India’s Transformer Play

Why TRIL Could Power the Next Decade

India’s power infrastructure is entering what can only be described as a supercycle. Transmission upgrades, renewable integration, and surging demand for high-grade electrical equipment are converging to create a once-in-a-generation investment opportunity.

At the heart of this buildout lies a quiet but critical enabler—Transformers & Rectifiers India (TRIL). Unlike flashy renewable developers or grid operators that often make headlines, TRIL works in the shadows, supplying the backbone hardware without which no energy transition can succeed. From powering rural substations in Uttar Pradesh to shipping heavy-duty transformers to Botswana, the company is emerging as a silent compounder in India’s industrial landscape.

Company Overview

Transformers & Rectifiers India ranks among the country’s leading transformer manufacturers, with a full-stack presence across design, manufacturing, and servicing. Its installed capacity of 22,000 MVA (under expansion) puts it in the upper tier of domestic peers.

The company services a wide spectrum of clients—state utilities, industrial powerhouses, and global EPCs. Its track record includes 400+ transformers deployed across generation, transmission, and industrial hubs, a sign of operational credibility. With three state-of-the-art plants, TRIL has steadily moved up the value curve from commodity distribution transformers to specialized, high-margin categories.

What differentiates TRIL is its engineering DNA—a quiet emphasis on product quality and reliability rather than volume chasing. This positioning is beginning to pay off as India’s grid modernisation requires bespoke, high-spec transformers for renewables, ultra-high-voltage transmission, and export-grade quality benchmarks.

Product Division: Building for Complexity, Not Just Capacity

TRIL’s portfolio spans the entire transformer spectrum, but each division carries a distinct strategic weight:

Power Transformers – The company’s bread-and-butter, supplying the critical nodes of India’s T&D network.

Special Duty Transformers – Already contributing 35% of revenues, these serve energy-intensive applications like furnaces, rectifiers, and high-reliability industrial users. They command premium pricing and form TRIL’s margin anchor.

Distribution Transformers – Mass deployment for state DISCOMs and utility programs, ensuring scale and steady volume.

Export Transformers – At ~10% of revenues today, this vertical is small but strategically important. Overseas orders demand higher specs, stronger certifications, and longer-cycle relationships. Success here builds credibility that spills over into the domestic market.

A key strategic pivot is TRIL’s move into backward integration through a CRGO (cold-rolled grain-oriented steel) unit. Given CRGO’s critical role in transformer performance—and the vulnerability to price volatility—internalising this supply chain offers margin stability and independence from imports.

