BAHETI RECYCLING: From Scrap to Ingots

Transforming Aluminium Waste into Industrial Raw Materials

Business Overview

On a hot afternoon in Dehgam, a forklift eases a bale of dull scrap toward a glowing furnace. Minutes later, gleaming alloy ingots cool in neat rows yesterday’s waste, today’s raw material. That alchemy is BRIL’s everyday rhythm: taking aluminium-based scrap and turning it into two workhorse products: aluminium alloy ingots for castings and aluminium de-oxidizer (de-ox) for steelmaking.

Incorporated in 1994 and currently serving in 25 states in India, the company supplies auto ancillaries, die-casters, electrical component makers and steel mills from a single integrated location in Gujarat. Recent presentations highlight a steadily expanded installed capacity and a focus on quality systems (spectro analysis, tensile tests, K-mold, vacuum tests) to keep composition tight and melt losses low. Management frames growth around better yields, product mix and technology upgrades rather than sheer tonnage.

The company positions itself as a processor that turns heterogeneous scrap into specification-grade inputs for customers in automobiles, engineering castings, and steelmaking, operating from its manufacturing base at Dehgam, Gujarat. Product pages and corporate materials consistently emphasise this dual focus on alloy ingots for castings and de-ox forms for steel furnaces.

Business Model

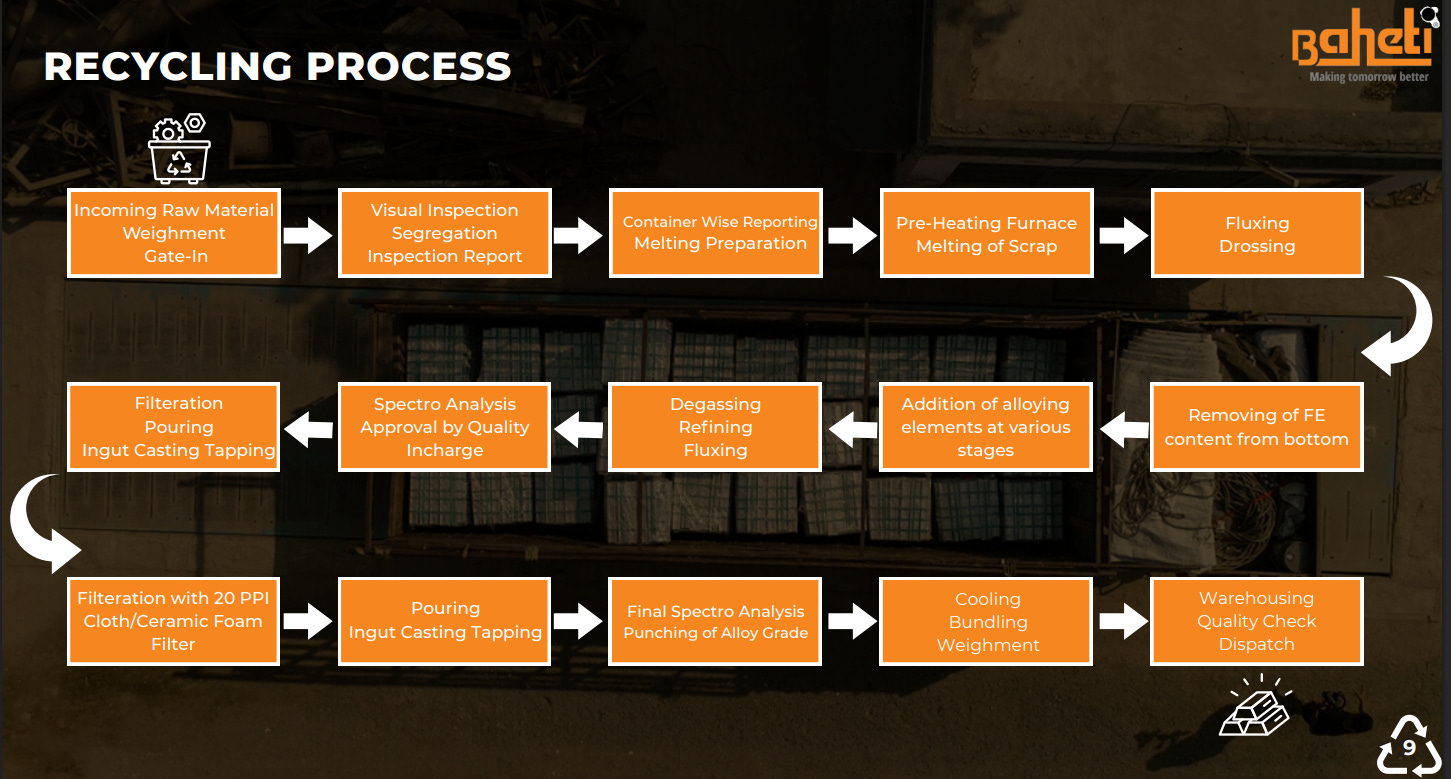

1) Scrap-to-Alloy Conversion at Scale: BRIL procures aluminium scrap, sorts/charges it into rotary, tilting-rotary and electric furnaces, refines the melt, and casts alloy ingots and de-ox forms (cubes, shots, notch bars). Quality gates spectro, vacuum, K-mold, tensile and microstructure are embedded through the line to meet automotive and steel-grade specs.

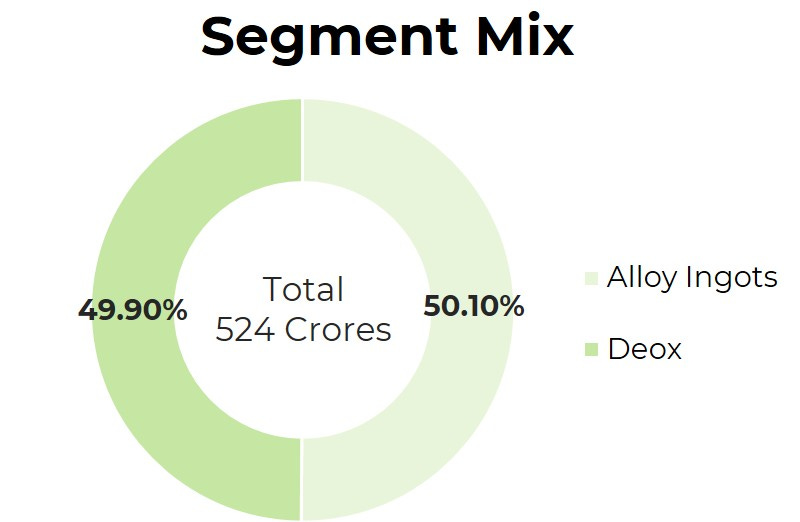

2) Two Product Streams, Two End-Markets

• Alloy ingots serve die-casting and auto components;

• Aluminium de-ox serves steelmakers as a deoxidizer.

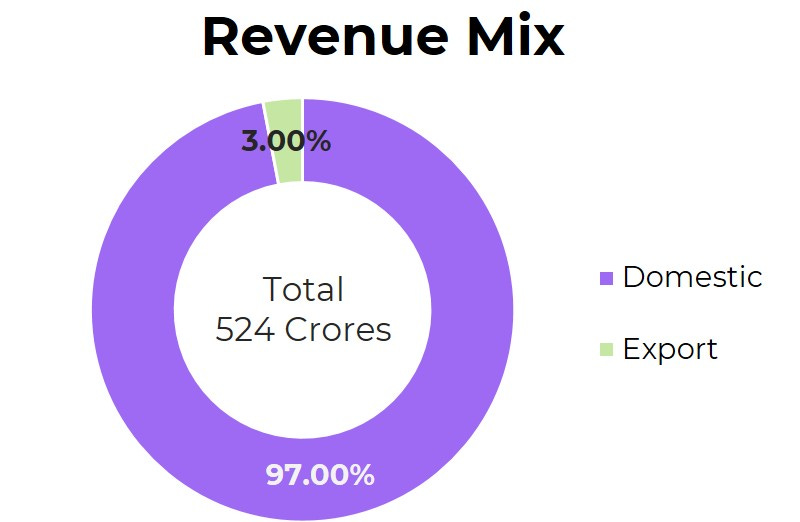

The split is balanced (FY25 revenue 50.1% alloy/49.9% de-ox), allowing BRIL to ride different demand cycles.

