Engineering Growth with Precision

How a niche motion-control player is building scale and global presence.

GALA PRECISION

Business Overview

When a maintenance engineer at a wind-farm in Tamil Nadu first asked Gala to design a custom washer that would resist repeated load reversals in cold weather, the company didn’t send a catalog it redesigned a part. That small problem became a pattern: Gala Precision Engineering began as a hands-on problem solver for OEMs, turning specialist requests into repeatable products.

Today the firm has 175+ customers and is recognised for technical springs, high-tensile fasteners and engineered fastening systems that serve renewable energy, railways, off-highway and general industrial customers.

Its growth story reads like a string of shop-floor solutions scaled up to plant capacity and exported abroad, comprising an extensive portfolio of 750+ SKUs.

Business Model

Gala operates a focused, industrial B2B manufacturing model built on four pillars:

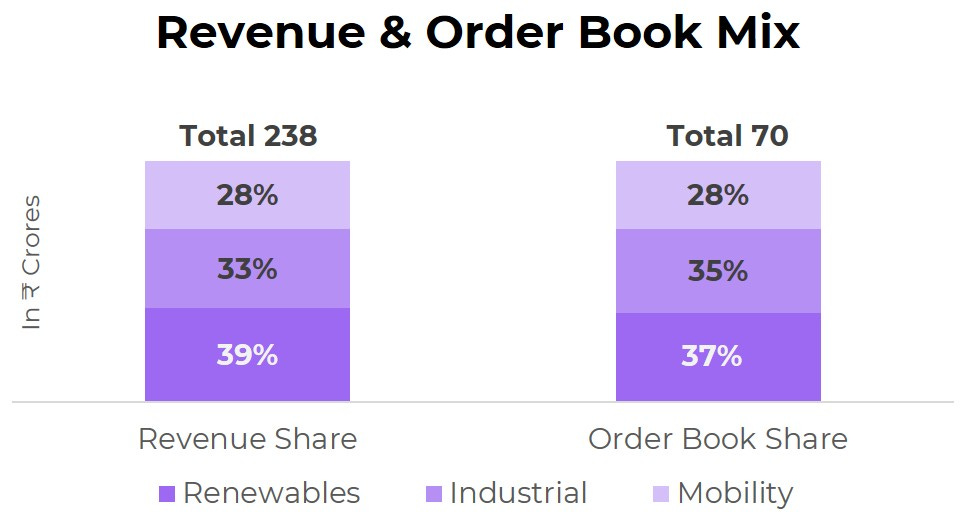

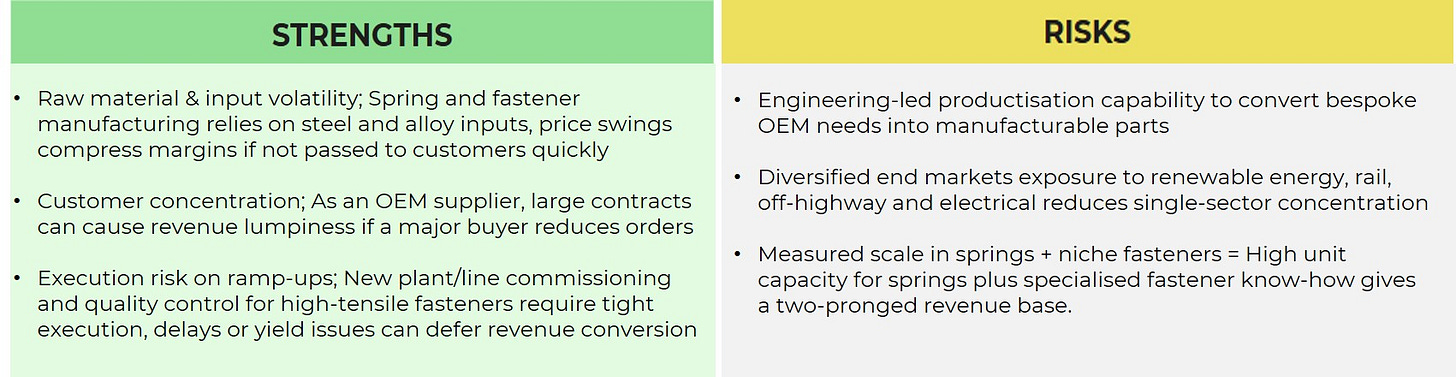

Problem-to-Product engineering: The company holds 10% of Indian disc springs market and 70% of the domestic DSS market for the renewable industry. Company works closely with OEMs and Tier-1 customers to convert bespoke requirements into standardized production items (disc & strip springs, coil/spiral springs, and specialty fasteners), giving it product stickiness with customers who value engineered solutions.

