Jane Street vs SEBI – A Market Manipulation Allegation That Could Rewrite Indian Derivatives Law

How One Ordinary Thursday Shook the Titans of Trading

On the surface, January 17, 2024, was just another expiry day on Dalal Street. But somewhere inside the lightning-fast servers of a global trading giant, a high-stakes plan was unfolding — one that would end with a single-day profit of ₹734.93 crore. The mastermind? Jane Street Group — the Wall Street legend known for its razor-sharp algorithms and dominance in high-frequency trading. What they allegedly did that day wasn’t just clever. According to SEBI, it was calculated market manipulation. And that day, SEBI began connecting the dots. Over 18 such expiry days, Jane Street is believed to have walked away with over ₹4,843 crore in profits — not through market insight, but through a pattern SEBI calls deliberate and deceptive.

Then came the hammer.

On July 1, 2025, SEBI issued an unprecedented interim ban on Jane Street and its associated FPIs, barring them from accessing India’s markets. It was the single largest action India had ever taken against a foreign trading entity — and it sent shockwaves through the global trading community.

But this isn’t just the story of one firm’s overreach. It’s a warning shot — a clear signal that India’s regulatory regime is evolving fast, no longer willing to play second fiddle to sophisticated global strategies.

What really happened behind the scenes? What exactly did Jane Street do, and how did SEBI piece it all together?

The Entity at the Center: Jane Street Group

What is Jane Street?

Founded in 2000 in New York City, Jane Street is no ordinary trading firm — it’s a fiercely private, ultra-quantitative powerhouse that trades exclusively with its own capital. Operating in the shadows of Wall Street with a reputation for mathematical precision and intellectual rigor, the firm recruits top-tier talent from the world’s best universities. Its signature strengths lie in ETF arbitrage, global market-making, and high-speed algorithmic execution, all executed with almost surgical efficiency. With trillions traded annually, Jane Street is not just a participant — it’s a dominant force in global index options and arbitrage markets, and increasingly, a headline name in regulatory crosshairs.

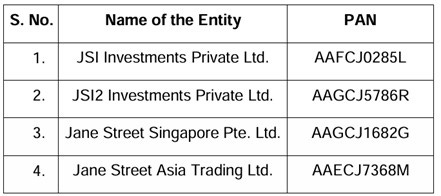

Presence in India: Not Just Another FPI Setup

On the surface, Jane Street’s India operations might appear routine — conducted through four registered Foreign Portfolio Investor (FPI) entities, just like many other global funds. But scratch beneath that regulatory veneer, and a very different picture begins to emerge. These aren’t passive investment vehicles — they are high-frequency, high-intensity trading engines, intricately linked and allegedly coordinated with surgical precision. As we’ll explore next, it’s this tightly controlled web of FPIs that lies at the heart of SEBI’s explosive allegations

.

The Unexpected Spark: A New York Showdown Lights Up SEBI's Radar

Believe it or not, the curtains on Jane Street's alleged Indian market maneuvers weren't initially pulled back by SEBI's watchful eye. Instead, the first glimpse of this high-stakes drama emerged in an unexpected arena: a New York courtroom in early April 2024.1

Picture this: Jane Street, usually an enigma, suddenly stepped into the spotlight by filing a bombshell lawsuit against another financial titan, "Millennium Management." The accusation? Nothing less than the alleged theft of a highly valuable, secret trading strategy—a strategy worth billions and, crucially, one that revolved around India's bustling index options market.

While these two Wall Street giants quickly settled their dispute behind closed doors, the legal skirmish had already served its purpose: it blew the lid off Jane Street's deep, previously unnoticed involvement in India's derivatives scene. The sheer value Jane Street placed on this "stolen" strategy underscored just how strategically important their Indian options trading truly was.

SEBI, India's diligent market regulator, couldn't ignore such a revelation. With Indian index options at the very heart of the courtroom drama, it became undeniably clear that an investigation was not just warranted, but absolutely essential. And so, an international legal spat became the unlikely catalyst for one of SEBI's most significant market manipulation probes.

SEBI’s Investigation Deepens: Unpacking the Jane Street Mystery

In April 2024, something unusual began to catch the attention of SEBI — India’s capital market regulator. It wasn’t just about large trades or sudden profits. It was about precision. A pattern. A rhythm that didn’t look like a coincidence.