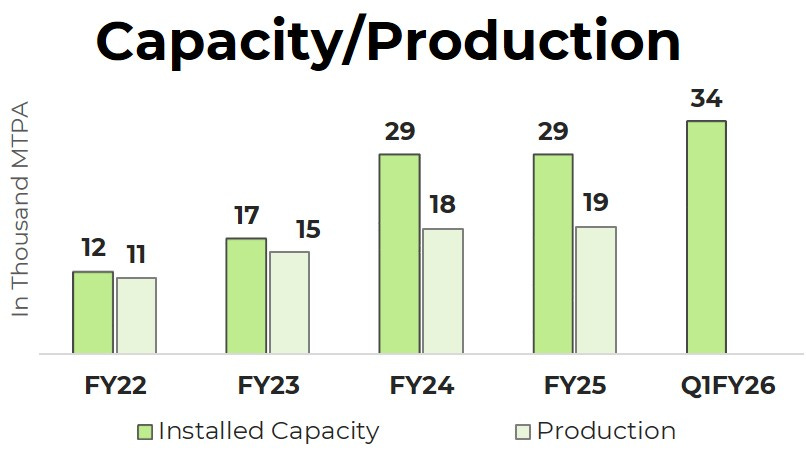

3) Utilisation-Led Operating Leverage & Yield Focus: Installed capacity was scaled to 29,160 MTPA, with management emphasising yield gains from newer furnaces and process modernisation. On the FY25 call, they discussed additional furnaces, dual-fuel flexibility (PNG/oil), and trials with biodegradable fuel to lower melt costs and emissions all aimed at lifting margins without disproportionate capex.

4) Customer Stickiness & Mix: The company serves 150+ customers, with the top ten contributing a large share; the pitch is on-time delivery, custom alloys and logistics reliability, which helps repeat ordering in both domestic and (smaller) export channels.

Product Segment

Aluminium Alloy Ingots: Custom compositions (e.g., Al-Si, Al-Mg series) cast as standard ingots for die-casting of housings, auto parts and electrical components. FY20–FY24 production rose from 3,587 MT to 11,576 MT as the capacity base expanded; testing infrastructure targets chemistry consistency and inclusion control.

Aluminium De-Ox (De-oxidizer): Cubes, shots, notch bars and ingots tailored for steelmakers’ ladle metallurgy. These products prioritize controlled dissolution and cleanliness. Volumes increased from 4,701 MT (FY20) to 7,034 MT (FY25). The de-ox stream offers a demand hedge when auto casting slows, and vice-versa.

Manufacturing Unit & Operations

Location & Works: BRIL operates from Shrinath Industrial Estate, Post-Sampa, Taluka Dehgam, District Gandhinagar (Gujarat) with registered office in Ahmedabad. Concentrating operations at one campus simplifies logistics, raw-material handling and lab oversight.

Installed Capacity & Assets: As of Q1FY26, installed capacity stood at 34,000 MTPA. The melt shop stack includes 3 rotary facilities, 8 furnaces (300 kg each), 7 electric furnaces (700 kg each), and TRF (tilting rotary & melting) 40 MTPD. Land area total of 5 acres (with 2.5 acres of idle), giving headroom for incremental assets.

Utilisation & Throughput: FY25 production totaled 18,160 MT, implying 64% utilisation on the expanded base. On the H2/FY25 call, management guided to 75–80% utilisation by year-end and noted that newer furnaces were driving yield improvements; they also discussed small, targeted capex to add another furnace set.

Energy & Process: The plant uses dual-fuel burners (PNG/oil) in parts, an electric furnace line in one shed, and has trialed biodegradable fuel on a smaller furnace with plans to extend if results continue to be positive measures intended to manage energy cost and emissions intensity.

People & Systems: The site runs with 450 employees (including 200+ contractual) and an in-house lab suite (spectro, vacuum, K-mold, tensile, microstructure), reflecting an operations model that tries to pair capacity with metallurgical control.

