KEI Industries: Building Scale for the Next Leg of Growth

KEI Industries: Powering India’s Growth with Scale, Innovation, and Global Reach

Company Overview

As India accelerates its power, housing, and infrastructure development, KEI Industries is quietly building the backbone of this growth. From household wires to extra-high-voltage (EHV) cables, the company is expanding capacity, entering new markets, and pushing exports aggressively, with the Sanand project expected to be a game-changer. Established in 1968 and headquartered in New Delhi, KEI Industries is now one of India’s leading wires and cables manufacturers with a growing global footprint. Backed by 34 branch offices, 26 warehouses, and a network of over 2,000 channel partners, KEI reaches customers across India. Internationally, the company exports to more than 60 countries and operates through offices in the UAE, Nepal, South Africa, and Gambia, strengthening its position as a trusted partner worldwide.

Manufacturing Footprint & Capacity Utilisation

Its six state-of-the-art manufacturing facilities are spread across Rajasthan and Dadra & Nagar Haveli, with dedicated PVC compound plants at Harchandpur and Dapada for backward integration. A seventh greenfield plant is coming up at Sanand, Ahmedabad, the largest bet in KEI’s growth journey, with the first phase of capex scheduled to go live by September 2025.

Comprehensive Product Portfolio

Cables

KEI serves a wide range of industries from power, oil and gas, and infrastructure to real estate, transport, and renewables. Its product basket includes LT, HT, and EHV cables, house wires, winding wires, and stainless steel wires, complemented by specialized solutions like solar and marine cables. The company is an early mover in the EHV segment up to 400kV through its partnership with Brugg Kabel of Switzerland, and has consistently built strong pre-qualification credentials for high-value tenders.

KEI’s core revenue comes from LT Power cables, contributing around 40% and remaining stable. The HW/WW segment is steadily growing, reflecting strong retail and urban demand. Smaller segments like EHV, SSW, and EPC contribute a minor portion of revenue.

EPC

In addition to manufacturing, KEI has established itself as a reliable EPC player, executing turnkey projects such as gas-insulated and air-insulated substations, overhead and underground transmission lines, and power distribution systems. the EPC business complements its core cables segment, though KEI continues to tilt strategically towards higher-margin retail and exports.

Business Segments Driving Growth

Retail

Retail remains the backbone of KEI’s growth. This segment comprises household wires and LT/HT cables and benefits from strong brand equity and deeper distribution.

KEI has 2,082 active dealers, over 20,000 retailers, and influence among nearly two lakh electricians.

The company has steadily expanded its reach across metros, Tier 1, and Tier 2 cities.

Retail sales stood at ₹1,325 crore in Q1 FY26, growing at over 25% annually.

Institutional

The institutional segment focuses on premium-grade EHV, HT, and LT cables, along with EPC projects.

Demand remains healthy from utilities, renewable projects, railways, metro networks, and industries like steel, cement, and refineries.

Institutional sales were ₹898 crore in Q1 FY26, supported by broad energy sector demand.

Exports

Exports are the third pillar of KEI’s growth.

KEI operates in over 60 countries, supplying cables to Australia, the US, Middle East, Europe, Nepal, and Africa.

Exports grew sharply to ₹373 crore in Q1 FY26, up from ₹1,267 crore in FY25.

Nearly 90% of the export business is with EPC contractors and utilities.

The company continues to win certifications and approvals to expand into new markets.

KEI aims to scale exports to 17–20% of total revenues in the next 2–3 years, with the Sanand plant supporting long-length demand for EHV cables.

Strong & Growing Order Book

As of 30th June 2025, KEI Industries maintained a healthy order book of ₹3,921 crore. The Wire and Cable segment formed the bulk of this, contributing ₹3,381 crore, with ₹2,140 crore coming from domestic cables and ₹538 crore from extra-high voltage (EHV) cables. The remaining ₹540 crore comprised pending EPC orders, reflecting steady demand across both manufacturing and turnkey project segments.

Types of Customers – KEI Industries Ltd.

KEI Industries Ltd. serves a diverse range of customers across multiple sectors, including Power, Infrastructure, Real Estate, Refineries, Oil & Gas, Defence, Chemicals, Metals, Information Technology, Pharmaceuticals, Manufacturing, Renewable Energy, Cement, Fertilizers, Consumer Durables, Data Centres, and Non-metal industries.

