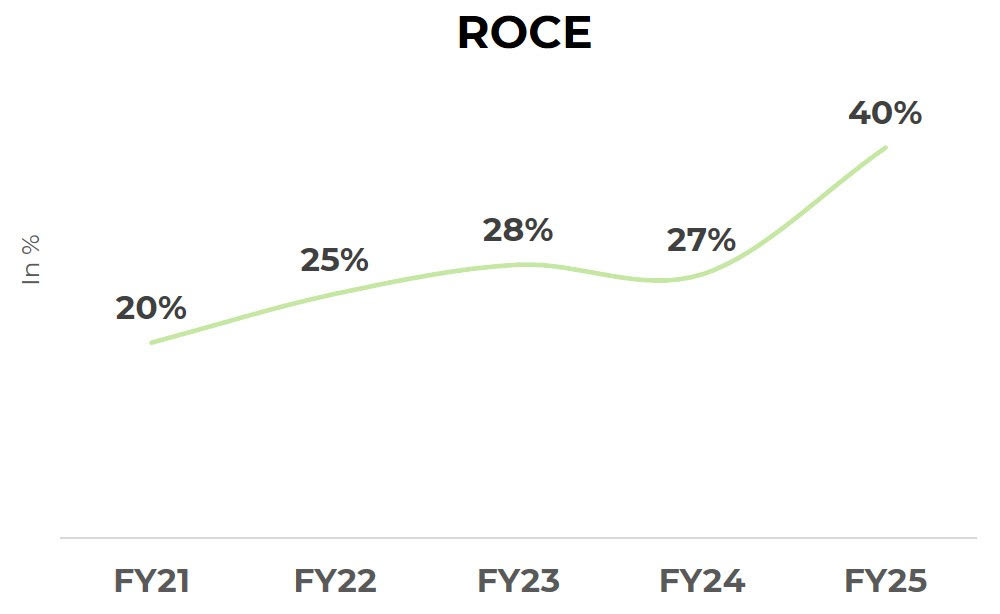

From Debt to Double-Digit Margins

A legacy road-builder is slashing ₹3–4K Cr in borrowings, monetizing assets, and primed for sustainable 10–11% EBITDA margins by FY 26

