Centum Electronics: Driving High-Reliability Solutions Across Defence, Aerospace, and Industrial Sectors

A Diversified ESDM Leader Leveraging Engineering Excellence, Global Partnerships, and Strategic Growth to Strengthen Innovation and Operational Performance

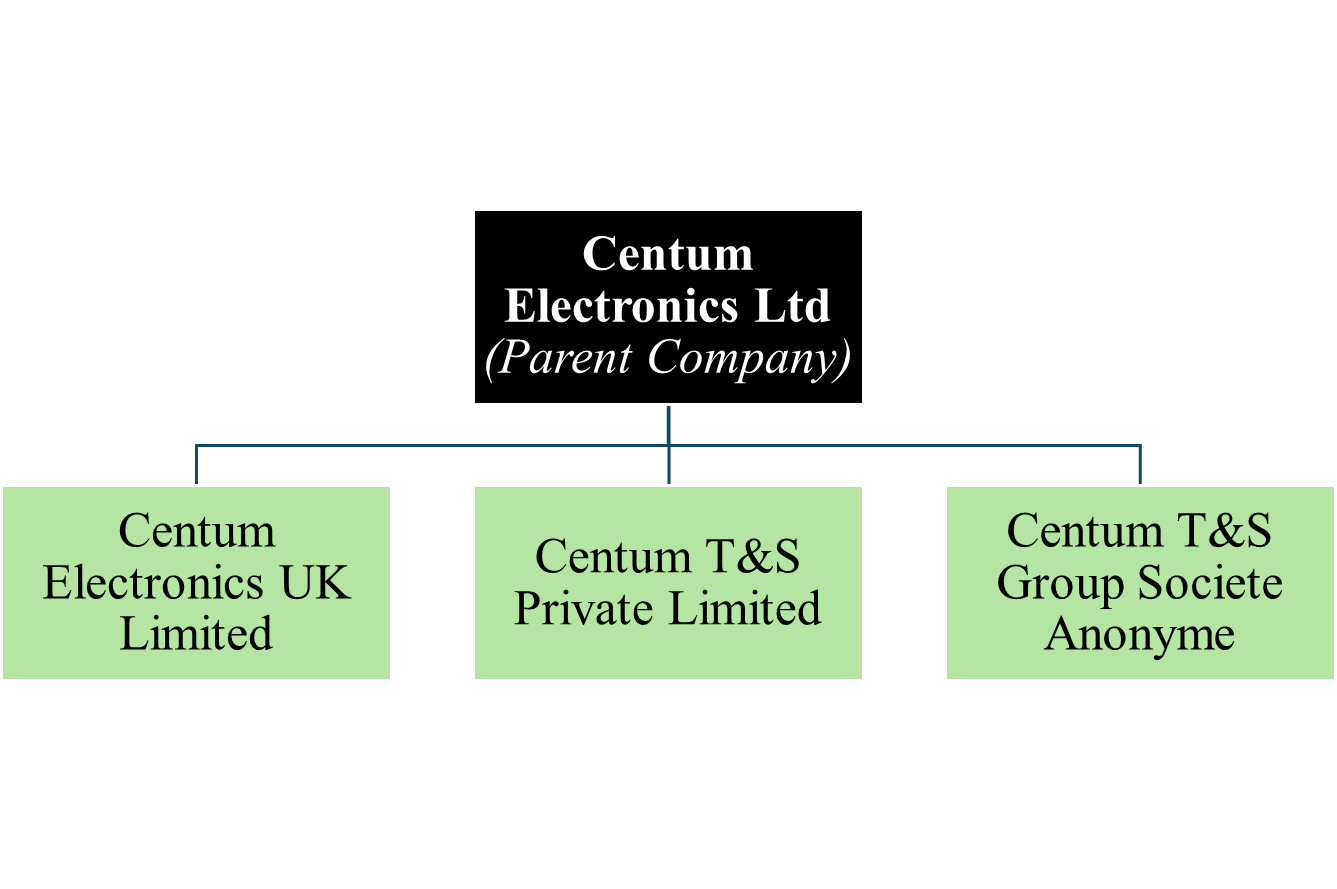

Company Overview

Since 1993, Centum Electronics has been a trusted leader in Electronics System Design and Manufacturing (ESDM), powering mission-critical sectors including Defence, Aerospace, Space, Transportation, Energy, Healthcare, and Industrial systems.