The firm at the center of this mystery? Jane Street — a powerful global trading firm known for its mathematical strategies and lightning-fast decision-making.

The Suspicious Pattern

SEBI started digging into Jane Street’s trades — but not just any trades. The focus was on expiry days — the days when weekly index options, like those on BANKNIFTY, come to an end and are settled.

And what did they find?

1. Aggressive Stock Buying & Selling

On expiry days, Jane Street would suddenly buy large volumes of stocks that are part of the BANK NIFTY index. This wave of buying would cause the index to move upward.

Then — often on the very same day — they would dump those stocks, pushing the index back down.

2. Simultaneous Options Trading

At the same time, Jane Street was placing huge bets in the BANKNIFTY options market — particularly on options expiring that very day.

These weren’t random bets. SEBI observed that Jane Street would often:

Sell call options (which benefit if prices don’t go up),

Buy put options (which benefit when prices fall).

And guess what? Their trades worked exactly as planned — time and again.

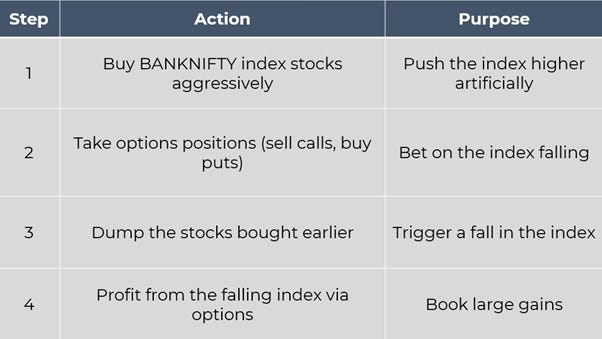

SEBI's Theory: A Coordinated Game Plan?

SEBI started to believe this wasn’t just smart trading — it could be market manipulation.

Here’s what they suspected Jane Street was doing:

The whole cycle — from pushing the market up, to bringing it down, to collecting profits — appeared carefully timed and repeated.

The Data Doesn’t Lie

To confirm this theory, SEBI asked the National Stock Exchange (NSE) for detailed expiry-day data covering Jane Street’s activity.

What they found strengthened their concerns:

Jane Street’s stock and options trades were precisely aligned — they always seemed to know when and how the index would move.

Their options trades consistently turned huge profits, particularly on days when expiry volatility is at its peak.

The repeatability of the pattern suggested it wasn’t just luck or smart risk-taking — it seemed systematic.

This wasn’t just a one-off case. SEBI saw a clear, repeating pattern — one that could potentially exploit the very structure of the options market.

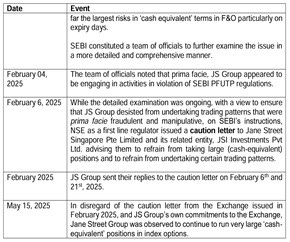

NSE Steps In

In February 2025, after reviewing SEBI’s findings, the NSE sent an official letter of caution to Jane Street.

The message was clear:

“Avoid large and suspicious expiry-day trades that match the pattern under investigation.”

Jane Street’s Response

Jane Street pushed back, claiming:

Their strategies were proprietary (i.e., secret and in-house),

They were not violating any laws, and

Their profits were due to efficient execution, not manipulation.

But SEBI didn’t buy it — especially after reviewing months of data that showed:

Unusual consistency in profits,

Perfect timing of trades, and

Unnatural market movements before and after Jane Street's trades.

Why This Matters

SEBI’s core concern is that if these kinds of expiry-day strategies go unchecked:

It could lead to unfair advantages for certain players,

Retail and institutional investors could be misled by price distortions,

It could undermine trust in the fairness of the Indian derivatives market — especially in one of the most actively traded segments: BANKNIFTY options.

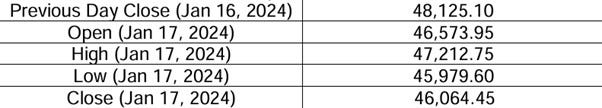

Key Date: What Happened on January 17, 2024?

