Anlon Technology Solutions- India’s Airside Engineering Specialist in Its Breakout Year

How a quiet Bengaluru OEM integrator turned capability into confidence and confidence into forty percent plus growth

There are years a company pushes and then there are years when everything built in the background suddenly explodes into unison. For Anlon, the first half of FY26 wasn’t just a moment; it was the moment the factory, the supply chain, the OEM relationships, and the team finally moved like a single, coordinated machine.

Business Overview

Anlon Technology Solutions is an engineering company focused on airside safety, firefighting, rescue and high performance cleaning systems for airports and industrial clients. It began as an integrator but is steadily transforming into a Make in India producer of complex specialty vehicles and a refurbishment specialist with international grade capability. The Bengaluru platform created in FY25 is now delivering predictable throughput and unlocking margin expansion.

The company operates in a sector where reliability is not optional. Airports, automotive plants and refineries rely on equipment that must work at zero notice. Anlon’s advantage comes from its flexible build model, its long standing access to global OEM superstructures and its ability to localize chassis and systems engineering. This creates a mix of manufacturing, assembly, refurbishment and service revenue that compounds year after year.

H1 FY26 proved the commercial readiness of this platform. The company delivered a four runway rubber removal machine to Airports Authority of India, a multifunction foam mist vehicle to Maruti Suzuki, a rapid intervention vehicle to Trivandrum Airport and two major refurbishments for Delhi and Goa airports. Each delivery reinforced the brand and expanded the capability map for future tenders.

Business Model and Segments

1. Manufacturing and Assembly

This segment integrates imported superstructures from Europe and the United States with Indian chassis while adding localized mechanical, electrical and control systems. The model provides flexibility, lower cost of ownership and faster delivery for clients. Margins in this segment are targeted between fifteen and twenty five percent as scale increases.

2. Refurbishment and Life Extension

This is the fast rising strategic segment. Anlon takes ageing runway rubber removal machines and crash fire tenders and restores them to near OEM performance at a fraction of replacement cost. Successful projects for Delhi and Goa have triggered audits and interest from Nepal, Bhutan, Israel and selected European operators. This segment is margin accretive and builds long term credibility.

3. Services and Annual Maintenance Contracts

Every delivered machine becomes a long term relationship through maintenance contracts that begin immediately after handover. Service income reached over thirteen crore in H1 FY26 and grows ten to fifteen percent annually due to contractual escalations and fleet expansion. This forms the steady, compounding annuity of the business.

4. Trading of Specialized Imported Equipment

Anlon continues to supply certain fully built imported vehicles and personal protective equipment when operationally required by airports. This maintains OEM alignment and broadens the company’s catalogue.

Product Line Ups

Airport Ground Support:

Runway Rubber Removal Machines

Sweeping and Solid Waste Machines (through international tie-ups)

Emergency Response Vehicles (Fire & Rescue):

Crash Fire Tenders (new build and refurbished)

Rapid Intervention Vehicles

Multifunction Foam Mist and Foam Water Vehicles

Specialized Firefighting Trucks for industrial and petroleum clients

Aerial and Safety Platforms:

High Rise Rescue and Aerial Work Platforms

Personal Safety:

Personal Protective Equipment and Safety Systems for airside operations

Production Details

The Bengaluru manufacturing platform is structured around a just in time philosophy. OEM superstructures from Germany, Austria, Switzerland and the United States arrive in synchronized batches while chassis are integrated on the floor with localized components that range from thirty five to eighty five percent depending on the vehicle category. The facility can support seven vehicles in six weeks and scales naturally to fifty to sixty vehicles annually without redesigning the layout.

Assembly lines are arranged by functional flow rather than linear progression. Pre fabrication bays handle hydraulic systems and electrical harnessing while integration bays complete chassis mating and control panel testing. Every vehicle undergoes multi stage pressure testing, pump calibration, thermal performance checks and multi axle load balancing before dispatch. This has become a quiet competitive advantage because airports demand performance certification before release of final payment.

Refurbishment uses a parallel workflow. Legacy vehicles are stripped, inspected, rebuilt and re skinned with newer mechanical and electrical systems. The quality achieved in this workflow is what has drawn OEM audits and international attention. This is the part of the business that could become a moat.

Industry Overview

India is entering a deep multi year cycle of airport expansion. Eleven additional airports are lined up for privatization and every new airport requires firefighting, rescue, runway cleaning and maintenance assets. Industrial safety norms are tightening across automotive, petroleum, chemical and metro rail segments. International OEMs prefer partners who can provide localized integration without compromising certification requirements.

The Make in India thrust is shifting procurement preferences toward hybrid models where critical superstructures are imported but chassis and integration are domestic. This positions companies like Anlon at the center of a high trust, high reliability ecosystem. With rising focus on refurbishment and lifecycle cost optimization, operators increasingly seek value driven alternatives to full replacement.

