Capex Cycle Boom (Building the Future)

Understanding Capital Expenditure and Why It Signals Confidence, Growth, and Long-Term Vision for Both Businesses and Governments

1. Introduction of Capex

Imagine a growing town deciding to build new roads, expand schools, and upgrade its water systems not just to fix today’s problems, but to prepare for tomorrow’s needs. That’s capital expenditure, or capex. Think of capex as a farmer investing in a tractor not just for today's harvest but for seasons ahead. Or a government building highways and hospitals not for headlines, but for the next generation. These are not everyday expenses; they’re decisions rooted in vision and growth, showing where confidence and long-term planning intersect.

Just like that town, businesses make long-term investments to acquire, maintain, or upgrade physical assets such as property, infrastructure, and machinery. These moves aren’t about instant returns, they're signals of confidence in future growth. In government terms, capex means allocating funds to create assets or reduce liabilities, all with one goal in mind: boosting the country’s economic growth. These investments often span infrastructure, machinery, healthcare, education, and more. Even when the government repays a loan, it’s considered capital expenditure because reducing liabilities strengthens the financial future, just like building a bridge or a power plant.

2. Importance of Capex

For an Economy

Capital expenditure (capex) plays a pivotal role in economic development by creating productive assets like roads, factories, power plants, and telecom infrastructure. It boosts employment, enhances industrial output, and attracts foreign investment. Government-led capex often crowds in private investment, triggering a multiplier effect on GDP growth.

Rising capex signals long-term confidence and lays the foundation for future consumption, innovation, and global competitiveness. During an upcycle, sectors like construction, cement, steel, and capital goods witness higher demand, fueling broader economic momentum. Ultimately, sustained capex is vital for infrastructure creation, capacity expansion, and driving inclusive, sustainable national growth.

For a Company

For a company, capex is essential to build, upgrade, or modernize fixed assets like plants, equipment, and technology, enabling increased production capacity and operational efficiency. Strategic capital investment helps firms meet future demand, reduce costs, improve quality, and stay competitive.

In growth industries, capex reflects confidence in long-term scalability and business expansion. Properly deployed capex enhances revenue visibility, improves asset utilization, and boosts shareholder value. Over time, disciplined capex can build economic moats, strengthen supply chains, and reinforce a company’s leadership in its sector.

3. Macro View of Capex

A. Public Infrastructure Investments

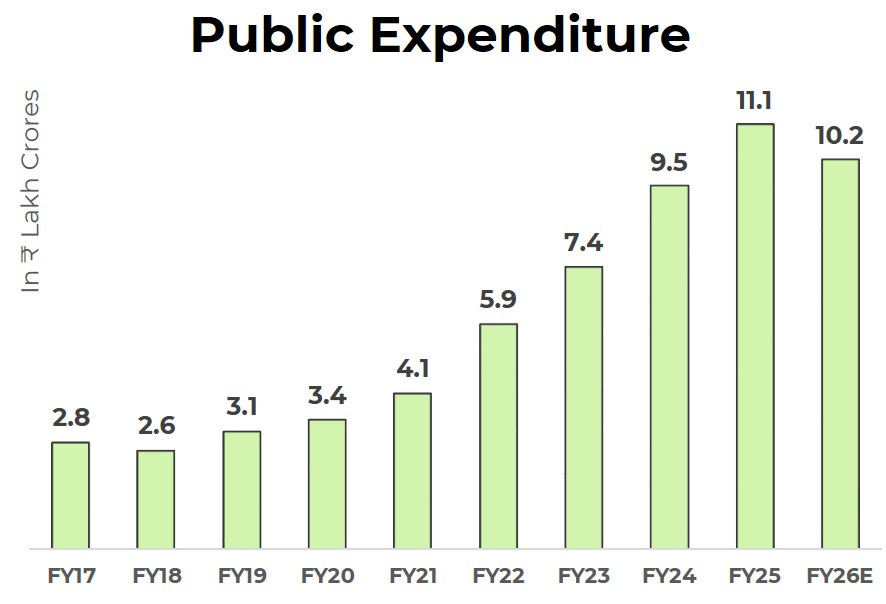

India is entering a high-growth capex cycle, supported by both public infrastructure investments and a rising wave of private sector spending. According to ministry of Finance, Union Budget 25 has allocated the capital expenditure of 10.18 lakh crore towards capital expenditure (Capex) to promote economic growth. This capex marks an 8.4% decrease from the last year's capex of 11.21 lakh crore.

