Brewing a Bold Future

Sourcing local molasses and Indian oak, this boutique spirit maker balances heritage‑driven craftsmanship with nimble operations and high ROI.

SDBL: Brewing a Bold Future : Volume Gains, Margin Stability & ₹600 Cr Greenfield Ambition

s

Overview

Som Distilleries & Breweries Ltd. (SDBL) is one of India’s fastest-growing alcoholic beverage companies, based in Bhopal. It manufactures beer and IMFL under popular brands like Hunter, Power Cool, Black Fort, and the newly launched Legend. With over 245 lakh cases sold in FY25, it’s among the top 2 beer players in Jharkhand and MP, and a strong contender in Karnataka, Odisha, and Delhi.

SDBL is expanding aggressively:

Commissioned a ₹600 Cr greenfield project in UP (via 100% subsidiary).

Expanded Odisha plant to 90 lakh cases/year.

Entered Tamil Nadu via Karnataka plant.

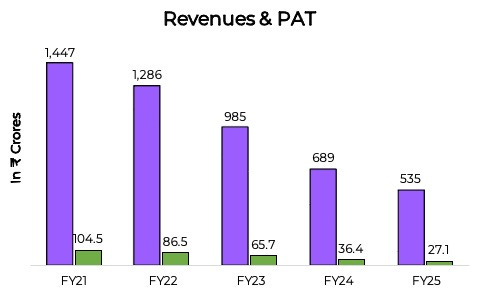

With FY25 revenue at ₹1,447 Cr (+13% YoY) and PAT at ₹104 Cr (+21% YoY), SDBL is scaling rapidly while maintaining strong margins and low leverage.

Business segments

Beer segment:

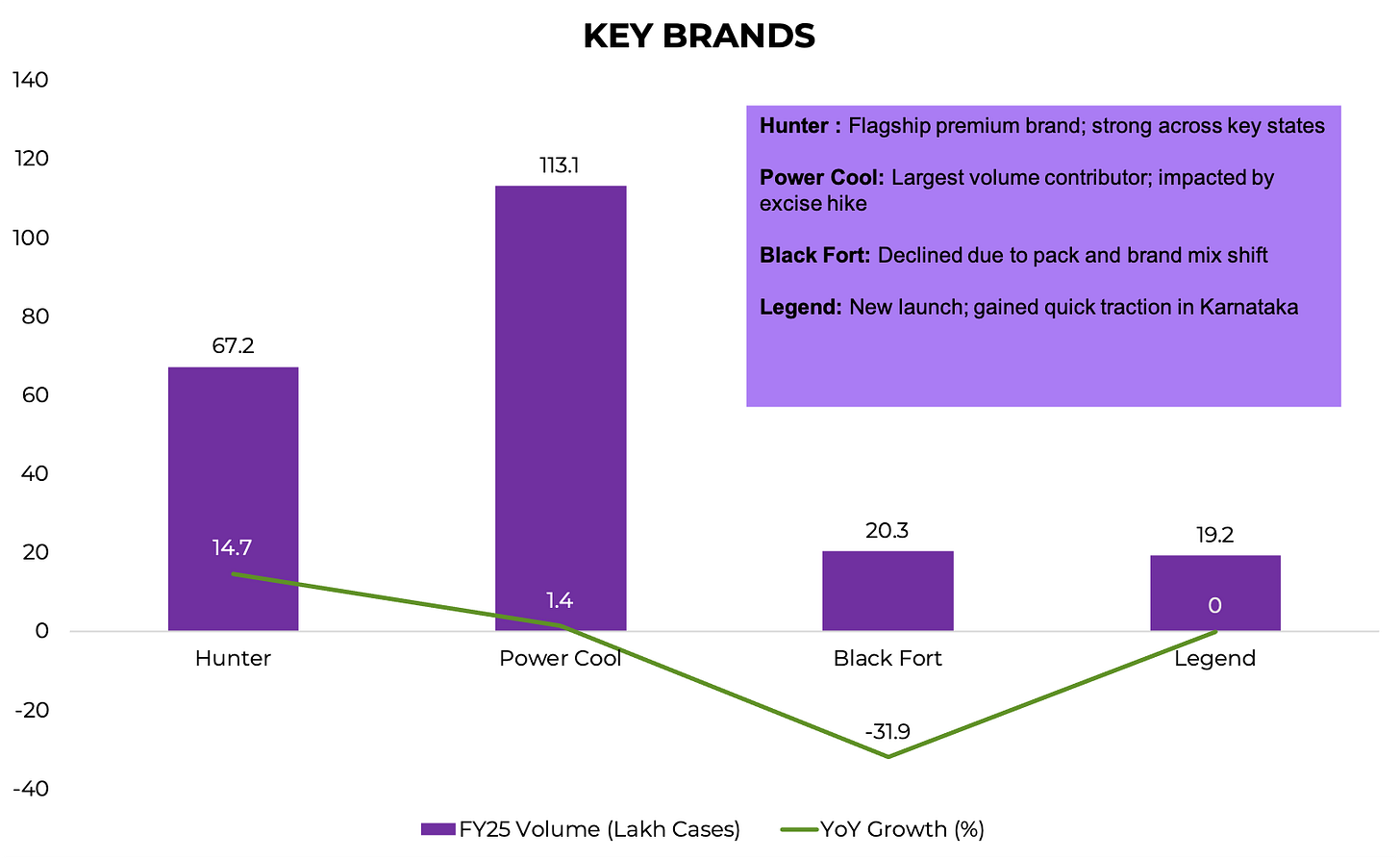

The beer segment is Som Distilleries’ core business and accounts for nearly 95% of total volumes and around 89% of revenue. In FY25, beer volumes stood at 234.4 lakh cases, registering a solid 10% year-on-year growth. The segment’s performance was led by flagship brands like Hunter, which grew 14.7% YoY, and the newly launched Legend, which quickly scaled to 19.2 lakh cases. While Power Cool faced temporary volume pressure due to excise duty hikes in Karnataka, the overall beer portfolio remained resilient. Average realization for beer during Q4 FY25 was ₹534 per case, slightly lower due to brand and pack mix shifts.