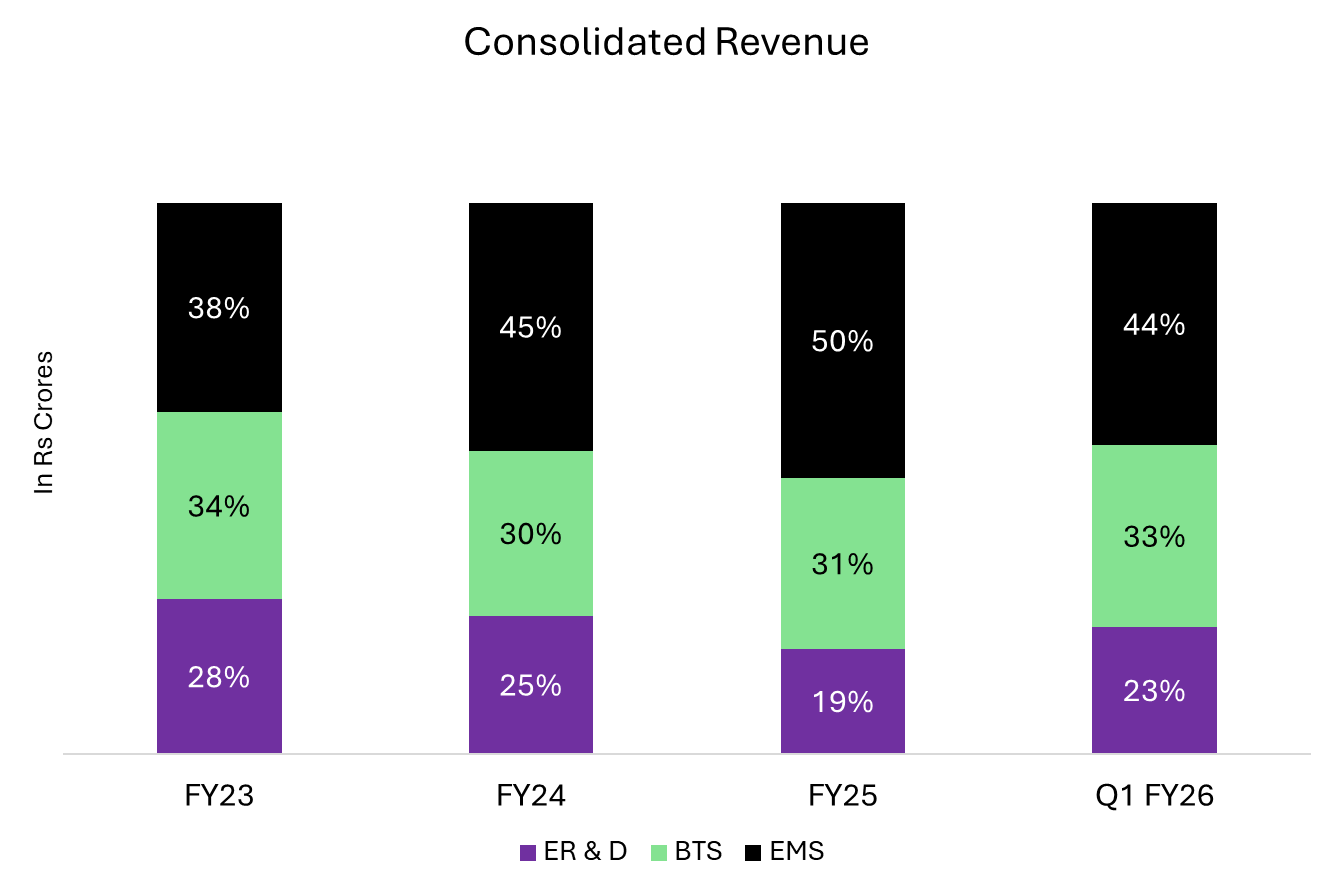

The company delivers high-complexity, high-reliability solutions engineered to excel in the most demanding environments. Its integrated capabilities across Engineering R&D Services (ER&D), Electronic Manufacturing Services (EMS), and Build-to-Specification (BTS) systems ensure a seamless journey from concept to deployment, accelerating product realization.

Strategic partnerships with leading multinational OEMs and Indian public sector organizations, including premier defence and space institutions, reinforce its position as a go-to provider for complex, high-technology electronic products.

Centum Electronics is anchored in innovation, technological excellence, and quality leadership, with continuous investment in engineering talent, supply chain resilience, and sustainable practices. A strong focus on human capital and community impact underlines long-term value creation.

Addressing International Subsidiary Challenges

The call highlighted degrowth and losses in Centum’s international subsidiaries, particularly in Europe and Canada:

ER&D Business Softness – The Engineering R&D segment has seen weak demand over the past 18 months, mainly due to uncertain macro conditions in Europe delaying customer decisions in the automotive and aerospace sectors.

Canadian Subsidiary Repositioning – The Canadian subsidiary is facing significant challenges, with losses of ~€2.4 million in FY25 and ~€600k–700k at the EBT level in Q1 FY26. The subsidiary, originally part of Centum’s French business and acquired from Alstom, primarily serves Alstom as its main customer. Revenue has dropped sharply from ₹ 70–75 crores in FY25 to ₹ 17–18 crores in Q1 FY26, mainly due to high employee costs relative to current deliveries and margins. Management is evaluating strategic actions, including negotiating with Alstom or divesting the division to stop the losses. Meanwhile, Centum has built similar capabilities in India with 30–40 engineers, delivering metro projects and the Vande Bharat program, reducing reliance on the Canadian entity.

