All e Technologies and the Quiet Build Toward an AI First Future

A Microsoft First Company Standing At The Edge Of An AI Inflection

There are quarters when a company grows loudly and there are quarters when the story grows quietly beneath the surface. For All e Technologies, Q2 and H1 of FY26 belong to the second kind. Revenue barely moves, yet margins stretch to leadership levels. Order decisions take longer, yet repeat and recurring business climbs above ninety percent. And while the world negotiates uncertainty, the company doubles down on something far more fundamental. It commits to reinventing every line of its business around data and artificial intelligence.

This is one of those phases when an organisation chooses reinvention over comfort. In the concall, management sounded less like they were defending a soft topline and more like they were preparing for a very different decade. That is the context in which this story unfolds.

Business overview

All e Technologies is a twenty five year old Microsoft native engineering and consulting partner. The company has grown into one of the most recognised names in the Microsoft ecosystem and is part of the exclusive Inner Circle for Microsoft Business Applications which places it among the top global partners. Its work sits at the centre of mission critical transformation for customers. These include cloud migrations, modernisation of legacy applications, building digital cores on Dynamics and Azure and designing data and artificial intelligence platforms that allow clients to move from transactional systems to predictive decision making.

The company’s revenue engine comes from two large streams. The first is project based professional services which include design, implementation, customisation and integration of enterprise grade systems. The second is the managed and recurring annuity business that flows from continued support, cloud consumption and multi year customer relationships. More than ninety percent of revenue in Q2 and H1 came from repeat or recurring engagements which shows both customer stickiness and long term contract depth.

What stands out this year is the customer geography split. Nearly sixty percent of services revenue comes from the Americas while India forms the next substantial block. Middle East, Africa and parts of Europe are small but growing territories. A healthy business distribution across manufacturing, professional services, retail, green energy and financial services keeps the company insulated from single industry shocks. All e Technologies has one more structural advantage. It operates as an asset light business with almost no debt and a very large cash position that nearly equals one third of its market capitalization.

Business model and segments

1. Digital core modernisation

This segment represents cloud migration and rebuilding old and fragmented systems into a unified digital core. It includes cloud adoption on Azure, refactoring legacy applications, strengthening collaboration platforms and setting up data pipelines. These projects usually form the foundation on which the next phase of transformation sits.

2. Enterprise applications

This is the largest services pillar around Microsoft Dynamics 365, Business Central, CRM, HCM and commerce applications. Customers come to All e Technologies to design and run their transactional backbone. For mid sized enterprises moving away from SAP or older ERPs, this segment is often the entry point.

3. Power Platform and process optimisation

The company builds low code applications, workflow automation and custom business apps using Microsoft’s Power Platform stack. This segment targets efficiency improvements, faster departmental digitisation and replacement of informal Excel driven operations with structured systems.

4. Data engineering and artificial intelligence

This is the fastest evolving area. The work includes setting up data platforms using Microsoft Fabric, creating predictive analytics, integrating copilots and building new intellectual property that embeds artificial intelligence inside vertical industry templates. The company expects this segment to define its next multi year growth curve.

5. Cybersecurity

A newer practice built on the Microsoft security stack. The team has closed initial small deals and is positioning itself for larger enterprise level mandates once its SOC 2 certification is completed.

6. Contact centre solutions

Built on Dynamics 365 based contact centre capabilities. The first Canadian customer is going live and the pipeline is beginning to build, although the application itself is a new Microsoft product that will mature over time.

Product line up

All e Technologies has developed a strong portfolio of industry-ready accelerators and frameworks, which are not standard off-the-shelf products. These intellectual properties are designed to significantly reduce project timelines and enhance predictability.

The company’s solutions span several key verticals:

Higher Education: Supports the complete student journey, from the initial admissions process through to ongoing alumni engagement.

Green Energy and Engineering Procurement Construction (EPC): A template for project-based organizations to manage multi-location deployments, including budget tracking and comprehensive asset management.

Manufacturing: Tailored for mid-sized industrial operations, this solution offers production planning, quality control, shop floor management, and end-to-end supply chain visibility.

Travel and Hospitality: Covers essential functions such as reservations, bookings, procurement, and vendor management.

Financial Services and BAFINS: Provides core capabilities for customer onboarding, relationship management, and regulatory compliance.

Currently, All e Technologies is focused on building the second generation of its IP across all these verticals, integrating native artificial intelligence layers into the design from the ground up.