Here’s the Trend in Government/Public Capital Expenditure.

India's capital expenditure fell by 12.3% year-on-year during April-November, impacted by general elections in the first quarter and heavy rains afterward. Several major government departments, including telecommunications, defense, railways, and highways, fell short of their planned spending targets during the first eight months of the current fiscal year (April-November), according to data from the Controller General of Accounts. This underutilization of funds coincides with a slowdown.

The government has restricted growth in public spending to stick to fiscal consolidation, even as a big push in capex is crucial for India’s growth dreams to become the third largest economy in the world and create ample jobs. However, the

increase in capex is still sizeable since it comes on a high base.

B. Private Infrastructure Investments

Private capex refers to investments undertaken by companies or private entities in creating or expanding physical assets such as manufacturing plants, machinery, data centers, warehouses, and infrastructure. It reflects confidence in demand outlook and typically leads to long-term productivity, employment generation, and economic growth.

Private capital expenditure (capex) is again becoming a significant driver of India’s investment and economic cycle. After years of underwhelming private sector investment due to corporate deleveraging, pandemic-induced uncertainty, and weak demand, the tide seems to be turning, supported by strong balance sheets, policy support, and strategic capacity expansions.

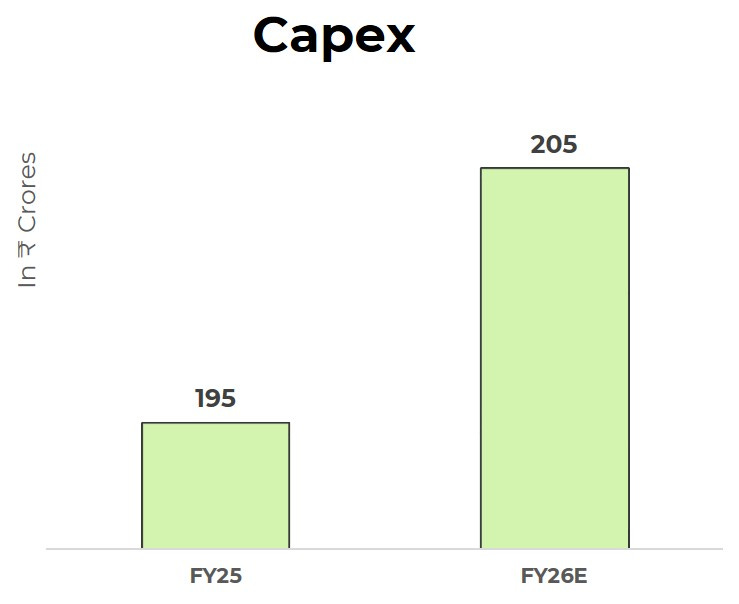

MoSPI’s inaugural Forward‑Looking Survey covers 2,172 private corporate firms across sectors and reveals. From FY22 to FY25, private sector capex surged by 66.3%, rising from ₹3.95 lakh crore to ₹6.56 lakh crore.

Here’s the Trend in Private Capital Expenditure.

C. What Triggered the Boom?

Key drivers include clean corporate balance sheets post-COVID, enabling companies to fund capex internally (even as credit growth lagged). Government incentives like PLI schemes in electronics, semiconductor, renewables, and infrastructure’s Gati Shakti unlocked demand for private investment. Finance Minister Nirmala Sitharaman emphasised capex as India’s primary growth driver in FY26 budget outline.

Multiplier Effect: The budget multiplier, or fiscal multiplier, measures how much real GDP increases in response to an increase in government spending, particularly capital outlays or public investment. According to National Institute of Public Finance & Policy (NIPFP) study, capital expenditure carries a strong fiscal multiplier in India. 1 rupee of capex could generate ₹2.45 in output in the short term, and even more over the years.

Thus, both public and private capex generate cascading demand across industries from capital goods to labor and services.