French Subsidiary – Sales decline has impacted margins. Efforts are focused on converting pipelines with key European defense and aerospace customers into new opportunities to improve sales and profitability.

Overall Subsidiary Losses – Total losses in Q1 FY26 were ~₹ 12 crores, split roughly equally between the Canadian and French subsidiaries.

Business Model

Centum Electronics delivers high-reliability, complex electronic solutions for Defence, Aerospace, Space, Industrial, Energy, and Transportation sectors. Offerings include radar and missile systems, avionics, satellite and launch vehicle modules, power converters, EV control systems, hydrogen solutions, and public transport technology.

Revenue is generated through end-to-end services spanning Engineering R&D (ER&D), Electronic Manufacturing (EMS), and Build-to-Specification (BTS) systems, enabling cost-efficient, timely delivery. Deep client collaboration, high-complexity expertise, and a global presence with India-based manufacturing create high entry barriers, support strong margins, and drive sustainable growth.

Products & Services:

1.Engineering R&D (ER&D)

Centum converts complex ideas into high-performance electronic solutions across hardware, embedded software, FPGA, analog, RF, and power electronics. With 30+ years’ experience and a global network of 600+ engineers, it delivers customized, mission-critical designs via flexible consulting and fixed-price models.

2. Electronic Manufacturing Services (EMS)

Centum delivers reliable, precise manufacturing for complex, high-performance products. Covering everything from circuit boards to full system integration, it combines flexibility, strong processes, and collaboration to meet lifecycle needs, manage supply chains, and bring products to market faster and cost-effectively.

3. Build to Specification (BTS)

Centum integrates engineering, manufacturing, and industrialization to handle the entire process from concept to mass production. Using its Design-to-Cost approach, it reduces development time and costs, manages product lifecycle changes, and ensures long-term value and reliability for customers.

