India’s Hidden Polymer Powerhouse

Once a backward integration arm in sugar, this company is now carving out a standalone identity in specialty polymers—riding on import substitution, margin expansion, and product innovation.

Ddev Plastiks Industries Ltd. stands as a prominent and leading manufacturer of polymer compounds in India, steadfastly dedicated to upholding excellence in its operations, driving continuous innovation in its products and processes, and ultimately creating sustainable value for its stakeholders

COMPANY OVERVIEW

For the year ended FY 2025, Ddev Plastiks Industries Ltd. reinforced its position as India's largest polymer compound manufacturer. Ddev Plastiks operates five modern, state-of-the-art manufacturing plants. These facilities are strategically positioned on both the east and west coasts of India, thereby minimizing freight costs. The company also has a world-class research and development facility, equipped with cutting-edge machinery and led by experts to deliver innovative solutions. They became a net debt-free company in Q4 FY 2024 and has maintained this position to date. A significant milestone in FY 2025 was the company's listing on the National Stock Exchange, which further enhanced its liquidity.

PRODUCTS

Ddev Plastiks Industries Ltd. delivered a strong performance in FY 2025, with its product portfolio primarily catering to the cable and wire companies, packaging, footwear, pipes, automobiles, consumer durables, electrical appliances, electricals and lightings, and electronics.

The company's diverse product range includes:

Polyethylene(PE): These compounds find extensive use across the automotive, construction, electrical and electronics, and packaging sectors. The company is expanding its PE compounding capacities and aims to scale polyethylene compounding capacity by 25,000 metric tonnes per annum by FY 2027.

Poly Vinyl Chloride(PVC): These are niche products that constitute a high-margin business for Ddev Plastiks. They are widely used in the Wire and Cable Industry as well as in the Construction Industry. The margins of PVC Compounds are 4-6%. The company is expanding its PVC compounding capacities to cater to growing demand. In the current fiscal year (FY 2026), approximately 25,000 tons of PVC capacity is planned, with machines expected in Q2 and commercial operation starting from Q3.

Halogen Free Flame Retardant (HFFR): The company sold approximately 3,200 tons of HFFR in FY 2025. The company is expanding its capacity for HFFR cables and expects to increase its HFFR capacity to 20,000 metric tonnes annually by FY 2026, driven by anticipated regulatory changes and stringent safety standards,.

XLPE (Cross-Linked Polyethylene) Compounds: Ddev Plastiks is expanding its XLPE compounding capacities to cater to the rising demand for high-voltage cables. The company plans to launch an XLPE compound suitable for cables up to 132 kV, with future plans to increase this capacity to 220 kV. Commercial revenue from 132kV is expected in FY 2027 or FY 2028.

Revenue Mix

BUSINESS SEGMENTS

Ddev Plastiks Industries Ltd. primarily operates in the polymer compounding sector, serving various industries including wire and cable, packaging, footwear, pipes, automobiles, consumer durables, electrical appliances, electricals and lightings, and electronics.

The Cables and Wire segment remains central to India's industrial expansion, with continued investments in power infrastructure, real estate, and private capital expenditures expected to sustain demand momentum. India's emergence as a net exporter of Cable and Wire products since FY 2020 underscores its ability to meet global demand. Key global demand drivers include the push for renewable energy, accelerated adoption of electric vehicles, and power grid modernizations. Export revenues also faced temporary headwinds in the first half of FY 2025 due to logistical disruptions and subdued demand, a recovery is underway. The company anticipates mid-teen growth in FY 2026, driven by higher export volumes, better realizations, and improved margins.

Ddev Plastiks is expanding its XLPE, PVC, and HFFR compounding capacities to cater to the growing demand for high-voltage cables. In Q1 of the current fiscal year, 5,000 tons per annum capacity for XLPE has been made operational. For PVC, machines are expected in Q2, with commercial operation starting from Q3, adding approximately 25,000 tons capacity. For HFFR, 5,000 tons capacity is already operational, and another 5,000 tons are on order to be operational by the end of September. These additions, totaling approximately 35,000 tons, along with debottlenecking activities, are expected to provide enough capacity to meet the projected 15% CAGR for the current year. The operational capacity for the new additions in FY 2026 is expected to be around 60% to 65%.

MANUFACTURING UNIT

Ddev Plastiks has five modern, state-of-the-art manufacturing plants strategically positioned, in West Bengal, Daman and Diu, and Dadra and Nagar Haveli. The company is the largest manufacturer of polymer compounds in India with an installed capacity of 237,500 MT.

As of FY 2025, the installed capacity stood at 233,400 metric tons per annum, and the company achieved a record capacity utilization of 81% during this fiscal year.

The company has a world-class R&D facility, equipped with cutting-edge machinery and led by experts, to deliver innovative solutions. This facility also engages in scientific and technological collaborations with esteemed institutes such as IIT Kharagpur and the University Institute of Chemical Technology (Mumbai) to deliver solutions aligned with the needs of modern industries.

FINANCIALS

FUTURE OUTLOOK

Ddev Plastiks is committed to driving sustainable growth through innovation and capacity expansion. The company plans to invest ₹300 crores over the next three years to expand manufacturing facilities, address operational bottlenecks, and develop new greenfield sites. This includes increasing HFFR compounding capacity by 5,000 metric tonnes per annum and establishing new greenfield sites on the Eastern and Western coasts in FY 2025. The company also aims to expand its HFFR compounding capacity by an additional 15,000 metric tonnes per annum in FY 2026. Furthermore, the objective is to scale polyethylene compounding capacity by 25,000 metric tonnes per annum by FY 2027.