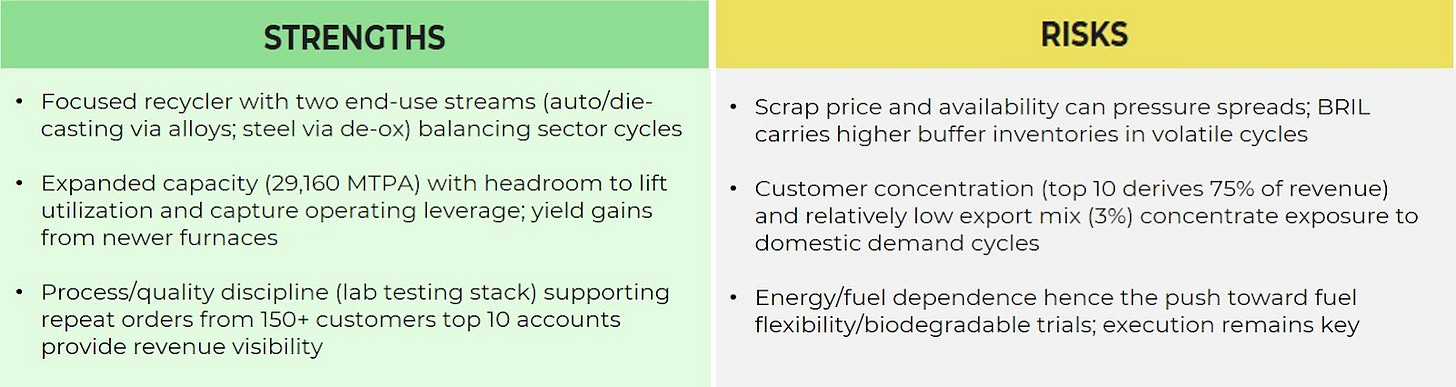

Strength & Risk

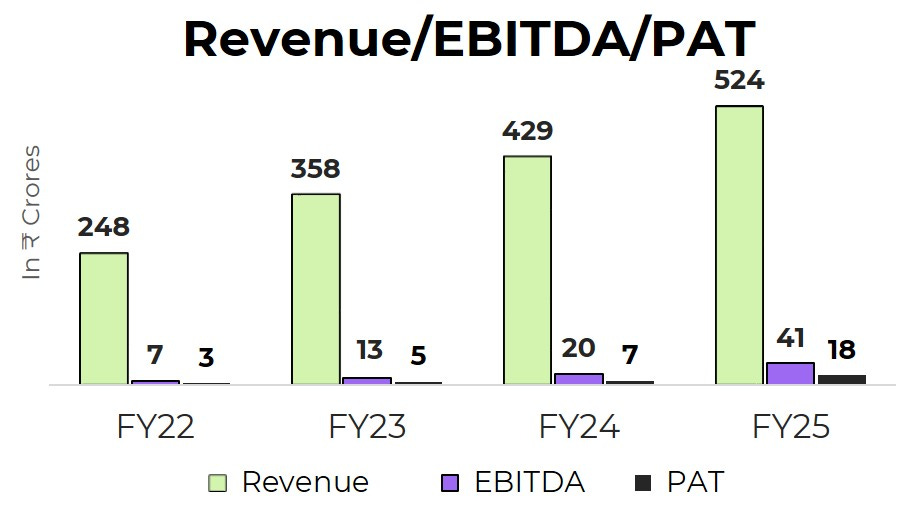

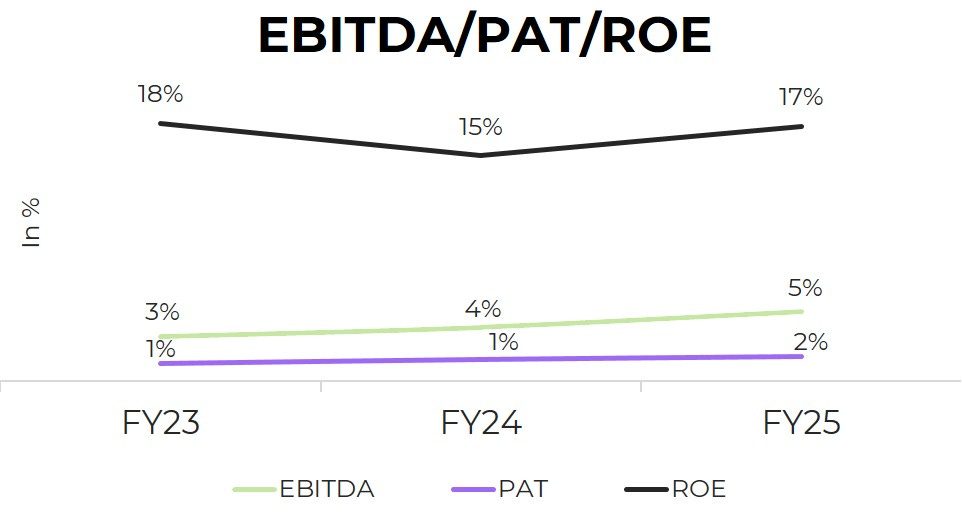

Financials

Future Outlook

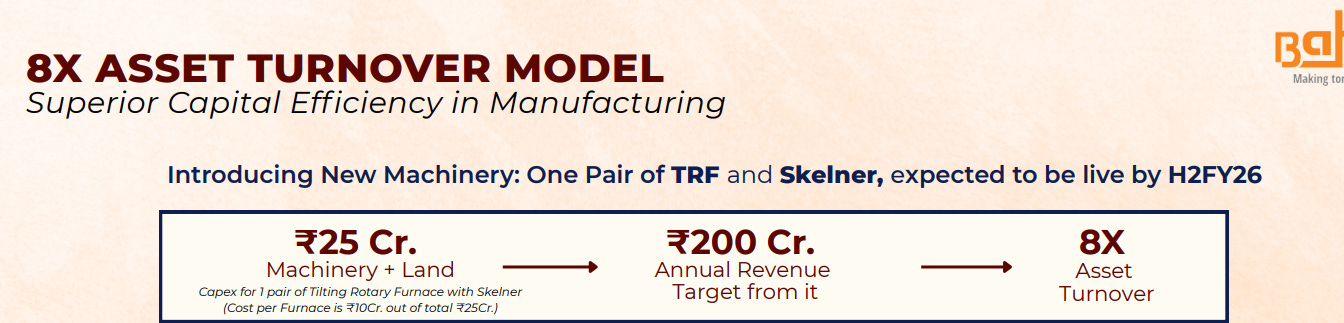

Introducing New Machinery:

Replacing traditional Rotary Furnaces with modern Tilting Rotary Furnaces + Skelners helps us with scaling capabilities and opens access to lucrative, high-margin revenue streams previously beyond our reach.

Our expansions target 80-90% utilization within 2 years for all our existing machines, with 1 TRF already operational, and second by H2FY26.

Advanced thermal technology reduces operational downtime and dependency on labour and better utilization of electricity.

Freehold Land Parcel available in our facility gives us an edge to add in more machinery at no additional expense.

CAPEX & Expansion

CAPEX of ₹10 Cr per furnace incurred to strengthen our manufacturing capabilities.

Strategic Brownfield Expansion: Replacing traditional Furnaces with pairs of modern TRFs boosting our production capabilities. Brownfield Expansion utilizes companies existing freehold spare land, eliminating land acquisition costs and enabling rapid capacity scaling with superior capital efficiency compared to greenfield projects.

Boosting Utilizations: Modernized furnaces and expanded capacity will significantly boost plant utilization and operational efficiency. Driving a new leg of growth through the strategic deployment of new machinery and optimizing existing asset utilization, ensuring superior operational efficiency and production capabilities.

Financials Outlook

“We are confidently positioned to reach a Revenue milestone of ₹1,100Cr by FY28”

Targeted Volume CAGR of 15-20% for the current year and for next 5 years.

Scaling up Cash Flows by optimizing operational efficiencies and accelerating revenue generation, thereby increasing our financial strength and liquidity for future investments.

Focusing on consistent inflow of orders, aiming sustainable to high margins, and using our better negotiation leverage and strength to drive growth.

Business & Segment Growth

Entered into new geographies of South India & European Countries including Hungary, Turkey, Germany, UK etc.

Achieving exponential business growth by aggressively expanding our market share within the automotive sector, alongside venturing into promising new industries to diversify our revenue streams.

Diversifying our Product Portfolio by addition of new products and verticals in our Core portfolio. This expansion helps us capture new market opportunities while leveraging our existing capabilities and expertise.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas.We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

"Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

"Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors."