Built for Visibility: A Tier-1 Titan You’ve Never Heard Of

Trusted by top auto OEMs, this player is driving the shift from halogen to LED with scale, tech, and localization at its core.

“From Lights to Leverage: Lumax Auto’s Journey to Tier 0.5”

With a legacy spanning 8 decades and a future aimed at digitized, clean mobility, Lumax Auto Technologies isn’t just building auto components—it’s building the future of Indian automotive integration.

OVERVIEW

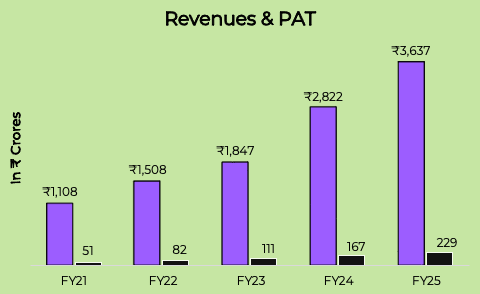

Lumax Auto Technologies Ltd. (LATL), part of the iconic Lumax-DK Jain Group, has transformed over the last 20 years from a lighting solutions provider into a comprehensive auto component powerhouse. Today, the company operates across 13+ product lines and partners with leading OEMs across Passenger Vehicles (PV), 2/3 Wheelers, CVs, and the aftermarket. FY25 revenue hit an all-time high of ₹3,637 Cr, driven by product diversification, strategic acquisitions (IAC India, Greenfuel), and innovation in clean and connected mobility.

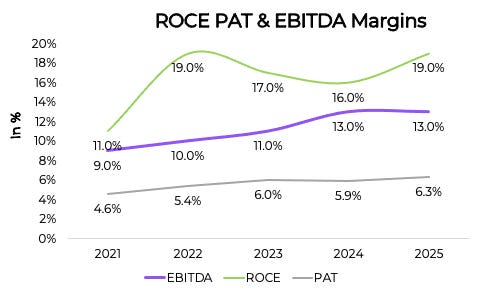

With its NorthStar strategy (20.20.20.20), Lumax aims for 20%+ revenue from clean mobility, 20% EBITDA margin, 20%+ ROCE, and 20% CAGR over the next six years under the bold "BRIDGE" transformation.

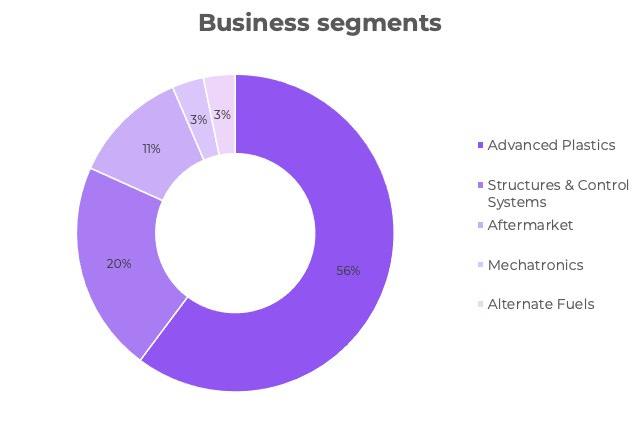

BUSINESS SEGMENTS

Lumax Auto operates across five core verticals, each contributing strategically to its future-ready product portfolio and growth trajectory.

1. Advanced Plastics (~₹2,036 Cr):

The largest contributor, supplying cockpits, door trims, tanks, panels, and headliners. Benefiting from premiumization in PV, and strong OEM traction across EV and ICE platforms, this vertical saw robust growth and leads the long-term content-up theme.

2. Mechatronics(~₹109 Cr):

Includes tech-driven products such as telematics units, sensors, antennas, and power window switches. Though a smaller slice (3%), this vertical is among the fastest-growing—reporting ~80% growth in FY25—and a strategic stepping stone into software-defined vehicle tech.

3. Structures & Control Systems (~₹727 Cr):

Produces critical mechanical systems including gear shifters, seat structures, shift towers, and smart actuators. As a core traditional business with stable 8–10% growth, it underpins Lumax’s OEM dependability in internal combustion and electric platforms alike.