The company caters to:

Government bodies and Public Sector Undertakings (PSUs) – Through B2B channels and EPC projects, especially for Transmission & Distribution (T&D) and rural/urban electrification schemes.

Private enterprises – Direct B2B sales across various industrial sectors.

Retail customers – Through an extensive network of dealers and distributors (B2C), offering wires and cables for households and commercial projects.

Export markets – Supplying products, including stainless-steel wires, to international customers.

Additionally, KEI’s EPC division focuses on specialized Extra High Voltage (EHV) cable laying and related infrastructure development, ensuring end-to-end project execution for both domestic and international clients.

Sanand: The Flagship Expansion

The Sanand greenfield facility is central to KEI’s long-term growth strategy. With ₹2,000 crore raised through a QIP, the company has already deployed ₹913 crore, with another ₹1,100 crore earmarked almost entirely for this project. Commercial production will begin in September 2025 with LT and HT cables, while the EHV line is targeted for mid-2026. The full project will be complete by the first half of FY27.

Once operational, Sanand will add a topline capacity of nearly ₹6,000 crore, including ₹1,200 crore from EHV and ₹4,800 crore from LV and MV cables. Its proximity to ports (350 km vs. 1,400 km for North India plants) is expected to yield significant logistics savings for exports, though these benefits will take time to reflect in margins. Beyond volume, Sanand is being built with a forward-looking product mix — common facilities for HVAC and HVDC cables, E-beam technology for solar wires, and scope for backward integration on additional land already acquired.

Domestic Performance

KEI’s domestic business continues to fire on all cylinders. In Q1 FY26, volumes grew 28–30% with stable prices. Housing wires are expected to sustain 20–25% growth, while winding wires remain a small niche. On the EHV side, the current order book is slightly softer but should deliver ₹550–600 crore for FY26, before Sanand capacity kicks in. The overall EHV market is set to double from ₹3,000 crore to ₹6,000 crore in the next three years, and KEI’s versatile capacity ensures that HT production can offset any temporary EHV softness.

Institutional demand remains strong from power transmission, EPC contractors, and solar projects, while the retail side continues to gain traction. The distribution network expands 5–7% annually, with added focus on South and East India. Channel financing already covers 70% of dealers, providing liquidity support and ensuring smooth flow of goods. Notably, cables now contribute nearly half of B2C sales, balancing the business mix between wires and cables in retail.

Innovation and Future Readiness

KEI continues to invest in R&D and product innovation to align with emerging opportunities. It recently commenced supplies of ESP cables for global oilfield markets, becoming the only Indian player in this space, and is preparing to launch HVDC cables from Sanand. Other developments include EV charging solutions, medium-voltage current-carrying cables, and e-beam technology for railways and shipbuilding applications.

Digital initiatives are also being piloted, such as machine-level monitoring at the Bhiwadi HT plant to improve productivity and reduce downtime. With energy-intensive operations, KEI has started sourcing 2.9% of its power from renewables, signaling its commitment to sustainability.

Financial Outlook:

Financial Discipline and Growth Outlook

The company remains prudent in managing its balance sheet. From the ₹2,000 crore QIP, apart from Sanand funding, ₹276 crore was used for debt repayment, keeping leverage low. Future capex will be largely funded through internal accruals, with annual investments of ₹600–800 crore planned for LV and MV expansions.

Management is targeting 18–19% revenue growth in FY26, accelerating to 20% CAGR over the next 2–3 years as Sanand ramps up. Margins are expected to gradually improve as the business mix tilts toward high-margin retail, exports, and EHV, while lower-margin EPC is scaled down.