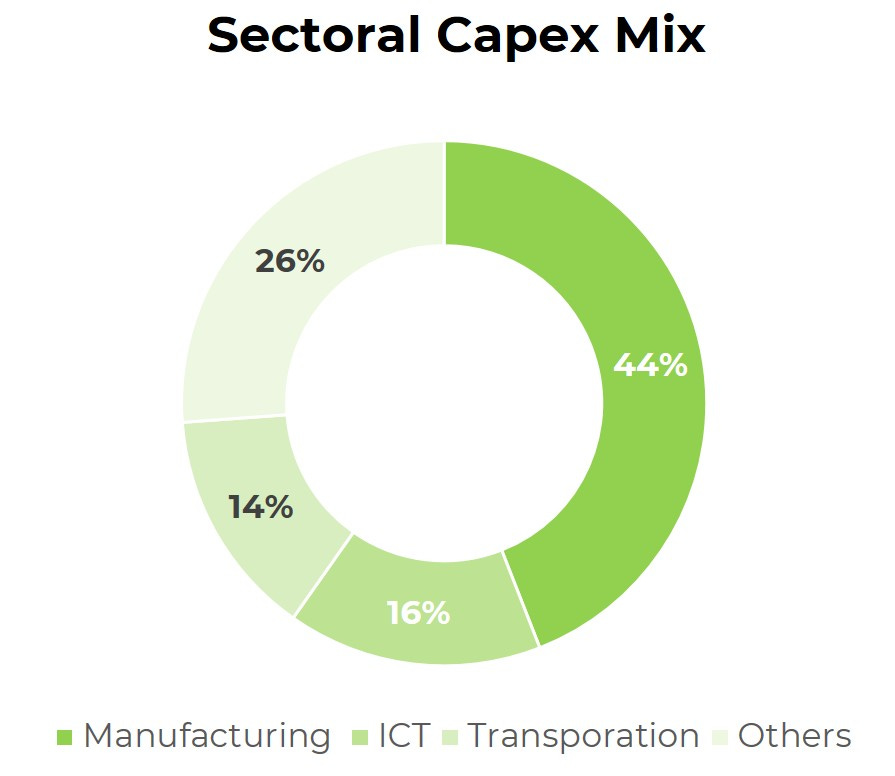

4. Sectoral Capex Overview

According to the MoSPI forward-looking survey for FY2024–25, the manufacturing sector leads capex plans, accounting for 43.8% of total intended private capital spending . This dominance reflects a shift toward capacity expansion in areas such as electronics manufacturing, consumer goods, machinery, autos, and food processing.

The Information & Communication Technology (ICT) space forms the second-largest segment at 15.6%, with investments focusing on data centre expansions, telecom infrastructure upgrades, cloud computing, and AI-driven automation. India’s data centre capacity is expected to double from 950 MW in 2023 to 1,800 MW by 2026, necessitating approximately ₹50,000 crore in capex across hyperscale, edge, and cloud-linked facilities

Next, Transportation & Storage, including logistics infrastructure, warehousing, courier services, and freight terminals, makes up 14% of projected capex. While this segment saw a notable dip in FY26 intentions from ₹1.35 lakh crore in FY25 to ₹23,400 crore, it nonetheless remains crucial due to expanding e-commerce and logistics networks . Capital goods manufacturing, often seen as a barometer of broader capex momentum, has recorded a 23.6% YoY growth in order books during FY24, signaling revival in heavy machinery and infrastructure supply demand.

Other sectors such as energy (solar and renewables), petrochemicals, and aviation are repidly gaining traction via government and private investments, currently accounting for 26%. The power sector witnessed a 13% projected CAGR in infrastructure capex, while petrochemical investments are expected to reach $87 billion over the next decade . Likewise, capex in small private airports is projected to grow 50–60% annually in the next three years.

5. Key Capex done by 5 companies

There’s lot of companies doing significant Capex for Brownfield as well as Greenfield expansion. Here’s a list of 5 Small & Mid cap companies from 5 different industries doing significant capex for future growth and expansion.

1) Time Technoplast Ltd

Time Technoplast is a multinational conglomerate involved in the manufacturing of technology and innovation driven polymer & composite products.

Capex & Expansion Plan

In Q4 FY25, Time Technoplast disclosed a total capex upto ₹200 crore for FY26. About ₹80-85 crore, reengineering, automation for established products of the annual spend is slated for brownfield expansion enhancing capacities in composite and ₹122 crore for value-added products (IBC tanks, composite cylinders , new products CNG, LPG development product)

A core priority behind such big capex is expanding composite LPG and CNG cylinder manufacturing. When CNG expansion is coming up, where we are investing ₹125 crores, which almost ₹80-85 crores have been done, equipment is going to arrive in this current financial year and the separate plant will be ready. The company's existing capacity of CNG is 480 cascades and 600 cylinder cascades so the total is 1080 cascade. In terms of the cylinder it is 30,000 cylinders , which is going to be increased to 66,000 cylinders.

Also we are setting up one more subsidiary in Middle East, for the steel drum manufacturing “Time Ecotech”, the company indicated that it will be spending about ₹120 crores over a period of next 3-4 years and will be done on an internal accrual basis.

Additionally, ₹25 crore is allocated to ramp up IBC manufacturing in the Konkan region to meet rising demand. The company also plans to introduce hydrogen cylinders and composite fire extinguishers , aligning with its strategy to grow value-added product mix to 35% of revenues over the next 2–3 years . The capex will support this transition and is backed by a QIP authorization of ₹1,000 crore for future funding. Value added products grew by 15% in FY25 as compared to FY24, while established products grew by 7%.

Time Technoplast is also targeting full debt elimination by March 2026. To that effect, it has allocated credit toward loan repayment and optimizing working capital. Its operating cash flow has already reduced debt by ₹98 crore in FY25.

The capex is expected to drive margin expansion and strong growth momentum in industrial packaging and composite cylinder segments. The company’s focus remains to increase the share of value-added products in its revenue and improve margins.

2) Indo Farm Equipments Ltd

Incorporated in 1994, Indo Farm Equipment Limited engaging in manufacturing Tractors , Pick & Carry Cranes, and other harvesting equipment.

Capex & Expansion Plan

Our new manufacturing facility being set up is in progress. Well the expansion will significantly enhance our production capacity of pick and carry cranes by 3,600 numbers per annum. This reinforce our long term vision of becoming a major player in construction, equipment segment in line with our strategic growth plan. We are currently in the process of acquiring tower Crane technology. We have already signed the agreement for technology transfer the core manpower, for this vertical has already been on board and we are confident that this will add significant value to our construction equipment portfolio going forward. The new unit is designed to enhance the company's crane manufacturing capacity by 3,600 units annually, taking the total installed capacity to 4,880 units per year.

Indo Farm Equipment Limited is in the process of setting up a new manufacturing unit dedicated to the production of Pick & Carry Cranes. The facility is being established near its existing plant in Baddi, Himachal Pradesh, with an investment of ₹71.13 crore funded through the proceeds of its recent IPO. These ₹71.13 crore used in the plant and machinery only, the company has acquired earlier. The new unit is expected to become operational in Q3 of FY26 and is going to spend this whole amount by December, January.

3) Jupiter Life line Hospitals Ltd

Incorporated in 2007, Jupiter Life Line Hospitals Limited is a multi-specialty tertiary and quaternary healthcare provider in the Mumbai Metropolitan Area (MMR) and western region of India.

Capex & Expansion Plan

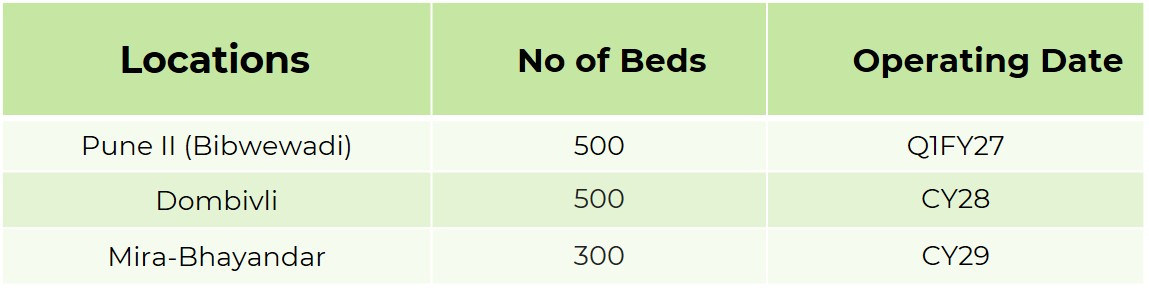

“In FY25, significant infrastructure upgrades were implemented at our Thane hospital through departmental restructuring. We now have visibility into a 2,500-bed network in our target region of Western India.

