High-Performance Without High Price

Serving data-intensive firms and elastic workloads, this provider delivers bare-metal speed and HPC capabilities—without the pricing complexity of hyperscalers.

Company Overview

E2E Networks Ltd, founded in 2009 and headquartered in Delhi NCR, is a listed AI-first cloud infrastructure company, empaneled under the Government of India’s IndiaAI Mission. It operates one of the largest GPU cloud infrastructures in India with ~3,700 high-end NVIDIA GPUs (H100, H200, A100), across data centers in Delhi and Chennai. E2E offers a sovereign, cost-effective alternative to global hyperscalers through its proprietary TIR platform, which supports AI/ML workloads including model training, fine-tuning, and inference. Its customer base spans startups, enterprises, government, and academia. With a strategic partnership with L&T and growing demand from IndiaAI and sovereign cloud initiatives, E2E is targeting rapid scale with a goal of reaching ₹35–40 Cr MRR by FY26.

Business Segments

E2E Networks operates through two core business segments, both focused on serving the fast-growing AI/ML and cloud infrastructure market:

1. Cloud GPU Infrastructure

(~90–95% of revenue | ~₹1,476 Mn in FY25)

This is E2E’s primary revenue driver, where it offers GPU compute instances via:

Public Cloud: Pay-as-you-go or reserved instances

Private/Hybrid Cloud: Enterprise-grade clusters (up to 512 GPUs) hosted at E2E DCs

Customers: GenAI startups, LLM developers, enterprises, educational institutions

Offered on NVIDIA A100, H100, H200, L40, V100, etc.

Use Cases: Model training, inference, media rendering, high-performance computing (HPC)

2. Sovereign Cloud Platform (TIR Software Platform)

(Emerging revenue stream | <5% in FY25 but scaling)

This is E2E’s in-house developed AI/ML platform sold as:

Bundled with GPU infra or

Software-only licenses (on-premise/co-location) for BFSI, government, and regulated sectors

The platform includes orchestration, security, model lifecycle tools, and air-gapped infrastructure capabilities—ideal for institutions that require data residency, control, and compliance.

Stock Performance:

From ₹5,500 to Half – What Happened?

Why the Stock Fell

E2E’s stock dropped from around ₹5,500 to nearly half despite strong FY25 results due to muted Q4 numbers. MRR stayed flat at ₹11 Cr, Q4 revenue declined 19.5% QoQ, and EBITDA margins dipped to 39.9% as over 2,000 new H200 GPUs were used for trials and POCs instead of paid contracts, delaying monetization.When Will It Recover?

Recovery is expected from Q2FY26 onwards, as GPU clusters go live for commercial use, trial clients start converting, and large-scale demand from the IndiaAI Mission (₹10,500 Cr opportunity) ramps up. E2E targets ₹35–40 Cr MRR by March 2026 with margins normalizing to ~60%.Management Commentary

The company said the short-term dip was a conscious choice to secure long-term enterprise deals. “We prioritized scale and future growth over immediate billing,” said MD Tarun Dua. Management remains confident in sustained growth as the full impact of capacity and pipeline kicks in through FY26.

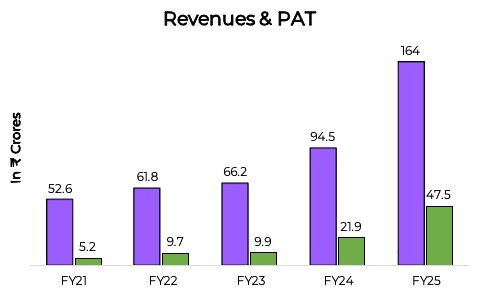

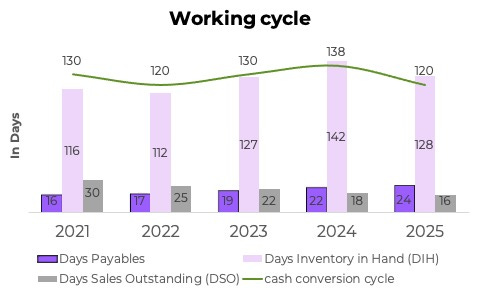

Financials

Infrastructure Capacity

Though E2E doesn’t manufacture hardware, it owns and operates one of India’s largest Cloud GPU clusters with ~3,700 units spread across multiple GPU architectures:

H200 GPUs (~2,300 units): Clustered up to 1024 GPUs

H100 GPUs (~700 units): Clustered up to 256 GPUs

Legacy GPUs (A30, A40, L40, V100, T4): ~700 units

Data Centers: 10 MW capacity in Delhi NCR (live) and Chennai (launching Q1FY26)

This scale places E2E at the top of Indian GPU infrastructure ownership, especially for sovereign AI workloads, with capacity already built to support MRR growth from ₹11 Cr to ₹35–40 Cr by FY26.