Business Overview

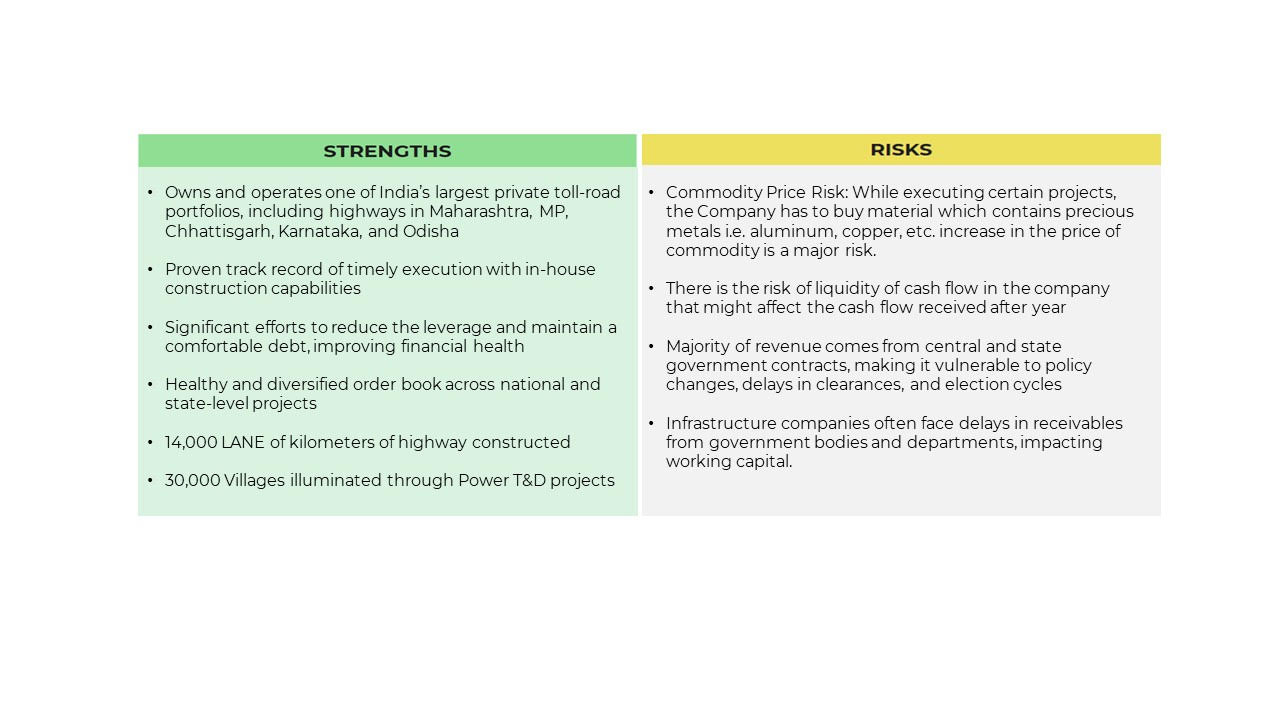

Ashoka Buildcon Limited, a Fortune India 500 company headquartered in Nashik, is a leading integrated infrastructure developer with a focus on highways, bridges, railways, power, buildings, and city gas distribution. With over 40 years of experience and a robust order book ₹16,000+ cr as of Dec 2024, it operates extensively across India and select overseas regions, works in Public-Private Partnership/Build-Operate-Transfer, Engineering, Procurement & Construction, Hybrid Annuity Model, and toll collection projects. The company also produces and sells ready-mix concrete (RMC) and bitumen, while offering toll-collection services for third-party projects.

Business Model & Divisions

1) Construction Contract

The company undertakes engineering, procurement, and construction (EPC) of road, rail, power projects, etc. The company has constructed 14,000+ lane km of highways and electrified 30,000+ villages through power Transmission & Distribution projects. Additionally, it has completed 750+ kms of overhead electrification, linked 170+ kms of railway tracks, laid 32,000 km of optical fiber, and built 10+ Mn sq. ft. of buildings.

2) Build-Operate-Transfer / Annuity Projects

The company was one of the first to enter the BOT road sector in India, winning its first project in 1997. The company has 21 BOT/HAM road projects, including 13 projects (6 BOT toll and 7 HAM projects). Overall, the group has 11 HAM projects, 10 of which are already operational or have received provisional completion. It also has 4 BOT annuity projects and 6 BOT toll projects.

3) Sale of Goods

The company manufactures ready-mix concrete. It also started executing smart city construction projects in 2016.

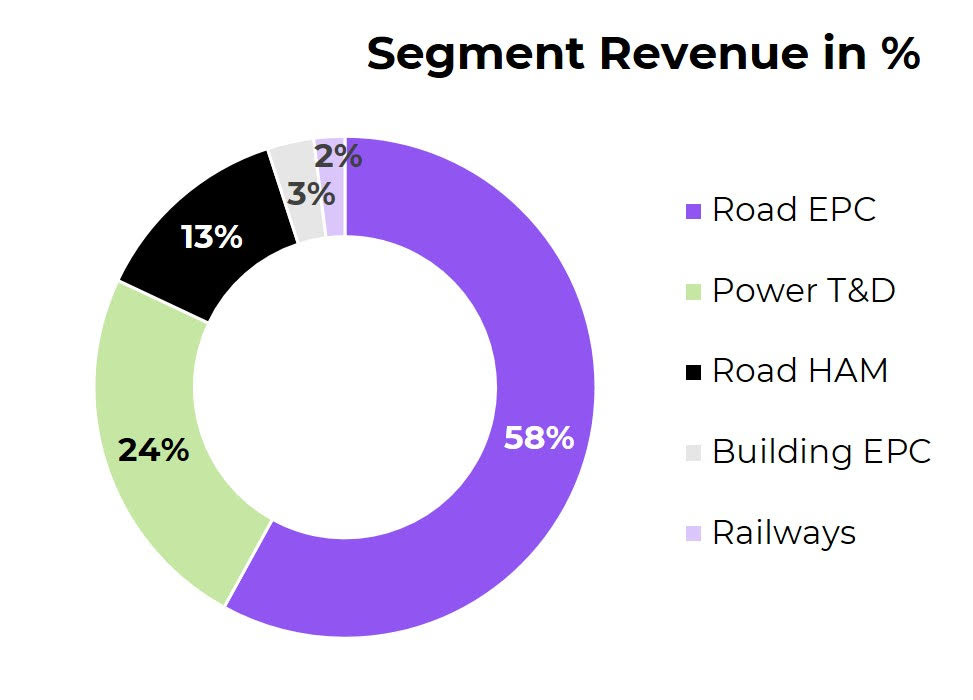

Product Segment

1. BOT / PPP / HAM Projects

Builds, operates, and transfers toll-based roads and bridges under various models (Public-Private Partnership, Build-Operate-Transfer, Hybrid Annuity Model)

2. EPC (Engineering, Procurement & Construction)

Designs, engineers, sources materials, and constructs large-scale infrastructure projects with-in-house project execution team.

3. Ready-Mixed Concrete & Bitumen Production

Manufactures and delivers ready-mix concrete and processed bitumen, primarily to support its own Engineering, Procurement & Construction (EPC) projects and external clients.

4. Toll Collection Contracts

Manages toll collection for roads and bridges owned by third-party entities. Utilizes proprietary toll-auditing systems to ensure transparent and efficient revenue recovery.

5. Support Services & Ancillary Businesses

Engages in operation & maintenance (O&M) contracts post-construction to ensure assets meet performance standards such as city gas distribution and building/construction for institutional, industrial, and commercial clients.

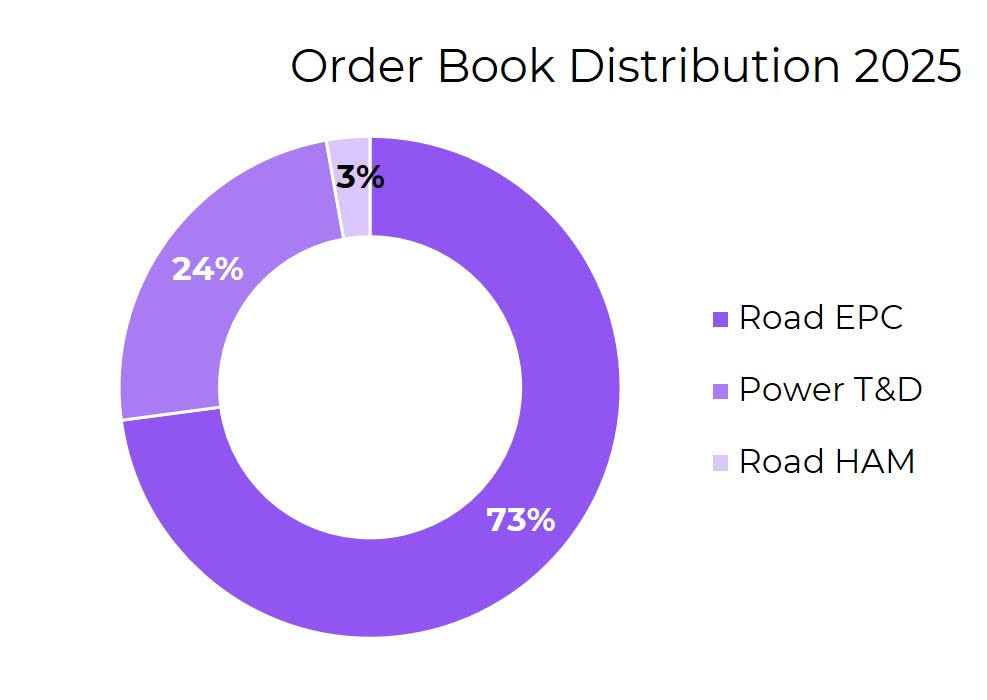

Order Book

Road and Railway Order Book Breakup:

The Road and Railway project portfolio comprises HAM (Hybrid Annuity Model), project valued at ₹911 crores, EPC road contracts totaling ₹4,426 crores, and railway segment orders amounting to approximately ₹877 crores.

Financials

Strengths and Risk

Future Outlook

Industry Tailwinds:

National Highways Authority of India, delivered a strong performance during the year. Capital spending crossed over ₹2.5 lakh crores, which is the highest ever and shows strong progress across ongoing infrastructure projects.

The government has announced a major investment plan of ₹10 lakh crore over the next two years improving infrastructure.

Infrastructure continues to see strong support from the private sector backed by stable government policies and new financing models.

The company has received two new project orders

First came in March 2025 from Maharashtra State Electricity Transmission Company, worth INR. 311.92 crores.

Second order was received in April 2025 for Central Railway, a value of INR. 568.86 crore

Sales are projected to grow by approximately 10% in FY26, with a stronger acceleration anticipated in FY27, potentially reaching a 15% growth rate.

3 Projects are expected to complete by the first week of FY26 i.e July and 2 projects by Dec, which should bring in approximately ₹1,600 crores.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."