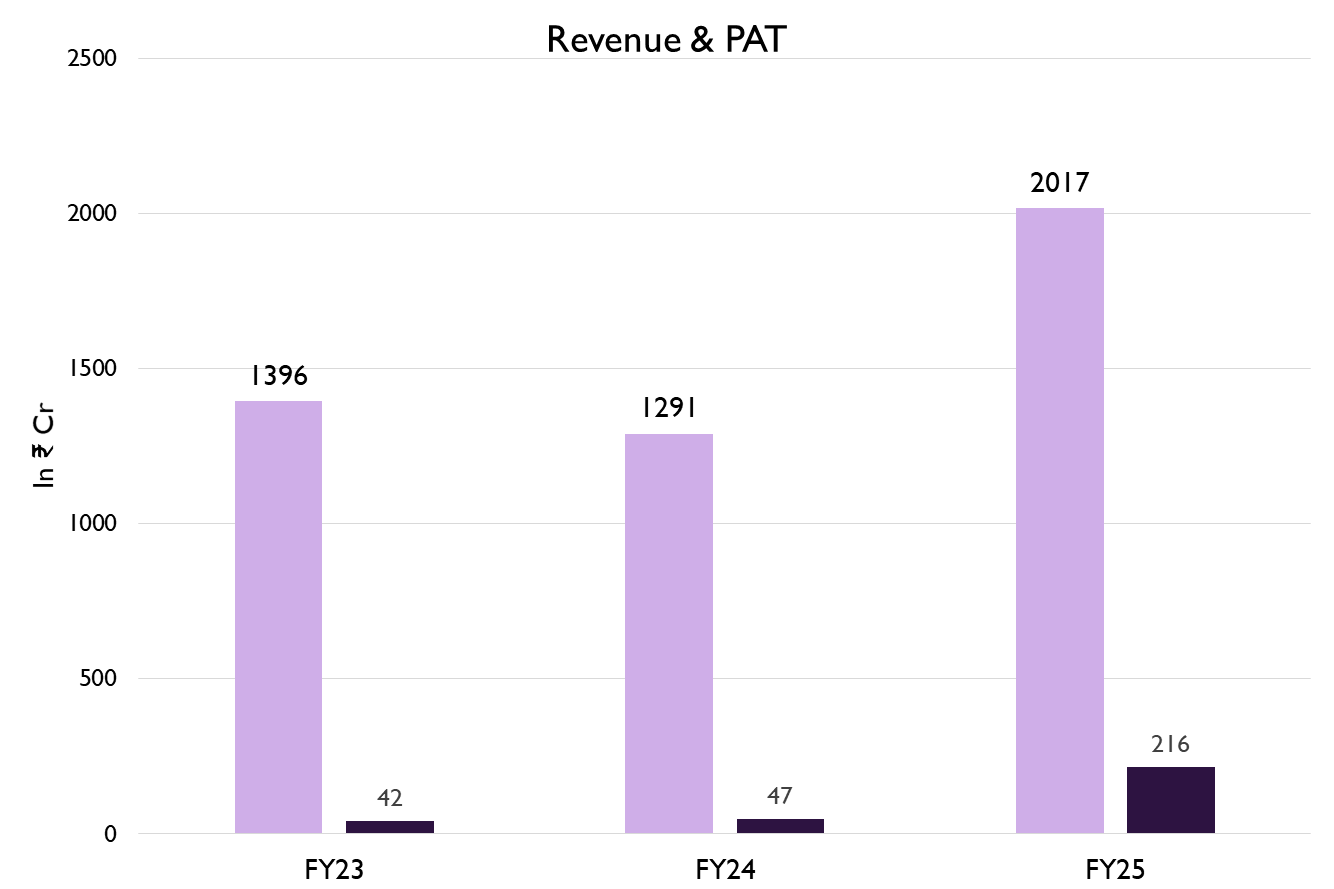

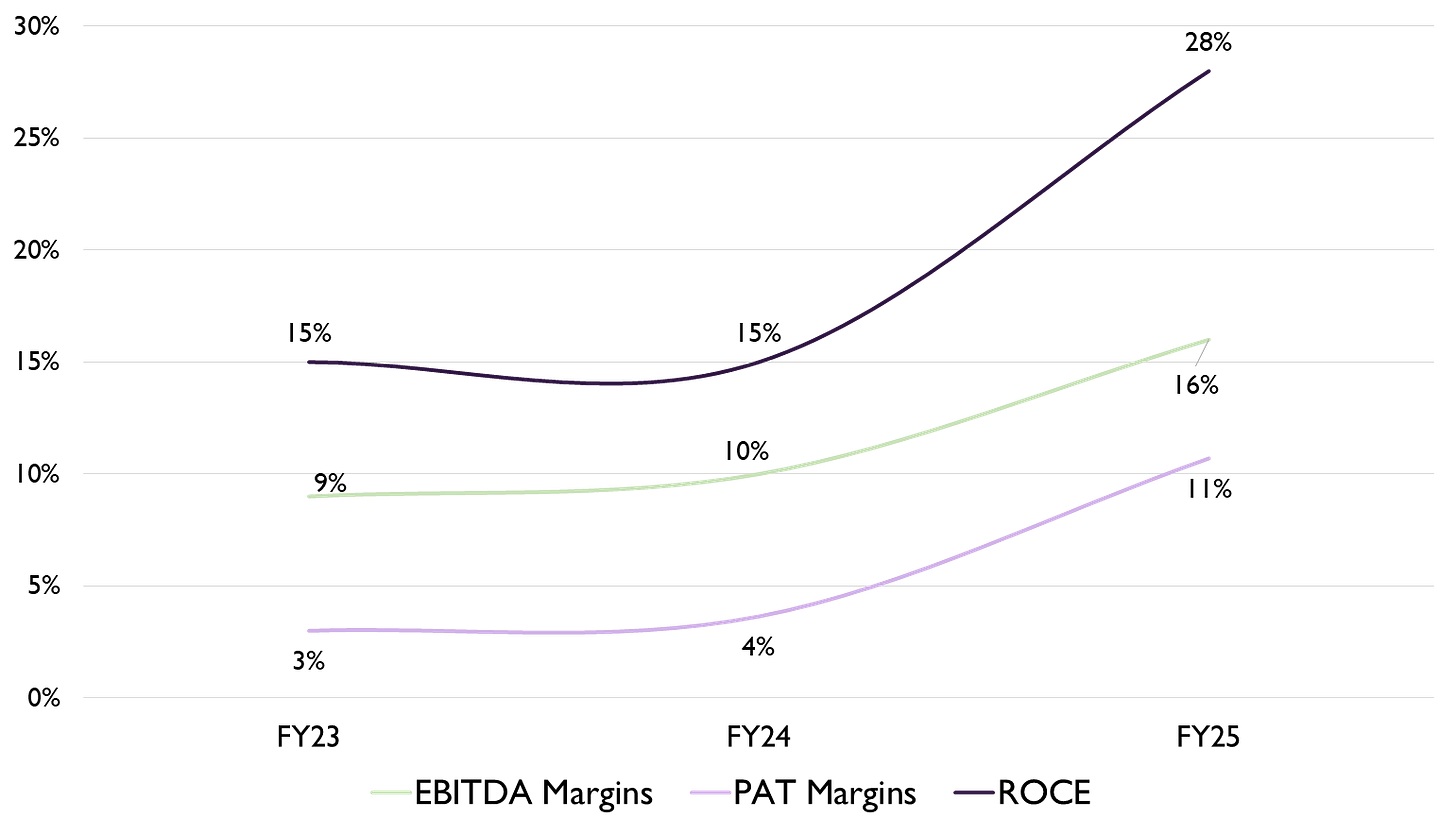

Financials

Orders & Execution: Visibility as a Moat

The numbers tell a clear story. Order inflows remain robust, translating into an unexecuted order book of over ₹5,200 crore. This ensures 15–18 months of revenue visibility—a luxury in India’s volatile capital goods cycle.

Beyond domestic wins, the company is stepping up its export push. A notable milestone was the USD 16.6 million transformer order for Jindal Energy in Botswana, underscoring TRIL’s credentials in international bidding. Exports now form a deliberate part of strategy, with management keen to maintain at least a 10% contribution.

Equally important is the inquiry pipeline, pegged at ₹18,000 crore under negotiation. With roughly a fifth tied to exports, TRIL is positioning itself as a global supplier of choice, not just a domestic vendor.

Meanwhile, capacity expansion at the 22,000 MVA Moraiya plant is on track. Once completed, utilisation is expected to rise materially, creating strong operating leverage. Execution here will determine whether TRIL can scale without diluting margins.

Future Outlook: Key Levers for Compounding Growth

Revenue Growth: TRIL’s growth is anchored by strong order momentum and capacity expansion. With ₹665 crore of Q1FY26 inflows and a ₹5,246 crore unexecuted order book, the company targets ₹3,500 crore turnover in FY26 and aims for USD 1 billion revenue within three years. Focus on high-margin, high-value special duty transformers drives both scale and profitability.

