ACME Solar – Scaling a PPA-Backed, Storage-Ready Renewable Platform

Disciplined capacity expansion and aggressive BESS deployment aim to strengthen ACME’s integrated solar and hybrid portfolio while maintaining a balanced funding strategy and long-term growth visibili

Business Overview

Incorporated in 2015, ACME Solar Holdings Ltd is one of India’s largest renewable independent power producers (IPPs), ranked among the country’s top-10 renewable players by operational capacity. The company develops, owns, and operates solar, wind, hybrid, and Firm & Dispatchable Renewable Energy (FDRE) projects across 12 Indian states, supplying round-the-clock clean energy through long-term power purchase agreements (PPAs). ACME manages the entire project lifecycle in-house covering land acquisition, engineering, procurement, construction (EPC), and operations & maintenance (O&M) which enables tight cost control, real-time performance monitoring, and plant-level reliability. Long-dated PPAs, typically 25 years, provide annuity-like revenues and protect against merchant price risk, while an early move into FDRE and energy storage positions ACME at the forefront of India’s evolving renewable landscape.

Business Model

ACME is a developer-owner of renewable IPP assets rather than a manufacturer. Its strategy focuses on:

Integrated Renewables: Solar remains the core, supplemented by wind and hybrid plants.

FDRE & BESS: Battery-equipped projects deliver firm, on-demand power and allow early merchant revenue capture during peak demand.

Central Offtake Bias: SECI, NHPC, NTPC and SJVN together account for ~80% of contracted capacity, ensuring superior payment security.

Financing Discipline: Projects are funded at roughly 75:25 debt-to-equity, with active refinancing (including green bonds) to lower cost of capital. Recent refinancing cut rates by ~95 bps on a 250 MW asset.

Management deliberately imports fully assembled battery packs from Tier-1 global vendors (Narada, Trina) to ensure warranty coverage and lender comfort, prioritizing reliability over marginal duty savings.

Order Book

ACME Solar Holdings has built a high-visibility pipeline that underpins multi-year growth. Its operational portfolio stands at ~2,890 MW (3,668 MWp) across 12 states, with Rajasthan contributing nearly 50% of capacity and achieving an industry-leading 30.3% CUF.

The under-construction pipeline totals ~4,080 MW across solar, hybrid, and FDRE projects, plus 550 MWh of standalone BESS, with ~55% already backed by PPAs. An additional ~1,730 MW of awarded capacity including 680 MW FDRE is awaiting PPA tie-ups, offering further growth upside.

ACME is also scaling storage aggressively, with 3.1 GWh of BESS orders placed toward a ~10 GWh target for its current 4 GW pipeline. The overall portfolio reflects a diversified mix of Solar (54.5%), Hybrid (23.5%), FDRE (20%), and Wind (2.5%), supported by a strong offtaker base led by SECI (42%), SJVN (14%), NTPC (13%), NHPC (11%), state utilities (16%), and merchant sales (5%). Early grid-connectivity planning further insulates projects from transmission delays and execution risks.

Capex

To support this ambitious pipeline, ACME has guided a FY26 capex of ₹12,000 - 14,000 crore, of which ₹7,000 crore of purchase orders have already been placed and ₹800 crore spent in Q1 FY26. Debt drawdowns are carefully synchronized with project milestones, leveraging a broad lender base that includes PSU banks, private institutions, and foreign investors.

The company is particularly focused on scaling energy storage, with BESS capex at a competitive landed cost of ~US$100/kWh, inclusive of balance-of-system, duties, and logistics. Management targets high-teens project IRRs, with BESS returns guided to never fall below 16% even after accounting for viability gap funding (VGF). Liquidity remains comfortable, backed by undrawn debt lines of ~₹3,000 crore to buffer execution timelines. Strengthening the balance sheet further, ACME successfully raised ₹2,900 crore in its November 2024 IPO (including a ₹2,395 crore fresh issue), which was primarily utilized to repay borrowings and provide financial headroom for upcoming projects.

Future Outlook

Management targets commissioning 450 MW of generation and 2.5 GWh of BESS in FY26, with all 2.2 GW of signed-PPA projects scheduled by FY27. Partial “battery-first” commissioning is planned to capture merchants upside before full FDRE COD.

Longer-term goals include ~10 GW of generation and ~15 GWh of BESS by 2030, supported by government incentives such as Viability Gap Funding (₹18 lakh/MWh in the new tranche) and extended ISTS waivers for co-located BESS.

With India’s non-fossil capacity already exceeding 50% of installed power and national renewable additions topping 12 GW in Q1 FY26 alone, ACME is ideally positioned to benefit from policy momentum, peak-power pricing, and falling battery costs.