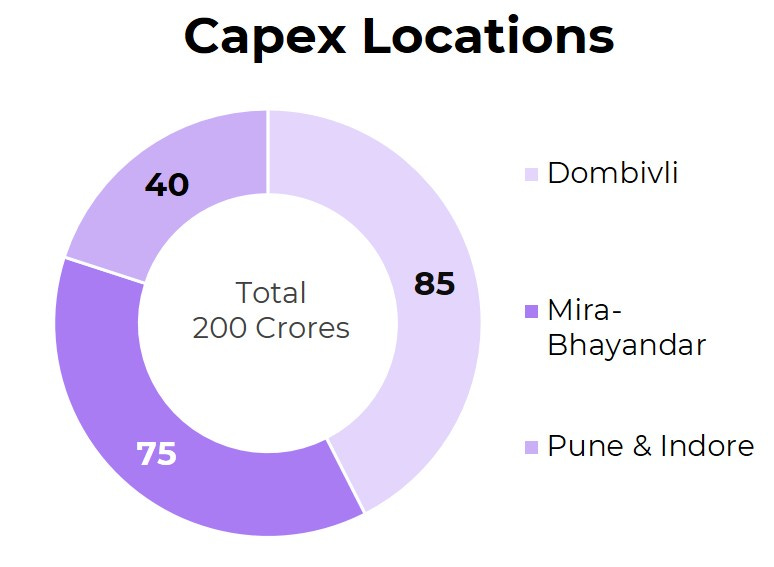

Dombivli Greenfield Expansion ₹85 cr

The 500-bed Dombivli hospital is expected to launch as planned in Q1FY27. The second Pune hospital, also with 500 beds, has received all building permissions and environmental clearances. Excavation work has commenced, and construction is expected to begin after the monsoon this year. Dombivli Hospital incurred a capital expenditure of ₹85 cr in FY25. Total expenditure to date, including land acquisition ₹165 cr.

Mira-Bhayandar Hospital land acquisition ₹75 cr

The land at Mira Road has been acquired; This will be our third hospital in the MMR. We plan to construct a 300-bed hospital there. Currently we are at the post-purchase regulatory stage of 7/12 updation, etc., and we will start working on the architectural drawings for that project shortly.

Brownfield Expansion (Pune I and Indore) of Beds of ₹40 cr

In Indore, we operationalised 78 additional beds starting January 1, 2025. Additionally, 11 ICU beds have been prepared for commissioning based on demand, enabling scalable critical care services. New Pune hospital is supposed to be 500 beds in size and is expected to be in operation from Q1FY27. We think that the capex incurred for that project should be somewhere in the tune of ₹500 crores excluding land.

The company's initial objective was to establish 2,500 beds and expand the hospitals networks from 3 to 6 hospitals. Company believes that they could achieve this milestone by leveraging their existing cash reserves and internal accruals. Jupiter Life line pleased to report that this first target of 2,500 beds in the Western India region is now within sight. Over the next 4, 5 years , as these hospitals become operational, we are confident that the operating cash flows generated should be sufficient to fund this capex and their ongoing operations. However, while 6 hospitals represented our initial target, they are certainly not the final destination. We are exploring some opportunities in addition to the above 6, which could be greenfield or in the form of an acquisition. With this in mind, we have raised additional debt to fund these new projects.

We have secured a sanction of ₹350 crores loan, which is earmarked for capex. Of this sanctioned amount, we have drawn ₹75 crores. We have the option to utilize the remaining ₹275 crores from this debt facility to fund our capex plans, which could be anywhere, Dombivli, Pune or something else. Jupiter Life line hospitals consider greenfield expansion as the first choice and open for both greenfield opportunities and an acquisition as long as the broad criteria that we have is met, Western India flagship and a logical capex plan.