Production and delivery engine

All e Technologies runs a distributed global delivery model anchored in India with limited onsite presence. The engine is consulting heavy which means projects begin with discovery, process mapping and blueprint creation. Once a customer signs off on the design, the engineering teams build, configure and integrate systems in sprints.

Artificial intelligence is now embedded inside this delivery chain as well. Pre-sales documentation is partly automated through internal copilots. Development teams use code generation tools. Quality assurance leverages automated test scripts. Internal knowledge bases are being reorganised using vector search. The company is training its staff in waves so that every consultant and developer uses artificial intelligence both as a productivity accelerator and as a delivery enhancement tool.

This creates a loop. Internal gains become demonstrable use cases for customers. Customer adoption produces more data. More data feeds new analytics and artificial intelligence offerings. This is the flywheel management wants to compound over the next few years.

Industry overview

The broader enterprise technology market is going through a transition cycle. Companies across the world have slowed large discretionary spending because of uncertain geopolitical events, tariff disruptions and delayed board level approvals. Mid market customers especially in the fifty million to one billion dollar revenue range have become cautious and multi committee decision making has lengthened deal closures by a quarter or two.

At the same time demand quality is shifting. Cloud adoption is mature and customers are now looking at productivity and intelligence layers. Artificial intelligence, copilots, platform unification and data fabric initiatives are becoming part of every transformation discussion. The Microsoft ecosystem is seeing a wave of embedded artificial intelligence capabilities across all products and partners like All e Technologies are positioned to monetise this shift because they operate across the full stack which includes Dynamics, Power Platform, Azure, M365 and security.