4. Alternate Fuels (~₹109 Cr):

Through Greenfuel Energy, this high-margin, asset-light vertical focuses on CNG/hydrogen kits. Though nascent, it already contributes ~₹109 Cr and is poised to expand rapidly, with pipeline FY26 revenue projections nearing ₹300–350 Cr.

5. Aftermarket (~₹400 Cr):

Delivered 10% Q4 YoY growth—its first double-digit jump. With refreshed SKUs and enhanced go-to-market focus, this engineered growth revival supports margin improvement and offers resilience beyond OEM cycles.

ORDER BOOK & CLIENT CONCENTRATION

Lumax Auto holds a healthy ₹1,300 Cr order book with execution visibility spread across FY26 (26%), FY27 (42%), and FY28 (32%). A major portion stems from new model wins rather than replacements—indicating rising content per vehicle and stronger OEM integration.

On the client side, Mahindra & Mahindra remains a key contributor, especially through IAC India’s cockpit and panel business. However, the company services a wide base including Maruti Suzuki, Tata Motors, Honda, Bajaj, Daimler, and Skoda VW. With strategic efforts underway to deepen engagement with Tata and Maruti, along with growth in aftermarket and alt-fuels, client concentration risk is gradually being diluted.

CAPACITY, CAPEX & FUNDING

Lumax Auto operates across 30+ manufacturing facilities in India, strategically located near major OEM hubs. These plants support high-volume production of plastic components, mechatronic assemblies, and control systems. IAC India also added two new BEV-focused plants in Chakan to cater to Mahindra’s EV platforms (BE6 & XEV9e).

In FY25, the company incurred ₹177 Cr in capex, which included SOP-related tooling, plant upgrades, and ₹30 Cr toward land acquisition in Kharkhoda, Haryana. The planned FY26 capex is ₹175–200 Cr, largely allocated toward expanding clean mobility infrastructure, tech integration for software-defined vehicles (SHIFT), and building land banks for future scalability.

The capex was funded through a mix of internal accruals and long-term debt, primarily to support strategic acquisitions (IAC & Greenfuel). As of March 2025, long-term debt stood at ₹458 Cr, keeping the debt-to-equity ratio comfortable at 0.49x. With ₹322 Cr in free cash and strong operating cash flows, Lumax remains well-capitalized for its aggressive growth roadmap.

FINANCIALS

Competitive Positioning

While peers like Motherson and Uno Minda dominate in scale, Lumax Auto stands out for its focused diversification across premium plastics, mechatronics, and clean mobility—without diluting capital efficiency. Unlike larger players chasing high-volume commoditized parts, Lumax has built niche depth with higher-margin segments like cockpits, telematics, and alt-fuels. Its strategic shift toward Tier-0.5 integration—offering full cockpit modules, not just parts—positions it uniquely in India’s fast-premiumizing PV market.

JV Ecosystem Advantage

Lumax’s strength lies in its global JV-led innovation engine, which includes names like Alps Alpine, Yokowo, Cornaglia, and Ituran. These alliances bring IP-rich tech, platform-ready components, and co-development capabilities—giving Lumax speed and credibility with top OEMs. Products like antennas, BCMs, and connected telematics are rolled out faster, with world-class standards, allowing it to win future-ready orders even before full domestic adoption takes place.

EV & SDV Alignment

Unlike suppliers exposed to ICE obsolescence, Lumax is EV-agnostic—its product lines (cockpits, trims, electronics) work seamlessly across ICE and EVs. With 20% revenue targeted from clean mobility by FY31 (up from 6% in FY25), and the launch of SHIFT (Smart Hub for Innovation & Future Trends) to lead software-defined vehicle development, Lumax is well-aligned with the auto industry’s transition to electric and intelligent platforms without risking near-term volumes.