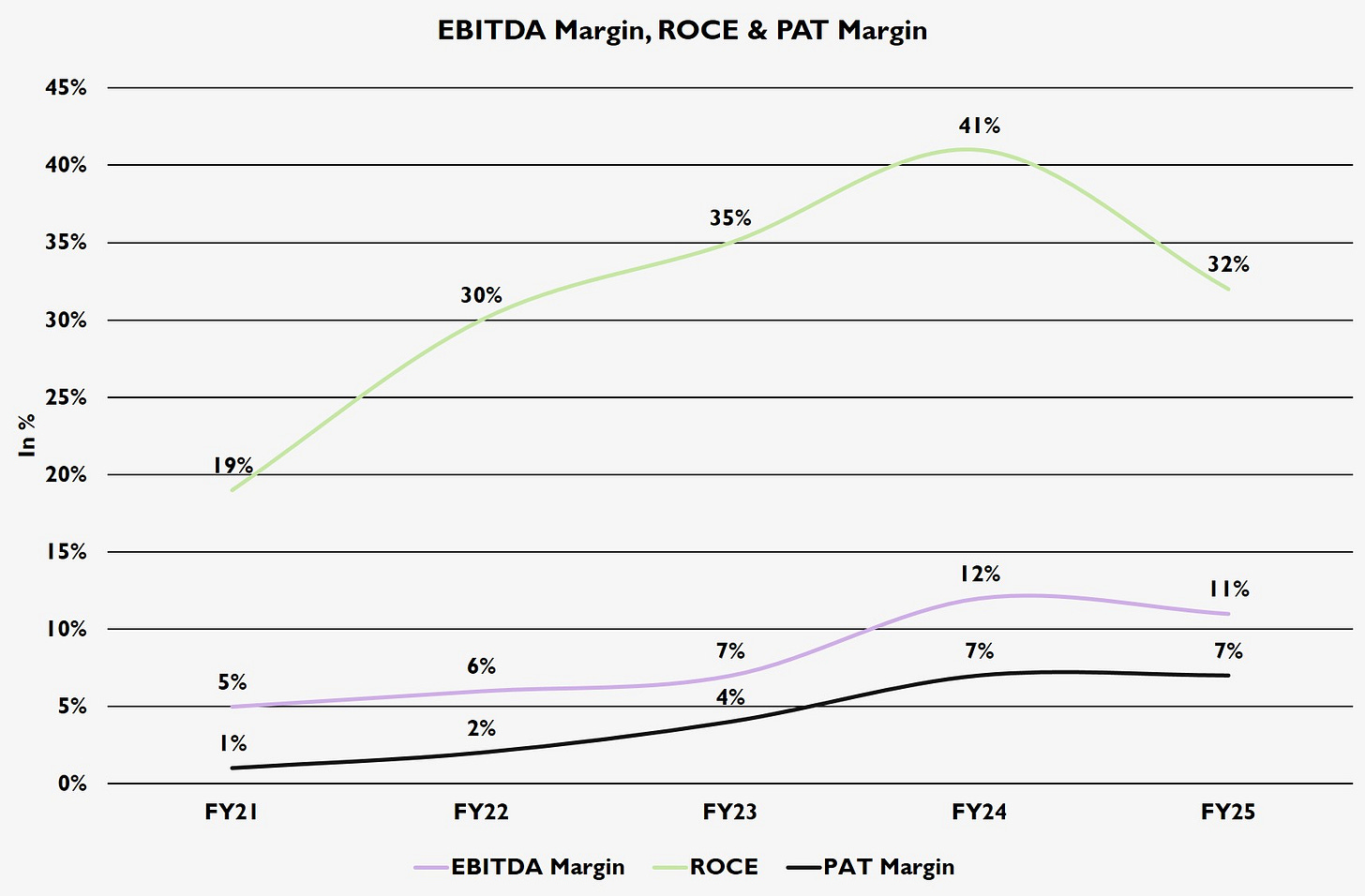

For FY 2026, the company projects a volume growth of 13% to 15% and a revenue growth of 12% to 15%. The company anticipates reaching a revenue of approximately ₹4,500 to ₹5,000 crores by FY 2030, maintaining a healthy EBITDA margin of around 10% to 12%. This growth will be supported by continued investments in power infrastructure, real estate, and private capital expenditures in the Cables and Wire segment. The domestic Cable and Wire market is projected to grow at a CAGR of 11% to 13% from FY 2024 to FY 2027.

The company expects to introduce an XLPE compound suitable for cables up to 132 kV, with future plans to extend this to 220 kV. Commercial revenue from 132kV is anticipated around FY 2027 or FY 2028. Exports, which faced temporary headwinds in H1 FY 2025, are expected to recover, driving mid-teen growth in FY 2026 due to higher export volumes, better realizations, and improved margins. The company also anticipates U.S. direct export approvals within the next month. This will open opportunities to export to more markets, including the U.S. directly, and to the Middle East, North Africa, and Europe for American market exports.

Industry Outlook

The global plastic compounding market is estimated to reach around USD 133.57 billion in 2033, expanding with a CAGR of 7.09% from 2024 to 2033. This growth is fueled by circular economy initiatives, increased vehicle production, focus on bio-based plastics, urbanization, infrastructure development, advancements in polymer science, public safety measures, and stricter regulations on plastics.

RISK & STRENGTHS

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."