Agarwal Toughened Glass: Where Precision Meets Strength

Building India’s next-generation safety glass powerhouse with technology, scale and sustainability.

A quiet revolution is unfolding inside a tempering unit in Jaipur. Sheets of raw glass enter as commodities and emerge as engineered safety assets, ready for airports, hospitals and high-rises. Behind this transformation stands a company that has turned discipline, quality and ambition into a fast-scaling ₹68 crore performance story.

Company overview

Agarwal Toughened Glass India Limited began as a regional glass maker and has steadily evolved into a high performance safety glass manufacturer known for reliability and project execution. From its manufacturing base in Jaipur, the company produces a wide range of safety and value added glasses and supplies infrastructure, commercial real estate, healthcare and hospitality projects. The business combines skilled floor operations with tempering technology and a product focus that marries standard BIS quality controls with bespoke project execution.

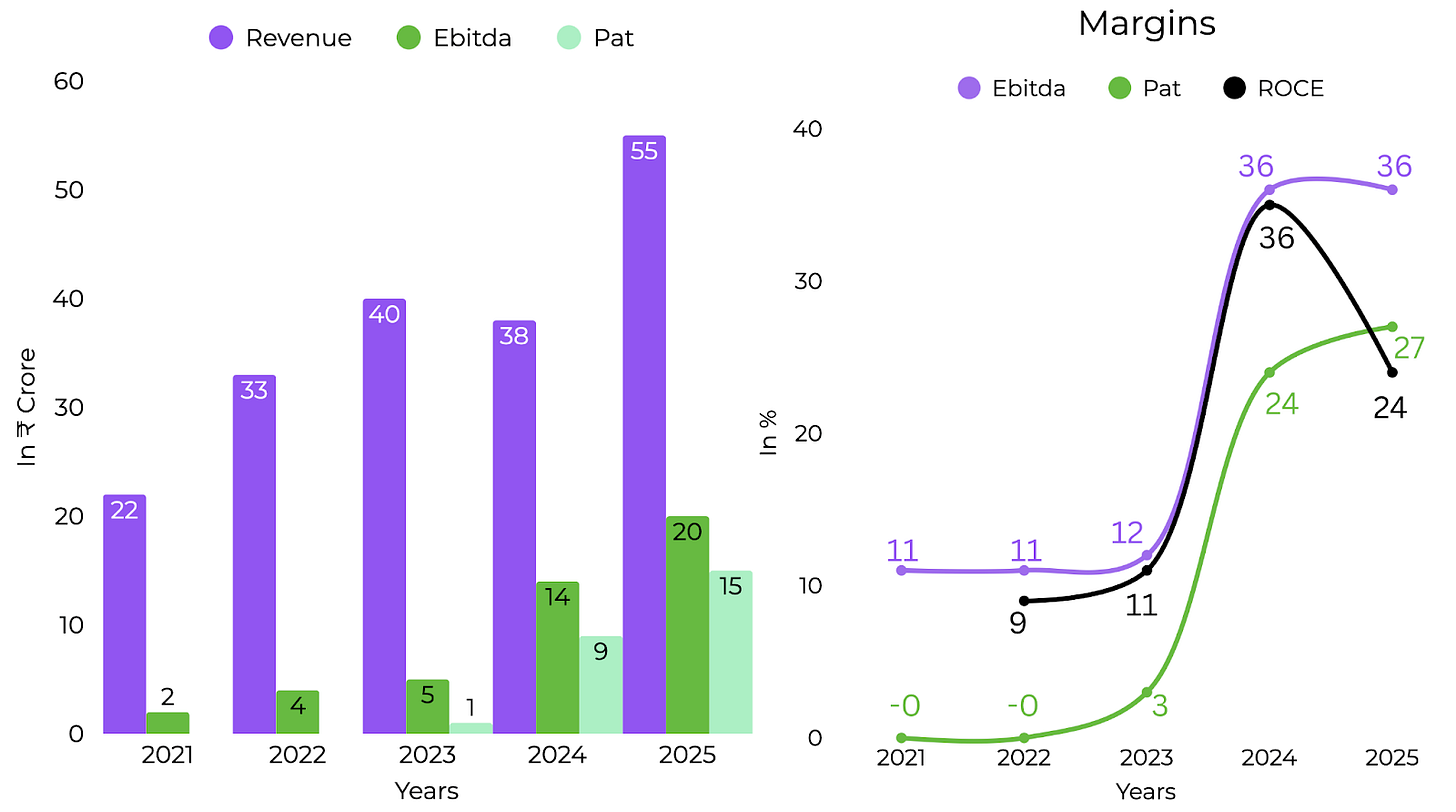

In financial year 2025 the company demonstrated a clear step change in scale and profitability, reporting total income of INR 68 crore while delivering industry leading operating profitability. Management has completed a strategic capacity expansion by investing INR 24 crore in a third tempering facility to lift production throughput, improve working capital dynamics and provide a base for new product lines. The company also intends to enter solar glass production to participate in the renewable supply chain and to pursue export opportunities in FY26.