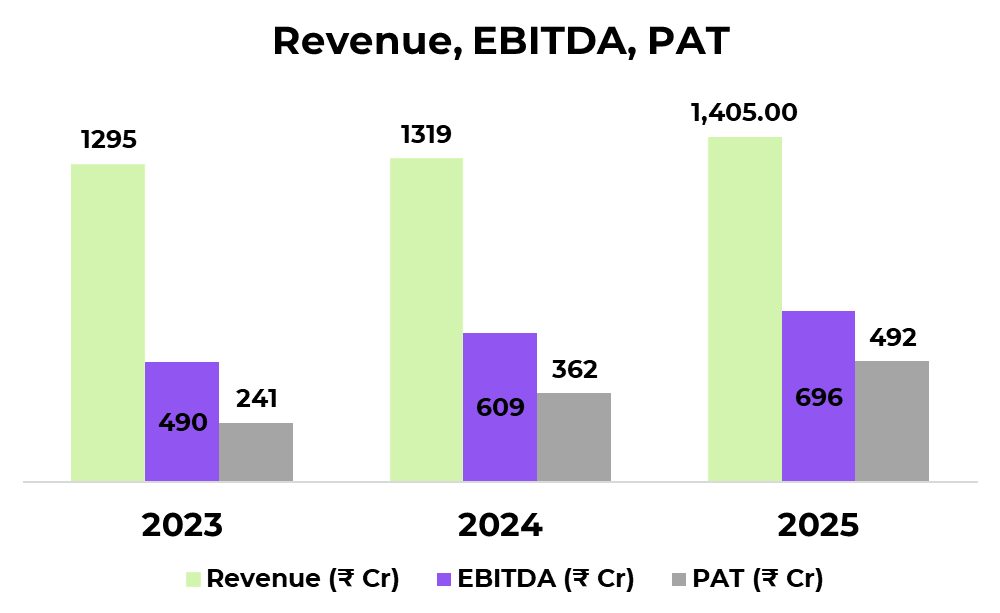

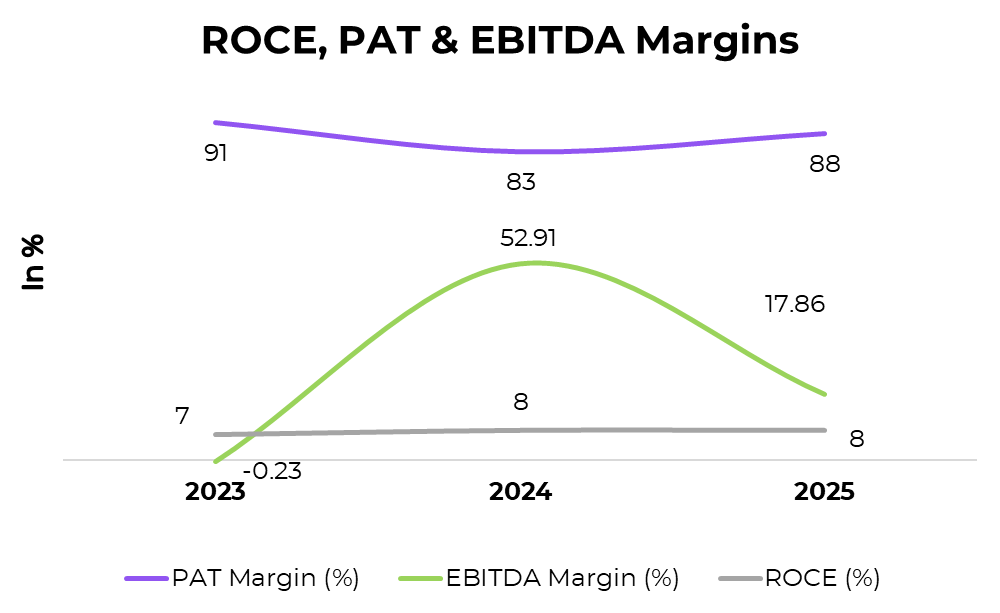

Financials

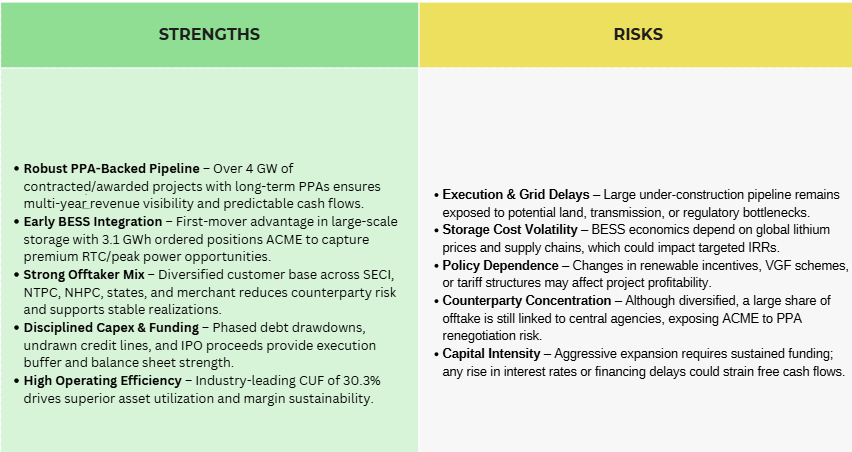

Strengths and Risks

If you an investor who keeps looking for such analysis on small & mid cap stocks, you can join our Emerging Titans model portfolio where we share detailed reports on such ideas. We are SEBI registered Research Analyst (with Registration No. INH000019789)

Disclosure

This article is for educational purposes only and does not constitute investment advice. Readers should consult a SEBI-registered advisor before making investment decisions.

Standard warning

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.“

Disclaimers

“Registration granted by SEBI, enlistment with RAASB and certification from NISM in no way guarantee performance of the Research Analyst or provide any assurance of returns to investors.”

If you’ve ever bought medicines from a local chemist, chances are they came through a distributor.

India has thousands of such distributors, most of them small and local.

But now, the industry is changing — big players are starting to take over.

One of the fastest-growing names in this space is Entero Healthcare Solutions.

https://stocklens.substack.com/p/entero-healthcare-the-new-giant-in