Diagnostics as a Distribution Business

Why Thyrocare’s Asset-Light, Hub-and-Spoke Model Still Matters in 2025

Thyrocare Technologies Ltd

India’s pioneering automated diagnostic lab delivering precision at scale.

Thyrocare Technologies Ltd. is India’s first fully automated diagnostic lab, delivering affordable, high-quality health tests at scale through advanced technology and a centralized model.

COMPANY OVERVIEW

Thyrocare Technologies Ltd, founded in 1996 and headquartered in Navi Mumbai, is one of India’s foremost diagnostic service providers. It pioneered the concept of a fully automated, centralized laboratory model, enabling high-quality diagnostic testing at affordable prices.

Thyrocare operates through a vast franchise network of over 1,100 outlets across India and neighboring countries, making advanced diagnostics widely accessible. Following its acquisition by API Holdings (PharmEasy), Thyrocare is accelerating its digital transformation, combining technology-driven healthcare with scalable operations to strengthen its leadership in the Indian diagnostics ecosystem.

PRODUCT

Test Portfolio Expansion: Thyrocare has expanded its test menu to over 1,000 diagnostic tests, encompassing wellness, lifestyle disease detection, and specialized diagnostics.

Aarogyam Wellness Packages: While Aarogyam packages continue to be significant, their contribution has decreased to 35% of revenue (from 40%) as specialized and non-Aarogyam tests experience faster growth.

Radiology & Imaging Services: Thyrocare provides PET-CT scans and other radiology services through its imaging vertical. The company operates its own medical cyclotron facility, enabling the production of radiotracers used in PET-CT scans for oncology, neurology, and cardiology diagnostics. This facility provides a competitive advantage in nuclear medicine imaging.

Sugarscan Devices: A minor portion of revenue 0.36% comes from the sale of diagnostic equipment and consumables, including glucometers and glucostrips under the 'Sugarscan' brand.

BUSINESS SEGMENTS

Pathology Diagnostics : Thyrocare now offers over 1,000 different tests. Notably, non-Aarogyam tests make up 65% of this revenue, while the share from Aarogyam wellness packages has declined to 35%.

Radiology & Imaging: PET-CT & nuclear imaging services generated ₹47.60 Cr (8.32%). Own cyclotron unit gives cost & speed edge.

MANUFACTURING UNIT

Centralized Automated Laboratory: Thyrocare operates India's largest fully automated diagnostic processing facility in Navi Mumbai. This central lab is designed to handle high-volume testing with minimal human intervention, processing approximately 4.8 lakh investigations per night.

Regional Processing Labs: The company has expanded its network to 32 regional labs across the country, ensuring faster sample processing and reporting. Out of these, 28 labs are accredited by the National Accreditation Board for Testing and Calibration Laboratories (NABL), contributing to 96% of the total test volumes.

Medical Cyclotron Facility: Thyrocare operates its own medical cyclotron unit, enabling the production of radiotracers used in PET-CT scans for oncology, neurology, and cardiology diagnostics. This facility provides a competitive advantage in nuclear medicine imaging.

Logistics and Supply Chain: Thyrocare manages its own pan-India logistics network, ensuring sample pickup and delivery within 6–24 hours. This efficient logistics backbone supports its volume-led model.