Margin Expansion Levers

Multiple levers support Lumax’s push toward its 20% EBITDA goal: the scaling of high-margin businesses like Greenfuel (22% EBITDA), rapid growth in mechatronics, and rising content per vehicle—especially with full cockpit systems. Integration of IAC also improves fixed cost absorption. The real kicker? The company’s shift from component maker to system integrator enables better pricing, stickier OEM relationships, and reduced competition on cost alone.

FUTURE OUTLOOK & SCOPE

Lumax Auto is entering a transformative growth phase, targeting ₹10,860 Cr in revenue by FY31 with a minimum 20% CAGR. The roadmap is anchored in four levers: expanding content per vehicle, full-scale cockpit integration, clean mobility (CNG, hydrogen, EVs), and software-driven components like telematics and BCMs.

With strategic tailwinds from India’s EV push, premiumization, and regulatory ADAS adoption, Lumax’s product mix is becoming more relevant—and margin-accretive. The company’s Tier-0.5 evolution, backed by JVs, R&D investments, and a sharp capex playbook, positions it to not just ride the auto upcycle but define its digital, sustainable next chapter.

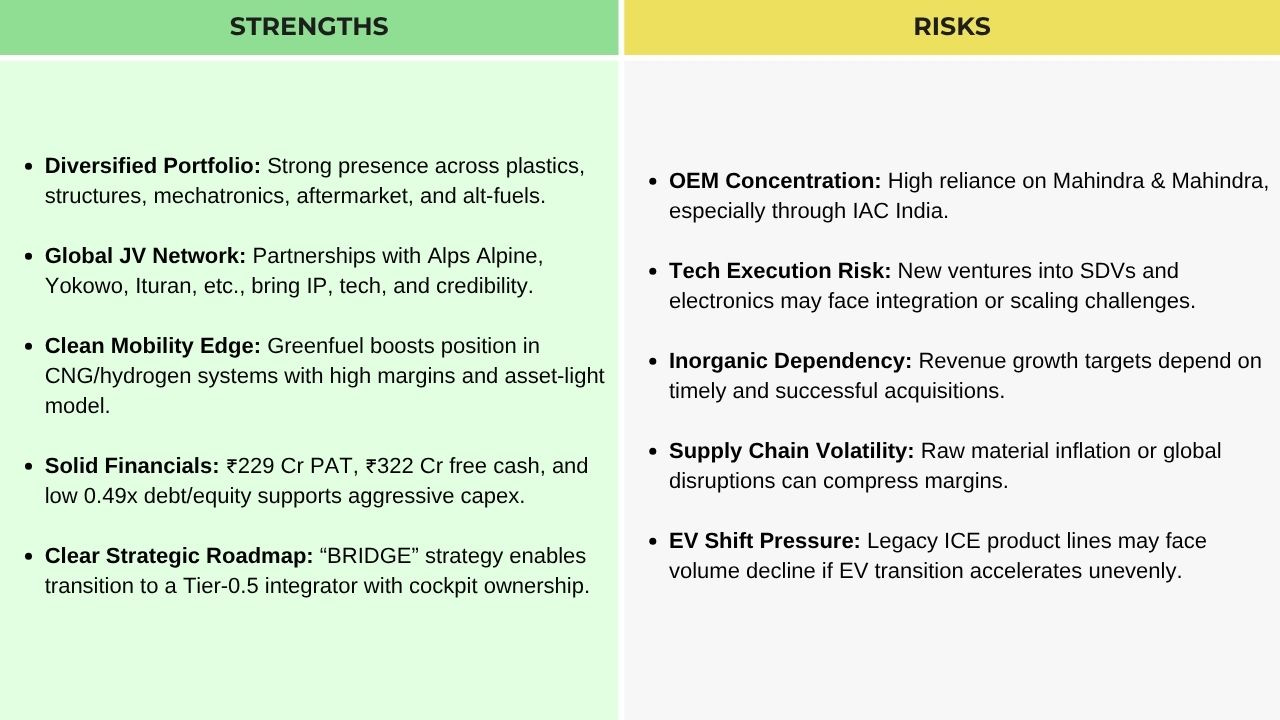

RISKS & STRENGTHS

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."