4) Som Distilleries & Breweries Ltd

Incorporated in 1993, Som Distilleries & Breweries Ltd. is one of the leading alcoholic beverages manufacturers in India engaged in the manufacturing and sale of Beer and Indian Made Foreign Liquor (IMFL).

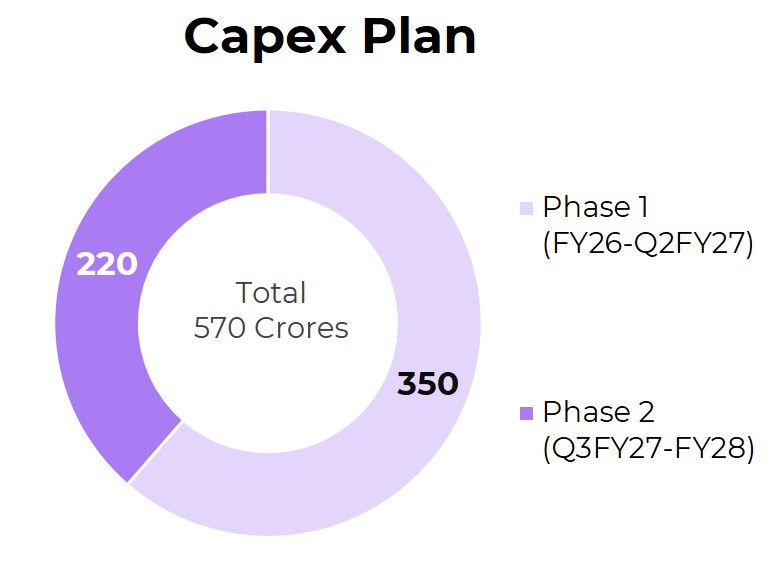

Capex & Expansion Plan

We completed capacity expansion in our Odisha plant, which is located in Cuttack to 90 lakh cases from the previous 60 lakh cases per year.

Key developments in the last year and last quarter was that we commenced construction of our ₹600 crore greenfield facility in Farrukhabad, UP with a capacity of about 10 lakh cases per month, under our subsidiary Woodpecker Greenagri Nutrients.

The project is divided into two phases:

Phase 1 required ₹350 crore capex and Phase 2 will require ₹200–225 crore (expected in FY27).

Sources of funds for the capex will be from Internal accruals and Term debt of ₹30-35 crore. Management confirmed they are not raising funds via QIP or other equity instruments.

For FY 26 the total capex planned is ₹150 crore out of that ₹40 crore already spent.

5) Kirloskar Ferrous

KFIL, incorporated in 1991, is a part of the Pune-based Kirloskar Group. KFIL manufactures pig iron and ferrous castings such as cylinder blocks, cylinder heads, and transmission parts and different types of housings required by automobile, tractor and diesel engine industries. It is one of the leading players in foundry-grade pig iron manufacturing and ferrous castings in the domestic market.