What differentiates Agarwal Toughened Glass is the combination of strong project execution, backward integration intent and a fast moving commercialization roadmap. A roughly 250 person workforce and an execution culture geared toward larger institutional projects enable the company to capture premium contract margins while scaling its geographic reach through a broadening marketing footprint. Management positions the firm to grow via deeper market penetration across India and selective entry into international project opportunities.

Business model and segments

1. Toughened glass and value added projects

The core business is manufacturing toughened glass and supplying project oriented value added products such as laminated glass and double glazed units. Revenue comes predominantly from contracting to institutional customers where order visibility is higher and payment terms and pricing reflect project scale and quality requirements. This segment drives the bulk of margins as projects allow for premium pricing and cash discounts from suppliers.

2. Retail and distribution solutions

The company services retail trade and smaller installations where volumes are smaller and raw glass procurement patterns differ. Retail remains an important addressable market but has historically applied margin pressure due to procurement patterns and inventory mixes. Management is reducing retail exposure while strengthening project oriented sales to improve margin stability.

3. Solar glass and exports

Agarwal is building production capability for solar grade glass in the new facility. This segment is a strategic diversification that targets lightweight durable panels for renewable installations and export markets. Management expects the solar glass line to complement core product sales and to provide higher volume, potentially lower working capital seasonal flows aligned with global renewables demand.

Product line up

Toughened safety glass: Ideal for facades and interior applications.

Laminated glass: Provides enhanced safety and superior acoustic performance.

Double glazed units (DGUs): Offers excellent thermal insulation and improved energy performance.

Specialty glass: Includes heat-soaked and frosted glass to meet specific niche and finishing requirements.

Solar grade glass: Produced for photovoltaic modules and available for export as the new production line increases capacity.

Production details

The company operates tempering lines in Jaipur with capacity expanded via a third facility invested with INR 24 crore to add tempering technology and downstream processing. Production flow begins with procured raw glass sheets which are cut and edge finished, then subjected to tempering ovens for strength and safety certification. For laminated and DGU products the workflow includes precise lamination presses and controlled spacer assembly followed by sealing and quality verification. Quality assurance follows BIS norms with lot sampling routines and monthly audits by large global customers and auditors which ensure consistent standards. Backward integration efforts focus on improving margins by bringing more of upstream processing in-house or reducing import dependency through strategic procurement. Operating discipline has emphasized working capital cycle management by aligning supplier advances and staged project completion, although the model still requires high upfront payments to suppliers for project timelines.

Industry Overview

The organized safety and architectural glass market in India is under-penetrated relative to downstream construction volumes and is characterized by few large suppliers and many regional players. Demand drivers include stricter safety norms for high rise and institutional buildings, rising commercial real estate activity, airport and hospital projects and the growing emphasis on energy efficient building envelopes. The organized segment benefits from scale, quality certification and faster project fulfilment. On the supply side, capacity additions are constrained by capital intensity of tempering lines and the need for tight quality control, creating an environment where disciplined, project-capable manufacturers can secure higher margin project work.

Financials

Capex

The company committed INR 24 crore to a third manufacturing facility that adds tempering and downstream capabilities. This capex is targeted at improving throughput, reducing per unit fixed cost, optimizing working capital, and enabling a new solar glass line intended for FY26 commercialization and export sales. Capital investments are calibrated to support a multi year revenue CAGR goal while keeping balance sheet stress moderate through phased execution.

Risk & Strengths

Future outlook

Key Strategic Objectives

Revenue Growth & Expansion: Achieve a target three-year Compound Annual Growth Rate (CAGR) of 35% to 45%. This growth will be driven by the full operational ramp-up of the third manufacturing facility and an expanded market reach through a broader marketing network.

Margin Enhancement & Sustainability: Maintain Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) margins in the 30% to 35% range. This will be accomplished by:

Shifting the project mix toward larger-scale opportunities.

Securing supplier cash discounts.

Improving backward integration processes.

Product Line Diversification: Commercialize the solar glass manufacturing line in the Financial Year 2026 (FY26). The initial focus will be on supplying domestic renewable energy projects, with selective exports targeted for nearby international markets.

Working Capital Optimization: Improve working capital efficiency by:

Better aligning supplier payment terms with project billing cycles.

Implementing staged project billing.

Utilizing the proceeds from the Initial Public Offering (IPO) to reduce dependence on costly cash credit facilities.

Market Penetration & Efficiency: Expand the company’s pan-India presence by establishing 15 marketing offices and localized storage hubs. This strategic move aims to expedite the conversion of regional project wins and sustain high project margins.

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

“Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors.”

Is OBSC Perfection and Influx Healthcar in would love to hear them.