Order Book Visibility: A robust backlog and a sticky ₹18,000 crore inquiry pipeline ensure multi-year revenue support, with 22% of inquiries export-focused. Management expects to close FY26 with ₹5,000 crore of confirmed orders, providing visibility well beyond a single fiscal cycle. This allows disciplined planning of production, procurement, and execution schedules.

Exports as a Strategic Lever: Overseas orders, including the USD 16.6 million Botswana order, demonstrate TRIL’s growing international credibility. Export revenue currently contributes ~10%, with developed markets like the US as future targets. Expanding exports will diversify revenue and enhance global positioning.

Profitability Drivers: Margins are expected to improve as special duty transformers grow, Moraiya plant utilisation rises from 65% to 85–90%, and the CRGO backward integration reduces raw material costs. Together, these factors provide structural support for both revenue and profitability.

Balance Sheet Discipline: Management plans to become debt-free within 18–24 months, supported by disciplined working capital management

The Bigger Picture

Energy transitions are rarely linear. India’s grid needs massive investment to integrate renewables, reduce losses, and cater to peak demand growth. Globally, aging infrastructure in Africa, the Middle East, and even parts of Europe is driving demand for reliable transformer supply.

In such a landscape, TRIL is not just a vendor—it is an enabler of reliability. If power is the “new oil,” then transformers are the pipelines. And companies like TRIL, often overlooked in market narratives, could quietly deliver multi-year compounding returns as capital expenditure cycles play out.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."

Sir your small case name please advice I