From Tracks to Treasury

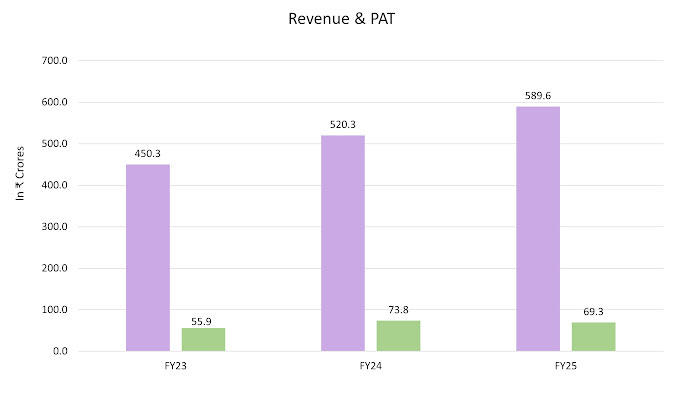

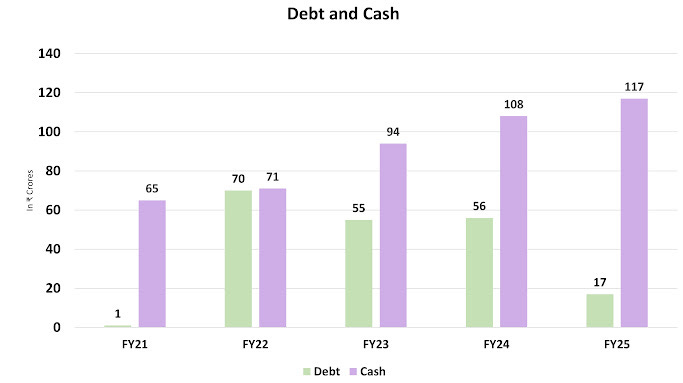

A music label turned cash machine—tripling profits in under three years, distributing ₹136 Cr to shareholders, and growing 117 million YouTube fans.

Tips Music Ltd

A long time ago, in the bustling heart of Mumbai, a company named Tips Industries Limited embarked on a melodious journey, later to be known as Tips Music Limited. If you've ever hummed along to a classic Bollywood tune or grooved to a viral reel, chances are, you've already experienced a touch of their magic. This isn't just a music company; it's a saga of hits, comebacks, and a keen eye for the evolving rhythm of the industry.

Company Overview

Tips Music Limited operates as a dynamic music company, adept at leveraging its extensive legacy catalog, which spans from 1988, while strategically acquiring new, high-quality content from films and independent artists. This dual focus ensures a continuous stream of popular music, with a significant 25% to 28% of their revenue earmarked for new acquisitions in FY 2026. The company excels at monetizing its content through widespread licensing across major digital platforms like YouTube, Spotify, and Meta, where their songs frequently go viral and generate substantial engagement. Key partnerships, including deals with Warner and Sony Music Publishing, further amplify their global reach and optimize revenue from publishing rights and public performances.

Business Segments

Digital Monetization: This is the core of their business. They license their music catalog to a wide array of online platforms, including:

Streaming Services: Platforms like Spotify, Amazon Music, Apple Music, Gaana, and Saavn. Users pay subscriptions or consume ad-supported content, and Tips Music earns royalties based on streams.

Social Media Platforms: Companies like Meta (which includes Instagram Reels and Facebook) and Snapchat. They monetize through the use of their music in user-generated content, viral reels, and associated advertising revenues. The company has seen significant success here, with older songs going viral and generating billions of views.

YouTube: They earn revenue from views on their official YouTube channels and from the use of their music in user-generated content on YouTube, especially after extending their deal with Sony Music Publishing for international publishing exploitation on the platform.

Non-Digital Monetization: While digital is dominant, they also have non-digital revenue streams. These can include:

Public Performance: Licensing their music for use in commercial spaces, events, and broadcasts.

Other Traditional Channels: This might include residual income from physical sales (though minimal now) or other legacy licensing agreements.

Strategic Partnerships: Tips Music forms alliances with major global music entities, such as Warner and Sony Music Publishing. These partnerships are crucial for broader distribution, enhanced royalty collection, and expanded reach into international markets and diverse platforms. For instance, the Warner deal contributes a notable portion of their overall revenue.

In essence, their business segments work by leveraging their valuable music intellectual property through licensing agreements across various consumption channels, with a significant strategic focus on maximizing digital revenues and expanding through key industry partnerships.

Content Strategy

This year, Tips Music adopted a clear mantra: quality over quantity. While they released 105 new songs in Q4 FY '25, including 37 film songs and 68 non-film songs, their future focus will be on releasing fewer, but higher-impact, songs. They are actively acquiring good music from films and independent artists, with a target to release 100-125 songs annually while investing 25% to 28% of their top-line revenue in new content acquisition for FY 2026.