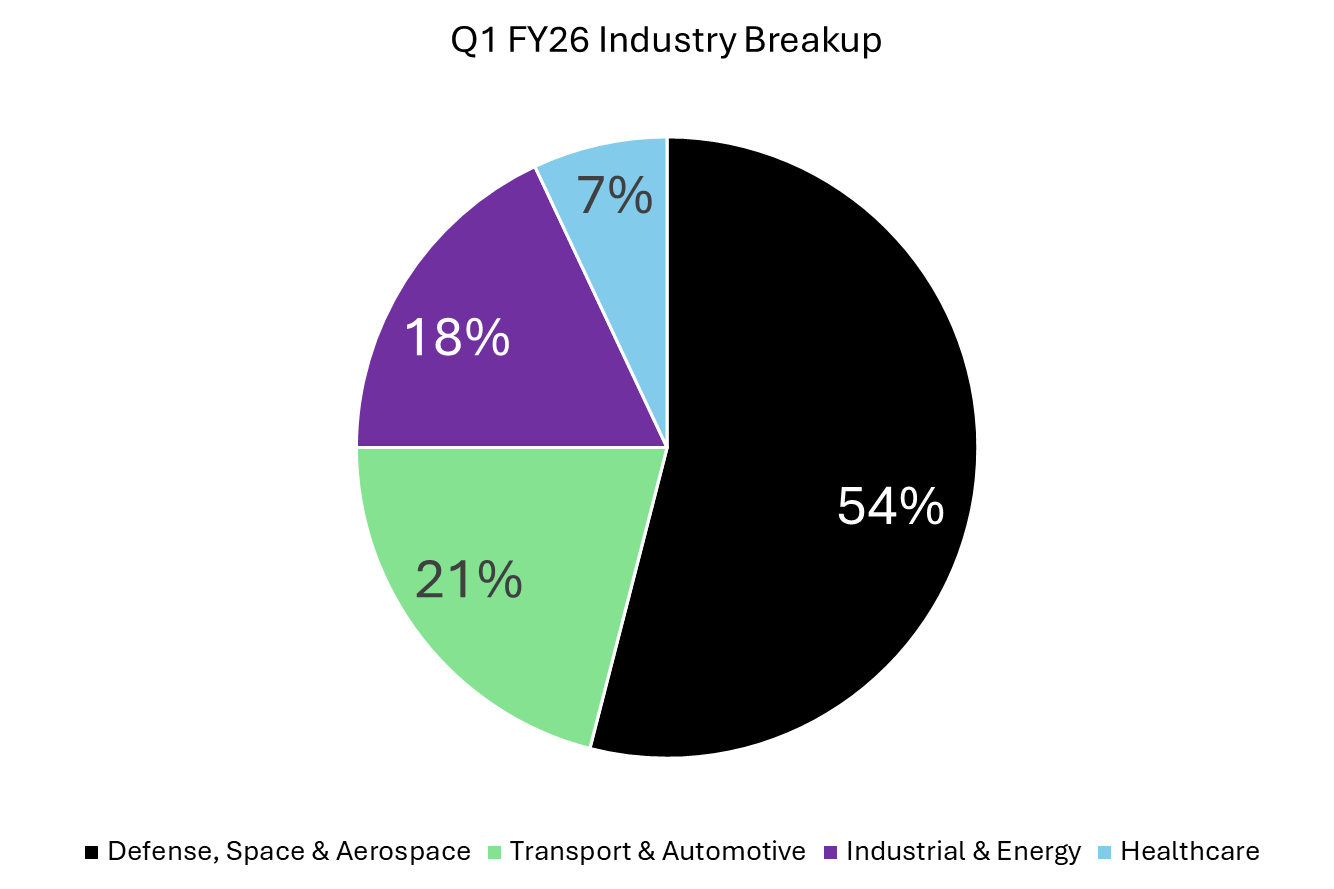

Industry Breakup:

1.Defence, Space & Aerospace

contributing more than half of Centum’s revenues, this segment supplies subsystems for satellites, missiles, tanks, and radar, partnering with ISRO, DRDO, and defence PSUs. From component supply, it has moved to full satellite payloads and advanced defence electronics, and provides cockpit and avionics systems for global OEMs. France operations focus on high-value projects, supporting India’s strategic self-reliance and the global aerospace ecosystem.

2. Transport & Automotive

Centum provides next-gen electronics and manufacturing solutions for global transportation and automotive sectors. Its technology powers advanced passenger information systems and supports electric mobility with EV inverters, control, and energy management systems. The company also collaborates on biometrics and automotive innovations, driving future mobility solutions.

3. Industrial & Energy

Centum provides intelligent electronics for industrial automation, energy conversion, renewable integration, and grid modernization. Through design-led manufacturing, it helps OEMs innovate faster while strengthening supply chains, with growing projects in semiconductors, biometric systems, and energy solutions supporting India’s energy transition.

4.Healthcare

Centum provides high-value medical electronics for radiology, diagnostic imaging, infusion systems, and surgical automation. Though a smaller revenue segment, it focuses on system efficiency, patient safety, and operational precision through collaborations with leading healthcare OEMs.

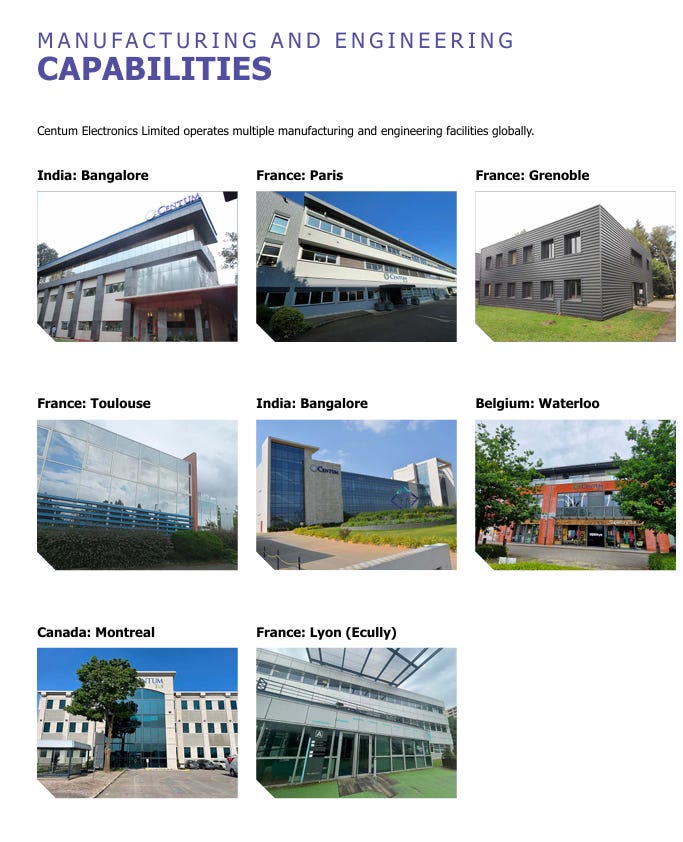

Manufacturing facilities:

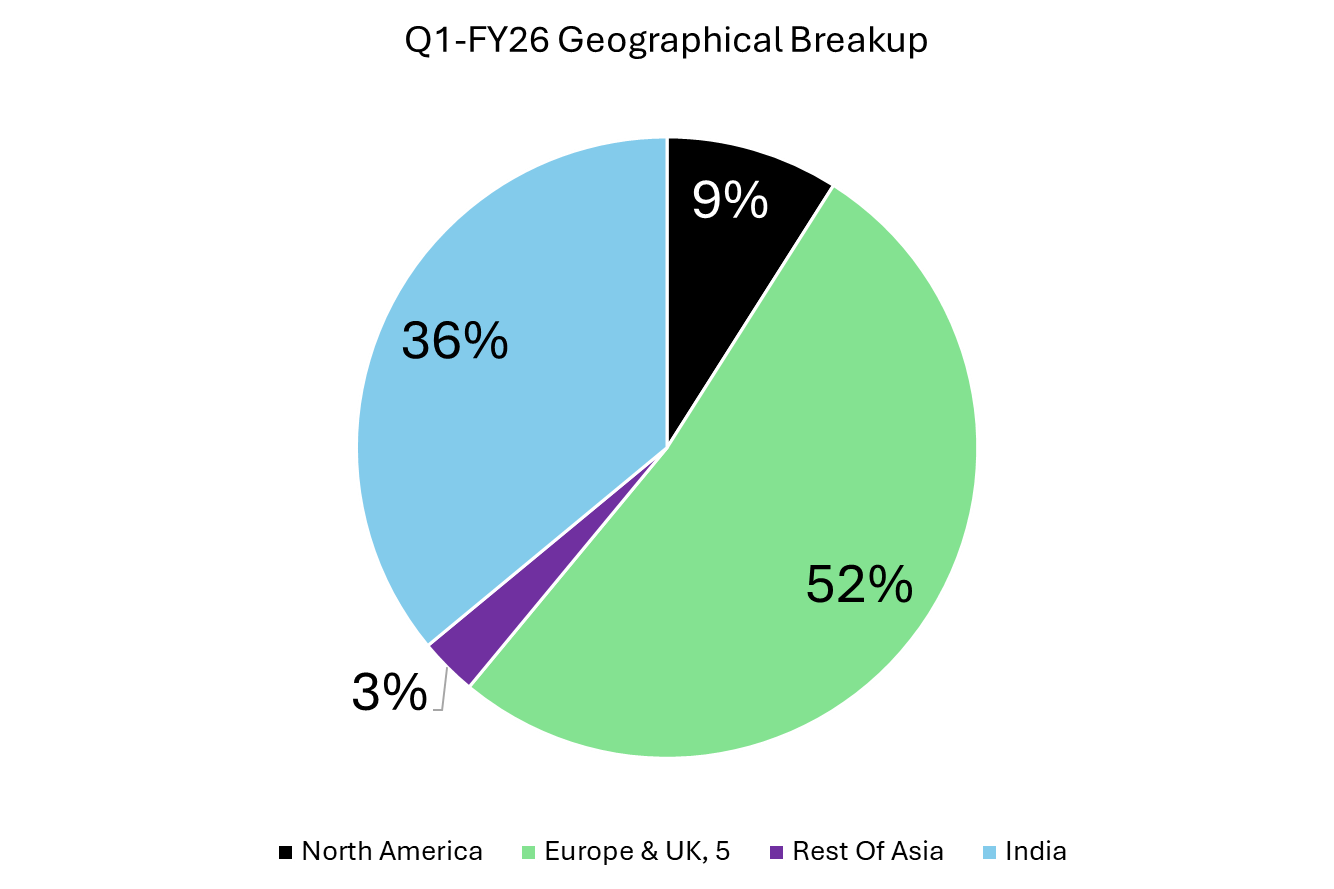

Operations are anchored by state-of-the-art design and manufacturing centers in India, Europe, and North America, combining global reach with local responsiveness. Defence and Aerospace account for over half of business, with growing presence in the Transportation, Industrial, and Healthcare sectors. Europe and the UK contribute a significant portion of revenue, highlighting international relevance.

Centum Industry & Market Overview

Centum operates across Defence, Aerospace & Space, Mobility, Industrial & Energy, and Healthcare sectors, aligning with India’s fast-growing Electronics System Design & Manufacturing (ESDM) industry. In Defence & Aerospace, it supports India’s USD 79B defence spend and ISRO missions like Chandrayaan-3, Gaganyaan, and NISAR, delivering high-reliability electronics for satellites, missiles, radar, and avionics. In Mobility, it enables EVs, ADAS, smart railways, and transport systems, tapping into India’s automotive electronics market projected to grow from USD 10.6B to USD 70–74B by 2032. Industrial & Energy solutions focus on automation, electrification, renewable integration, and smart manufacturing, supporting India’s energy transition and infrastructure modernization. In Healthcare, Centum provides mission-critical medical electronics for imaging, diagnostics, and surgical systems, leveraging growth from technology adoption, government initiatives, and domestic manufacturing. Across sectors, Centum combines engineering, R&D, and manufacturing to deliver reliable, scalable, and innovative electronic solutions aligned with India’s strategic and industrial ambitions.