Multi-segment end-market approach: Rather than relying on a single vertical, Gala serves renewable energy (wind), railways, electricals, off-highway equipment and general engineering diversifying cyclical risk across segments.

Integrated manufacturing with scale: The company invests in automated forming, heat-treatment and testing capabilities that allow high volumes (springs and washers) alongside lower-volume, higher-margin specialised fasteners enabling an economy of scale for commodity items and a premium for specialised solutions.

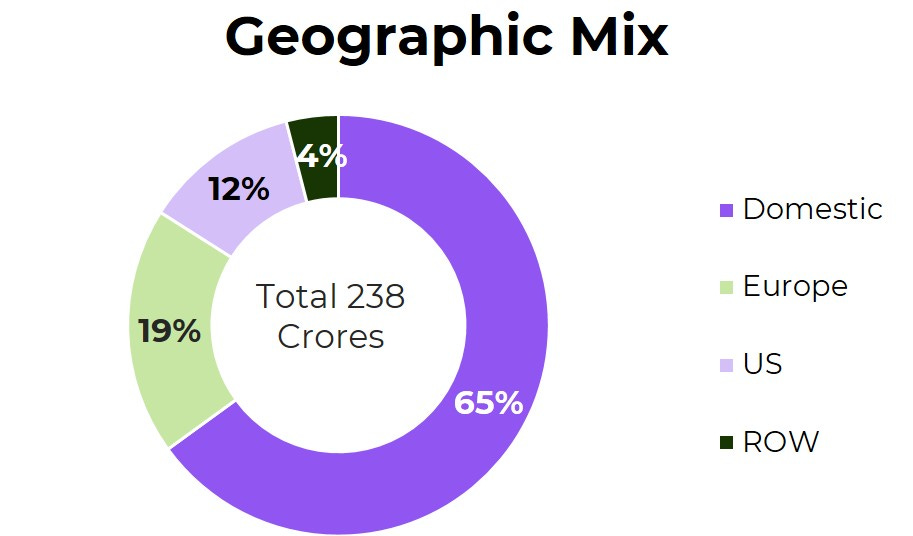

Export plus domestic channels: The company has an office in Frankfurt, Germany and it exports to 25+ countries, contributing 37% in total revenue. Gala combining direct OEM contracts with distributor/channel relationships to broaden market access.

Capex-led capacity growth: The firm times capacity additions (new plant lines, fastener cells) to capture demand from renewables and industrial customers, keeping utilization and product mix under active management via periodic expansions.

CAPEX FROM IPO PROCEEDS:

WADA PLANT, NEAR MUMBAI, MAHARASTRA : ₹ 11.1 Cr

VALLAM PLANT, NEAR CHENNAI, TAMIL NADU : ₹ 37.0 Cr

Product Segment

Gala groups its offerings into clear technical segments:

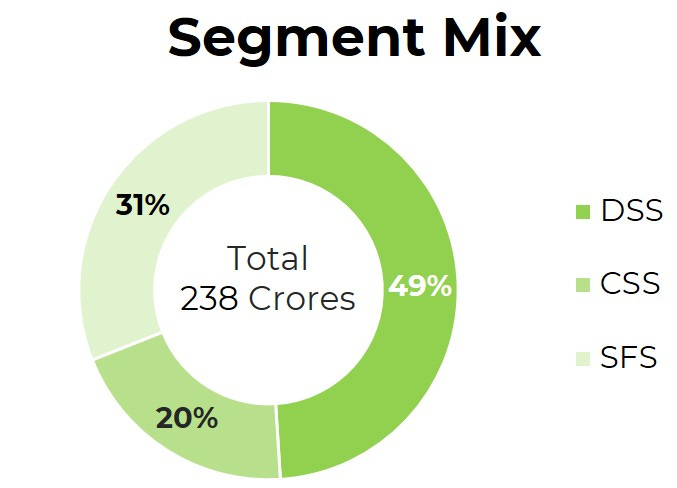

Disc & Strip Springs (DSS): This includes wedge-lock washers, Belleville/disc springs and strip spring forms used in high-load, repetitive applications where compact spring action is needed. These products are largely standardized but require precision in forming and heat treatment. DSS contributes materially to the company’s volumes due to high unit counts and regular replacement cycles in industrial assemblies.

Coil & Spiral Springs (CSS): Coil and spiral springs serve mobility, electrical switches and industrial actuation applications. These items bridge commodity and engineered categories, with manufacturing focused on automated coiling and strict dimensional controls to meet OEM tolerances. CSS supports recurring revenue where service-replacement and OEM assemblies drive demand.

Specialty Fastening Solutions (SFS): High-tensile bolts, anchor bolts, studs, and customised fastener systems for wind turbines, hydro projects and heavy machinery form this higher-value product set. Gala claims a measurable share in domestic SFS markets (notably wind-turbine fasteners) and positions this segment as strategic for margin expansion since it combines engineering with metallurgical controls.

Others: Ancillary items (washers, precision stamped components, assemblies) and value-added services such as surface treatments and sub-assembly work. These allow Gala to offer bundled solutions rather than standalone parts, increasing customer wallet-share.

Manufacturing Unit & Operations

Gala operates multiple facilities in India that split production between springs/washers and high-tensile fasteners. The primary manufacturing locations are

Manufacturing Plant at Wada, Near Mumbai, Maharashtra - Spread Across (Land Area) 28,800 Sq Mtrs

Upcoming Manufacturing Plant at SIPCOT, Near Chennai, Tamil Nadu - Spread Across (Land Area) 6,718 Sq Mtrs

In 2025 the company expanded capacity through added lines and a new Chennai facility commissioning fastener capability.

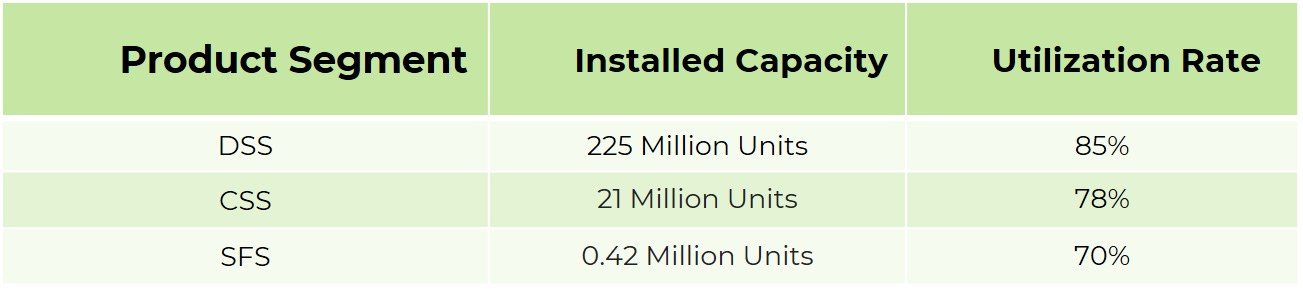

An annual installed capacity of approximately 225 million units for Disc and Strip Springs (DSS), Coil & Spiral Springs, 21 million for Disc and Strip Springs (DSS) and 0.42 million for specialised fasteners (SFS).

The company mentioned that utilisation management is seasonal and skewed to order cycles from renewable projects and large industrial OEMs; the firm has reported phased ramp-ups as new fastener cells came online and trial runs were converted to commercial production.