Capex

In FY25, E2E undertook significant expansion:

Funds Raised: ₹14,849 Mn (via preferential issue of equity)

Key Investments:

₹6,362 Mn in CWIP for ~2,048 H200 GPUs (testing complete, deployment in Q1FY26)

₹5,170 Mn still available for future deployments

Total Capex Target: ~₹2,500–3,000 Cr over FY26–FY28

Capacity to expand to ~10,000 GPUs in the next 2–3 years

Capex waves tied to GPU architecture cycles (Hopper → Blackwell)

Funding Mode: Mix of cash flows, debt, and partner (L&T) capital

Research & Development

E2E’s key moat is its in-house developed platform software, TIR (Training-Inference-Research), a GenAI-ready stack combining curated open-source frameworks with proprietary features:

Key Capabilities:

LoRA/BnB quantization, vLLM, vector DBs, multi-node orchestration

Seamless fine-tuning, inference tracking (W&B), data pipeline building

Platform Integration: Bundled into GPU cloud and sovereign deployments

Team: ~100+ AI/ML and cloud engineers

R&D drives E2E’s ability to offer air-gapped sovereign AI clouds and long-term software revenue streams with high margins

Global Presence

E2E Networks serves clients in over 30 countries, including the US, UK, Canada, Germany, and UAE, primarily through its cloud-based infrastructure. While its data centers are located in India (Delhi NCR and Chennai), its services are globally accessible. Strategic partnerships with L&T and NVIDIA further strengthen its international reach, especially for enterprise and sovereign cloud opportunities.

Order Book & Pipeline

No quantified public order book disclosed. Instead, the company highlights a strong pipeline of large-scale POCs and trials across enterprise, government, and educational sectors, especially for 128–512 GPU deployments.

Actively engaged in IndiaAI Mission projects (₹10,500 Cr overall ecosystem), which are expected to convert into long-term contracts.

Based on management commentary, several POCs are expected to convert into binding contracts by Q2–Q3 FY26, significantly contributing to the planned MRR rise.

Future Outlook

E2E is well-positioned to benefit from the ₹10,500 Cr IndiaAI Mission, where it's already empaneled and targeting a 10–20% market share. With 2,048 new H200 GPUs going live by Q1FY26, the company expects MRR to scale from ₹11 Cr to ₹35–40 Cr by March 2026. Strategic partnerships (like L&T) and its proprietary TIR platform will drive growth in sovereign cloud, enterprise, and education segments. Margin recovery to ~60% is expected as POCs convert to long-term contracts in the coming quarters.

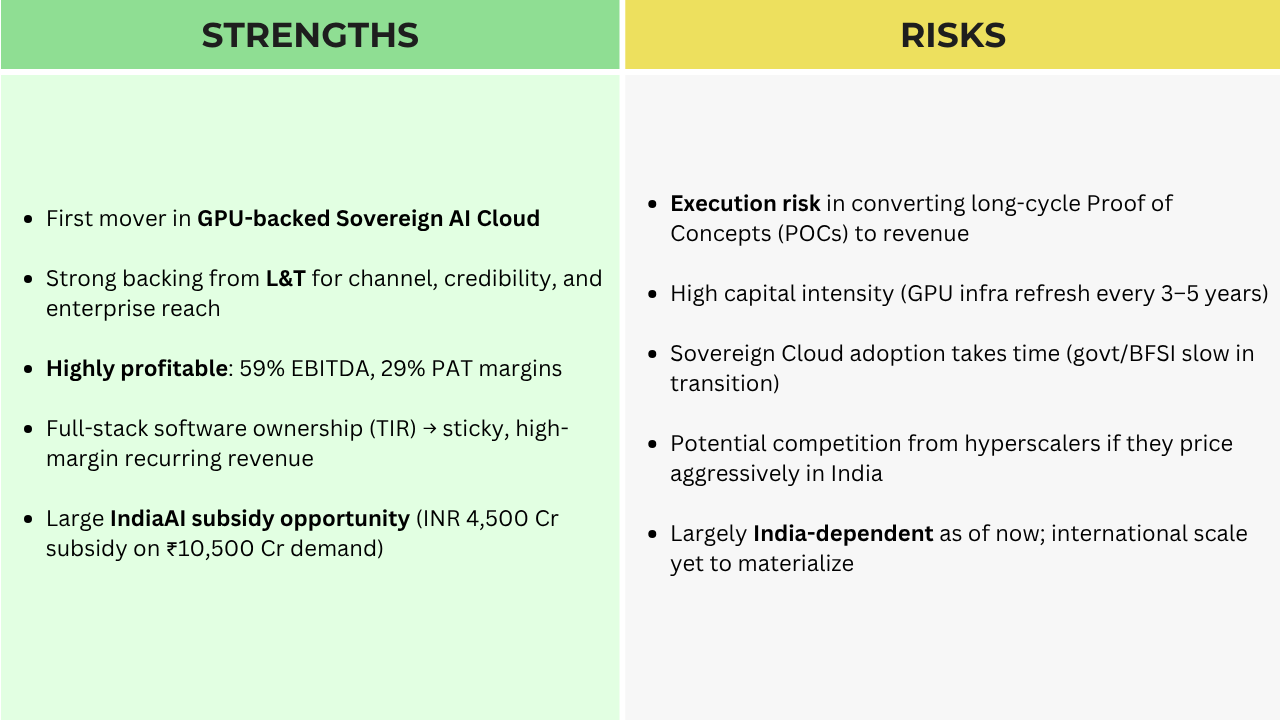

Risks & Strengths

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."