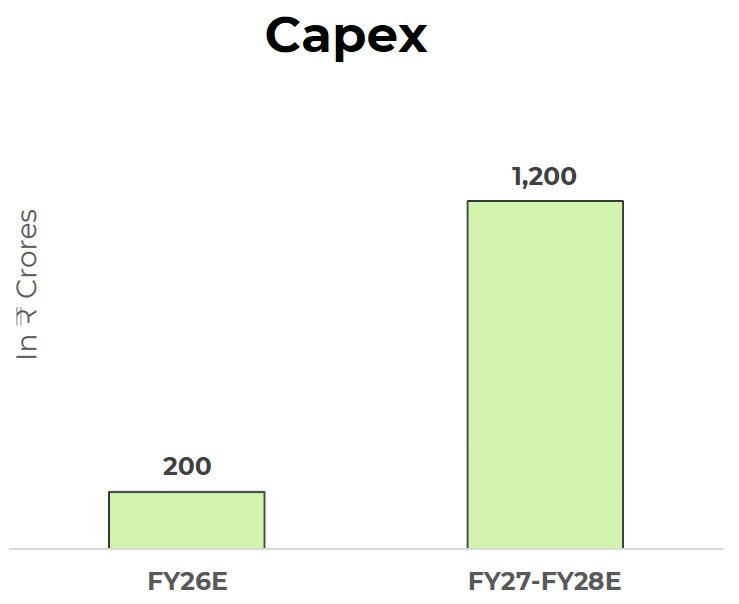

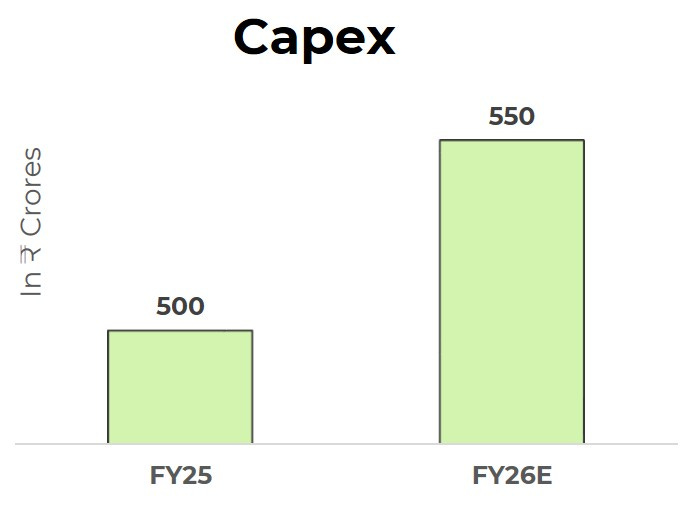

Capex & Expansion Plan

We have spent around ₹500 crores in FY25. Now for FY26-27, the major capex would be steel plants, solar and wind power and machine shop machines because we are setting up the machine shop in Oliver Rajpura also. And in addition to that, infrastructure development as well as de-bottle necking investments are there for each location. It all depends on how strong the business will continue, but we can expect the capex of the order of ₹500 crores to ₹600 crores even this year. “We have lined up for that in the area of cost reduction, in the area of productivity and production increase, in the area of de-bottle necking”. All areas prioritised projects have been taken.

The company has already identified and initiated key projects across these focus areas. These include:

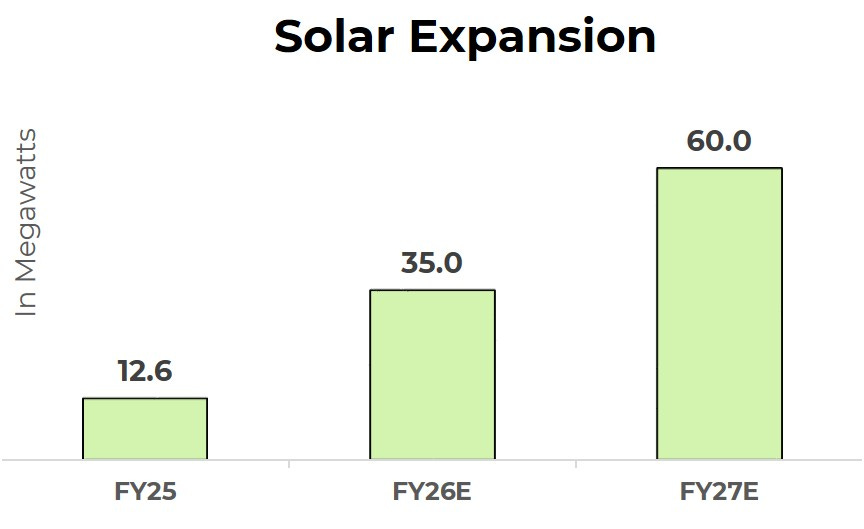

Expansion of renewable energy capacity (solar and wind): I think the quick answer is solar power plant, we have got a benefit of about ₹40 crores last year. This year, we expect it to give us benefit of total ₹80 crores. So another ₹40 crores more in this year. Company is looking for 12.6 megawatt of wind and it produces at least double of solar and 35 megawatts of solar. For FY27 could be another 50 to 60 megawatts of solar. It also depends on government policies.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."