Types of Clients Served

Centum serves a wide range of customers across industries, leveraging its expertise in Electronics Design & Manufacturing Solutions. It provides end-to-end design services and manufacturing for systems and subsystems in the Defence, Space, Aerospace, Industrial & Energy, Transportation & Automotive, and Healthcare sectors.

The company helps customers turn ideas into products. Its main customers include government agencies, defence organizations, aerospace companies, and industrial enterprises. Centum is also a trusted partner for OEMs seeking customized electronic solutions to meet specific requirements.

Capital Expenditure (CAPEX):

FY26 CAPEX: Projected at ₹ 40 crores, exclusively for the Indian business. No new funds are being invested in international subsidiaries.

Asset Turns: Standalone asset turns (net block level) are currently at 6x-7x and are expected to improve to 8x-9x in the next year or two as new CAPEX augments capabilities and capacities across analog, digital, power, and RF domains

Strategic Development Orders & Order Book Growth:

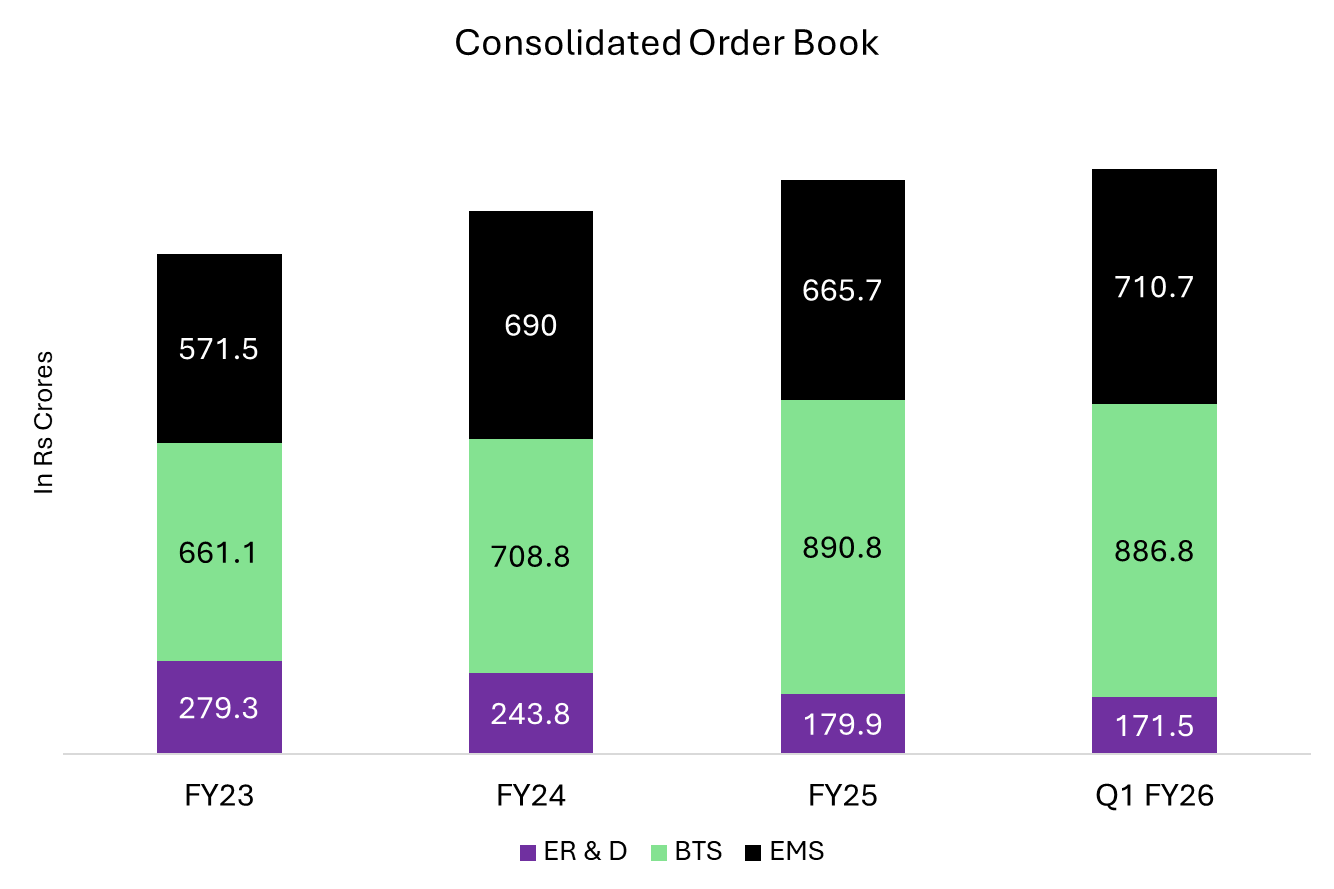

Centum secured new development orders from DRDO, including the Virupaksha Radar. While the initial order is modest (~₹ 10 crores), it opens a strategic long-term pipeline for major airborne platforms like the Sukhoi-30, potentially unlocking opportunities of ₹ 1,000 crores or more over 3–4 years. The technology is also expected to support UAVs, helicopters, and next-generation fighters. Overall, the order book grew to ₹ 1,769 crores as of June 30, 2025, supported by new EMS customers moving into serial production after successful New Product Introduction (NPI) qualifications, particularly in semiconductors, biometric security, and export defense/aerospace, with NPIs expected to contribute USD 15 million in FY26.