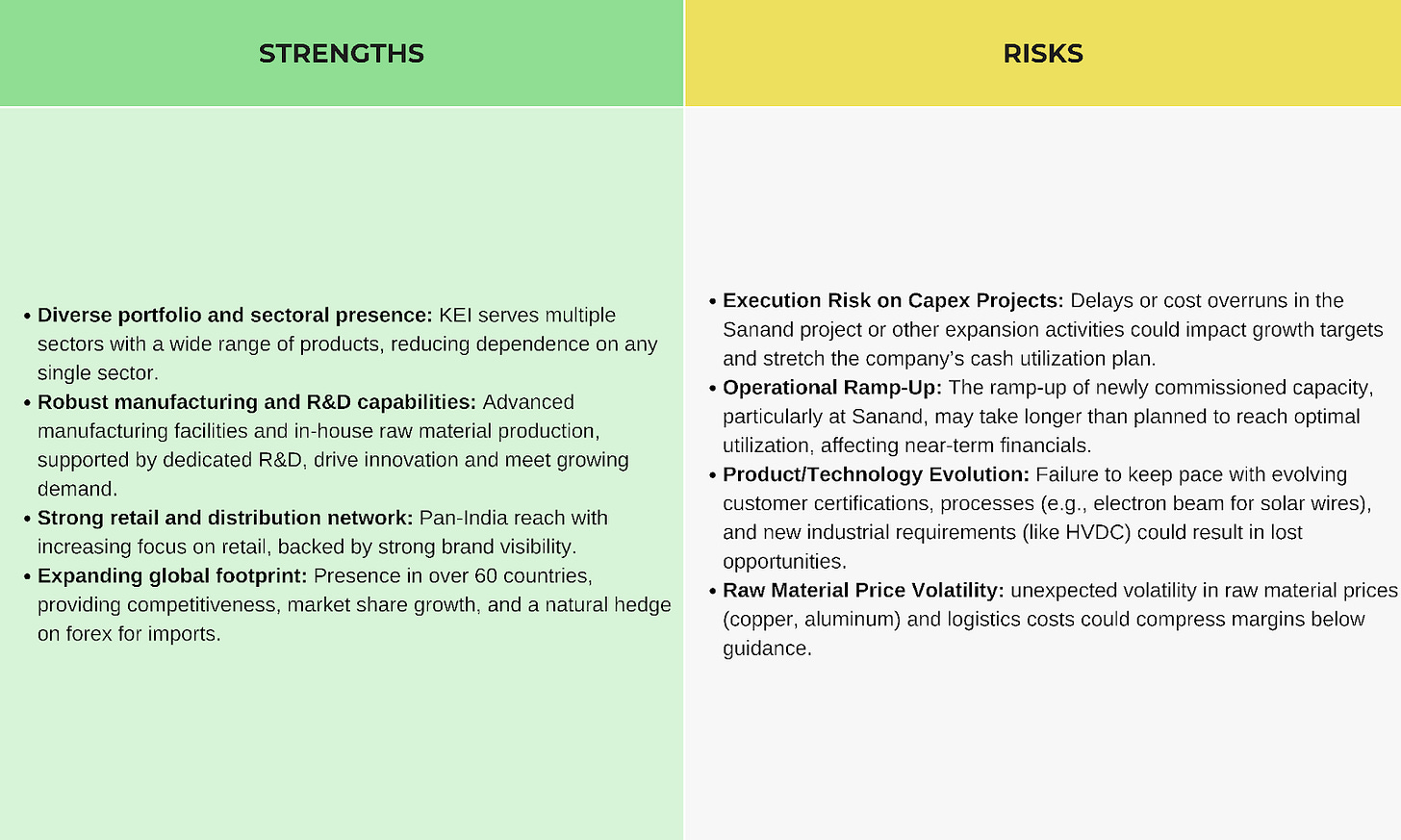

Key Strengths & Risks

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."

For years, Reliance Industries has been the most profitable company in India.

But things are changing. State Bank of India (SBI), the country’s biggest bank, is now making profits of about ₹19,000 crore every three months.

At this pace, SBI may soon earn more profit than Reliance in a year.

This is a big deal. It shows how strong SBI has become, and why investing in such large, stable companies can help protect your wealth.

https://stocklens.substack.com/p/sbis-profit-may-soon-overtake-reliance

Solara Active Pharma Sciences is no longer just a turnaround story — it is evolving into a growth platform. With:

High-margin products

Global regulated market presence

Promoter-backed strategic vision

…the company has entered a new growth phase. With its reset behind it and promoter skin in the game, Solara is becoming a pharma stock to watch for long-term investors.

https://stocklens.substack.com/p/the-solara-active-pharma-turnaround