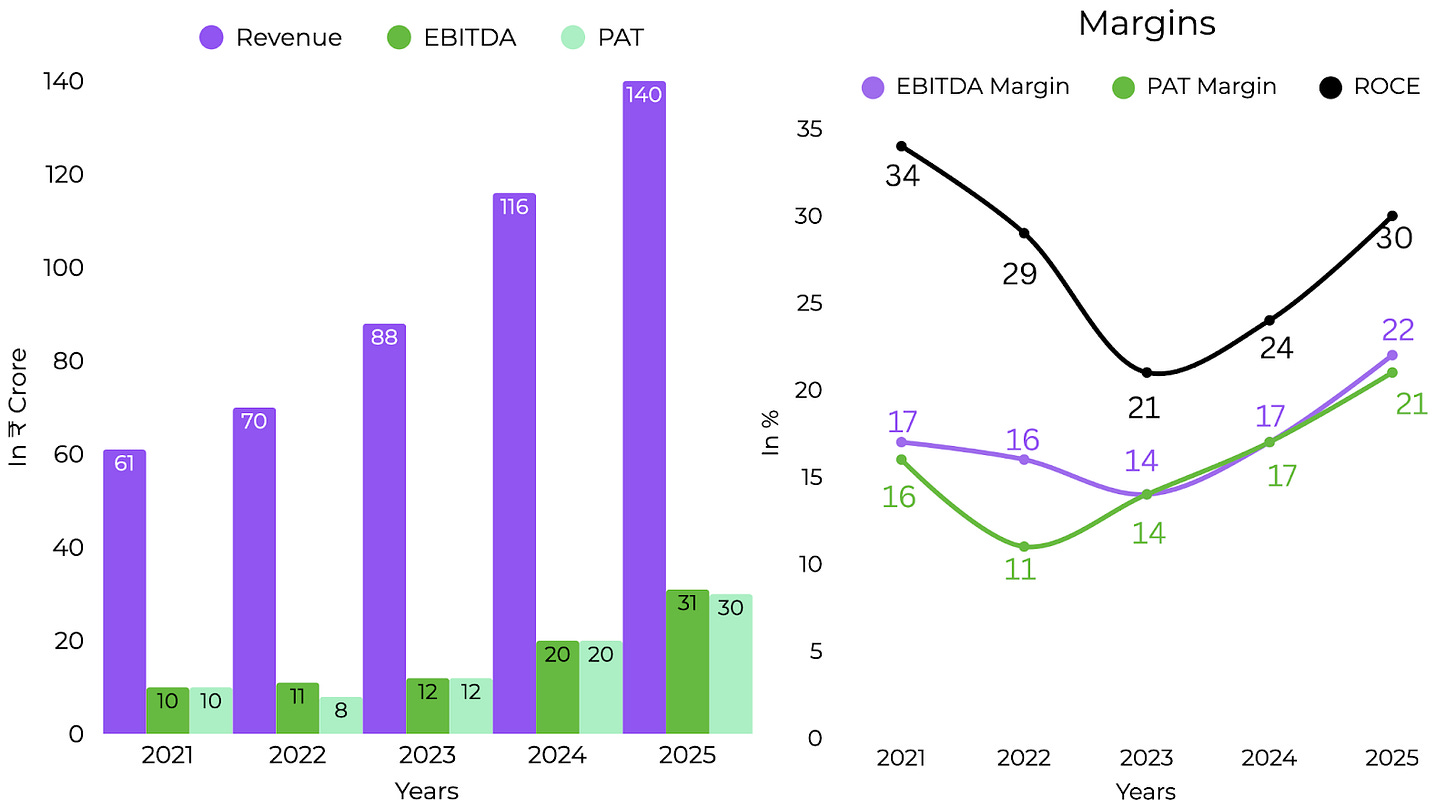

Financials

Capex and capital allocation

The company does not require heavy capital expenditure because of its asset light model. The large cash position is being conserved for an inorganic acquisition in the Microsoft BizApps, Data and artificial intelligence space. Management has confirmed one ongoing conversation though no agreement has been executed. Shareholders expecting buybacks have been told that capital must remain available for strategic acquisitions that can elevate scale and capability. Routine capex continues to be small and primarily involves IT infrastructure, employee tools and training.

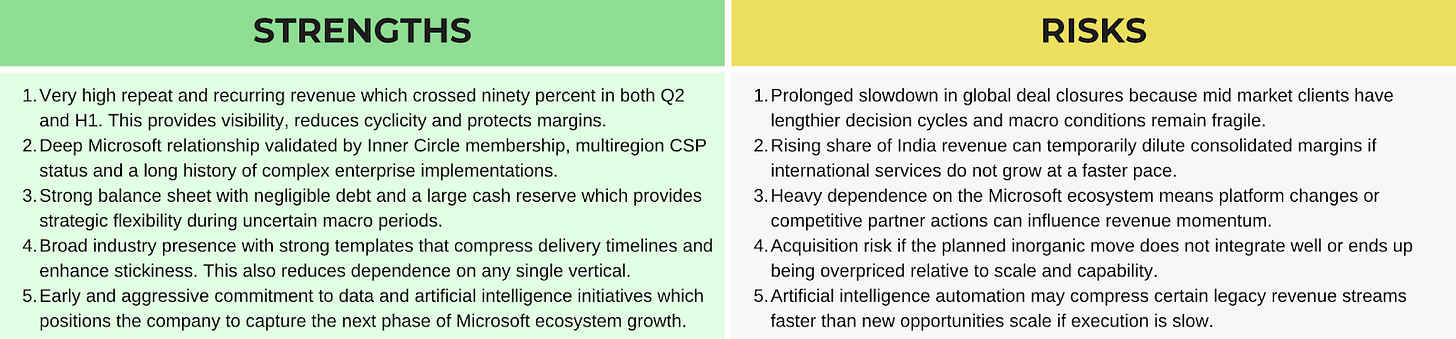

Strengths & Risk

Future outlook

The management anticipates a recovery in growth momentum within approximately two quarters, provided no new macro-level shocks occur.

Key Growth Drivers and Strategy:

India Business: Expected to gain traction, fueled by migrations from SAP to Microsoft and increasing cloud adoption among mid-sized enterprises.

International Services: Will remain the principal driver of profit margins. The company’s focus will be on converting deals that slipped in Q3 and Q4.

Artificial Intelligence (AI): AI-led projects, including customer adoption of copilots, Microsoft Fabric, and predictive analytics, are projected to account for a larger share of revenue.

Vertical IP 2.0: Initiatives integrated with AI are likely to strengthen market differentiation and pricing power.

Cybersecurity: The practice is poised to scale up once the SOC 2 certification is finalized.

Inorganic Growth: Acquisitions remain the most significant strategic lever for quickly enhancing capabilities and expanding geographic reach.

Profitability Outlook:

Overall profitability is expected to remain robust, primarily sustained by international services as the core revenue stream and compounding internal productivity gains driven by artificial intelligence.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

“Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors.”

Brillaint analysis on All e Technologies positioning itself ahead of the AI curve rather than just reacting to it. What stands out is how they're turning their internal productivity gains into demonstrable use cases for clients, essentially creatinga self-reinforcing flywheel where every AI tool they adopt internally becomes proof of concept for their next sales conversation. Most consulting shops are still treating AI as a seperate practice area, but All e is weaving it through the entire delivery chain from pre-sales documentation to QA automation. This approach could dramtically compress their time to market for new vertical IP while simultaneously improving margins.