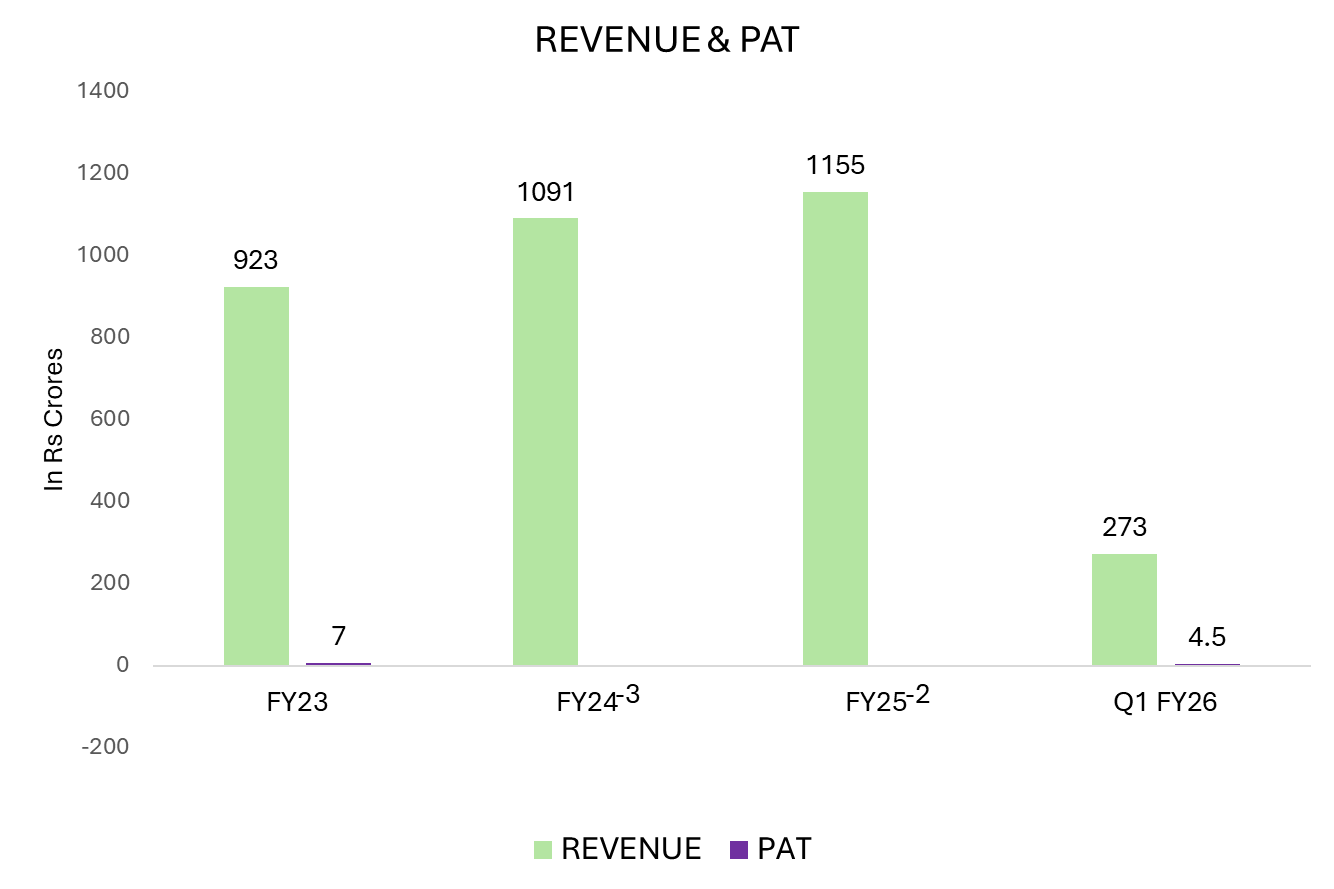

Financial Outlook

Centum Electronics – Strategic Outlook

Centum Electronics operates a diversified EMS business across defense, aerospace (exports), industrial, energy, medical, automotive, semiconductor equipment, biometrics, and security, ensuring stable, recurring revenues with long product life cycles of 10+ years.