SEBI zeroed in on January 17, 2024, for a deep dive because something unusual stood out—Jane Street made a staggering ₹734.93 crore in just 6.5 hours trading index options. That kind of profit in such a short time raised red flags. When SEBI dug deeper, they discovered a suspicious trading pattern, which they called the "Intraday Index Manipulation" strategy. Shockingly, this same pattern appeared on 15 out of the 18 days they investigated.

Understanding SEBI’s Focus on Jane Street and the January 17 Incident

What is Bank Nifty?

The Bank Nifty index represents the performance of major Indian banking stocks, such as HDFC Bank, ICICI Bank, Axis Bank, etc. The index moves depending on how these heavyweight stocks perform. Because a few large banks have a significant weight, even small price movements in those stocks can cause sharp fluctuations in the overall index.

What Happened on January 17, 2024?

SEBI selected January 17 for detailed investigation because Jane Street earned an unusually high profit of ₹734.93 crore within just 6.5 hours—solely from Bank Nifty options. This raised concerns, especially given the scale and speed of the profits.

On this day, the Bank Nifty index followed a suspicious pattern:

It fell sharply during the morning,

Then recovered briefly, and

Dropped again before the close.

Market Context

SEBI found that Jane Street's trading activity closely aligned with these movements. Their option positions seemed to benefit significantly from the index’s sharp intraday swings. This led to suspicions that Jane Street may have influenced the underlying stocks of Bank Nifty to create short-term movements that favoured their option trades—a strategy SEBI refers to as “Intraday Index Manipulation.”

Why Expiry Days Are Critical

January 17 was a weekly expiry day—the last day for settlement of derivatives contracts based on the Bank Nifty index.

On expiry days:

The final index value determines the profit or loss on large volumes of options and futures contracts.

Even a 10–15 point movement in Bank Nifty can lead to crores in gains or losses.

Hence, these days witness high volatility and aggressive trading as institutions and traders attempt to influence or hedge their positions right up to the close.

On Jan 17 alone, Bank Nifty options worth over ₹10,000 crore were traded, making the index highly sensitive to any manipulation.

SEBI’s Core Concern

SEBI’s forensic analysis revealed a recurring pattern: On 15 out of the 18 days investigated, Jane Street’s trades seemed to align with short-term, large index movements, particularly on expiry days. This repeated correlation between stock trades and options positioning forms the crux of SEBI’s case.

The concern is not just about the profit made, but how it was made—possibly by influencing the movement of high-weightage banking stocks intraday, thereby indirectly moving the Bank Nifty index to benefit their derivatives positions.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Alleged “Intraday Index Manipulation” Strategy

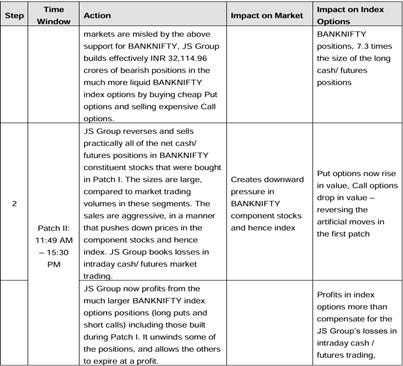

On January 17, Jane Street allegedly executed a two-part strategy that drew SEBI’s attention:

The "Intra Day Index manipulation strategy" described in the text is deemed manipulative primarily because it creates a false and misleading impression of market activity to profit from options trading, rather than being based on genuine economic rationale.1 Here's a breakdown of why it's considered manipulative:

1. Patch I: The Rise (09:15 AM – 11:47 AM):

In the morning (Patch I), the JS Group aggressively bought a massive amount of BANKNIFTY component stocks and futures (INR 4,370.03 crores). This created an artificial demand, pushing up the BANK NIFTY index levels. The sheer scale and aggressiveness of these purchases, coupled with the immediate reversal later, suggest these were not genuine investment decisions

.

2. Exploiting Misled Market Participants:

Simultaneously, while the BANK NIFTY index was artificially inflated, the JS Group took the opposite side in the highly liquid index options market. They net sold a significantly higher cash equivalent (INR 32,114.96 crores) of BANKNIFTY options by buying puts and selling calls. This strategy allowed them to acquire these options at "very advantageous prices" because other market participants were misled by the artificially propped-up index levels. They were unaware that the index's rise was temporary and self-induced by JS Group's own actions.