Indian Made Foreign Liquor segment:

The IMFL (Indian Made Foreign Liquor) segment continued its upward trajectory with 11.4 lakh cases sold in FY25, marking a 14% YoY growth. This growth was supported by a richer product mix and improved presence in core states. The company focused on refining its IMFL portfolio and pricing strategy, achieving a strong realization of ₹991 per case in Q4 FY25, up from ₹914 YoY. Although smaller than beer in terms of volume, the IMFL business is strategically important for portfolio diversification and margin enhancement.

Key Brands

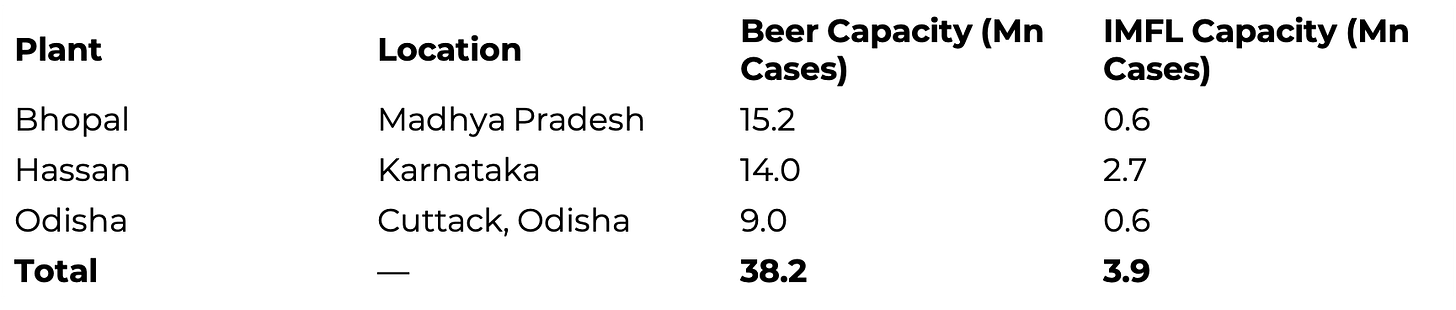

Capex & Capacity

Som Distilleries is investing ₹600 crore in a phased greenfield project in Farrukhabad, Uttar Pradesh through its 100% subsidiary, Woodpecker Greenagri Nutrients. Phase 1 involves ₹350 crore, with ₹150 crore to be spent in FY26 and the rest spilling into FY27; ₹40 crore has already been spent. Phase 2 will add another ₹200–225 crore in FY27. The project will create a capacity of ~10 million beer cases annually and will be funded through internal accruals and term debt, with no equity dilution planned

Financials

Orderbook

Som Distilleries doesn’t follow a traditional order book model, but its strong volume growth and state-wise expansion offer solid demand visibility. In FY25, total volumes reached 245.8 lakh cases, up 9.7% YoY, with a sharp 32% dispatch growth from the Bhopal plant in April 2025. The company holds leading positions in MP, Jharkhand, and Delhi, and entered Tamil Nadu in FY25 via its Hassan plant. It expects to capture 7–8% market share in new states within 1–3 years. Backed by expanding capacity and product demand, FY26 volume growth is guided at ~18%, with 20–22% revenue growth.

Future Outlook

Som Distilleries expects 18% volume and 20–22% revenue growth in FY26, driven by expansion into new states like Uttar Pradesh and Tamil Nadu, along with ramp-up at the Odisha plant. However, the company faced pressure in Q4 FY25—revenue declined 12% YoY and beer volumes dropped 10%, mainly due to steep excise hikes in Karnataka, which impacted their largest brand, Power Cool.

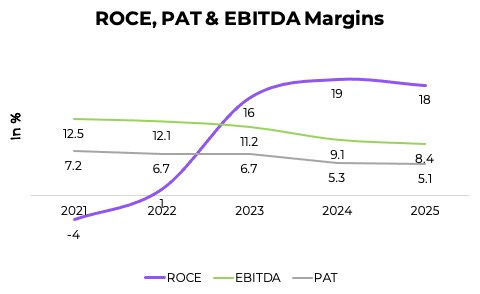

Management clarified that this was a temporary issue, and the excise duty was rolled back in May 2025. They’ve also taken price hikes in multiple states (Odisha, Karnataka, Kerala) to protect margins. Additionally, they’re focusing on improving product mix (more premium sales) and tight cost control, with gross margins remaining stable despite lower volumes.

On the financial side, the company remains disciplined—capex is funded via internal accruals and term loans, with no equity dilution. With margin recovery expected, higher utilisation of expanded plants, and entry into new markets, SDBL aims to stabilize performance and resume its upward growth trajectory in FY26.

Risk & Strength

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.

We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."

Thanks for sharing these insights