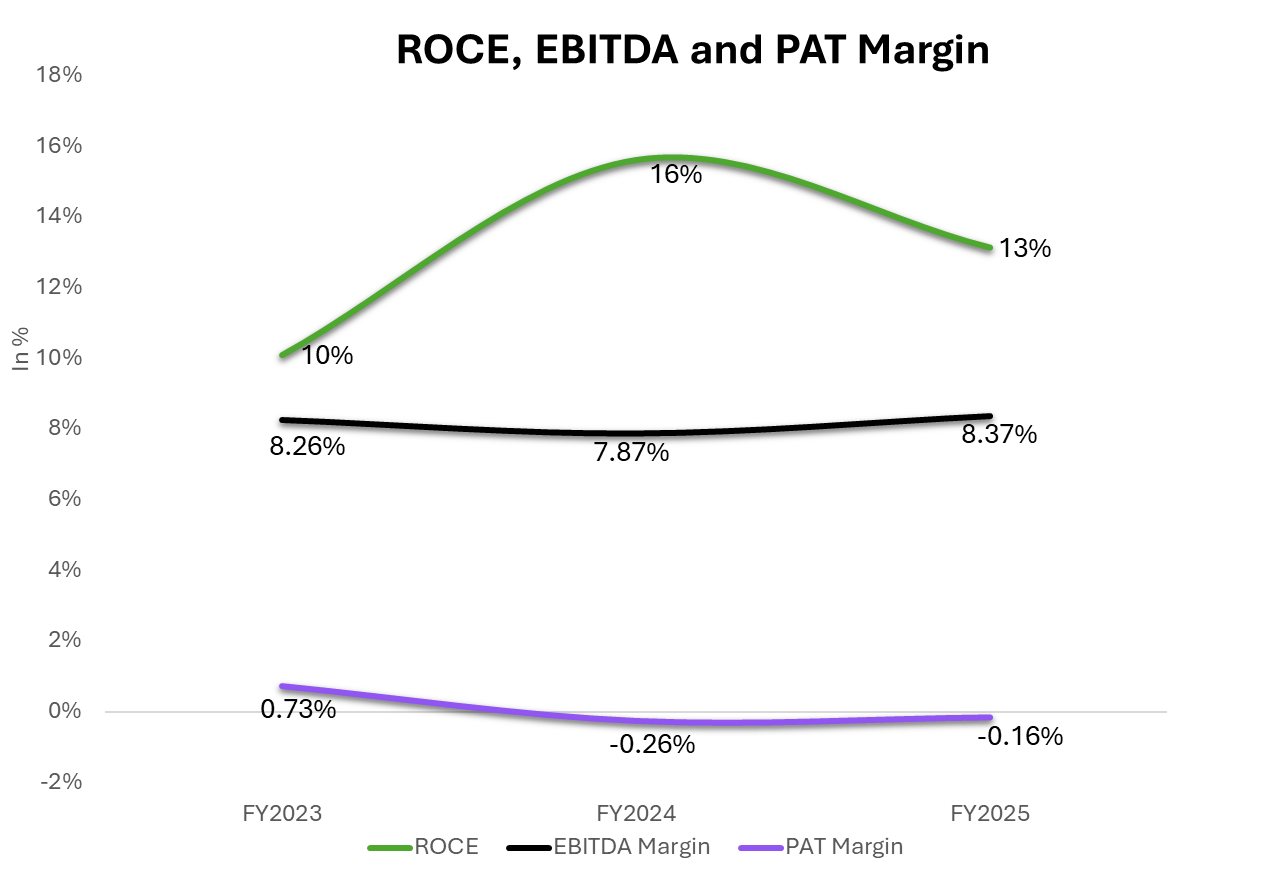

The company aims to raise its consolidated EBITDA margin from 8.38% to 13–15%. The standalone business already delivers ~14% EBITDA, while the focus is on improving subsidiary performance—stopping losses in Canada and driving margin recovery in France from ~1% to 10–11% over the next two years.

Historically, Q4 drove higher margins for the BTS business, but Q1 FY26 showed stronger and more evenly distributed performance, signaling improved operational efficiency. Q4 is still expected to post peak margins.

Management targets medium-term consolidated growth of 18–20%, with the standalone business expected to grow 25%+, fueled by BTS and EMS segments. Large tri-service opportunities are under government review, offering potential substantial contracts. Centum is also pursuing strategic partnerships with start-ups and global companies to capitalize on space sector opportunities, particularly with ISRO. The Indra Sistemas program remains stalled, with no new updates.

Key strengths & Risks

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."

For years, Reliance Industries has been the most profitable company in India.

But things are changing. State Bank of India (SBI), the country’s biggest bank, is now making profits of about ₹19,000 crore every three months.

At this pace, SBI may soon earn more profit than Reliance in a year.

This is a big deal. It shows how strong SBI has become, and why investing in such large, stable companies can help protect your wealth.

https://stocklens.substack.com/p/sbis-profit-may-soon-overtake-reliance