3. Rapid Reversal and Price Dumping (Patch II):

In the afternoon (Patch II), the JS Group abruptly reversed their morning strategy, aggressively dumping the very same BANKNIFTY component stocks and futures they had purchased. They net sold INR 5,372.12 crores, becoming the single largest net seller. This aggressive selling was designed to push down underlying stock prices and, consequently, the BANK NIFTY index levels

.

4. Trading at a Loss in Underlying to Gain in Options:

Crucially, the aggressive buying in Patch I and subsequent aggressive selling in Patch II resulted in a net intraday trading loss of INR 61.6 crores for JS Group in the cash and futures segment. This significant loss in the underlying market highlights that these trades were not for investment or any standalone economic purpose. The only plausible economic rationale was to manipulate the index to benefit their much larger positions in the BANK NIFTY index options market

5. Profiting from Manipulation at Expiry:

The downward pressure created on BANKNIFTY at expiry directly allowed JS Group to profit immensely from their outstanding net short cash equivalent positions in the BANK NIFTY index options segment, making a profit of INR 734.93 crores on the day from these options. This is a classic case of "marking-the-close," where an entity with large expiring options positions manipulates the underlying market in its favor.

6. Lack of Economic Rationale and Intent to Distort:

The entire pattern of trading, especially the rapid and aggressive reversal of positions at a loss in the underlying market, lacked any genuine economic rationale. The "by preponderance of probability" conclusion is that these trades were undertaken only to distort BANK NIFTY index option prices in the interim and entice other market participants to trade at such artificial levels, while the JS Group capitalized on this distortion. The claim by JS Group that these trades were to "remove unwanted delta" or "manage overall delta" is considered insufficient to justify the clear manipulative intent seen in the trading pattern and its outcomes.

In essence, the JS Group used its significant market power to artificially inflate and then deflate the BANK NIFTY index, creating a misleading market environment. They then exploited this self-created distortion to profit substantially from their options positions, at the expense of unsuspecting market participants.

Why SEBI Considers It Manipulative

Key Grounds

Lack of Economic Rationale: SEBI found no legitimate economic rationale for such large intraday reversals in Jane Street's trading, asserting that these trades were not part of long-term investment or hedging strategies.

Direct Influence on Index Movements: The regulator concluded that Jane Street’s trades directly influenced index movements, as evidenced by Last Traded Price (LTP) impact analysis.

Misleading Retail Traders: SEBI contends that retail traders were misled into trading at artificial index levels created by Jane Street’s actions.

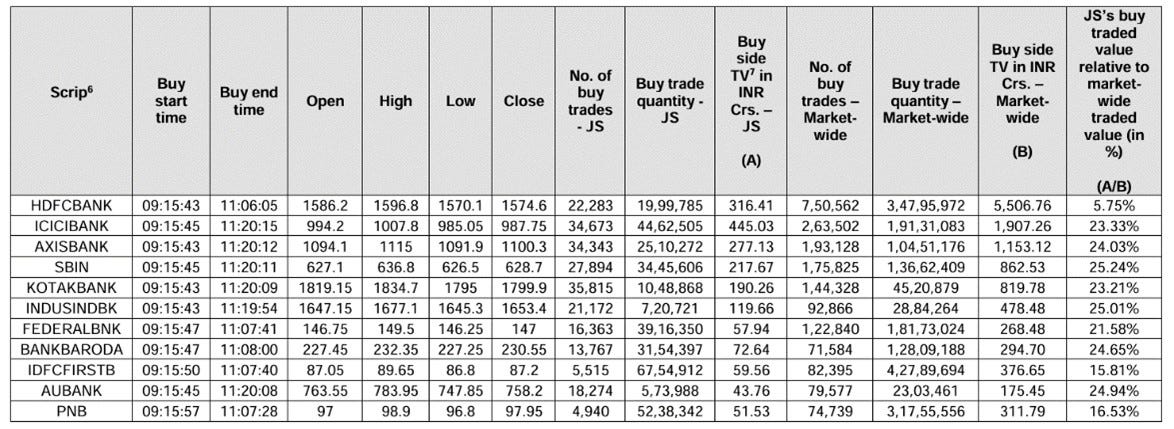

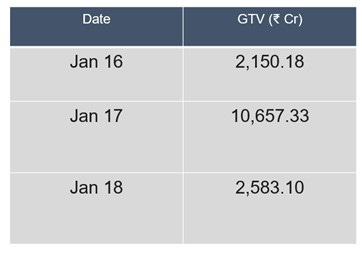

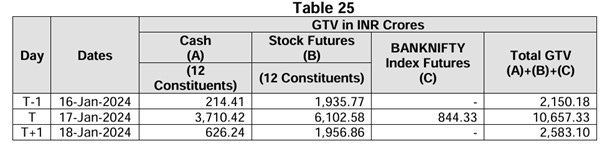

Trading Anomaly on Jan 17:

SEBI's analysis of Jane Street’s Gross Traded Value (GTV) further highlighted the anomaly:

The GTV on January 17 was nearly five times greater than on the preceding day, an anomaly directly attributed to the alleged strategic expiry manipulation.

Forensic Insight – LTP Impact:

Jane Street placed over 35,000 buy orders in Patch I (morning), with more than 8,000 of these orders

Executed above the LTP, directly pushing stock prices upward.

Similarly, during Patch II, aggressive selling occurred at or below LTP, driving prices down.

Examples of LTP-based impact:

Axis Bank: ₹2,224 Cr LTP-based impact

ICICI Bank: ₹1,847 Cr LTP-based impact

SEBI's View on Wrongdoing:

SEBI's core argument is that Jane Street was "shaping" the market. The firm's trades were so large and aggressively placed that they singularly moved prices.In several BANK NIFTY constituent stocks (e.g., Kotak, Axis, ICICI), Jane Street's activity accounted for up to a fifth of all trading volume in short timeframes, allowing them to steer the market. By aggressively buying stocks in the morning, they aimed to create an impression of rising demand. While others were drawn into this perceived rally, Jane Street was covertly betting on a market fall. Then, they reversed their trades, dumping the same stocks, thereby forcing the market down. SEBI views this as creating an outcome to profit from a predetermined bet, which constitutes market manipulation.

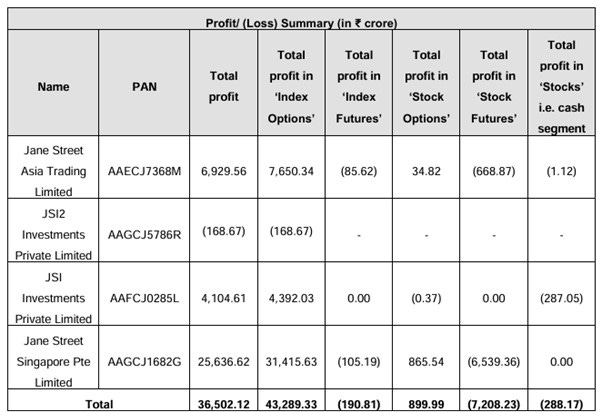

Profit Table: Day-wise Gains from Index Strategy

SEBI Interim Report lists 21 expiry days where similar strategies were allegedly employed. Here’s a snapshot of the profits:

On average, Jane Street's profits on expiry days were seven times higher than on other trading days. Across all 18 days studied by SEBI, Jane Street's options profit amounted to approximately ₹43,000 crore, while they incurred losses of about ₹7,500 crore in the cash and futures segments as part of implementing this alleged strategy.

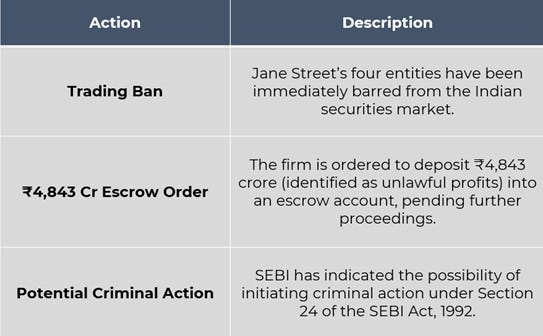

SEBI’s Interim Order —

In response to its findings, SEBI has taken stringent interim measures:

This impoundment amount is reportedly the highest ever ordered by SEBI for illegal market activity.