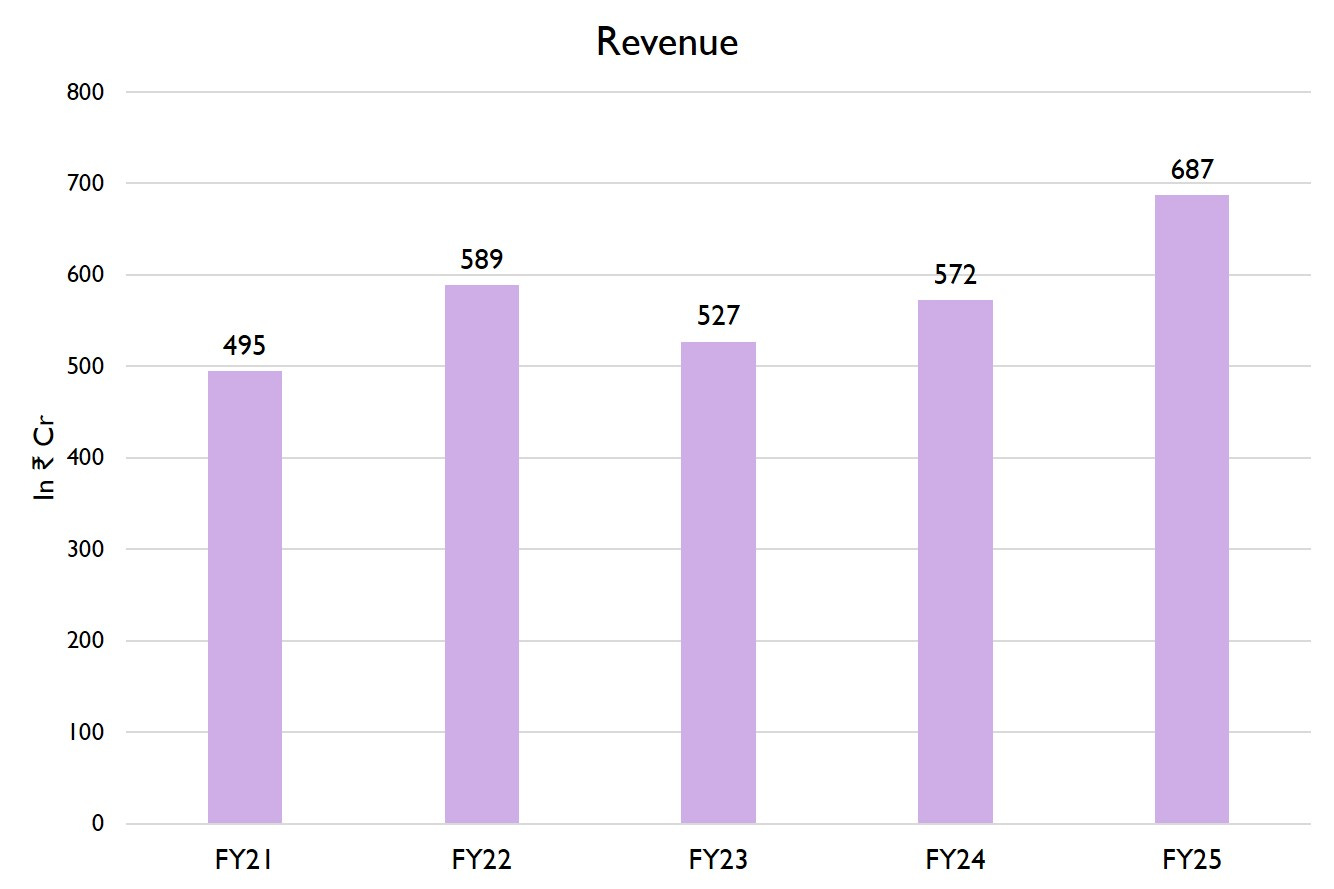

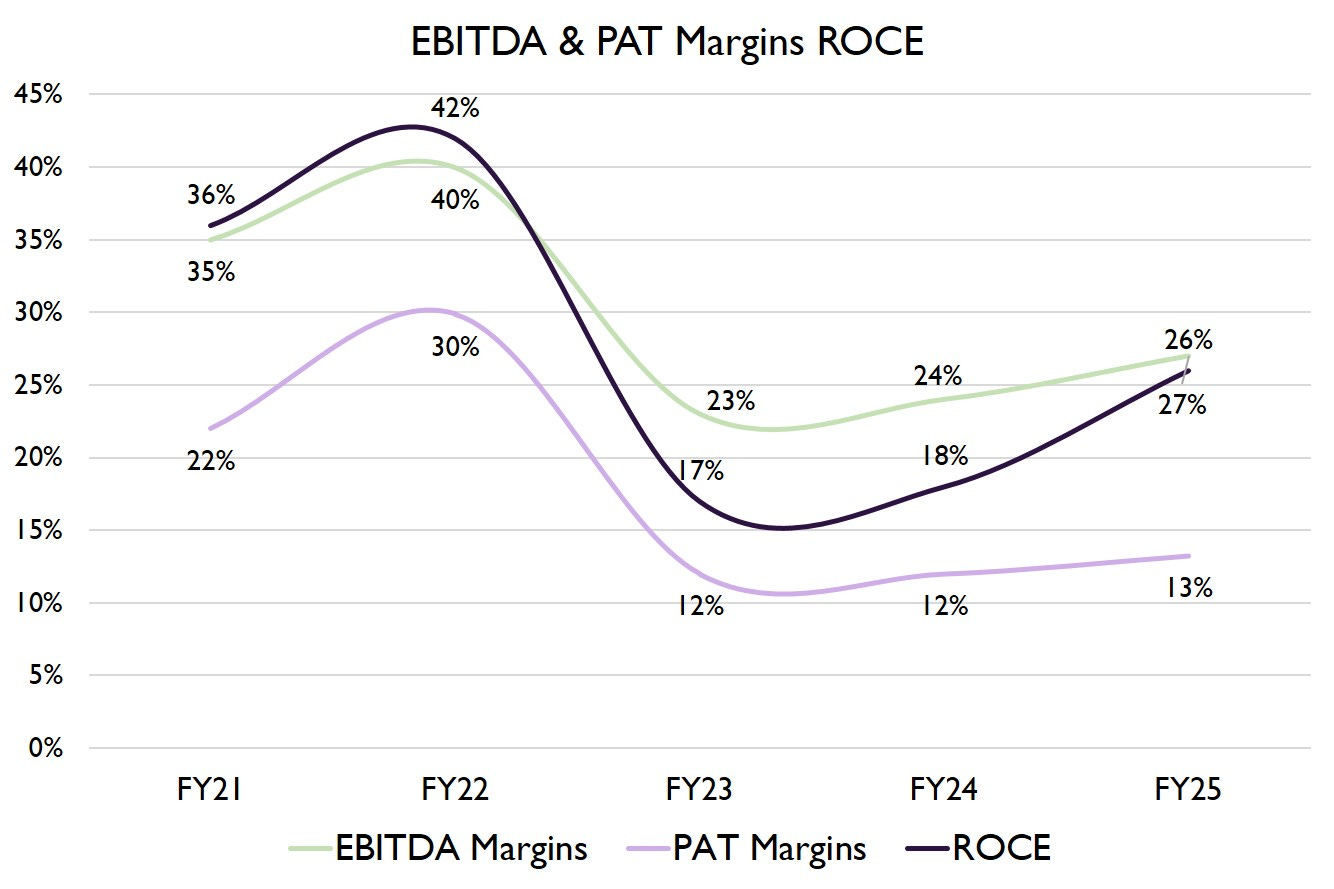

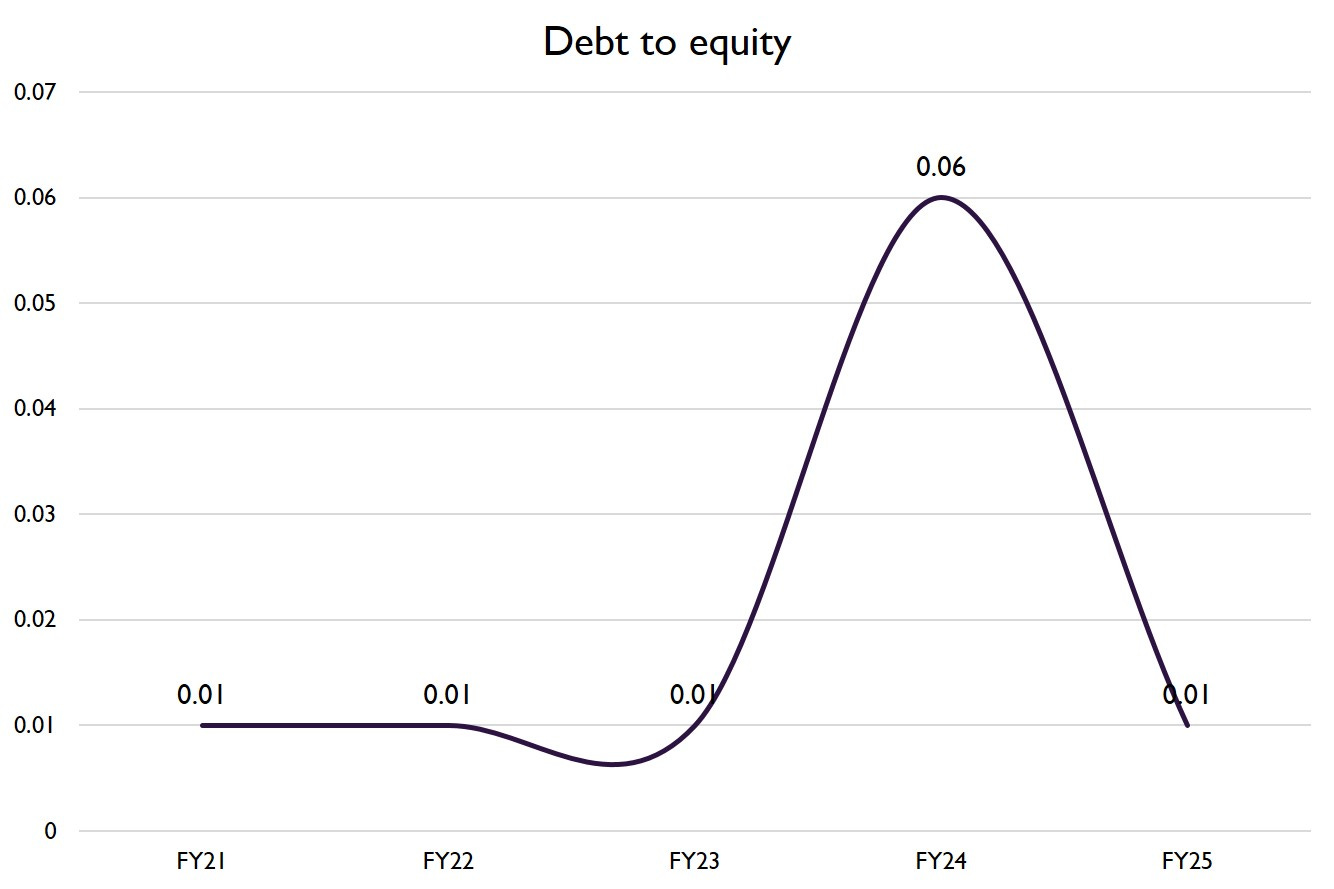

FINANCIALS

FUTURE OUTLOOK

1.Volume vs. Value Dynamics:

Thyrocare's ~14% volume growth versus ~20% revenue growth is mainly due to a shift in test mix and franchise profile—not price hikes. More specialized, higher-priced tests and onboarding of smaller franchisees (who operate at higher slabs) led to increased revenue per test.

2. Radiology and Nuclear Medicine Segment:

The radiology and nuclear medicine business has seen margin improvements following recent price increases. However, due to the high capital expenditure required (around ₹10 crore per diagnostic center), the company currently does not plan to invest heavily in opening new centers in this segment. This cautious approach helps maintain financial discipline while maximizing returns from existing infrastructure.

3.Franchise Network Expansion:

Continuing its asset-light and scalable franchise strategy, Thyrocare plans to add over 1,500 new franchise partners in FY26. This aggressive expansion aims to deepen penetration in both existing and new markets, including tier 2 and tier 3 cities.

Strategic Acquisitions: In FY25, Thyrocare acquired Polo Labs in July 2024 and the clinical diagnostics division of Vimta Labs in October 2024, enhancing its presence in North and South India and supporting broader test offerings.

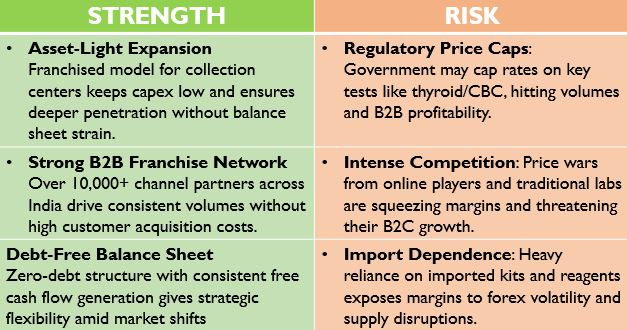

STRENGTHS & RISKS

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."