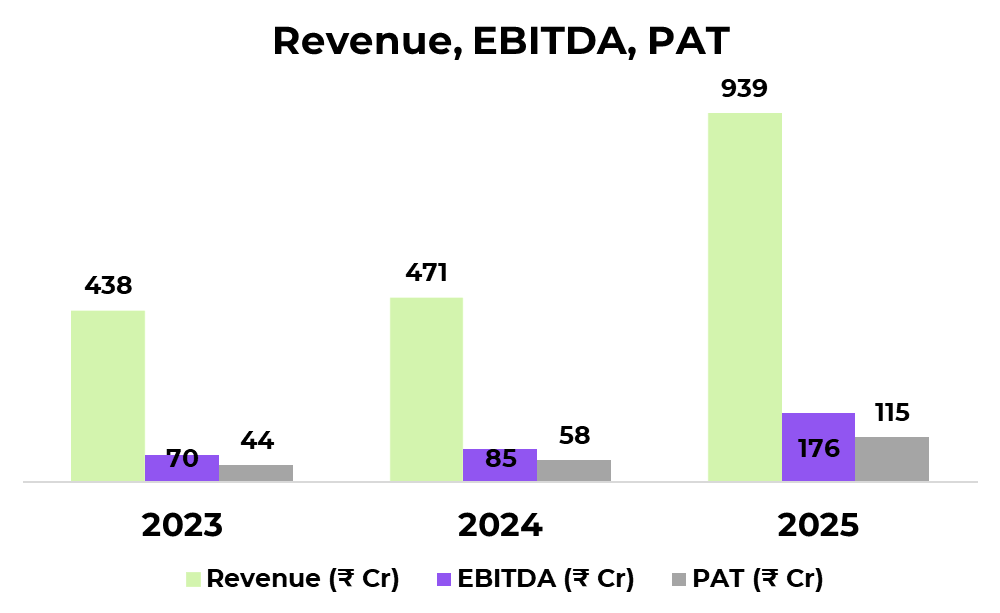

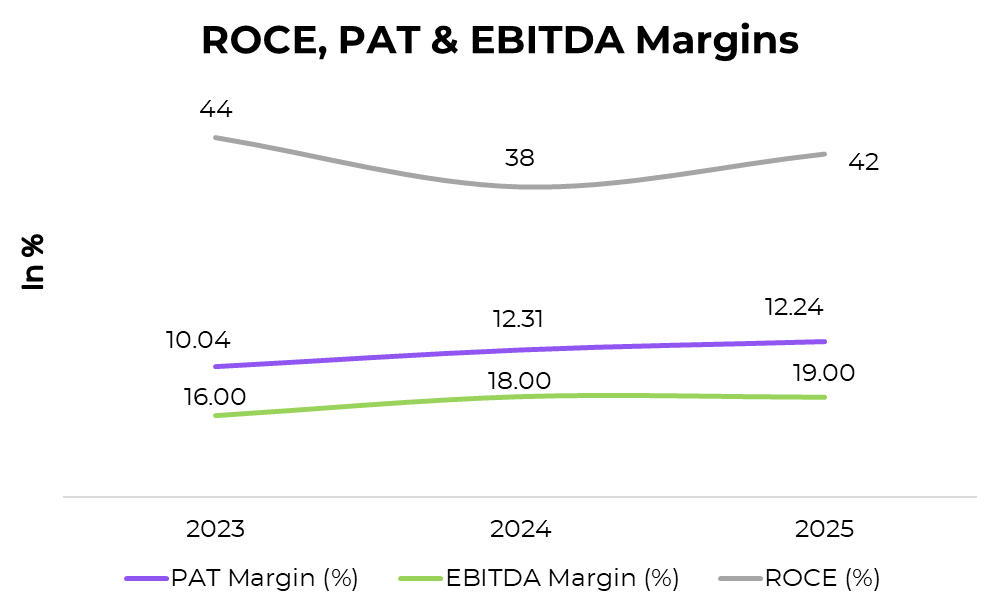

Financials

Risk & Strengths

Future Outlook

KP Energy enters FY26 with strong momentum, underpinned by record quarterly revenues, a robust EPC order book, and a well-defined IPP growth pipeline. The company is ideally positioned to benefit from India’s target of 500 GW renewable capacity by 2030, with wind and hybrid projects playing a central role in this transition.

In the near term, execution ramp-up and strong order inflows are expected to sustain revenue growth. Over the medium term, increasing O&M revenues and annuity cash flows from IPP assets will provide a more balanced, recurring income profile, strengthening resilience across cycles.

Longer term, offshore wind and hybrid projects present a multi-GW growth opportunity. With its proven turnkey execution model, resource ownership, and financial discipline, KP Energy is strategically positioned to capture these opportunities while delivering sustainable shareholder value creation.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."

If you’ve ever bought medicines from a local chemist, chances are they came through a distributor.

India has thousands of such distributors, most of them small and local.

But now, the industry is changing — big players are starting to take over.

One of the fastest-growing names in this space is Entero Healthcare Solutions.

https://stocklens.substack.com/p/entero-healthcare-the-new-giant-in