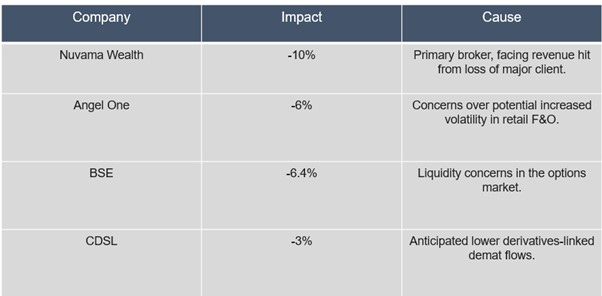

Collateral Damage – Market & Brokers React

The ban on Jane Street, a significant liquidity provider, sent tremors through the Indian derivatives market.The immediate impact was felt by various market participants and related entities:

The total market capitalization erosion within 48 hours following the announcement exceeded ₹12,000 crore. As Nithin Kamath, founder of Zerodha, commented, SEBI's move was necessary, but it also highlighted the market's heavy reliance on firms like Jane Street, which drive nearly half of all options volumes. Their withdrawal inevitably causes market tremors.

SEBI’s Larger Concerns & Regulatory Context

SEBI’s actions against Jane Street align with its broader efforts to address risks in the derivatives market. An earlier 2024 SEBI study revealed that 93% of retail F&O traders lost money over three years. SEBI posits that Jane Street’s alleged behavior exploited expiry-day pricing dynamics to harvest liquidity from unsuspecting retail participants.

Other Market Actions by SEBI:

November 2024 Reforms: SEBI introduced rules limiting weekly options trading to just two major indices—NIFTY and SENSEX—and imposed additional margins on expiry days, alongside other risk-control measures.

May 2025 Reforms: SEBI implemented further reforms, including a new method for calculating market open interest using option delta and raising position limits for individual firms.The aim was to mitigate the risk of any single participant unduly impacting the market.

These collective steps underscore SEBI’s ongoing commitment to curbing expiry-day volatility and enhancing the resilience and fairness of the options market.

Jane Street Deposits ₹4,843 Cr to Resume Trading in India — What It Means for Markets

Jane Street, the secretive global trading powerhouse, has just deposited a whopping ₹4,843 crore (~$567 million) into an escrow account as directed by SEBI, India’s market regulator. This move comes after SEBI accused the firm of running a “sinister scheme” to manipulate index derivatives like Bank Nifty options, earning alleged profits of ₹35,000+ crore in under two years.

With this deposit, Jane Street has taken the first major step toward resuming trading in India — but the path ahead is still tricky.

Here’s what’s going on in simple terms:

Why the Deposit?: SEBI had banned Jane Street from trading after it accused the firm of manipulating the market by creating sharp, artificial moves in major bank stocks to influence the Bank Nifty index — a tactic that reportedly harmed retail investors and moved the entire options market.

Impact So Far: Since the ban in early July 2025, trading volumes in index derivatives like Bank Nifty options dropped sharply, as Jane Street was one of the biggest players. This shook up liquidity and hurt sentiment across the derivatives market.

What Happens Now?: Jane Street can technically resume trading, but only under strict scrutiny. SEBI is reviewing their request to lift the restrictions — though any questionable trading strategies are still off-limits. For now, the firm says it has no immediate plans to restart options trading, likely to avoid further conflict.

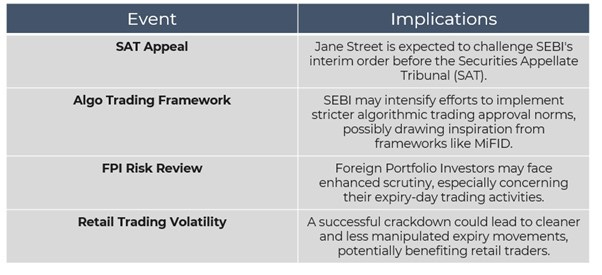

What’s Still Pending?: This deposit doesn’t mean Jane Street is off the hook. SEBI is continuing its investigation, and legal proceedings could drag on. It’s likely Jane Street will challenge some of SEBI’s findings — so this story isn’t over yet.

Why It Matters: This is one of the biggest-ever enforcement actions in India’s financial markets. It sets a strong precedent for how India will handle foreign institutional behavior and sends a message that no matter how big the player, market integrity comes first.

What to Expect Next

The Jane Street case in India is an ongoing legal battle that is being closely watched, as its outcome could significantly reshape regulatory oversight for foreign institutional traders and high-frequency trading in India's burgeoning derivatives market.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."