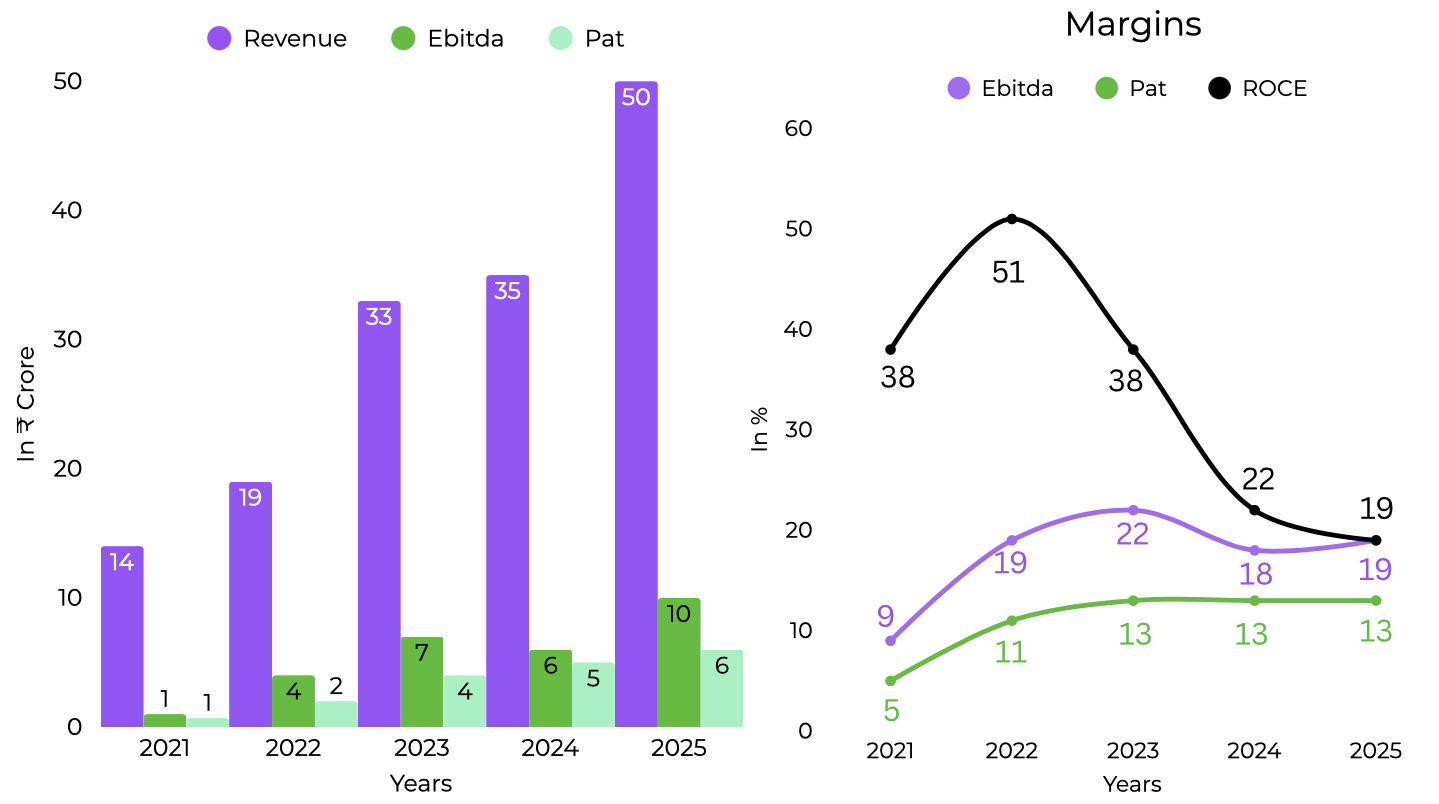

Financials

Capex

Capex remained disciplined. H1 FY26 involved a small office construction outlay of roughly one lakh and an investment of three point seven crore in demo and hire sweeping machines. The core manufacturing infrastructure created in FY25 is adequate for current scale. Future capex will focus on R and D capability, rented sheds for peak load and possible expansion into government allotted larger land.

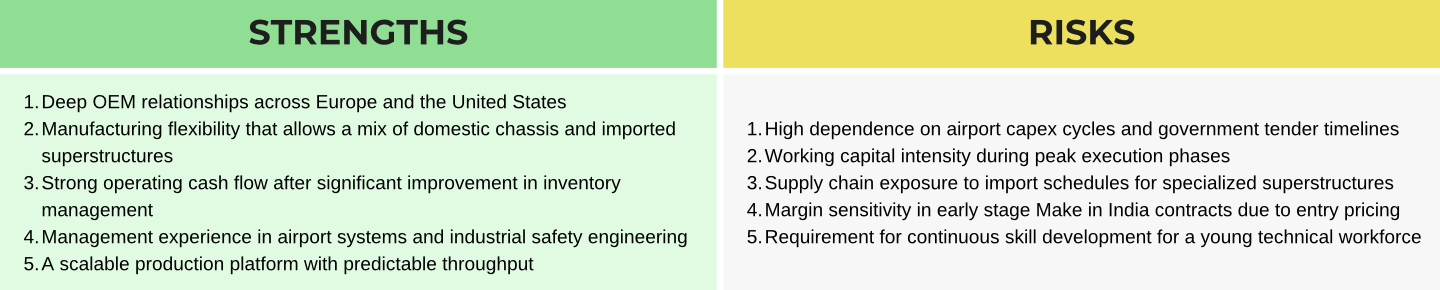

Risk & Strengths

Future Outlook

Financial Growth:

Targeting revenue growth exceeding forty percent for FY26, followed by thirty to thirty-five percent in FY27.

The current order book of ₹115 crore is set for execution, with ₹35-40 crore expected to be billed by March 2026.

Market and Business Expansion:

Refurbishment: Expanding the refurbishment pipeline, leveraging successful projects in Delhi and Goa, and securing incoming audits from Original Equipment Manufacturers (OEMs).

New Sectors: Strategic entry into new high-growth markets:

The petroleum sector.

The high-rise rescue market, utilizing specialized vehicle variants.

Services: Scaling the services division, anchored by the five-year operations and maintenance contract for the Noida airport.

Partnerships: Exploring a key partnership with Bucher Switzerland for solid waste solutions, aligning with ‘Swachh Bharat’ applications.

Operational and Debt Strategy:

Operational Shift: Gradually transitioning the existing facility into a dedicated research and competence center, with production capacity expanding into leased or government-provided facilities.

Working Capital: Selective utilization of debt for working capital is planned only until H1 FY27, coinciding with the maturation of the order book.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

“Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors.”