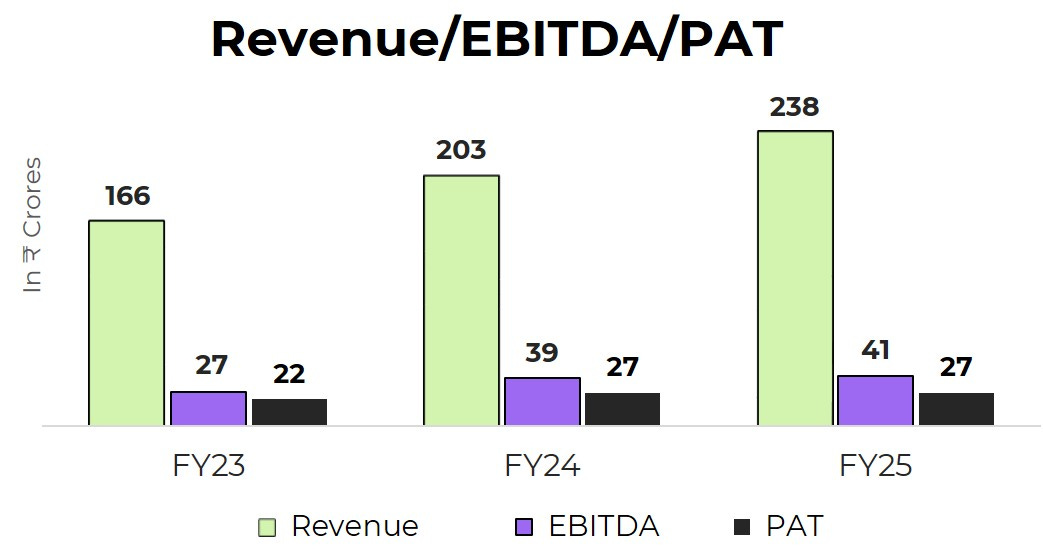

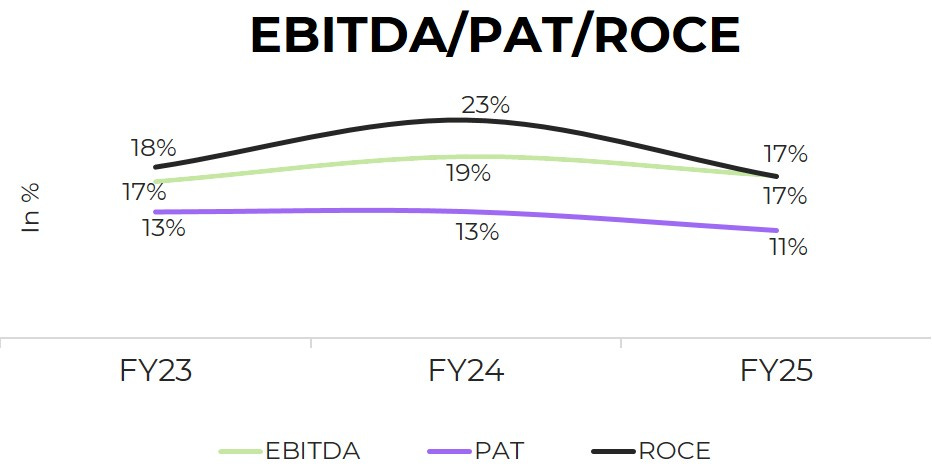

Financials

Future Outlook

Gala emphasized a capex-led strategy focused on capacity building for specialised fasteners and continued automation of high-volume spring lines.

Product Development (Seat retractor springs)

Gala Testing is completed; samples submitted to Tier-1 customer

Next Phase: Full-fledged internal validation underway

OEM Engagement: Ongoing discussions for application approval

Next 2–3 Months: Updates expected post full testing and OEM feedback

Market opportunity: ₹20 Annual demand from India and Globally 5-7X global demand.

In FY25 the company described investment for Commissioning additional fastener cells at its Chennai facility:

NEW CAPACITY AT VALLAM, NEAR CHENNAI, TAMIL NADU

Proposed Capacity - 4,600 MT

Across (Land Area) 6,718 Sq Mtrs (Plant Area Sq Mtrs - 4,000)

Focuses on producing high-tensile fasteners including bolts and nuts (primarily for US customers)

Production has begun in July 2025 and Gala expect dispatches to commence

from this month, August

Gala has also started sales from their Wada plant to new industrial

customers in their SFS business

CAPEX

Chennai Facility

The total CAPEX is going to be ₹48-50 Cr and is divided in two phases

Phase 1: CAPEX of ₹30+ completed; production commenced last month and is expected to contribute ₹30 Cr to total revenue in FY26.

Phase 2: Under review; decision expected in 2–3 quarters, likely by Q4 FY26.

CAPEX Estimated: ₹15–20 crore.

After completion of CAPEX, Gala is expected to generate ₹120 Cr revenue, and is expected to achieve in FY27 or FY28.

Wada Facility

CAPEX is ongoing as per DRHP disclosures.

Incremental CAPEX will be incurred year-on-year, depending on:

Order book strength

Operational progress

Typically, clarity on additional CAPEX emerges 2–3 quarters in advance.

Capacity Expansion Plans

Land Acquisition: Actively scouting locations in Chennai, Maharashtra, and Gujarat

Decision expected within 6 month

Growth Guidance

For Short-term (FY26):

Revenue Growth targeting 20%–25% YoY

EBITDA Margin: Expected to remain stable at 17%–19%

For Medium to long-term (FY28–FY29)

Revenue Growth targeting ₹425–450 crore range, depending on product mix and utilization at 20% YoY

Company has current infrastructure that supports this scale for the next 1.5–2 year

In order to Achieve this number Gala will fund from internal accruals:

₹25+ crore corpus from IPO, parked in fixed deposits

Zero long-term debt on books

Healthy cash accruals year-on-year

EBITDA Margin: Expected to sustained at 17%–19%

If executed, these investments could shift the revenue mix toward higher-margin SFS products while maintaining volume through put in DSS and CSS lines. The outlook therefore combines steady demand from established segments with incremental margin potential from higher-value fasteners, subject to execution and macro demand cycles in renewable and industrial capex.

Strength & Risk

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.We are SEBI registered Research Analyst (with Registration No. INH000019789)

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."