Manufacturing Units

Tips Music Limited operates primarily as an intellectual property company focused on the acquisition, management, and monetization of music content. Their core business model revolves around acquiring music rights, digitally distributing this music to various streaming platforms like Spotify, YouTube, and Meta, and managing publishing and public performance rights. As such, their operations do not involve physical manufacturing plants or units, as their "products" are digital assets and associated rights, distributed and consumed electronically.

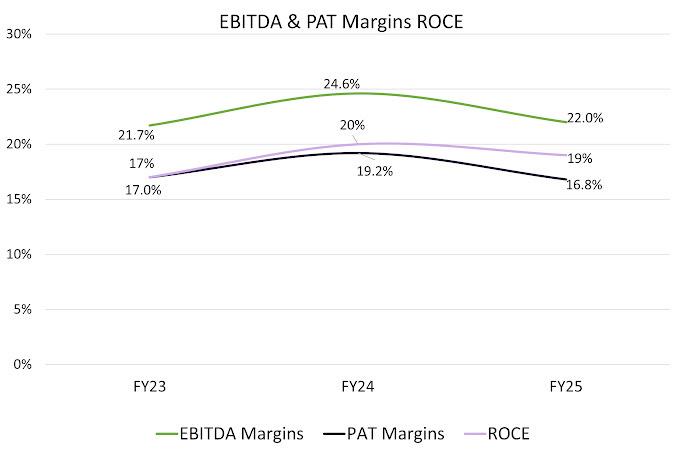

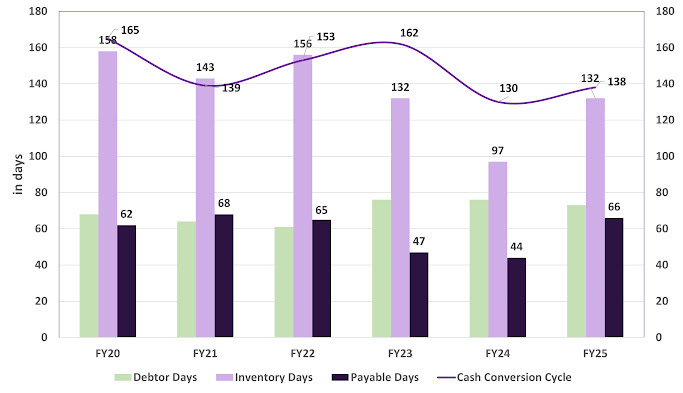

Financial

Future Outlook

The melody of Tips Music's growth is set to continue, with ambitious targets and a keen understanding of the evolving music landscape.

Sustained Growth Trajectory: The company is confident of maintaining a 30% top-line and 30% bottom-line growth, aligning with their achievements in recent years. This confidence stems from a robust pipeline of new releases and existing deals. The overall Indian music industry, currently valued at around ₹3,500-4,000 crores, is projected to swell to ₹10,000 crores in the next 4-5 years, offering immense potential.

Investment in Quality Content: For FY 2026, Tips plans to invest in the range of 25% to 28% of its revenue in acquiring new, high-quality music content. This strategic focus on quality over quantity is expected to drive future success.

Booming Streaming and Subscription Business: Management is highly optimistic about the growth of streaming and subscription models. They believe that the Indian consumer, who once readily paid for caller ringback tones (CRBT) and song downloads, will embrace subscriptions, leading to a significant surge in revenue. India's contribution to global music streaming volume rose from 0.6 trillion in 2022 to 1 trillion in 2023, indicating a vast untapped market.

Monetization of Short-Form Content: Reels and other short-form content platforms are becoming major revenue drivers. Tips Music has witnessed significant monetization from these platforms, especially after integrating Instagram into their Warner deal. The potential return of platforms like TikTok to India could further amplify these revenues.

Growth in Public Performance and Publishing: Public performances and licensing deals, such as the renewed and significantly larger Sony Music Publishing deal, are expected to contribute substantially to revenue. Sony's extensive reach to collection societies worldwide will enhance their publishing revenues.

Upcoming Film Music: The company has several anticipated film music releases on the horizon, including Malik, Sarbala ji, a movie with David Dhawan and Varun Dhawan, another with Siddhant Chaturvedi and Wamiqa Gabbi, and No Entry Mein Entry. They are also in negotiations with other major banners.

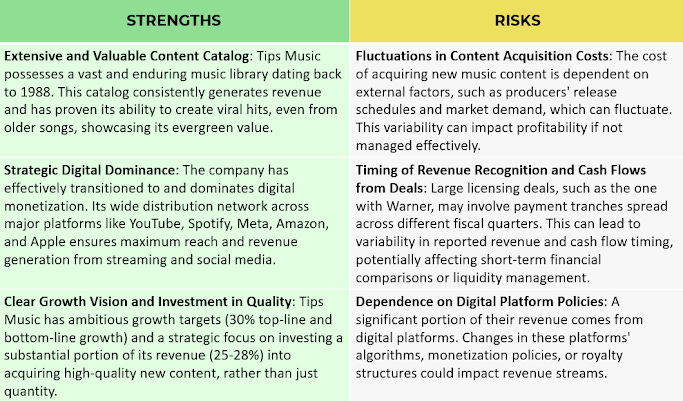

Risk & Strengths

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."